Copper Pulls Back Ahead of Trump's Address

February 28 2017 - 7:17AM

Dow Jones News

By Ed Ballard

LONDON--Copper prices fell on Tuesday ahead of a policy speech

by Donald Trump that could shed light on the government's plans for

infrastructure spending.

The London Metal Exchange's three-month copper contract was down

0.3% at $5,921.50 a metric ton.

The day's main event promises to be President Trump's address to

Congress. Any specific proposals on infrastructure investment may

shift the market's perceptions of supply and demand for metals.

Commentary on economic policy more generally may indirectly

influence metals markets by moving the dollar and changing the cost

of dollar-priced commodities.

Brokerage firm Marex Spectron said copper is "like a deer in

headlights, " potentially vulnerable to a reversal if a labor

dispute at the world's largest copper mine in Chile is resolved, or

if speculators quickly sell their sizable bullish position in the

futures market.

But Marex said concerns over supply, combined with declining

stocks of metal in LME warehouses, are keeping the market supported

for now.

Workers are striking over pay at the Escondida mine in Chile,

majority-owned by BHP Billiton Ltd., while Freeport-McMoRan Inc. is

locked in a standoff with the Indonesian government over permission

to export copper concentrate produced at the Grasberg mine.

Aluminium was up 0.1% at $1,899.50 a ton, lead was up 0.8% at

$2,277 a ton, tin was up 0.7% at $19,150 a ton and zinc was up 0.6%

at $2,827.50 a ton. Nickel was down 0.5% at $10,975 a ton.

Write to Ed Ballard at ed.ballard@wsj.com

(END) Dow Jones Newswires

February 28, 2017 07:02 ET (12:02 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

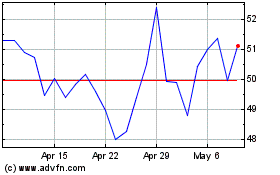

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

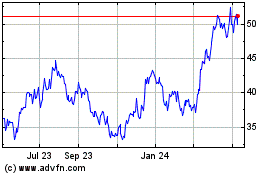

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024