FedEx to Formally Launch $4.8 Billion Offer for TNT Express on Monday

August 21 2015 - 3:22AM

Dow Jones News

By Ellen Proper

AMSTERDAM--FedEx Corp. (FDX) said Friday it will formally launch

its $4.8 billion offer for Dutch rival TNT Express NV (TNTE.AE)

next week and that it is optimistic the deal will get the necessary

regulatory approval.

FedEx said its offer of EUR8 a share will be launched Monday and

expire on Oct. 30, and will be subject to a minimum acceptance

level of 95% of TNT shares. The threshold can be lowered to 80% if

TNT's shareholders approve the takeover at a shareholders meeting

on Oct. 5.

FedEx last month hit a bump with the planned acquisition after

the European Commission said it opened an in-depth investigation

into the transaction, amid concerns about the combined group's

dominance in the international delivery of small packages in some

European markets.

FedEx, however, said the process of obtaining regulatory

approval remains on track. Responding to the commission's concerns,

FedEx said that the deal "presents a pro-competitive proposition

for the provision of small package delivery services within and

outside Europe."

FedEx also said that TNT's chief executive, Tex Gunning, would

resign once the deal is completed. Mr. Gunning will continue to

serve on the integration committee of the merged company for a

period of six months.

Write to Ellen Proper at ellen.proper@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 21, 2015 03:07 ET (07:07 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

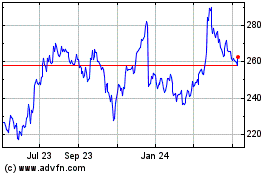

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

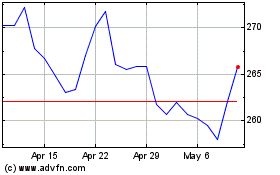

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024