UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 16, 2015

FactSet Research Systems Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware |

1-11869 |

13-3362547 |

|

(State or other jurisdiction of |

(Commission |

(I.R.S. Employer |

|

incorporation or organization) |

File Number) |

Identification Number) |

601 Merritt 7

Norwalk, Connecticut 06851

(Address of principal executive offices)

(203) 810-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On June 16, 2015, FactSet Research Systems Inc. (“FactSet” or the “Company”) issued a press release announcing its results for the three months ended May 31, 2015. The press release is attached as Exhibit 99.1 to this report on Form 8-K. This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Exhibit 99.1 to this report contains certain financial measures that are considered non-GAAP financial measures as defined in the SEC rules. Exhibit 99.1 to this report also contains the reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles, as well as the reasons why Registrant’s management believes that presentation of the non-GAAP financial measures provides useful information to investors regarding the Registrant’s results of operations and, to the extent material, a statement disclosing any other additional purposes for which Registrant’s management uses the non-GAAP financial measures.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No. |

|

Description |

|

99.1 |

|

Press Release of FactSet Research Systems Inc., dated June 16, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

FACTSET RESEARCH SYSTEMS INC.

(Registrant) |

| |

|

|

|

Date: June 16, 2015 |

By: |

/s/ Maurizio Nicolelli |

| |

|

Maurizio Nicolelli |

| |

|

Senior Vice President and Chief Financial Officer |

| |

|

(Principal Financial Officer) |

EXHIBIT INDEX

|

Exhibit No. |

|

Description of Document |

|

99.1 |

|

Press Release of the Registrant, dated June 16, 2015 |

|

FactSet Research Systems Inc. |

|

|

601 Merritt 7 |

|

|

Norwalk, Connecticut 06851 |

|

|

203.810.1000 / 203.810.1001 Fax |

Exhibit 99.1 |

|

News Release |

Contact:

Rachel Stern |

| |

FactSet Research Systems Inc. |

|

FOR IMMEDIATE RELEASE |

203.810.1000 |

FactSet Reports Results for the Third Quarter of Fiscal 2015

| |

● |

ASV increased 8.9% organically to $1.02 billion |

| |

● |

Adjusted EPS rose 13.6% to $1.42 |

|

|

● |

Quarterly free cash flow was $98.5 million, up 7.8% over the prior year |

NORWALK, Conn., June 16, 2015 - FactSet Research Systems Inc. (NYSE:FDS) (NASDAQ:FDS), a leading provider of integrated global financial information and analytical applications to the investment community, today announced its results for the third quarter of fiscal 2015.

For the quarter ended May 31, 2015, revenues advanced to $254.5 million. Included in this total was $2.4 million from acquisitions completed since June 2014. Operating income was $85.4 million compared to $73.0 million in the year ago quarter. Net income was $61.4 million versus $51.5 million a year ago. Diluted earnings per share were $1.45 compared to $1.21 in the same period of fiscal 2014.

Adjusted operating income for the quarter increased 12.2% over the prior year. Adjusted operating income in the year ago third quarter excludes $3.0 million of pre-tax charges related to vesting of performance-based stock options and the settlement of a legal claim. Adjusted net income advanced 13.0% over the prior year and excludes income tax benefits of $1.4 million from finalizing prior years’ tax returns and other discrete items. Adjusted net income in the year ago quarter excludes $0.6 million in income tax benefits from finalizing tax returns and after tax expense of $2.1 million from the vesting of performance-based stock options and the settlement of a legal claim .

Adjusted diluted EPS rose 13.6% to $1.42 and excludes income tax benefits of $0.03 per share from finalizing prior years’ tax returns and other discrete items. Prior year adjusted diluted EPS of $1.25 excludes $0.01 in income tax benefits and $0.05 from the vesting of performance-based stock options and settlement of a legal claim.

A reconciliation between GAAP and adjusted financial measures is presented on page 9 of this press release.

