Freeport to Sell Stake in Africa Copper Mine -- WSJ

May 10 2016 - 3:04AM

Dow Jones News

Congo asset to be sold to Chinese company for $2.65 billion in

bid to cut U.S. firm's debt

By Ben Dummett

Freeport-McMoRan Inc. agreed Monday to sell its stake in an

African copper operation to a Chinese mining-and-processing firm

for $2.65 billion, as the Phoenix-based miner looks to pay down

debt amid a stream of similar moves by big miners.

Freeport, the biggest U.S. mining company by market value, said

it would sell its interests in TF Holdings Limited, a Bermuda

holding company that indirectly owns an 80% interest in the Tenke

Fungurume mine in the Democratic Republic of the Congo, to China

Molybdenum Co. Freeport has a 70% stake in TF Holdings, and an

effective 56% interest in Tenke.

The move comes as uneven global economic growth raises concerns

over demand for and prices of commodities including copper, which

has fallen in price over the last year by 27% to $2.10 a pound and

has stagnated so far this year. Weak prices are pushing some of the

world's biggest miners to sell assets and shore up their

debt-burdened balance sheets as they contend with heavy losses.

The Tenke deal also underscores how China, where demand for

foreign mining assets remains strong, is benefiting from the

weakened bargaining positions of some sellers to acquire resources

cheaply.

China Molybdenum's deal with Freeport is its second transaction

in less than a month. The company, which is partly state-owned,

agreed in late April to acquire Anglo American PLC's Brazilian

niobium and phosphates business for $1.5 billion. Phosphates are a

key ingredient used to make fertilizers while niobium helps to make

steel stronger.

Other Chinese companies have targeted gold mines. Last year,

China's Zijin Mining Group agreed to buy a 50% stake in the unit

that manages Barrick Gold Corp.'s Porgera gold mine in Papua New

Guinea.

While many big miners are selling assets, Freeport has been

under increasing pressure to reduce its debt since August, when

activist investor Carl Icahn disclosed the purchase of a stake in

the miner. Since then, Freeport has suspended its dividend, cut

capital spending, and announced the resignation of longtime

Chairman James R. Moffett, an oil wildcatter who also developed the

company's Grasberg mine in Indonesia, one of its so-called super

mines.

Since the beginning of this year, Freeport has announced more

than $4 billion in asset-sale transactions.

By selling the Tenke stake, Freeport is reducing its exposure to

a politically risky area without undermining its ability to

increase copper production.

The Tenke mine operation is about 110 miles northwest of

Lubumbashi in the Katanga province, and as of the end of December

had recoverable reserves of 7.2 billion pounds of copper.

But the sale of conflict minerals, including tin, tantalum,

tungsten and gold, has made it a "challenging operating

environment," as proceeds used by rebels to buy weapons spur

"regional conflicts and attacks against innocent civilians," noted

Lundin Mining Corp., a minority owner in the Tenke project, on its

website.

Freeport also owns assets in the Grasberg minerals district in

Indonesia, one of the biggest copper and gold deposits, as well as

the Cerro Verde complex in southern Peru, which is expected to

produce over a billion pounds of copper in 2016.

"We are committed to our immediate objective of reducing debt,

while retaining...a leading position in the global copper

industry," Freeport Chief Executive Richard Adkerson said in a

statement.

Freeport had a debt load of about $20.8 billion at the end of

March and reported a $4.2 billion loss for the first quarter,

largely due to the declining book value of its oil and gas assets.

The company made a big bet on energy in 2013 when it bought McMoRan

Exploration Co. and Plains Exploration & Production Co. for a

total of $9 billion, a deal that added to the company's debt load

ahead of a steep decline in energy prices.

Last month, Freeport announced it would cut 25% of the

oil-and-gas workforce, or 325 jobs, as part of an overall

restructuring in that business. The company said it is evaluating

options for the oil-and-gas business, including possible asset

sales or joint-venture arrangements.

In addition to the TF Holdings transaction, Freeport said it

would negotiate exclusively with China Molybdenum to enter into

agreements to sell its interests in joint venture Freeport Cobalt,

which includes the Kokkola Cobalt Refinery in Finland, for $100

million. The company also seeks to sell the Kisanfu Exploration

project in the Democratic Republic of Congo for $50 million.

--Joshua Jamerson contributed to this article.

Write to Ben Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

May 10, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

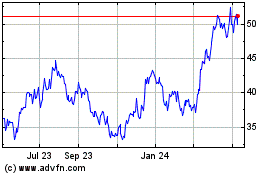

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

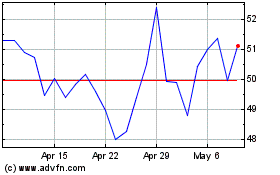

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024