SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2015

FTI CONSULTING, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Maryland |

|

001-14875 |

|

52-1261113 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1101 K Street NW, Washington, D.C. 20005

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (202) 312-9100

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 2.02. Results of Operations and Financial Condition

On October 29, 2015, FTI Consulting, Inc. (“FTI Consulting”) held a conference call relating to the press release issued on

October 29, 2015 announcing financial results for the three- and nine-months ended September 30, 2015 and updating guidance for the year ending December 31, 2015. The text of the transcript of the conference call is furnished as

Exhibit 99.1 hereto and incorporated by reference herein.

ITEM 7.01. Regulation FD Disclosure

FTI Consulting defines “Segment Operating Income (Loss)” as a segment’s share of consolidated operating income (loss). FTI

Consulting defines “Total Segment Operating Income (Loss)” as the total of Segment Operating Income (Loss) for all segments, which excludes unallocated corporate expenses. FTI Consulting uses Segment Operating Income (Loss) for the purpose

of calculating Adjusted Segment EBITDA. FTI Consulting defines “Adjusted EBITDA” as consolidated net income (loss) before income tax provision, other non-operating income (expense), depreciation, amortization of intangible assets,

remeasurement of acquisition related contingent consideration, special charges, goodwill impairment charges and losses on early extinguishment of debt, “Adjusted Segment EBITDA” as a segment’s share of consolidated operating income

(loss) before depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges, and “Total Adjusted Segment EBITDA” as the total of Adjusted

Segment EBITDA for all segments, which excludes unallocated corporate expenses. FTI Consulting defines “Adjusted EBITDA Margin” as Adjusted EBITDA as a percentage of total revenues, and “Adjusted Segment EBITDA Margin” as

Adjusted Segment EBITDA as a percentage of a segment’s share of revenue. Although Adjusted EBITDA, Adjusted Segment EBITDA, Total Adjusted Segment EBITDA, Adjusted EBITDA Margin and Adjusted Segment EBITDA Margin are not measures of financial

condition or performance determined in accordance with U.S. generally accepted accounting principles (“GAAP”), FTI Consulting believes that they can be useful supplemental operating performance measures. FTI Consulting uses Adjusted

Segment EBITDA to internally evaluate the financial performance of each of its segments because it believes it is a useful supplemental measure which reflects current core operating performance and provides an indicator of the segment’s ability

to generate cash. FTI Consulting also believes that these non-GAAP measures, when considered together with GAAP financial results, provide management and investors with a more complete understanding of FTI Consulting’s operating results,

including underlying trends, by excluding the effects of remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. In addition, EBITDA is a common alternative measure of operating performance

used by many of FTI Consulting’s competitors. It is used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in FTI Consulting’s industry. Therefore, FTI Consulting also

believes that these measures, considered along with corresponding GAAP measures, provide management and investors with additional information for comparison of its operating results to the operating results of other companies.

1

FTI Consulting defines “Adjusted Net Income” and “Adjusted EPS” as net income

(loss) and earnings per diluted share, respectively, excluding the impact of remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and losses on early extinguishment of debt. FTI Consulting uses

Adjusted Net Income for the purpose of calculating Adjusted EPS and uses Adjusted EPS to assess total FTI Consulting operating performance on a consistent basis. FTI Consulting believes that this non-GAAP measure, when considered together with its

GAAP financial results, provides management and investors with a more complete understanding of its business operating results, including underlying trends, by excluding the effects of remeasurement of acquisition-related contingent consideration,

special charges, goodwill impairment charges and losses on early extinguishment of debt.

Non-GAAP financial measures are not defined in

the same manner by all companies and may not be comparable to other similarly titled measures of other companies. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained

in FTI Consulting’s Consolidated Statements of Comprehensive Income.

Reconciliations of GAAP to non-GAAP financial measures are

included in the accompanying tables to the Presentation.

The information included herein, including Exhibit 99.1 furnished herewith,

shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by

reference into any filing pursuant to the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such filing.

ITEM 9.01. Financial Statements and Exhibits

(d)

Exhibits

|

|

|

| 99.1 |

|

Transcript of October 29, 2015 Conference Call of FTI Consulting, Inc. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, FTI Consulting, Inc. has duly caused this report to be signed

on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

FTI CONSULTING, INC. |

|

|

|

|

|

| Dated: November 2, 2015 |

|

|

|

|

|

By: |

|

/S/ CURTIS LU |

|

|

|

|

|

|

|

|

Curtis Lu General Counsel |

3

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Transcript of October 29, 2015 Conference Call of FTI Consulting, Inc. |

4

Exhibit 99.1

EDITED TRANSCRIPT

FCN - Q3 2015 FTI Consulting Inc

Earnings Call

EVENT DATE/TIME: OCTOBER 29, 2015 / 01:00PM GMT

1

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

CORPORATE PARTICIPANTS

Abby Healy

FTI Consulting Inc - Manager of IR

Steve Gunby FTI Consulting Inc - President and CEO

David Johnson FTI Consulting Inc - CFO

CONFERENCE CALL PARTICIPANTS

Tim

McHugh William Blair & Company - Analyst

Tobey Sommer SunTrust Robinson Humphrey - Analyst

David Gold Sidoti & Company - Analyst

Ato Garrett Deutsche Bank - Analyst

Randy Reece Avondale Partners - Analyst

PRESENTATION

Operator

Good day, everyone, and welcome to the FTI Consulting third quarter of 2015 earnings conference call. As a reminder today’s call is being

recorded. Now for opening remarks and introductions, I’ll turn the call over to Abby Healy, Manager of Investor Relations at FTI Consulting. Please go ahead, ma’am.