Consolidated Statements of Income

| (Condensed and Unaudited) |

|

Three Months Ended |

|

|

|

|

|

| |

|

May 31, |

|

|

|

|

|

|

(In thousands, except per share data) |

|

2015 |

|

|

2014 |

|

|

Change |

|

|

Revenues |

|

$ |

254,522 |

|

|

$ |

231,761 |

|

|

|

9.8 |

% |

|

Adjusted Operating income |

|

$ |

85,356 |

|

|

$ |

76,084 |

|

|

|

12.2 |

% |

|

Adjusted Net income |

|

$ |

60,001 |

|

|

$ |

53,095 |

|

|

|

13.0 |

% |

|

Adjusted Diluted earnings per share |

|

$ |

1.42 |

|

|

$ |

1.25 |

|

|

|

13.6 |

% |

|

Diluted weighted average shares |

|

|

42,297 |

|

|

|

42,615 |

|

|

|

|

|

“FactSet continued its strong performance during the third quarter as each key operating metric experienced healthy growth,” said Philip Hadley, Chairman and CEO. “Our ASV growth rate accelerated to 9%, our highest rate of growth in three years while our 14% EPS increase represented our 20th consecutive quarter of double-digit adjusted EPS growth. I am also excited for Phil Snow to become our next CEO on July 1st. He and the veteran FactSet management team are well positioned to lead the Company into our next phase of growth.”

“Philip Hadley has led FactSet to new levels of growth and I look forward to the opportunity to lead as our next CEO,” added Phil Snow, President. “Our proven business model is supported by an experienced leadership group and I’m excited to focus on executing our future growth strategies.”

Annual Subscription Value (“ASV”)

ASV was $1.021 billion at May 31, 2015, up 8.9% organically over the prior year. Excluding the effects of foreign currency and an acquisition, ASV increased $17.0 million over the last three months. ASV at any given point in time represents the forward-looking revenues for the next 12 months from all services currently being supplied to clients. Buy-side clients account for 82.8% of ASV and the remainder derives from sell-side firms that perform Mergers & Acquisitions (“M&A”) advisory work, capital markets services and equity research. The buy-side and sell-side ASV growth rates were 8.5% and 10.9%, respectively. Supplementary tables covering buy-side and sell-side ASV growth rates are presented on page 10 of this press release.

Financial Highlights – Third Quarter of Fiscal 2015

| |

● |

ASV from U.S. operations was $688 million and $333 million was related to international operations. |

| |

● |

U.S. revenues were $172.1 million. Excluding incremental revenue from acquisitions completed in the past 12 months, the U.S. growth rate was 8.6%. |

| |

● |

Non-U.S. revenues rose to $82.4 million. Excluding the impact of foreign currency, the international growth rate was 10.5%. |

| |

● |

Operating margin was 33.5% compared to an adjusted operating margin of 32.8% a year ago, which excludes $3.0 million from vesting performance-based stock options and settling a legal a claim. |

| |

● |

The effective tax rate for the third quarter was 28.5%, as compared to 29.8% a year ago. Excluding income tax benefits from both periods, the current year annual effective tax rate was 30.1% compared to 30.5% in the prior period. |

| |

● |

Quarterly free cash flow was $98.5 million, an increase of 7.8% over the prior year. Free cash flow in the last 12 months also grew by 7.8% and totaled $272.7 million. |

Operational Highlights – Third Quarter of Fiscal 2015

| |

● |

Annual client retention was greater than 95% of ASV. When expressed as a percentage of clients, annual retention was 94%, up from 93% in the prior year third quarter. |

| |

● |

Client count rose by 47 and totaled 2,915 at May 31, 2015. |

| |

● |

Users of the FactSet workstation rose by 1,587 and totaled 58,995 professionals at May 31, 2015. |

| |

● |

Employee count was 6,951 at May 31, 2015, up 9.1% over last year. |

| |

● |

Capital expenditures were $3.6 million. |

| |

● |

The regular quarterly dividend was increased 13% from $0.39 to $0.44 per share, beginning with the Company’s dividend payment on June 16, 2015. |

