SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 5, 2015

FTI CONSULTING, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Maryland |

|

001-14875 |

|

52-1261113 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1101 K Street NW, Washington, D.C. 20005

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (202) 312-9100

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events

On November 5, 2015, the Board of Directors (the “Board”) of FTI Consulting, Inc. (“FTI Consulting”) authorized a stock repurchase

program, under which FTI Consulting may repurchase up to $50 million of its outstanding common stock at any time for a period of up to six months.

The

specific timing and amount of repurchases will be determined by FTI Consulting’s management, in its discretion, and will vary based on market conditions, securities law limitations and other factors. The program may be suspended or discontinued

at any time without prior notice, and the Board may choose to cancel the program or to replace it with a longer-term authorization at any time during the six month period. The repurchases may be funded using available cash on hand or a combination

of cash and borrowings under FTI Consulting’s senior secured revolving bank credit facility.

FTI Consulting issued a press release on

November 5, 2015 announcing the stock repurchase program. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference herein.

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which involve uncertainties and risks. Forward-looking statements include statements, without limitation, regarding plans for share repurchases. When used in this

press release, words such as “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” “may” and variations of such words

or similar expressions are intended to identify forward-looking statements. All forward-looking statements are based upon FTI Consulting’s expectations at the time it makes them and various assumptions. FTI Consulting’s expectations,

beliefs and projections are expressed in good faith, and it believes there is a reasonable basis for them. However, there can be no assurance that management’s plans will be achieved. Factors that could cause changes to FTI Consulting’s

plans include risks described under the heading “Item 1A Risk Factors” in FTI Consulting’s most recent Form 10-K and in FTI Consulting’s other filings with the Securities and Exchange Commission. FTI Consulting is under no

duty to update any of the forward-looking statements to conform such statements to actual results or events and does not intend to do so.

ITEM 9.01. Financial Statements and Exhibits

(d) Exhibits.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated November 5, 2015 of FTI Consulting, Inc. |

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, FTI Consulting, Inc. has duly caused this report to be signed

on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

| |

|

FTI CONSULTING, INC. |

|

|

|

| Dated: November 6, 2015 |

|

By: |

|

/S/ CURTIS LU |

|

|

|

|

Curtis Lu |

|

|

|

|

General Counsel |

2

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated November 5, 2015 of FTI Consulting, Inc. |

1

Exhibit 99.1

FTI Consulting, Inc.

1101 K Street NW

Washington, DC 20005

+1.202.312.9100

Investor & Media Contact:

Abaigeal Healy

+1.617.747.1727

abaigeal.healy@fticonsulting.com

FTI

Consulting, Inc. Announces $50 Million Stock Buyback Program

Washington, D.C., Nov. 5, 2015 — FTI Consulting, Inc. (NYSE: FCN), the

global business advisory firm dedicated to helping organizations protect and enhance their enterprise value, today announced that on November 5, 2015, the Company’s Board of Directors authorized a stock repurchase program, under which FTI

Consulting may repurchase up to $50 million of its outstanding common stock at any time for a period of up to six months.

Under the program, FTI

Consulting may repurchase shares in open-market purchases in accordance with all applicable securities laws and regulations, including Rule 10b-18 of the Securities Exchange Act of 1934, as amended. The specific timing and amount of repurchases will

be determined by FTI Consulting’s management, in its discretion, and will vary based on market conditions, securities law limitations and other factors. The program may be suspended or discontinued at any time without prior notice, and the

Board may choose to cancel the program or to replace it with a longer-term authorization at any time during the six month period. The repurchases may be funded using available cash on hand or a combination of cash and borrowings under the

Company’s senior secured revolving bank credit facility.

About FTI Consulting

FTI Consulting, Inc. is a global business advisory firm dedicated to helping organizations protect and enhance enterprise value in an increasingly complex

legal, regulatory and economic environment. With more than 4,400 employees located in 26 countries, FTI Consulting professionals work closely with clients to anticipate, illuminate and overcome complex business challenges in areas such as

investigations, litigation, mergers and acquisitions, regulatory issues, reputation management, strategic communications and restructuring. The Company generated $1.76 billion in revenues during fiscal year 2014. More information can be found at

www.fticonsulting.com.

Safe Harbor Statement

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, which involve uncertainties and risks. Forward-looking statements include statements, without limitation, regarding plans for share repurchases. When used in this press release,

words such as “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” “may” and variations of such words or similar

expressions are intended to identify forward-looking statements. All forward-looking statements are based upon our expectations at the time we make them and various assumptions. Our expectations, beliefs and projections are expressed in good faith,

and we believe there is a reasonable basis for them. However, there can be no assurance that management’s plans will be achieved. Factors that could cause changes to our plans include risks described under the heading “Item 1A Risk

Factors” in the Company’s most recent Form 10-K and in

the Company’s other filings with the Securities and Exchange Commission. We are under no duty to update any of the forward-looking statements to conform such statements to actual result or

events and do not intend to do so.

# # #

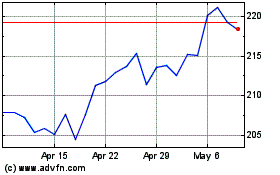

FTI Consulting (NYSE:FCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

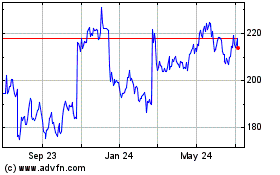

FTI Consulting (NYSE:FCN)

Historical Stock Chart

From Apr 2023 to Apr 2024