Corporate-Bond Market Absorbs $11.5 Billion, Ignores Greece

February 08 2012 - 5:50PM

Dow Jones News

Seven issuers managed to stuff $11.5 billion of high-grade

corporate bonds into the new-issue market Wednesday despite a

volatile backdrop informed by continued delays in the resolution of

Greece's debt crisis.

At the top of the calendar were two $3 billion, multitranche

deals offered by AT&T Inc. (T) and Freeport-McMoRan Copper

& Gold (FCX). Among banks, Wells Fargo & Co. and HSBC

priced $2 billion and $1.5 billion of three-year notes,

respectively.

While trading in the secondary market was generally mixed,

appetite for new-issuance remained upbeat as investors show a

preference towards liquid bonds.

Enterprise Products Operating even enlarged its offering of

30-year bonds to $750 million and then priced them without a

concession.

Usually a new-issue offers investors a concession--or some extra

yield--to entice buyers. But these bonds were priced to yield

4.897%, or 175 basis points over Treasurys, representing a 15 basis

point premium, or negative concession, to comparable outstanding

bonds due 2041.

"People are willing to pay up if they are able to get bonds," a

banker at one of the lead underwriters said, referring to demand as

overwhelming. "If they try to buy them in the secondary, in the

size that a lot of people want, they would drive the market a lot

tighter than where it's trading."

The AT&T bonds were priced with spreads of 55, 80, and 105

basis points on three-, five-, and 10-year bonds. Pricing on each

was on the narrower side of earlier guidance.

The Freeport-McMoRan deal also featured three-, five-, and

10-year bonds, sold at spreads of 110, 135, and 160 basis points.

Their pricing too was slightly better than earlier guidance.

Tom Murphy, portfolio manager at Columbia Management, in

Minneapolis, said it is astounding how much demand there has been

for corporate bonds in recent weeks even with the European crisis

continuing to flare up.

"Six weeks ago, everyone hated everything," he said. "But now,

people have a new risk-budget, or a new time horizon around their

new risk-budget."

The corporate bond market didn't continue to rally Wednesday,

nor have overall prices moved much this week, but the fact that

trading is sideways rather than selling off is considered

significant as reports of further delays in Greece dominate

economic headlines.

"We could be a couple of days from a Greek default, yet the

market is rallying," Murphy said. "If this was happening six months

ago, we'd be at DEFCON 1."

Markit's CDX North America Investment Grade Index, a measure of

health in the corporate bond market, recovered from earlier

deterioration and had improved 0.6% as of 4:35 pm EST. It now

stands at 94.4 basis points--among the best levels since July.

Jody Lurie, credit analyst at Janney Capital Markets, said gloom

and doom headlines from Europe have become "the new normal." For

better or for worse, she said, investors are unfazed by the latest

developments.

"It could definitely be naive," Lurie added. "If something

definitive happens, then we'd see some real reaction. But right now

we're in this limbo state and investors and issuers are both taking

advantage of it."

The seven issuers in Wednesday's market sold $11.5 billion of

new debt. As of Wednesday, markets in February had already absorbed

$31.6 billion--more than half the volume in all of February 2011,

according to Dealogic.

Wells Fargo's three-year notes priced at 100 basis points over

Treasurys to yield 1.347%, and HSBC's three-year notes priced at a

210 basis point spread to yield 2.449%.

Elsewhere, Aflac Inc. (AFL) sold $750 million in a two-year deal

featuring five- and 10-year bonds. They were priced at 185 basis

points and 205 basis points over Treasurys, respectively, yielding

2.669% and 4.022%.

BMC Software Inc. (BMC) also sold $500 million of 10-year bonds

at 235 basis points over Treasurys, yielding 4.316%.

-By Patrick McGee, Dow Jones Newswires; 212-416-2382;

patrick.mcgee@dowjones.com

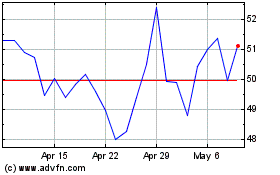

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

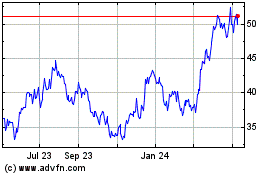

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024