| |

● |

The Company repurchased 440,100 shares for $70.2 million during the quarter. At May 31, 2015, $212.7 million remained authorized for further repurchases. |

| |

● |

Over the last 12 months, $317 million has been returned to stockholders in the form of share repurchases and dividends, funded entirely by cash generated from operations. |

| |

● |

Common shares outstanding were 41.5 million at May 31, 2015. |

| |

● |

The Company held its U.S. Symposium in March 2015, with industry professionals from 234 firms in attendance. |

| |

● |

FactSet was ranked #48 on Fortune’s “100 Best Companies to Work For,” marking the Company’s seventh appearance on the list in the last eight years. |

| |

● |

FactSet was recently recognized as one of the UK’s “Best Workplaces” by the Great Place to Work® Institute UK for the seventh consecutive year, listed in Crain’s “Chicago’s Best Places to Work” for the third year in a row and included in the “2015 Best Places to Work in France” list for the fourth consecutive year. |

| |

● |

In May 2015, FactSet was named Best Research Provider at the annual Inside Market Data Awards and Inside Reference Data awards held in New York. FactSet was previously awarded Acquisition of the Year in 2014, Best Research Provider in 2012, and Best Analytics Provider in 2008, 2009 and 2011. |

Business Outlook

The following forward-looking statements reflect FactSet’s expectations as of today’s date. Given the number of risk factors, uncertainties and assumptions discussed below, actual results may differ materially. FactSet does not intend to update its forward-looking statements until its next quarterly results announcement, other than in publicly available statements.

Fourth Quarter Fiscal 2015 Expectations

| |

● |

Revenues are expected to range between $259 million and $263 million. |

| |

● |

Operating margin is expected to range between 33.0% and 34.0%. |

| |

● |

The annual effective tax rate is expected to range between 30.0% and 31.0%. |

| |

● |

Diluted EPS should range between $1.46 and $1.48. The midpoint of this range represents 12% growth over the prior year. |

Conference Call

The Company will host a conference call today, June 16, 2015 at 11:00 a.m. (Eastern Time) to review the third quarter fiscal 2015 earnings release. To listen, please visit the investor relations section of the Company’s website at www.factset.com.

Forward-looking Statements

This news release contains forward-looking statements based on management's current expectations, estimates and projections. All statements that address expectations or projections about the future, including statements about the Company's strategy for growth, product development, market position, subscriptions, expected expenditures and financial results are forward-looking statements. Forward-looking statements may be identified by words like "expects," "anticipates," "plans," "intends," "projects," "should," "indicates," "continues," "subscriptions" and similar expressions. These statements are not guarantees of future performance and involve a number of risks, uncertainties and assumptions. Many factors, including those discussed more fully elsewhere in this release and in FactSet's filings with the Securities and Exchange Commission, particularly its latest annual report on Form 10-K and quarterly reports on Form 10-Q, as well as others, could cause results to differ materially from those stated. These factors include, but are not limited to: the current status of the global economy; the ability to integrate newly acquired companies and businesses; the stability of global securities markets; the ability to hire qualified personnel; the maintenance of the Company's leading technological position; the impact of global market trends on the Company's revenue growth rate and future results of operations; the negotiation of contract terms with corporate vendors, data suppliers and potential landlords; the retention of key clients; the successful resolution of ongoing audits by tax authorities; the continued employment of key personnel; the absence of U.S. or foreign governmental regulation restricting international business; and the sustainability of historical levels of profitability and growth rates in cash flow generation.

