Freeport-McMoRan Sells $1 Billion in Shares

September 18 2015 - 9:10AM

Dow Jones News

Freeport-McMoRan Inc. said Friday that it has brought in $1

billion through a sale of its shares and disclosed plans to raise

another $1 billion, as the beleaguered miner looks to raise cash

amid weak commodity prices.

Freeport-McMoRan, which last month became the target of activist

investor Carl Icahn, said it plans to use the proceeds from the

offerings on things such as the repayment of borrowings and for

capital spending.

Freeport added that it continues to have discussions with

investors about potential investments in its oil-and-gas

business.

Shares, down 48% this year, sank 2.7% in premarket trading to

$11.72 a share.

Phoenix-based Freeport announced in August that it would slash

2016 capital spending by 29%, cut about 10% of its U.S.

workforce—or more than 1,500 jobs—and reduce output. That came on

top of plans to cut spending in its oil-and-gas operations.

Just hours after Freeport announced the cuts, Mr. Icahn revealed

that he had taken a 8.5% stake in the company. A securities filing

said he would potentially seek board representation and wants the

company to cut spending levels and executive compensation.

Freeport has struggled recently as global commodity prices sink

amid concerns about increasing global oil supplies and slowing

demand from China, including for copper, a big source of revenue

for Freeport.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 18, 2015 08:55 ET (12:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

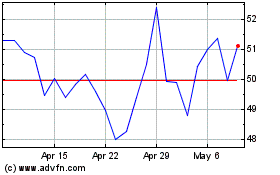

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

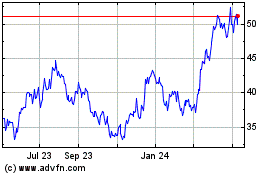

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024