Abby Healy - FTI

Consulting Inc - Manager of IR

Good morning. Welcome to the FTI Consulting conference call to discuss the Company’s

third quarter of 2015 results, as reported this morning. Management will begin with formal remarks, after which we will take your questions.

Before we

begin, I would like to remind everyone that this conference may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, that involve risks

and uncertainties.

Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events, future revenues, future

results and performance, expectations, plans or intentions relating to financial performance, acquisitions, business trends, and other information or other matters that are not historical, including statements regarding estimates of our medium-term

growth targets, future financial results, and other matters.

For a discussion of risks and other factors that may cause actual results or events to

differ from those contemplated by forward-looking statements, investors should review the Safe Harbor statement in the earnings press release issued this morning, a copy of which is available on our website at www.fticonsulting.com, as well as other

disclosures under the heading of Risk Factors and Forward-Looking Information in our most recent Form 10-K and in other filings filed with the SEC. Investors are cautioned to not place undue reliance on any forward-looking statements, which speak

only as of the date of this earnings call, and will not be updated.

During the call, we will discuss certain non-GAAP financial measures, such as

adjusted EBITDA, adjusted segment EBITDA, total adjusted segment EBITDA, adjusted segment EBITDA margin, adjusted earnings per share, and adjusted net income.

For a discussion of these and other non-GAAP financial measures, as well as our reconciliation of non-GAAP financial measures to the most recently comparable

GAAP measure, investors should review the press release and the accompanying financial tables that we issued this morning. Lastly, there are two items that have been posted to our Investor Relations website this morning for your reference.

These include a quarterly earnings call presentation that we will refer to during this morning’s call and an Excel and PDF document of our historical,

financial, and operating data, which has been updated to include our third quarter of 2015 results. With these formalities out of the way, I’m joined today by Steve Gunby, our President and Chief Executive Officer, and David Johnson, our Chief

Financial Officer. At this time, I will turn the call over to our President and Chief Executive Officer, Steve Gunby.

2

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

Steve Gunby - FTI Consulting Inc - President and CEO

Thank you, Abby. Good morning and welcome. We have fair amount of detail to cover this morning, so let me briefly introducing some key

messages, then turn it over to David to give you some granular detail. I will come back before Q&A and share a few perspectives on where I see us on the overall change journey.

I’d like to start the session by talking about three points, two that are somewhat sobering and one that is substantially more positive. First, though

the Q3 numbers look reasonably solid, as David will talk about, embedded in those numbers are some concerning trends in a couple of businesses that we believe will persist into Q4 and well into next year. As a result of those trends and some timing

issue, we are taking our guidance for 2015 for adjusted EPS down to a range of $1.80 to $195.

Second, and a message that I find toughest to swallow, is

that based on that lower platform, we can no longer transmit confidence that we will meet at $2.50 per share aspirational target in the time frame we had originally hoped, which was 2016. That change is an important one for me. The $2.50 per share

was not just a number to me. For me, it’s somewhat of a milestone for our Firm, marking a targeted end of the first phase of the major change efforts that we are collectively driving here. Though we’ll talk about it, the progress we are

making, I and we had serious hopes of getting there in the next 12 months.

Though we are making considerable progress in our change efforts, and the

efforts are showing momentum, both in qualitative terms and in financial terms, there some current business headwinds and some legacy headwinds that have persisted longer than we anticipated when we first set the aspiration for 2016 that make it no

longer realistic to say we’re on track for hitting that number in 2016. I’ll come back to those comments in my close.

The last point is, to me,

at least as important as the first two. Notwithstanding those first two messages, I and the rest of our team remain very bullish, not just on where this Company can go, but where we are already heading. The platform of this year’s results is

not as high as we had hoped, but the results are still indicative of substantial improvement and a positive trajectory that is underway and going forward.

We will talk about this more in David’s remarks and the close, but we’re making progress in multiple areas: organic headcount, stopping poor

acquisitions, using cash in ways that is accretive and investment behind core bets, and making investments that are working, and growing the capabilities of this Organization to identify and make great bets to drive organic growth.

This combination of continued investment for the future, realizing the result of initial bets, good deployment of cash, means that notwithstanding legacy

issues and some current business headwinds and, candidly, some places where we’re simply not performing at the level we need to, notwithstanding all of that, the numbers are going up. This year, for the first year in many years, we’re

going to have growth in our EPS, and not only growth, but growth in double-digits.

We believe that through a prudent use of cash and organic growth, we

are on a path toward steady year in, year out, double-digit EPS growth. Let me get back to some of the points in a little bit more detail after David has had a chance to go through some of the numbers. David?

David Johnson - FTI Consulting Inc - CFO

Thanks, Steve. Turning to slide 4, revenues for Q3 were $455.5 million, up 1% from the prior-year quarter. FX cut an estimated 3.1% from

revenue growth, and adjusted, we grew 4.1% year-over-year, with 3.6% of that being organic. Revenues were up sequentially from Q2 2015 by 1.4% with minimal impact from FX.

Fully diluted GAAP EPS were $0.25 in the quarter compared to $0.55 in the prior year. EPS in the current quarter included our previously disclosed $19.6

million loss on early extinguishment of debt, which decreased EPS by $0.28 Adjusted EPS for Q3 were $0.53 versus $0.63 last year. Adjusted EBITDA was $56.1 million, or 12.3% of revenues, compared to $63.4 million, 14.1% of revenue, in the third

quarter of 2014, and up fractionally from $55.8 million in Q2.

Turning to our segments on slide 5. Corporate finance and restructuring revenues increased

13.4% to $113.5 million, compared to $100 million last year. This was net of an estimated 4.3% negative hit from FX. Excluding FX, revenues increased 17.8%, driven by continued high demand in North America, particularly for distressed services.