About Adjusted Financial Measures

Financial measures in accordance with U.S. generally accepted accounting principles (“GAAP”) including operating income, net income and diluted earnings per share have been adjusted. Adjusted operating income in the year ago quarter excludes a non-cash pre-tax charge of $1.4 million related to vesting performance-based options granted in connection with StreetAccount and $1.6 million of legal fees incurred primarily to settle a claim. Adjusted net income during the current year third quarter excludes $1.4 million in income tax benefits from finalizing prior years’ tax returns and other discrete items. Prior year adjusted net income excludes the after-tax stock-based compensation charge of $1.0 million, after-tax legal fees of $1.1 million and $0.6 million in income tax benefits from finalizing tax returns. Fiscal 2015 third quarter adjusted diluted EPS of $1.42 excludes income tax benefits of $0.03 per share from finalizing prior years’ tax returns and other discrete tax items. The year ago third quarter adjusted diluted EPS of $1.25 excludes $0.02 from stock-based compensation, $0.03 from legal fees and $0.01 in income tax benefits. FactSet uses these adjusted financial measures, both in presenting its results to stockholders and the investment community, and in its internal evaluation and management of the business. The Company believes that these adjusted financial measures and the information they provide are useful to investors because it permits investors to view the Company’s performance using the same tools that management uses to gauge progress in achieving its goals. Investors may benefit from referring to these adjusted financial measures in assessing the Company’s performance and when planning, forecasting and analyzing future periods and may also facilitate comparisons to its historical performance. The presentation of this financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP.

About Non-GAAP Free Cash Flow

The GAAP financial measure, cash flows provided by operating activities, has been adjusted to report non-GAAP free cash flow that includes the cash cost for taxes and changes in working capital, less capital expenditures. Included in the just completed third quarter was $102.1 million of net cash provided by operations and $3.6 million of capital expenditures. The presentation of free cash flow is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. FactSet uses this financial measure, both in presenting its results to stockholders and the investment community, and in the Company’s internal evaluation and management of the business. Management believes that this financial measure is useful to investors because it permits investors to view the Company’s performance using the same metric that management uses to gauge progress in achieving its goals and is an indication of cash flow that may be available to fund further investments in future growth initiatives.

About FactSet

FactSet, a leading provider of financial information and analytics, helps the world’s best investment professionals outperform. More than 50,000 users stay ahead of global market trends, access extensive company and industry intelligence, and monitor performance with FactSet’s desktop analytics, mobile applications, and comprehensive data feeds. The Company has been included in FORTUNE's Top 100 Best Companies to Work For, the United Kingdom’s Great Places to Work and France’s Best Workplaces. FactSet is listed on the New York Stock Exchange and NASDAQ (NYSE:FDS) (NASDAQ:FDS). Learn more at www.factset.com, and follow us on Twitter: www.twitter.com/factset.

FactSet Research Systems Inc.

Consolidated Statements of Income – Unaudited

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

May 31, |

|

|

May 31, |

|

|

(In thousands, except per share data) |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

254,522 |

|

|

$ |

231,761 |

|

|

$ |

744,990 |

|

|

$ |

681,671 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of services |

|

|

100,686 |

|

|

|

90,661 |

|

|

|

297,745 |

|

|

|

261,165 |

|

|

Selling, general and administrative |

|

|

68,480 |

|

|

|

68,063 |

|

|

|

200,980 |

|

|

|

197,673 |

|

|

Total operating expenses |

|

|

169,166 |

|

|

|

158,724 |

|

|

|

498,725 |

|

|

|

458,838 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

|

85,356 |

|

|

|

73,037 |

|

|

|

246,265 |

|

|

|

222,833 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income, net |

|

|

482 |

|

|

|

334 |

|

|

|

1,445 |

|

|

|

1,018 |

|

|

Income before income taxes |

|

|

85,838 |

|

|

|

73,371 |

|

|

|

247,710 |

|

|

|

223,851 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

24,429 |

|

|

|

21,839 |

|

|

|

68,843 |

|

|

|

67,715 |

|

|

Net income |

|

$ |

61,409 |

|

|

$ |

51,532 |

|

|

$ |

178,867 |

|

|

$ |

156,136 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per common share |

|

$ |

1.45 |

|

|

$ |

1.21 |

|

|

$ |

4.23 |

|

|

$ |

3.62 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted weighted average common shares |

|

|

42,297 |

|

|

|

42,615 |

|

|

|

42,317 |

|

|

|

43,170 |

|

FactSet Research Systems Inc.

