Anadarko Narrows Loss But Misses Quarterly Revenue, Sales Marks

October 31 2016 - 5:30PM

Dow Jones News

Anadarko Petroleum Corp. narrowed its loss during the latest

quarter but still sharply missed Wall Street expectations for

earnings and revenue.

Anadarko shares, down 10% over the past year, fell 1.8% to

$58.40.

Prolonged weakness in energy prices has punished companies

across the sector, forcing them to shore up capital and make cuts

to investment, head count and dividends.

Anadarko, based in The Woodlands, Texas, reported a loss of $830

million, narrower than the same period last year, in which it lost

$2.24 billion. On a per-share basis, the company booked a loss of

$1.61 compared with a loss of $4.41. Excluding certain items, the

company's loss per share was 89 cents versus a loss of 72 cents per

share in the year-ago quarter.

Revenue rose 12% to $1.89 billion. Analysts projected an

adjusted loss of 57 cents a share on $2.19 billion in revenue.

In September, the company paid $2 billion for oil and gas assets

in the Gulf of Mexico from mining giant Freeport-McMoRan, expanding

its footprint in offshore oil.

Under the deal, Anadarko will pick up 91 drilling blocks in the

Gulf of Mexico that will allow the company to double its output in

the region to about 155,000 barrels of oil equivalent a day. Before

the purchase, Anadarko held 1.6 million acres across 269 drilling

blocks in the Gulf of Mexico.

And last week, people familiar with the matter told The Wall

Street Journal that Sanchez Energy Corp. was in talks to partner

with Blackstone Group LP on a deal for Anadarko's South Texas

oil-and-gas assets. The deal was expected to value the Anadarko

assets at between $3 billion and $3.5 billion.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

October 31, 2016 17:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

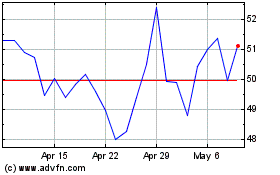

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

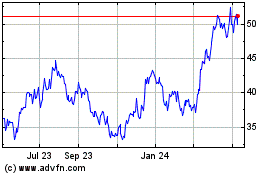

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024