Revenues increased 4.9% sequentially from Q2, excluding FX.

Adjusted segment

EBITDA for the quarter was $26.7 million, or 23.5% of revenues, compared to a 15.5% margin in the prior year, and 22.2% margin in Q2. The 20[%]- plus margins we have seen so far this year are driven by increased volume from North American distressed

work, which in turn drove higher utilization, and improvements in staff leverage. We are particularly pleased with the improvement in leverage. Corporate finance grew headcount 15% year-over-year and 7% sequentially, exactly when they were needed.

Turning to the outlook. Several of our largest North American distressed projects will likely wind down in the fourth quarter. Our backlog is good, but

it does not match the levels we saw at this point in the prior three quarters.

3

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

The lower backlog, coupled with normal seasonality, causes us to expect some pullback in Q4 from our

year-to-date pace. Revenue will likely be down single-digits sequentially, but still north of $100 million in the fourth quarter, and margins will be mid- to high teens.

In forensic and litigation consulting, or FLC, we reported revenues of $116.2 million in the quarter, decreasing 4.6% from prior year, and 7.9% down

sequentially. Excluding an estimated negative impact of FX, revenues were down 2.3% year-over-year, and 7.4% sequentially. The decline came primarily from lower demand in our global disputes and investigation practices, offset only partially from

success fees in health solutions and improved demand in our North American data analytics practice.

FLC’s adjusted segment EBITDA was $13.4 million,

or 11.5% of segment revenues, compared to $22.3 million, or 18.3% margin, in the prior-year quarter. On a sequential basis, adjusted segment EBITDA was down $6.6 million from Q2. The major drivers of the decrease in adjusted segment EBITDA and our

margin were lower demand in our global disputes and investigations practices, coupled with the ramp-up of hiring in certain core practices, and higher bad debt expenses compared to bad debt recoveries in the prior-year quarter.

These results are a significant disappointment. While FLC met its targets in July, revenues and profits weakened sharply in August. The trend continued in

September and our current backlog indicates little hope for recovery in the fourth quarter.

There are three things occurring here. First, we continue to

suffer from the comparison with 2014, which was the best year in FLC’s history. Several large matters drove utilization and profits up dramatically. Most of that business is now in the rearview mirror.

Second, several large North American offices are now seeing weak demand versus even our normal run rate expectations. We’re aggressively analyzing the

drivers, but much of this business is reactive. If the volume of investigations and disputes drops, then so does our business. We do not perceive a loss of share, but we’re looking closely.

Third, much of the increase in cost is intentional. Just as in corporate finance, FLC headcount, particularly junior staff, is up, in FLC, 6.5%

year-over-year, excluding health solutions. Normally, revenue lags headcount. We’ve been lucky in corporate finance that it hasn’t. However when demand doesn’t just lag, but instead drops, the cost from the headcount goes right to the

bottom line.

The increased FLC hiring since the beginning of the year added more than $3 million of salary costs to the quarter, and year-to-date, they

are more than $11 million. Nonetheless, we are completely and totally committed to both the hiring program and the strategy of organic growth. We believe this staff is a necessary, but we get it, it is not a sufficient condition for growth, but we

must have the staff.

In our outlook, we expect to see revenue, margin, and EBITDA in the fourth quarter to all be slightly down again from third-quarter

levels. This is a further step back from our last forecast, when we expected FLC’s second half to be stronger than the first half of the year. The core FLC business will likely tread water in fourth versus third quarter and the segment reported

EBITDA should see a small step back from third-quarter levels, which benefited from success fees in health solutions.

Third-quarter economic consulting

revenues declined 4.9% to $114.5 million compared to $120.5 million in the prior-year quarter, which includes an estimated 2.2% negative impact of FX. A small acquisition made in the fourth quarter last year contributed $1.7 million of third-quarter

revenue, a 1.4% lift. Excluding both the acquisition and FX, revenue declined $5 million, or 4.2% year over year.

M&A-related revenue continued at

high levels and remained our bright spot in the quarter. The international arbitration regulatory and valuation practices in economics were also up year-over-year. This strength was offset yet again year-over-year by decreased demand for non-M&A

related anti-trust and financial economics services.

However, sequentially, revenues in the segment increased 5.4% from $108.7 million in Q2. Adjusted

segment EBITDA decreased slightly to $16.7 million year-over-year and increased slightly from $15.3 million in Q2. Margins were down 1 point year-over-year and essentially flat sequentially.

In our outlook, we expect revenue and EBITDA in the fourth quarter to be largely unchanged from second- and third-quarter levels. Given that December is

historically very weak in this segment, that means we are hoping for some improvement versus our year-to-date run rate in the first two months of the quarter.

In the third quarter, technology revenues of $55.6 million decreased 10.9% compared to $62.4 million in the prior-year quarter, including a 1.5% decrease from

FX. Excluding FX, revenues decreased 9.4%. The decrease in revenues was primarily due to a decline in consulting and other services related to financial services companies and large global cross-border investigations, which was only partially offset

by M&A-related second request work.

4

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

While we continue to win new M&A-related matters, they do not make up for the loss of the larger

investigations that drove 2014. Sequentially, revenues dropped 10.1%. Adjusted segment EBITDA was $10.8 million, or 19.5% of segment revenues, compared to $17.8 million, or 28.6% of segment revenues, in the prior-year quarter.

The decrease in adjusted segment EBITDA margin was due to lower utilization and realized pricing related to client mix and reduced licensing revenues.

Technology is a business that we know is extremely dynamic and lumpy. One or two big projects can materially change results.

Nonetheless, based on our

current backlog, we do not expect this business to dramatically change in 4Q or early 2016. We expect revenues to be slightly down in the fourth quarter, with minor improvement in margins, leaving EBITDA levels largely unchanged.