Consolidated Statements of Comprehensive Income – Unaudited

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

May 31, |

|

|

May 31, |

|

|

(In thousands) |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

61,409 |

|

|

$ |

51,532 |

|

|

$ |

178,867 |

|

|

$ |

156,136 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive (loss) income, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unrealized (loss) gain on cash flow hedges* |

|

|

(1,020 |

) |

|

|

2,341 |

|

|

|

(289 |

) |

|

|

5,625 |

|

|

Foreign currency translation adjustments |

|

|

(4,187 |

) |

|

|

545 |

|

|

|

(25,753 |

) |

|

|

12,199 |

|

|

Other comprehensive (loss) income |

|

|

(5,207 |

) |

|

|

2,886 |

|

|

|

(26,042 |

) |

|

|

17,824 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income |

|

$ |

56,202 |

|

|

$ |

54,418 |

|

|

$ |

152,825 |

|

|

$ |

173,960 |

|

* For the three and nine months ended May 31, 2015, the unrealized loss on cash flow hedges were net of tax benefits of $606 and $172, respectively. The unrealized gain on cash flow hedges disclosed above for the three and nine months ended May 31, 2014, was net of tax expense of $1,391 and $3,352, respectively.

FactSet Research Systems Inc.

Consolidated Balance Sheets - Unaudited

| |

|

May 31, |

|

|

August 31, |

|

|

(In thousands) |

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

157,895 |

|

|

$ |

116,378 |

|

|

Investments |

|

|

25,020 |

|

|

|

20,008 |

|

|

Accounts receivable, net of reserves |

|

|

91,860 |

|

|

|

90,354 |

|

|

Prepaid taxes |

|

|

12,190 |

|

|

|

6,532 |

|

|

Deferred taxes |

|

|

1,770 |

|

|

|

1,841 |

|

|

Prepaid expenses and other current assets |

|

|

15,479 |

|

|

|

14,662 |

|

|

Total current assets |

|

|

304,214 |

|

|

|

249,775 |

|

| |

|

|

|

|

|

|

|

|

|

Property, equipment, and leasehold improvements, net |

|

|

54,458 |

|

|

|

57,641 |

|

|

Goodwill |

|

|

307,231 |

|

|

|

285,608 |

|

|

Intangible assets, net |

|

|

41,561 |

|

|

|

41,855 |

|

|

Deferred taxes |

|

|

16,531 |

|

|

|

22,377 |

|

|

Other assets |

|

|

4,081 |

|

|

|

5,956 |

|

|

TOTAL ASSETS |

|

$ |

728,076 |

|

|

$ |

663,212 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

31,445 |

|

|

$ |

26,971 |

|

|

Accrued compensation |

|

|

36,780 |

|

|

|

42,481 |

|

|

Deferred fees |

|

|

44,323 |

|

|

|

36,504 |

|

|

Taxes payable |

|

|

2,959 |

|

|

|

5,036 |

|

|

Deferred taxes |

|

|

1,071 |

|

|

|

- |

|

|

Dividends payable |

|

|

18,274 |

|

|

|

16,299 |

|

|

Total current liabilities |

|

|

134,852 |

|

|

|

127,291 |

|

| |

|

|

|

|

|

|

|

|

|

Deferred taxes |

|

|

1,711 |

|

|

|

2,921 |

|

|

Taxes payable |

|

|

6,381 |

|

|

|

5,501 |

|

|

Long-term debt |

|

|

35,000 |

|

|

|

- |

|

|

Deferred rent and other non-current liabilities |

|

|

17,757 |

|

|

|

16,417 |

|

|

TOTAL LIABILITIES |

|

$ |

195,701 |

|

|

$ |

152,130 |

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Common stock |

|

$ |

501 |

|

|

$ |

491 |

|

|

Additional paid-in capital |

|

|

508,402 |

|

|

|

413,754 |

|

|

Treasury stock, at cost |

|

|

(910,210 |

) |

|

|

(734,746 |

) |

|

Retained earnings |

|

|

977,645 |

|

|

|

849,504 |

|

|

Accumulated other comprehensive loss |

|

|

(43,963 |

) |

|

|

(17,921 |

) |

|

TOTAL STOCKHOLDERS’ EQUITY |

|

|

532,375 |

|

|

|

511,082 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

728,076 |

|

|

$ |

663,212 |

|

FactSet Research Systems Inc.

