By Laura Stevens

FedEx Corp. on Wednesday cut its earnings outlook for the year,

blaming weaker demand for its freight services, higher costs in its

Ground division and higher insurance costs.

The move came as the delivery giant missed Wall Street

expectations for the quarter despite a 6% increase in profit as

restructuring of its Express division pays off and the company

experiences a surge in e-commerce growth.

FedEx said it expects adjusted earnings of $10.40 to $10.90 for

the year ending May, down from its previous guidance of $10.60 to

$11.10 a share.

FedEx's stock price has dropped from a high of about $185 in

June to $147.68 in recent trading. Shares have declined since the

company missed earnings expectations in June owing to litigation

costs and a $2.2 billion pretax charge as it changed its

pension-accounting method. Also weighing on the stock, FedEx is

more exposed to Asia than some of its rivals, a concern because of

the weakening global economic environment.

On an earnings call with analysts, executives said that they are

confident that the company has the right amount of capacity in its

Asia-Pacific network. In addition, most of its business exposure in

China is serving multinational companies. And while costs were up

in its freight and ground segments for the quarter, executives said

that those were one-time items, and that those businesses are still

well positioned for longer-term growth.

Chief Executive Fred Smith said that without increasing its

self-insurance reserves, the company would have beat Wall Street

expectations for the quarter and kept its full-year guidance.

"All the rest of the stuff is just noise and various issues

inside the operating company, so it's important that you focus on

that one issue," Mr. Smith said.

The increased self-insurance reserve, which accrues in part as

the company puts more trucks on the road and drives more miles,

lowered the Ground business's first-quarter operating margin by 1.7

percentage points. That helped reduce Ground's operating margin to

14%, from 18.4% a year ago.

FedEx's Ground business, which contributed about a third of

total revenue, was hurt by other one-time items. It spent more

money as it integrates GENCO, a company that specializes in product

returns, which FedEx acquired for $1.4 billion this year. In

addition, FedEx is taking its Smartpost business, which uses the

U.S. Postal Service to deliver packages the so-called "last mile,"

and incorporating it into Ground.

Average daily volume for Ground's package business grew 4% in

the quarter, which was about in line with the company's

expectations. But a higher percentage than expected--about half of

both Ground and Express deliveries in the U.S. now--is residential

traffic owing primarily to the increase in e-commerce, executives

said.

An analyst questioned whether the change in the business mix

lowered Ground margins. Small, slow e-commerce parcels are

typically less profitable than business-to-business shipments,

where a delivery driver is usually dropping off several heavier,

more urgent and expensive packages at one location.

"E-commerce is clearly changing the dynamics of the industry,

and it's driving incredible growth," said Henry Maier, head of

FedEx Ground. "I think we're best positioned to benefit from the

e-commerce economy."

Ground's operating income slipped 1% to $537 million, while

revenue shot up 29% to $3.83 billion in part from the addition of

GENCO.

The company also provided guidance on what it expects to be

another record holiday season, saying it plans to hire more than

55,000 employees, up from 50,000 last year. FedEx is working

closely with retailers to forecast package shipments, but warned it

plans to turn away packages it doesn't have room for, something it

did in past years.

The company also outlined its plans to charge more for oversize

packages. The Wall Street Journal reported in July that rival

United Parcel Service Inc. was removing discounts on oversize

packages as e-tailers increasingly ship large packages that clog up

operations.

"More and more e-commerce companies are electing to ship those

packages through networks like ours rather than handle them in the

store, [and] we've seen an increase," said Mike Glenn, executive

vice president of market development, on the call.

Overall, for the first quarter ended Aug. 31, FedEx posted a

profit of $692 million, or $2.42 a share, up from $653 million, or

$2.26 a share, a year earlier. Profit in the prior-year period

included a benefit from its recent pension accounting change.

Revenue rose to 5% to $12.3 billion.

A bright spot for the company was continued improving margins at

Express, which contributes more than half of total revenue. The

company's restructuring of the division, which included buyouts and

modernization of its airfleet, helped boost the segment's operating

income by 45% to $545 million.

FedEx said costs went up at its Freight division, as volumes

fell unexpectedly and too many employees were left idle. Revenue

was flat at $1.6 billion, and operating income fell 21% to $132

million.

Chelsey Dulaney contributed to this article

Write to Laura Stevens at laura.stevens@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 16, 2015 14:57 ET (18:57 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

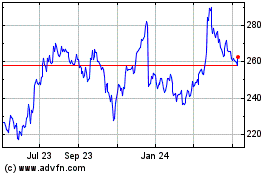

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

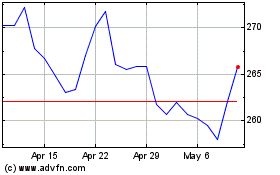

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024