In strategic communications, third-quarter revenues increased 19.7% to $55.7 million, which included an estimated 7% unfavorable impact from FX. Excluding FX,

revenues increased 26.7%; however, of this, $9.3 million was a result of higher pass-through revenue, with the other $3.1 million coming from organic growth, driven largely by higher M&A in public affairs project-based revenues in EMEA and North

America. Sequentially, revenues were 28.5%, or $12.3 million higher, but also benefiting from the pass-through revenue.

Adjusted segment EBITDA was a

$8.7 million, or 15.6% of segment revenues, compared to $6.6 million, or 14.2%, in the prior-year quarter, and $5.6 million, or 13% of segment revenues, in Q2. This marks the sixth straight quarter of double-digit margins in strat comm. The increase

in adjusted segment EBITDA margin is largely driven by redeploying and matching headcount towards profitable work and the improved staff leverage that resulted from cost-saving activities initiated in 2014, as well as a shift in mix to higher-priced

project-based revenue.

In our outlook we expect the spike in pass-through revenue in third quarter to reverse, leaving fourth-quarter revenue at levels

comparable to third quarter, but excluding pass-throughs. Excluding pass-throughs, those were $42 million. Margin should be relatively unchanged, leaving EBITDA very slightly down.

As usual, I won’t spend a lot of time on the geographic breakdowns on slide 6. North America remains our primary engine, with corporate finance driving

results for the third quarter in a row. EMEA dropped a little bit due to negative contributions from technology and FLC, but was largely in line with normal revenue contribution the past two quarters.

Asia-Pacific remains weak, still driven largely by Australia, though EBITDA in the region saw positive improvement year-over-year. Latin America was a bit

slower than expected, with a drag at FLC revenues, and negative FX impact from strat comm.

Turning to slide 7, our cash and cash equivalents were $105

million at quarter-end, as we completed the retirement of our 6.75% notes. We estimate that our total refinancing program, retiring the $400 million of notes with a mixture of cash and bank debt, will benefit our fourth-quarter adjusted EPS by

approximately $0.08.

For 2016, we expect a further, on top of the $0.08, incremental benefit of $0.17, or slightly north, depending on your view of

LIBOR. We are projecting a fourth-quarter tax rate of 36%, plus or minus, but as you know, this can be quite volatile from quarter to quarter.

Finally,

we look for our corporate investment spending to peak in the fourth quarter. Our corporate expense line should approach $30 million. The largest part of the increase, just as was the case last year, is our annual all SMD meeting, which produces

$0.06 to $0.07 of cost. Given the weakness we are seeing in results, we considered postponing the meeting; however, that would be exactly the wrong message to our SMDs.

Sustained organic growth requires sustained investments that doesn’t waiver with quarterly fluctuations. These annual sessions are not parties; they are

intense planning and training sessions in our strategy for growth and they are essential for our future.

As you saw in our release, we have lowered our

outlook for fourth quarter significantly. The midpoint of our new range is $0.18 below the previous level. The vast majority of our diminished outlook is driven by FLC, with minor reductions from technology and corporate finance.

As Steve will discuss, our belief that value is created by organic growth with disciplined use of capital is unchanged. Each of our businesses has and will

benefit from our program of investment, which is, one, a steady pipeline of increased talent both developed internally and hired from outside; two, incremental expansion of products in areas of practice; three, deepened coverage of countries and

regions; four, R&D where it is relevant; five, improvements in cost structure; and six, expansion of our vision of and capabilities in origination.

Doing these things will increase EPS. However, this is a volatile business and our growth will always be off a difficult-to-predict baseline.

5

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

Since the beginning of 2015, we have seen six major changes in our outlook. First, corporate finance has

materially outperformed. Second, the earnings benefit we found from the use of our cash to restructure our debt proved high. Unfortunately, we also now have three segments with weaker results in 2015 than hoped: economics, technology, and now, FLC.

Up until now, this weakness this has been offset by corporate finance and delayed investment spending, but with FLC down and our investment programs

underway, we will now have to grow in 2016 off a lower base. We are not yet ready to provide our 2016 guidance. However, given our run rates going into the fourth quarter, it is unlikely we can reach $2.50 per share in 2016. Now I’ll hand it

back to Steve.

Steve Gunby - FTI Consulting Inc - President and CEO

Let me pick up on David’s points and bridge a bit between the results this quarter, the fact that is taking us longer to reach $2.50 a

share, and the positives that we are seeing. One way I’d like to do that is provide some historical perspective, disaggregating our business into two parts, a group of four business that I got a lot of questions on when I first started, and the

other two businesses.

The four businesses that I received a lot of questions about when I started were strat comm, corp fin, FLC, and health solutions.

If you look at the slide on page 8, you will see why many of the people were asking about those businesses. From 2009 to 2013, as most of you know, these businesses were down substantially in adjusted EBITDA, cumulatively $114 million, which is

about $1.70 EPS impact for a Company that, as you know, only earned $1.64 last year.

This huge impact was notwithstanding the fact that, during this

period, we invested a substantial amount of money in acquisitions behind some of these businesses. Some of the decline was the aftermath of the restructuring boom in 2009, but as you know and can see on slide 9, the decline persisted for an extended

time after the restructuring boom ended, and collectively drop below pre-restructuring boom levels, and hence the many questions.

We have since focused

on a lot of these businesses. When you look at them, they cry out that we have a right to win, to succeed, to grow in these businesses, not to shrink, but to be growing them. We have great professionals, and in many geographies, we have very strong

competitive positions. We should be able to do better.

And we’ve made changes. We downsized certain subparts of certain businesses, while we

invested behind other ones. And we made a lot of what we call bets, which are the colloquial term, it means investments behind key positions. A number of those investments are working.