Consolidated Statements of Cash Flows - Unaudited

| |

|

Nine Months Ended |

|

|

(In thousands) |

|

May 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

178,867 |

|

|

$ |

156,136 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

24,229 |

|

|

|

25,852 |

|

|

Stock-based compensation expense |

|

|

17,112 |

|

|

|

17,425 |

|

|

Deferred income taxes |

|

|

3,041 |

|

|

|

(2,038 |

) |

|

Gain on sale of assets |

|

|

(17 |

) |

|

|

(62 |

) |

|

Tax benefits from share-based payment arrangements |

|

|

(23,926 |

) |

|

|

(6,815 |

) |

|

Changes in assets and liabilities, net of effects of acquisitions |

|

|

|

|

|

|

|

|

|

Accounts receivable, net of reserves |

|

|

(1,159 |

) |

|

|

(9,001 |

) |

|

Accounts payable and accrued expenses |

|

|

5,973 |

|

|

|

(2,260 |

) |

|

Accrued compensation |

|

|

(5,496 |

) |

|

|

(7,368 |

) |

|

Deferred fees |

|

|

5,951 |

|

|

|

4,709 |

|

|

Taxes payable, net of prepaid taxes |

|

|

16,213 |

|

|

|

20,777 |

|

|

Prepaid expenses and other assets |

|

|

78 |

|

|

|

(1,931 |

) |

|

Deferred rent and other non-current liabilities |

|

|

1,873 |

|

|

|

(1,241 |

) |

|

Other working capital accounts, net |

|

|

103 |

|

|

|

(461 |

) |

|

Net cash provided by operating activities |

|

|

222,842 |

|

|

|

193,722 |

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Acquisition of businesses, net of cash acquired |

|

|

(33,556 |

) |

|

|

(46,873 |

) |

|

Purchases of investments |

|

|

(12,437 |

) |

|

|

(7,818 |

) |

|

Proceeds from sales of investments |

|

|

7,535 |

|

|

|

6,871 |

|

|

Purchases of property, equipment and leasehold improvements, net of proceeds from dispositions |

|

|

(15,391 |

) |

|

|

(11,704 |

) |

|

Net cash used in investing activities |

|

|

(53,849 |

) |

|

|

(59,524 |

) |

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Dividend payments |

|

|

(48,404 |

) |

|

|

(44,736 |

) |

|

Repurchase of common stock |

|

|

(177,556 |

) |

|

|

(205,154 |

) |

|

Proceeds from debt |

|

|

35,000 |

|

|

|

- |

|

|

Debt issuance costs |

|

|

(32 |

) |

|

|

- |

|

|

Proceeds from employee stock plans |

|

|

51,852 |

|

|

|

26,799 |

|

|

Tax benefits from share-based payment arrangements |

|

|

23,926 |

|

|

|

6,815 |

|

|

Net cash used in financing activities |

|

|

(115,214 |

) |

|

|

(216,276 |

) |

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

(12,262 |

) |

|

|

4,309 |

|

| |

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

41,517 |

|

|

|

(77,769 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of period |

|

|

116,378 |

|

|

|

196,627 |

|

|

Cash and cash equivalents at end of period |

|

$ |

157,895 |

|

|

$ |

118,858 |

|

Reconciliation of GAAP to Adjusted Financial Measures

Financial measures in accordance with U.S. GAAP including operating income, net income and diluted earnings per share have been adjusted below. FactSet uses these adjusted financial measures, both in presenting its results to stockholders and the investment community, and in its internal evaluation and management of the business. The Company believes that these adjusted financial measures and the information they provide are useful to investors because it permits investors to view the Company’s performance using the same tools that management uses to gauge progress in achieving its goals. Adjusted measures may also facilitate comparisons to FactSet’s historical performance.

