By Sara Schonhardt

JAKARTA, Indonesia -- Freeport-McMoRan Inc., one of the world's

biggest copper miners, is heading toward a showdown with the

Indonesian government that is threatening global supply of the

metal and roiling the markets.

The Arizona-based company, whose majority-owned Grasberg copper

mine in Indonesia is the world's second largest, on Monday said it

wouldn't accept terms of a deal with the government that would

allow it to resume shipments of copper concentrate that have been

halted since Jan. 12.

The Indonesian government last Friday offered Freeport a new

one-year export permit, but only if it agreed to new rules

requiring it to build a new copper smelter in the country within

the next five years and switch to an operating license, the terms

of which dictate the company eventually would have to give up

control of Grasberg.

Freeport Chief Executive Richard Adkerson said the company was

unwilling to revisit the terms of its current 30-year contract to

mine at Grasberg, which accounts for about a third of Freeport's

annual copper production and 40%-50% of the value of its world-wide

assets. He said Freeport would consider going to arbitration if it

can't resolve the dispute within the next 120 days.

Its current contract allows for another extension up to 2041.

The company says it has been willing to compromise with the

government but requires certainty over its long-term operating

rights to make future investments.

"They're holding fast to the idea that for us to export we have

to accept forfeiting our [contract of work], and we're holding fast

to the position that we're unwilling to do that," Mr. Adkerson told

The Wall Street Journal.

Indonesia's minister of energy and mineral resources, Ignasius

Jonan, said the government also could bring Freeport to

arbitration.

"It's not just Freeport [that has such a right], the government

does too, " Mr. Jonan told reporters on the sidelines of an event

Monday.

The latest chapter in the standoff sent copper above $6,000 an

ounce on the London Metal Exchange, a nearly 1% increase, on

Monday. Prices of copper, one of the world's most highly traded

metals used in electrical cables and consumer goods, have risen 12%

this year, partly thanks to Freeport's problems at Grasberg. An

industrial dispute at the world's largest copper mine at Escondida

in Chile, part-owned by BHP Billiton PLC, also has pushed prices

higher.

Freeport's row in Indonesia comes as concerns grow about a rise

in protectionism globally, following U.S. President Donald Trump's

election victory in November. The trend is a particular concern for

mining companies, which rely heavily on smooth global trade flows

to get commodities from producing nations to consuming ones.

Without the cash generated from sales of copper concentrate

produced at Grasberg, Freeport could face a heavy hit to earnings

and its ability to invest elsewhere, including mines it is

developing in the U.S. southwest. Revenue from Freeport's Indonesia

operations was $3.3 billion in 2016, and it expects to generate

$5.9 billion this year if operations run normally.

The company sold $6.6 billion worth of mining and oil and gas

assets in 2016 to address debt issues, which Mr. Adkerson said had

put the company back on a "reasonable" financial footing.

"We need the financial support from Indonesia to invest in the

United States," Mr. Adkerson said. He said major shareholders such

as activist investor Carl Icahn were "very concerned" about the

company's problems in Indonesia.

Resource-rich Indonesia is a top producer of minerals such as

copper, tin and nickel. Under President Joko Widodo, the Southeast

Asian nation has sought to attract more foreign investment.

But while Mr. Widodo's government relaxed a three-year ban on

exports of nickel ore and bauxite earlier this year, Mr. Adkerson

said shifting policies had limited the country's ability to take

full advantage of its natural-resource wealth and discouraged

investment.

"We all want to see Indonesia succeed, but the policies they're

adopting for the mining business are flawed," he said. "And they're

flawed for them as well as for us."

Bambang Gatot Ariyono, director general of minerals and coal at

Indonesia's mining ministry, said the government couldn't allow

Freeport to disobey its new rules as they already had been

issued.

"We cannot run from this regulation," he said. "We have to find

a 'win-win' solution," he said, adding that the government didn't

want to bankrupt Freeport and remained in discussions with the

company.

Last week Freeport cut 10% of its expatriate workforce in

Indonesia, and Mr. Adkerson said it plans to start cutting contract

workers who account for around two-thirds of its 32,000 employees

in Papua, the eastern province where Grasberg is situated. On

Saturday the chief executive of Freeport's local subsidiary

resigned.

Freeport said in a statement Monday it expects its copper sales

to fall by 17% in the first quarter as a result of the impasse in

Indonesia, with gold sales down 59%.

Freeport said it has invested $12 billion in its mine in

Grasberg to date and has plans to invest an additional $15

billion.

A strike at the sole smelting facility where Freeport processes

around 40% of its output has added to production woes. Unable to

move copper concentrate off-site to be processed for export,

Freeport was forced to stop production at Grasberg and declare

force majeure earlier this month.

--Biman Mukherji in New Delhi contributed to this article.

Write to Sara Schonhardt at Sara.Schonhardt@wsj.com

(END) Dow Jones Newswires

February 20, 2017 11:13 ET (16:13 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

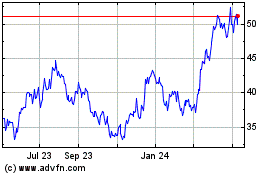

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

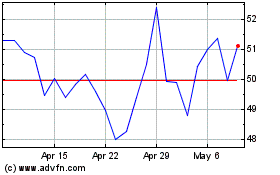

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024