Cumulatively, the effect is that we have begun to turn these businesses around. In 2014, those businesses cumulatively were flat in EBITDA and adjusted

EBITDA. Flat, we would all agree is hardly exciting, but compared to a drop of $[28] million a year over the prior years, flat, without any support from acquisitions, is a start.

This year, when we look at these businesses, even incorporating the FLC fallout from the second half of the year that David talked about, and the substantial

investment in headcount, cumulatively these businesses will be up roughly 10% this year in adjusted EBITDA.

The 10% growth is with far from all of these

business humming. Some of the acquisitions we’ve talked about from time to time are not yet fully performing, some places some of the new revenue bets are not working, added headcount in some places that are not fully deployed. But even with

those headwinds, there is enough good stuff that is going on in these businesses, that we have been able to take this pattern of many years and start to turn it around.

This is what we’re trying to do with all of our businesses in ever better ways. We don’t need to be perfect. What we need are strong, solid

investments that collectively work, and we’re seeing those results here. Let me switch from where we have made clear progress to the other two businesses.

If you look at slide 12, you see a different story for econ and tech for 2007 to 2013. They were wonderfully stable businesses during this period, with growth

up to 2011 and stability thereafter, really the core rocks of stability for the Company during this period. If you look over the last two years, of course, they have not been the rocks of stability.

Combined, they are down $50 million in adjusted EBITDA between 2013 and where we believe they’re going to come out this year. The biggest surprise for me

has been econ. We have unbelievable professionals in this business and it had been a real growth business historically.

There were new employment

contracts beginning in 2014 and some other cost issues that created a margin hit for the business, but the forecasted at that time and for many quarters since was that EBITDA, though it would take a short-term hit, would be back up, that top-line

growth would overcome this hit. As you know, the expected revenue growth hasn’t come.

6

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

If you look a bit deeper, in fact, econ EBITDA peaked in Q1 of 2013, at $26 million, and declined with jagged

edges to roughly one-half that level by early 2015. A year ago, based on the revenue forecasts, I had expected that we would get the earnings back to 2013 levels by 2016. This is clearly not going to be the case and is one of the major reasons why

the $2.50 a share aspirations for 2016 is unlikely to be met.

Nor have we yet turned these econ businesses back into substantial growth businesses, but

we believe we have a much better handle on these businesses and significant actions by the teams involved have stabilize these businesses. We’ve taken a hard look at the businesses on two dimensions: first, simply to make sure we have more

realistic revenue forecasts, and second, to talk about what do we need to do to actually get these businesses growing again.

We have the best franchise

in the world, the world’s best professionals. These are businesses that have historically produced tremendous growth. We’re committed to continue to invest behind the strong positions and the strong professionals and we believe those

investments and the efforts of the professionals have stopped the multi-quarter hit that started in the first quarter of 2013. We’ve thus eliminated a significant persistent drag on our earnings. We look forward over time to turn these

businesses back to the substantial growth engines they once were.

The second issue is tech. We’ve always known that this business is heavily

dependent on large jobs and we worried about both the risk that in any quarter or two would lack for the large jobs, and the more systemic issue of whether, as the financial crisis litigation ran off, the market as a whole might slow.

I would say that the market has moved as fast in a negative direction as our scenario ranges feared. We have been affected by that about as much as we could

envision. We believe that e-discovery business will be around for a long time and we have a terrific position in that business and terrific professionals. Nevertheless, given the market dynamics, we are looking at the fundamental strategic elements

and working to figure out how to get that business back on a growth trajectory.

We have heavy attention on that, both within the segment and in our

strategy department. I’m confident we will find good answers, given the strength of those professionals. Having said that, none of that gives us confidence, particularly in the absence of a big core job or two, that this is a substantial growth

engine for 2016.

So let me step back. Where does that leave us as a whole? It leaves us with a substantially lower base than where I hoped we would be at

this point in time, but the beginnings as well of a growth trajectory and no less confidence in our forecast of a going-forward growth trajectory.

We

have formula for growth that is working across the first four businesses. Though in any period time, any one of those businesses can be off in a significant way, as we have seen this year, with FLC, cumulatively we believe we have turned a major

corner on a very difficult historical trend there.

Over the past couple of years, we’ve had a big drag from econ. Though we cannot yet claim to have

returned econ to its historical growth trajectory, we do believe we have bottomed out the decline and have the right conversations going on internally to over time return it to growth. More important, we have the right set of professionals to do

that.

We clearly have some uncertainty near term about tech, but we also have terrific people there who are focused on the right questions and I’m

confident we will find good answers. The net of all that is for sure a lower base than we had hoped, but even so, a base that we believe this year will be up double-digits over last year in terms of EPS.

More important, a belief that we have a sustained growth trajectory going forward, a trajectory that can both create the sort of Firm that delights and

inspires the great professionals, but also that delivers on sustained double-digit EPS growth going forward. So with that, let me open the floor for questions for David and me. Thank you.

QUESTION AND ANSWER

Operator

(Operator instructions)

We will go first to Tim

McHugh from William Blair & Company.

Tim McHugh - William

Blair & Company - Analyst

Thanks. First, maybe just to focus e-discovery and economics, I get you — you made

some comments, maybe to start with economics, that you feel like you stopped the declines and are in a better place. But what’s going to drive — can you elaborate on what gives you confidence that we are on a better trajectory here, other

than, I know the comparisons and so forth get easier, but just maybe a little bit more detail there?

7

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

David Johnson - FTI Consulting Inc - CFO

Well, actually the comparisons are a big part of it. Year-over-year, we have had weakness in financial economics and private antitrust that

started first quarter last year. Those have persisted, but we have bottomed out and actually now started to see sequential some signs of sequential growth.

