By Alex MacDonald And John W. Miller

LONDON--Mining company stocks plunged across the world on

Tuesday on continued fears that China's economic slowdown would

cause metal prices to tumble further.

The carnage was most apparent at Switzerland-based trader and

producer Glencore PLC, where shares fell below GBP1 ($1.55) for the

first time, down more than 16%. The beleaguered company's shares

recovered slightly but closed down 10%.

But Tuesday's tumble was another hammer on the head of almost

all mining companies.

Freeport-McMoRan Inc., the biggest American miner, lost almost

1.5% of its value in afternoon trading in the U.S. In the U.K.,

Anglo American PLC fell 6.73%, while Anglo-Australian miners BHP

Billiton Ltd. and Rio Tinto PLC ranked among the 10 biggest losers

in London trading.

In London, the FTSE 350 mining index lost 2.5%. In Toronto, a

major center for mining finance, the stock market's materials

index--home to miners of gold, copper and potash, among other

commodities--was down 4.2% on the day, bringing its 12-month drop

to 30%.

The losses were an extension of a pattern of market volatility

since the U.S. Federal Reserve said on Thursday it wasn't raising

interest rates this month. The Fed's decision sparked renewed fears

over the sluggish pace of global growth and has left investors

second-guessing when the first rate move will come.

Miners also have been roiled by a long rout in commodities

prices, with gold, copper and iron ore trading at multi-year lows

in recent weeks on worries that demand is slackening in China, the

world's biggest consumer of many raw materials.

On Tuesday, there were widespread worries that data to be

released late Wednesday will show a continued decline in Chinese

factory activity.

The copper price, the largest earnings driver for Glencore and

Freeport-McMoRan, led a group of metals' prices lower in afternoon

European trading, falling 3.6% to $5,036 a ton. Meanwhile the price

of zinc, a major metal for Glencore, fell to a more than six-year

low of $1,640 a ton on Tuesday.

Credit Suisse Group AG on Tuesday slashed earnings estimates

across the mining sector.

"Until China demand and emerging market currencies find a floor,

it will remain challenging to put an absolute floor on commodity

prices," Credit Suisse said in a note.

Even in the gold mining sector, traditionally considered an

outlier from global macroeconomic forces, companies were shellacked

on Tuesday.

North America's two major gold producers, Toronto-based Barrick

Gold Corp. and Colorado-based Newmont Mining Corp. both suffered

share price losses over 5%.

The mood is particularly bleak at the Denver Gold Forum, an

annual mining conference this week. Chief executives of the world's

biggest gold companies watched helplessly Tuesday as their share

prices fell.

Mining executives are "projecting optimism, but off the record,

they're very concerned about where prices are going," says Paul

Sacks, chief investment officer of New York-based Aurum, a start-up

gold trading fund.

A big worry is that "nobody really sees where the bottom is,

that's the $64,000 question," he added.

As share and metals prices plummet, mining companies are

increasingly responding by slashing costs.

Investment and capital spending are "increasingly difficult as

the gold price drops," said Chuck Jeannes, president and chief

executive of Vancouver-based Goldcorp, Inc., one of the world's

biggest miners. "We are laser-focused on reducing operating

costs."

Glencore has become a symbol for investor jitters around Chinese

demand. The company is exposed to a host of commodities -- from

copper to zinc to coal -- that have experienced huge price drops

thanks to uncertain Chinese demand.

The company also has heavy debt -- something that it needs to

finance its massive commodities trading arm but that has become a

liability as its cash flow sinks and questions get raised about its

credit rating.

The company issued $2.5 billion in new shares last week and

announced a host of cost cuts, asset sales and other measures to

restore investors' faith -- to no avail so far, analysts said.

"Glencore has suffered a complete loss of confidence from

investors," Credit Suisse said in a note to clients on Tuesday. The

company's stock could rebound, the bank said, if it delivers on its

second half earnings targets.

Glencore's shares are down nearly two thirds since the beginning

of the year and are down more than 80% since the company's London

share listing in 2011. All of the share price gains made since the

company's debt-reduction plan was announced have been wiped

out.

Analysts were struggling to explain why Glencore's stock had

fallen so much more than others, except to note that funds are

likely short selling the stock in greater numbers.

"It's too big a move," said Liberum Capital analyst Ben Davis.

"This feels more technically driven than fundamentals [driven]," he

noted.

Write to Alex MacDonald at alex.macdonald@wsj.com and John W.

Miller at john.miller@wsj.com

(END) Dow Jones Newswires

September 22, 2015 15:10 ET (19:10 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

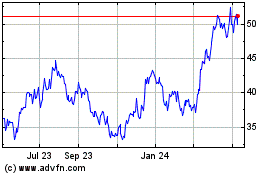

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

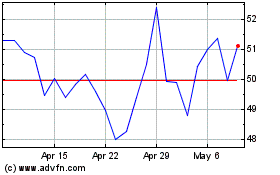

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024