| (Unaudited) |

|

Three Months Ended |

|

|

|

|

| |

|

May 31, |

|

|

|

|

|

(In thousands, except per share data) |

|

2015 |

|

|

2014 |

|

|

Change |

|

|

GAAP Operating income |

|

$ |

85,356 |

|

|

$ |

73,037 |

|

|

|

|

|

|

Vesting performance-based stoczk options (a) |

|

|

- |

|

|

|

1,415 |

|

|

|

|

|

|

Legal charge primarily from settling a claim (b) |

|

|

- |

|

|

|

1,632 |

|

|

|

|

|

|

Adjusted Operating income |

|

$ |

85,356 |

|

|

$ |

76,084 |

|

|

|

12.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net income |

|

$ |

61,409 |

|

|

$ |

51,532 |

|

|

|

|

|

|

Vesting performance-based stock options (a)(c) |

|

|

- |

|

|

|

983 |

|

|

|

|

|

|

Legal charge primarily from settling a claim (b)(c) |

|

|

- |

|

|

|

1,134 |

|

|

|

|

|

|

Income tax benefits (d) |

|

|

(1,408 |

) |

|

|

(554 |

) |

|

|

|

|

|

Adjusted Net income |

|

$ |

60,001 |

|

|

$ |

53,095 |

|

|

|

13.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Diluted earnings per common share |

|

$ |

1.42 |

|

|

$ |

1.25 |

|

|

|

13.6 |

% |

|

Weighted average common shares (Diluted) |

|

|

42,297 |

|

|

|

42,615 |

|

|

|

|

|

|

(a) |

GAAP operating income in the third quarter of fiscal 2014 was adjusted to exclude a non-cash pre-tax charge of $1.4 million for stock-based compensation. The vesting of performance-based stock options increased stock-based compensation, net of tax, by $1.0 million and reduced diluted earnings per share by $0.02. |

|

(b) |

GAAP operating income in the third quarter of fiscal 2014 was adjusted to exclude a $1.6 million pre-tax legal charge primarily from settling a claim. The legal charge increased expenses by $1.1 million, net of tax, and reduced diluted earnings per share by $0.03. |

|

(c) |

For the purposes of calculating adjusted net income and adjusted diluted earnings per share, the pre-tax stock-based compensation charge of $1.4 million and the legal charge of $1.6 million were taxed at the year ago annual effective tax rate of 30.5%. |

|

(d) |

Current year GAAP net income was adjusted to exclude $1.4 million of income tax benefits related to finalizing prior years’ tax returns and other discrete items. GAAP diluted EPS was adjusted to exclude $0.03 from these same income tax benefits. GAAP net income in the year ago third quarter was adjusted to exclude $0.6 million of income tax benefits related to finalizing tax returns while GAAP diluted EPS was adjusted to exclude $0.01 from these same income tax benefits. |

Supplementary Schedules of Historical ASV by Client Type

The following table presents the percentages and growth rates of ASV by client type, excluding currency, and can be useful to facilitate historical comparisons.

| |

Q3’15 |

Q2‘15 |

Q1‘15 |

Q4‘14 |

Q3’14 |

Q2‘14 |

Q1‘14 |

Q4‘13 |

|

% of ASV from buy-side clients |

82.8% |

82.8% |

82.5% |

82.6% |

83.1% |

82.7% |

82.2% |

81.6% |

|

% of ASV from sell-side clients |

17.2% |

17.2% |

17.5% |

17.4% |

16.9% |

17.3% |

17.8% |

18.4% |

| |

|

|

|

|

|

|

|

|

|

ASV Growth rate from buy-side clients |

8.5% |

8.7% |

8.9% |

8.5% |

8.0% |

6.4% |

6.2% |

6.4% |

|

ASV Growth rate from sell-side clients |

10.9% |

7.9% |

6.7% |

1.6% |

0.0% |

(0.5%) |

(2.7%) |

0.7% |

|

ASV Growth rate from all clients |

8.9% |

8.5% |

8.5% |

7.3% |

6.8% |

5.5% |

5.0% |

5.9% |

The following table presents the calculation of the above-mentioned growth rates by client type for the third quarter of fiscal 2015.