So we’re now not going to be fighting negative comparisons from fourth quarter onward in those segments. In the other businesses where we’ve been

seeing substantial growth, which has been offset by those weaknesses, any further positive efforts we have there now, can go to the bottom line.

M&A,

again, you can’t — that’s volatile, too. We will rise or fall with the volume of global M&A revenue, but our franchise is fantastic, our share is great there, and we’ve been doing really good in that area and in arbitration

all through the year. It’s just been offset by the comparisons in the other two segments. Those are now stabilized with some signs of sequential growth and we’re still looking for good stuff in the international arbitration and M&A.

In arbitration, it’s not as volatile or susceptible just to the wave of M&A going up and down. That is one where if you add incremental

professionals, you get incremental share and volume and we’re continuing to invest. So it’s all positive signs that we think we have bottomed, and at the minimum, hopefully this will not be a source of negative surprise, and hopefully we

can have some upside going forward.

Tim McHugh - William Blair & Company - Analyst

Okay. And let me just ask a bigger picture, or somewhat bigger picture. You’ve resisted wanting to talk about profit margins in the past

and I know you’ve pointed out more revenue at a lower margin is still a good thing. But given your new guidance margins implies will be down again this year.

Despite all the headcount, the growth is really fairly modest at this point. I get you’ve got different segment with puts and takes, but does the thought

of a margin for the next year or two or some medium-term margin target, do you have any thoughts on where you sit on balancing those factors?

David Johnson - FTI

Consulting Inc - CFO

We’ve never resisted talking about what our margins are, but as you correctly point out,

we’ve resisted saying what is the perfect target margin for the overall Company and for each segment. And actually the results of the quarter give a good example of one of the reasons why we do resist that.

Not that we don’t think about it, and not that we’re not willing to talk about it in pieces, but for example, in corporate finance, we’ve heads

at a dramatic amount, and because, as Steve said, many of the investments that we’ve made over time have been so successful there, those heads not only where immediately rushed to the front lines to do the work, but they did it in a way that

improved our operating leverage and further boosted the margins.

In FLC, on the other hand, we also added the heads, but because the revenue and the

demand was not there, it degraded it. So on a rolling three-year basis, if you have sustained revenue growth, those headcounts, in both cases, are part of structurally improving the margin, and by giving us the benefit of operating leverage when we

have adequate demand to put them to work in a more profitable way. And if you look at our [corp] finance numbers, the cost per billable head is dropping as revenue is going up.

So it’s working exactly as you want, but the margin is, in some ways, a little bit more volatile because you have the costs. So we definitely are willing

to talk about it, but it’s almost impossible on a quarterly or even an annual basis to nail a target margin when you’re trying to build for a long-term sustainably more profitable, and on average, higher-margin business. I know Steve has

views on this, too.

Steve Gunby - FTI Consulting Inc - President and CEO

Good answer.

David Johnson - FTI

Consulting Inc - CFO

Does that answer your question, Tim, or start to answer your question?

8

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

Tim McHugh - William Blair & Company - Analyst

Yes. That’s fine. All right. Thanks, Tim.

David Johnson - FTI

Consulting Inc - CFO

Thanks, Tim.

Operator

We’ll go next to Tobey Sommer of SunTrust.

David Johnson - FTI

Consulting Inc - CFO

Good morning, Tobey.

Tobey Sommer -

SunTrust Robinson Humphrey - Analyst

Good morning. Within your headcount growth, is there a difference in the

rates of year-over-year consulting growth, if you look at it from an SMD and top-level, mid-level, and at the junior end?

David Johnson - FTI

Consulting Inc - CFO

For sure. There’s a huge amount of variation across our segments, depending on their starting

place, Tobey, but absolutely. We’re up on all levels. Our SMD headcount is up, as is across the board, and by level, but it’s different by level. The percentage headcount growth in the SMD is the lowest because part of what we’re

trying to do is rebuilt leverage that we did not have.

You can’t achieve the profitability targets that we think we deserve or the growth

aspirations with the low leverage that we have allowed ourselves to get through for a while. So most of the headcount growth is not at the SMD level, but we have growth at each level in the pyramid. Did that answer your question?

Tobey Sommer - SunTrust Robinson Humphrey - Analyst

So without specific percentages, somewhat lower in the SMD level, maybe it’s mid-single-digits, rather than 8% or 9% like the aggregate,

and in the low level, is in the double-digits somewhere?

Steve Gunby - FTI Consulting Inc - President and CEO

Yes. that’s about right. Yes again, it depends, but yes, even low single-digits on SMD is depending on the practice.

David Johnson - FTI Consulting Inc - CFO

Yes.

Tobey Sommer -

SunTrust Robinson Humphrey - Analyst

I’m curious about — thank you — you’ve now been at the

helm for several quarters, and you’ve seen variation in the Company’s forecasting versus actual results. Has anything — have you altered anything about your forecasting process is one question? And then I’m curious if the sharp

focus on onboarding new talent is at all maybe taking precedent over the financial forecasting? Thank you.

9

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

Steve Gunby - FTI Consulting Inc - President and CEO

I will answer the first one. Actually, we have — since I joined and then since David joined, we’ve done a number of steps to upgrade

our forecasting. We could’ve just done a better job of — there’s some inherent unforecastability about this business, which you’ll never get rid of. And then there’s some part where if we had been a little more probing in

our questions and challenging our data with historical analogs and so forth, we could’ve gotten rid of some less probabilistic forecasts.

That’s just part of the continuous improvement. I would say we’re now significantly better at forecasting than we were, but it’s probably still

work to do. The second part of your question was are we focusing on onboarding and is that distracting from our financial forecasting? I don’t think those two are connected at all, actually.

