John Paulson's subprime trade led to historic fortune. His

drug-company investments? Big losses and plunging assets.

Mr. Paulson's hedge-fund firm, Paulson & Co., is suffering

painful losses this year, extending a period of uneven performance

that has left the firm managing about $12 billion, down from $38

billion in 2011. Behind the recent difficulties: A big, faulty bet

on pharmaceutical companies, as well as excessive caution about the

broader market, according to people close to the matter.

Over the past two years, Mr. Paulson has argued to his investors

that the pharmaceutical industry's consolidation would accelerate,

boosting growth prospects of specialty drug companies cutting

deals. Six of Paulson & Co.'s 10 largest holdings as of June 30

were pharmaceutical companies, the most recent securities filings

show, including the firm's four largest positions. At one point in

late 2014, Mr. Paulson told a client that one of Paulson's major

holdings, Valeant Pharmaceuticals Inc., would hit $250 a share. At

the time, the stock was trading at around $140. To hedge, or

protect, his drug investments, Paulson adopted bearish positions on

the overall market, viewing stocks to be expensive.

The trades haven't worked out. Health care is the worst

performer among the 11 sectors in the S&P 500, with a drop of

6.1% so far this year. Paulson's holdings have done worse. Shares

of the firm's largest investment, U.K. pharmaceutical company Shire

PLC, are down 19% so far in 2016. The holding, worth about $864

million at current share prices, represented 9.1% of Paulson &

Co.'s portfolio at the end of June, according to FactSet Research

Systems Inc. The next three biggest Paulson investments, Mylan NV,

Allergan PLC and Teva Pharmaceutical Industries, are down 37%, 40%

and 40% this year, respectively. The three stocks represent $2.16

billion of investments for the firm at current prices. Meanwhile,

the S&P 500 is up 2.2% this year, undercutting Paulson's

bearish position.

As for Valeant, Mr. Paulson was right—briefly. The stock crossed

$262 in August of last year. But it has since tumbled to just over

$19, amid accounting questions and executive departures. Paulson

held more than 19 million shares, or about 5.5% of Valeant's shares

outstanding, at the end of June, after adding about 5.8 million

shares this year.

Some of Mr. Paulson's moves have been winners. His fifth-largest

holding, the SPDR Gold Trust, is up 23% this year. And in an

industry where many funds ape one another, clients give Mr. Paulson

credit for adopting distinctive positions and holding them over

longer periods than some rivals, reducing their potential tax

hit.

Paulson isn't the only major fund placing faith in drug stocks.

Andreas Halvorsen's Viking LP was Teva's second-largest holder at

the end of June, for example, while William Ackman's Pershing

Square Capital Management LP remains Valeant's largest

investor.

Still, the Paulson Advantage fund was down 18.5% through

September, Paulson Partners fund was down 22.3% and the Paulson

Special Situations fund was down 29%, investors say. A credit hedge

fund is close to flat this year, while Paulson's gold fund, the

smallest of his funds, rose 80% through September.

Mr. Paulson gained fame betting against subprime mortgages and

financial investments before the financial crisis, making his firm

$20 billion in 2007 and 2008. That resulted in a rush by investors

into his funds. In subsequent years, the firm has made significant

investments in gold, banks and other areas, with mixed results.

In some ways, the pharmaceutical investments hark back to those

of Mr. Paulson's early career. For over a decade before the

subprime trade, Mr. Paulson was a merger arbitrager, betting on

companies involved in acquisitions. He sometimes took a riskier

stance than rivals by holding shares he thought might receive

takeover offers, as well as companies making acquisitions that he

felt investors had unfairly punished.

Over the past two years, Paulson built huge stakes in some of

the drug companies after they entered deal talks, and held on after

talks fell apart. In the third quarter of 2014, for example,

Paulson bought 5.7 million shares of Shire, more than doubling its

holdings to $2.3 billion of shares. In October, 2014, AbbVie Inc.

and Shire officially agreed to terminate a $54 billion deal amid an

effort by the Obama administration to deter overseas mergers

prompted by tax advantages. Instead of selling Shire shares, as

some of its rivals did, Paulson held on to most of its stock as

Shire made its own acquisitions. Shire's shares have fallen more

than 35% since the end of the third quarter of 2014.

Part of the reason pharmaceutical shares are struggling: The

expectation among some investors that Hillary Clinton, the

Democratic presidential nominee, will emerge victorious in next

Tuesday's presidential election. Mrs. Clinton has been critical of

drug pricing. In August, for example, amid scrutiny over Mylan's

high-profile move to raise prices for its EpiPen product, Mrs.

Clinton tweeted that "there's no justification for these price

hikes," pushing Mylan shares lower. Mr. Paulson's firm owned more

than 4% of Mylan's shares at the end of June.

For his part, Mr. Paulson has been a vocal supporter of Donald

J. Trump. In June, he co-hosted a fundraiser for the Republican

nominee at Manhattan's Le Cirque restaurant. If Mr. Trump emerges

as president, drug stocks likely would rise. A person close to Mr.

Paulson said his investments have no bearing on his backing for Mr.

Trump.

(END) Dow Jones Newswires

November 04, 2016 06:45 ET (10:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

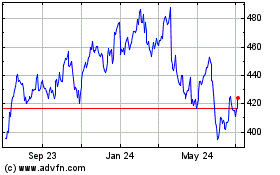

FactSet Research Systems (NYSE:FDS)

Historical Stock Chart

From Mar 2024 to Apr 2024

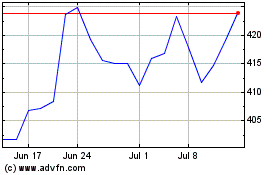

FactSet Research Systems (NYSE:FDS)

Historical Stock Chart

From Apr 2023 to Apr 2024