Metals Pull Back as Dollar Climbs

March 02 2017 - 7:06AM

Dow Jones News

By Ed Ballard

LONDON--A resurgent dollar weighed on base and precious metals

prices on Thursday.

Copper was down 0.2% at $6,002 a ton, with other industrial

metals from aluminum to zinc losing between 0.1% and 0.5%. Gold was

down 0.4% at 1,243.95 a troy ounce in late-morning trade, with

silver, palladium and platinum down between 0.3% and 0.5%.

Gold's losses were kept in check by political uncertainty in the

U.S. and Europe, while continuing supply disruption supported

copper.

The WSJ Dollar Index was recently up 0.3%, its highest level

since mid-January. The dollar is rising on expectations that the

Federal Reserve will raise interest rates given strength in the

U.S. economy.

As of Wednesday, markets were allocating a roughly two-thirds

chance that the Fed will raise rates at its March 15-16 meeting, up

from a 35% chance on Tuesday, according to data from CME Group.

A stronger dollar makes dollar-priced commodities more expensive

for holders of other currencies. In the case of gold, higher rates

can also reduce demand by increasing the returns on offer from

yield-bearing assets.

The U.S. trading session will bring jobless claims statistics

and a speech from Loretta Mester, president of the Federal Reserve

Bank of Cleveland, who may join the chorus of Fed officials saying

growth, inflation and employment in the U.S. warrant tighter

monetary policy.

But despite the pressure from a stronger dollar, gold is holding

on to its gains for the year. The metal is currently not far below

its 2017 peak, when it topped $1,260 an ounce on Feb. 24.

"There is still a significant amount of underlying risk in the

markets right now--largely political--which may explain why gold--a

traditional safe haven asset--is only trading 1.5% below its

near-four month high," wrote Craig Erlam, an analyst at Oanda

Corp.

Analysts at Commerzbank said the precious metal is "holding its

own amazingly well," saying demand is kicking in whenever the

market dips. The bank also noted continuing inflows of money into

exchange-traded funds that buy gold.

Copper continued to be buoyed by supply disruption at two huge

mines. Commerzbank estimated that 60,000 tons of production have

been lost due to a strike at the Escondida copper mine in Chile.

Violent clashes between workers and the police were reported

Thursday as the strike enters its fourth week.

Freeport-McMoRan Inc. remains locked in a standoff with the

Indonesian government over permission to export copper concentrate

produced at the Grasberg mine.

Brokerage firm Marex Spectron said the copper market is

susceptible to some vicious moves making holding intraday positions

difficult.

Write to Ed Ballard at ed.ballard@wsj.com

(END) Dow Jones Newswires

March 02, 2017 06:51 ET (11:51 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

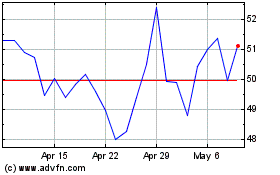

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

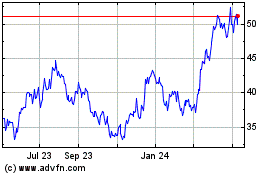

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024