We do have a lot of focus on onboarding. We have some conversations internally as to how much work we have put in to making sure we’re getting the right

talent. To get the right talent sometimes means you have to have your senior-most professionals involved in hiring, and whether that helped distract from the marketplace activities, and contributed to some of the slowdown we’re seeing in a

couple of place. We’re talking about that, but I haven’t seen any connection between that and the financial forecasting. David, would you agree?

David Johnson - FTI

Consulting Inc - CFO

It’s completely different people for the most part. We’ve increased the frequency and the

depth of the reforecasting exercise, certainly since when I first started. On a segment-by-segment basis, we are improving the backlog, you could call it interrogation tools. But inherently, there’s always going to be a portion of even a

quarter’s forecast for business that has to be acquired.

You have greater or lesser amounts of confidence depending on how much of the expected

business for the quarter is in firm backlog, as opposed to how much to be acquired. Generally, the surprises in my now 15 months in the Company, generally seem to come from matters winding up a little faster than expected. That’s usually when

you get a divot of expectation within the current quarter.

Tobey Sommer - SunTrust Robinson Humphrey - Analyst

And my last question is on the economic practice. The slowdown in the top line did seem to occur more or less when the change in compensation

occurred. At this point, do you see a linkage between the two or do you consider it a market phenomenon?

Steve Gunby - FTI

Consulting Inc - President and CEO

I don’t see a linkage between the two. I don’t think there’s a causal

link between those two, if that’s a question. There are market phenomena that are going on in all of these businesses, and whether we’ve lost or gained share in a subset of our business is another factor we talked about internally, but I

don’t see a connection between that and the new compensation arrangements, Tobey.

Tobey Sommer -

SunTrust Robinson Humphrey - Analyst

Can I sneak one more in? In prior election cycles, there has been a slowdown

around government-led investigations as top regulators go back out into private employment and their custodian subordinates don’t tend to launch as many new investigations, but rather just execute on the ones that are already ongoing. Have you

looked at that as a potential explanation for activity in the marketplace? Is that anything you’re seeing?

Steve Gunby - FTI

Consulting Inc - President and CEO

I’m sure that those discussions are going on in FLC right now. I’ve actually a

bit resisted those. The truth is that even though that could be a macro factor, my sense here, Tobey, is we’ve been a little bit too willing to go to macro factors. Yes, that could be true. The truth is that we have great professionals who,

even if there’s market slowdown, will typically gain share and we need to not use that as an excuse.

10

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

If the market is a macro slowdown, we need to be figuring out how do we gain share so we can deploy the

professionals that we’ve added and get this back business back to growing. So I don’t think that we should be — that might be true and I’ll be meeting with FLC tomorrow to go through the latest hypotheses they’ve got going

through and I’ll see what they say about that.

But I want to be clear, I don’t think we should be using that as an excuse. We have slowdown in

some of the offices with the most outstanding professionals. My experience is the outstanding professionals focused on the market can get their people back busy. The question is how long will it take, but I believe we can and need to get the folks

back busy. Does that answer your question, Tobey?

Tobey Sommer - SunTrust Robinson Humphrey - Analyst

It does. Thank you.

Operator

We will go next to David Gold of Sidoti.

Steve Gunby - FTI

Consulting Inc - President and CEO

Good morning, David.

David Gold - Sidoti & Company - Analyst

Hi. Good morning. Just a couple of questions. First, on the FLC side, just following up there. As we think about that business, do you think

there are secular changes there that maybe now we have to focus on a little more closely and therefore maybe we should be going about that business in a different way?

Steve Gunby - FTI

Consulting Inc - President and CEO

We will be talking to all those hypotheses. I have strategy conversation every three

months with each of the segments and I have one tomorrow with FLC. So we talk about all of that stuff. At this point, I don’t — it’s similar to the question with Tobey — at this point, I don’t think there’s enough of a

secular change in that market that we should be changing direction.

What we need to do is get our professionals back in the market and get our people

busy. Does that mean there aren’t specific geographies and specific sub-practices and so forth around the world? We’re a very complicated business. There’s always a truth to that in sub-practices and sub-geographies, but as a whole, I

don’t think so, David. That’s not our conclusion. Our conclusion is we’ve got get back to work and get our people busy.

David Gold -

Sidoti & Company - Analyst

Okay. And then broader question. As we think about what has gone on over the

last year, say, versus the strategic review process that went on when you initially joined, two questions. First, at this point your level of confidence in that strategic review process, say, and maybe you have the planned outcome there given that

we’ve run into some bumps in the road? And then two, is it time, perhaps, for a closer re-review maybe of all the business lines? Forgive me if it’s unfair. I’m just—?

Steve Gunby - FTI Consulting Inc - President and CEO

No, it’s fine. In terms of re-review of the business lines, we are — you recognize that when you first start, you get a strategic

review and you need to look at each of those businesses sequentially and make sure it holds. We’re doing that every quarter and we’re doing deeper dives with different businesses or sub-parts of the businesses periodically. It is a part of

our process, so I agree with that.

11

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

In terms of the business versus what I saw, there are surprises, but I would say, again, let me go back to my

remark, the biggest surprise is actually with one of our best businesses, is econ, where we thought that — where there was going to be a cost hit in 2014 but we would rapidly overcome that with growth. And that growth hasn’t come. It

doesn’t make the business less of a great business, but that is a big gap in where we are today versus where I thought we would be today.

Mainly

because it’s such a great business. It was very — given the trajectory — it was very easy to believe what I believe last Management believes, which was that with the cost hits would rapidly be overcome by growth. The cost hits have

come and they haven’t been rapidly overcome by growth, and that’s a new reality and it’s a key part of it.