| |

|

May 31, |

|

|

Q3 2015 |

|

|

(In thousands) |

|

2015 |

|

|

2014 |

|

|

ASV Growth Rate |

|

|

As reported ASV |

|

$ |

1,021.2 |

|

|

$ |

932.5 |

|

|

|

|

|

|

Less acquired ASV (a) |

|

|

(9.7 |

) |

|

|

- |

|

|

|

|

|

|

Currency impact (b) |

|

|

4.1 |

|

|

|

- |

|

|

|

|

|

|

Organic ASV total |

|

$ |

1,015.6 |

|

|

$ |

932.5 |

|

|

|

8.9% |

|

|

Buy-side |

|

$ |

840.9 |

|

|

$ |

774.9 |

|

|

|

8.5% |

|

|

Sell-side |

|

$ |

174.7 |

|

|

$ |

157.6 |

|

|

|

10.9% |

|

|

|

(a) |

Acquired ASV from acquisitions completed in the last 12 months. |

|

|

(b) |

The negative impact from foreign currency movements over the past 12 months was added back in order to calculate total organic ASV. The foreign currency effect was primarily from ASV billed in Japanese Yen, which was negatively impacted by a decline in the Japanese Yen vs. the U.S. dollar. |

Reconciliation of Non-GAAP Financial Measures

Financial measures in accordance with U.S. GAAP including operating income, net income and diluted earnings per share have been adjusted below.

|

Three Months Ended May 31, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Condensed and Unaudited) |

|

GAAP |

|

|

Income Tax

Benefits (b) |

|

|

Adjusted |

|

|

YoY

% Change |

|

|

Stock-Based

Compensation |

|

|

Amortization of

Intangible Assets |

|

|

Non-GAAP |

|

|

Operating Income |

|

$ |

85,356 |

|

|

|

- |

|

|

$ |

85,356 |

|

|

|

12.2 |

% |

|

$ |

6,075 |

|

|

$ |

2,284 |

|

|

$ |

93,715 |

|

|

Net Income (a) |

|

$ |

61,409 |

|

|

$ |

(1,408 |

) |

|

$ |

60,001 |

|

|

|

13.0 |

% |

|

$ |

4,246 |

|

|

$ |

1,597 |

|

|

$ |

65,844 |

|

|

Diluted EPS |

|

$ |

1.45 |

|

|

$ |

(0.03 |

) |

|

$ |

1.42 |

|

|

|

13.6 |

% |

|

$ |

0.10 |

|

|

$ |

0.04 |

|

|

$ |

1.56 |

|

|

Weighted Average Shares |

|

|

42,297 |

|

|

|

|

|

|

|

42,297 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42,297 |

|

| |

(a) |

For the purposes of calculating non-GAAP net income and non-GAAP diluted EPS, stock-based compensation expense and the amortization of intangible assets were taxed at the current year annual effective tax rate of 30.1%. |

| |

(b) |

GAAP net income was adjusted to exclude $1.4 million of income tax benefits related to finalizing prior years’ tax returns and other discrete items. GAAP diluted EPS was adjusted to exclude $0.03 from these same income tax benefits. |

Page 11 of 11

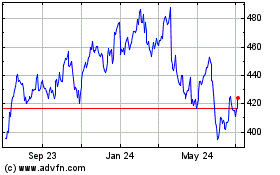

FactSet Research Systems (NYSE:FDS)

Historical Stock Chart

From Mar 2024 to Apr 2024

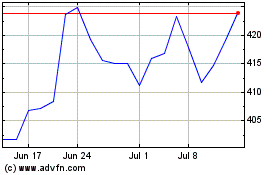

FactSet Research Systems (NYSE:FDS)

Historical Stock Chart

From Apr 2023 to Apr 2024