Materials Up as Dollar Weakens -- Materials Roundup

April 26 2016 - 4:33PM

Dow Jones News

Shares of raw-materials companies rose as the dollar weakened in

anticipation of a dovish Federal Reserve policy statement and after

a report showed a more modest than anticipated increase in

durable-goods orders in March. Gold futures neared their highest

levels of the year. Freeport-McMoRan ticked up to trade at more

than triple its lows from earlier in the year even after the

largest U.S. mining company by volumes wrote down its oil-and-gas

holdings and posted a $4.2 billion quarterly loss. Investors were

encouraged that revenue fell 15% from a year earlier and that the

company was standing by its metals-production plans. Hedge funds

concentrated on the raw-materials and industrial sectors reported

large inflows in the first quarter as investors chased the rebound

from the commodities bust.(rob.curran@dowjones.com)

(END) Dow Jones Newswires

April 26, 2016 16:18 ET (20:18 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

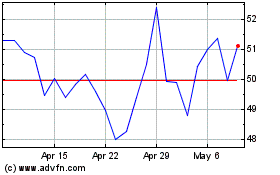

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

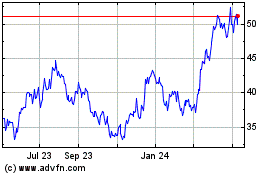

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024