Copper Pulls Back as Supply Issues Wane

March 30 2017 - 6:48AM

Dow Jones News

By David Hodari

The price of copper slipped Thursday, surrendering its overnight

gains as supply-side problems in Indonesia appeared to be close to

ending.

Copper prices fell 0.66% to $5,866.00 a metric ton in midmorning

London trading.

Gold also traded lower, by 0.20% to $1,249.90 a troy ounce,

continuing to come off its political risk-driven gains seen earlier

in the week.

Early-day reports indicated that Freeport-McMoRan Inc. and the

Indonesian government had reached the final stage in negotiations

that could allow the miner to resume copper exports.

Indonesia's Energy and Mineral Resources minister, Ignasius

Jonan, said Thursday that Freeport had in principle agreed to new

goverment-stipulated regulations, according to Commerzbank's

morning note.

The reported agreement would see Freeport convert its

pre-existing contract into a special mining license, Marex

Spectron's Alastair Munro said.

"The developments at Grasberg might well have had an impact" on

copper's price, Julius Baer's Carsten Menke said. A resumption of

exports from Grasberg, coupled with the end of industrial action at

BHP Billiton's Chilean Escondida mine, would add to global supply

in a market which is already seeing "no signs of tightness," he

added.

While the strikes at Escondida are over for now, the 44-day

action may deliver a 250,000-metric-ton hit to the mine's expected

output for the year, according to Investec analyst Gustavo Lagos.

Prior to the strike, BHP Billiton had been guiding for annual

production of just over 1 million metric tons.

Copper investors were looking for any clues as to President

Trump's tax plan, ahead of his meeting with the National Economic

Council--expected Thursday-- according to Marex Spectron's Dee

Perera.

Aside from that, Chinese manufacturing purchasing managers index

data, quarter-end trading, and movements ahead of the Chinese Qing

Ming holiday weekend were all in traders' sights heading into

Friday.

Gold's price recovery was stymied by a stronger dollar and the

European Central Bank's clarification that its last Governing

Council meeting had not been intended to signal a move to tighter

monetary policy, according to Commerzbank. The WSJ Dollar Index,

which measures the dollar against a basket of currencies, was

recently up 0.11 to 90.17. A stronger dollar makes the metals more

expensive for holders of other currencies.

The revelation that global physical gold demand dropped 18% in

2016--according to data released Thursday by research body

GFMS--may also have dragged on the precious metal.

Among base metals, aluminum was flat at $1,955.00 a metric ton,

lead fell 0.77% to $2,325.00 a metric ton, and zinc was down 0.58%

at $2,842.50 a metric ton, tin fell 0.75% to $19,950.00 a metric

ton and nickel dropped 0.40% to $9,985.00 a metric ton.

Among precious metals, silver fell 0.55% to $18.15 a troy ounce,

platinum rose 0.36% to $956.50 a troy ounce and palladium was down

0.19% at $791.00 a troy ounce.

Write to David Hodari at david.hodari@wsj.com

(END) Dow Jones Newswires

March 30, 2017 06:33 ET (10:33 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

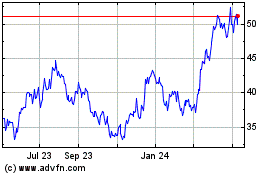

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

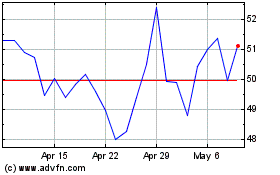

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024