If you adjusted for that

reality, the noise around all the rest of the businesses would even out. Corp fin is outperforming where I thought we would be at this point and FLC is below. Strat comm is — there was a lot of skepticism about strat comm — strat comm has

done a terrific job of moving its thing.

So there’s clearly differences from where we were a year ago. I would say there’s only one fundamental

surprise and it’s with one of our best businesses and we’ve got that understood at this point. We do have an important set of questions with tech, driven by the market, and we have a look at that going on right now. Does that help David?

David Gold - Sidoti & Company - Analyst

It does. It does. And then just one last one. I know one of the key plans has been making some investments and some broader bets and maybe

plant the seeds of growth longer term. Any of those bets that you can either talk about just yet, or is it too early? And part two, at this point, do we back off some of that investment or do we keep that going?

Steve Gunby - FTI Consulting Inc - President and CEO

There’s a lot of detail we could go into. I don’t know whether we want to go into all of that here. In every one of the businesses,

we have investments. In strat comm, the key of the turnaround to strat comm was to figure out sub parts of that business where we thought we could invest at the time we were dis-investing or slowing the growth in some other parts.

We’ve invested behind, as we’ve talked about, public affairs, which we have a very strong position in; we’ve invested behind our energy

practice in the US; our public affairs business in Brussels. There’s terrific results are. I don’t know if we are releasing numbers of headcount of our Brussels office, but — we’re not — but there’s substantial growth.

By many measures, we’re the number one public affairs business in Brussels right now. There those sorts of stories in every business. We’ve

talked about some of the investments we’ve made to drive businesses in our corp fin business: nondistressed businesses in the US, some businesses in Europe.

The businesses in Europe were a big loss — drag in the first year of investment. This year they are net positive, by the end of this year, and we

expected things going forward. And the same thing for some of the US businesses there.

So embedded — and even in FLC, which is weak right now,

there’s some very strong successes. Our construction solutions business that we’ve invested in is going extremely — is growing very solidly. So I would say that we have not had too many investment failures which we’ve had to pull

the plug on. We’ve had a couple.

The biggest investment of course, though, is in the headcount. And right now, you see the issue that happens if you

add the heads and you don’t get the revenue and you see that in FLC. We’re pretty resolved to get that improved by next year by getting the revenue and to employ those people. So does that help?

David Gold - Sidoti & Company - Analyst

It does. It does. Thank you.

Operator

We will go next to Paul Ginocchio of Deutsche Bank.

12

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

Steve Gunby - FTI Consulting Inc - President and CEO

Good morning, Paul.

Ato Garrett - Deutsche

Bank - Analyst

Good morning. This is Ato on for Paul. Good morning.

Steve Gunby - FTI Consulting Inc - President and CEO

Good morning, Ato.

Ato Garrett - Deutsche

Bank - Analyst

Just a couple of questions on your healthcare business. First, can you size that business? And secondly,

have you seen any change, or can you give us some thoughts on what you’re seeing, as far as the demand picture?

Have you seeing any slowdown or any

pullback in demand as hospitals are having a better margins and that may be influencing some of performance improvement projects? And third, net of those of what you’re seeing from a demand picture, can you give us remind me whether or not that

has changed your hiring plans for that group?

Steve Gunby - FTI Consulting Inc - President and CEO

Healthcare is a relatively small part of the segment that we reported as FLC. We don’t break that out specifically. We play in some fairly

defined and particular places in the healthcare space and the dynamics we see are probably a little bit different than some of our competitors whose results you may have seen.

So we have a business there that is in advisory and investigations, which really runs on its own dynamic and the volumes there are very much driven by our

origination activity. Then we have a performance improvement business that, again, is not as oriented around the very large research institutions, and is more in the regional and then smaller space.

And again there, while we certainly see what’s going on in the larger healthcare space, typically our demand is driven by our origination activities,

which does tend to go in some cycles, so the business is doing okay this year. It’s roughly comparable to its performance last year, which was down from a very good 2013, but it’s not a particular drag or boost to our results this year.

We’re pleased with what we’re doing.

Ato Garrett - Deutsche Bank - Analyst

Great. Just one more. You mentioned across a number segments that you’ve had some positive results driven by your exposure to the M&A

cycle. Previously, FCN has said that your overall revenue exposure to mergers and acquisitions was about 10% to 15%. Do you think that, that’s still true, and if not, about what do you think that exposure is now?

Steve Gunby - FTI Consulting Inc - President and CEO

I’m not sure that — I haven’t tallied that up in that way recently. The two — we have three segments that have some —

we have four segments — all of our segments (laughter) have some participation in M&A if I think it through here. But the amount — how it varies is rather dramatic and different.

Our corp fin business has a growing transaction advisory service, particularly in Europe, but also in the US. That can obviously — but that plays in a

different cycle than, say, our antitrust business, which will tend to not be on the diligent side, but on the support of approval. Our strategic communications business obviously has some participation in M&A, too.

13

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

I would say the only two segment where generally you would call out M&A as being a material driver of

better or worse would be the economic segment and strategic communications. Really the only one where you would say a large defined portion that can move materially is probably economics, though strategic communications, it is important, but

it’s — we’re in ongoing dialogue with these clients.

Much of it retainer-based, and when they do M&A, obviously, the business grows a

lot, but it’s not that it’s as big or episodic as the way it could be in economics. Generally, I don’t think we would sign up for a 10% to 15%, but the fact that it is not one-half our business or that we are not an M&A

cycle-dominated Company, we definitely would agree.

Ato Garrett - Deutsche Bank - Analyst

Okay, great. Just one more I’d like to sneak in. Looking at some of the strength that you’ve seen in North America on the distressed

worked that you’ve been doing within corporate finance and restructuring, is that primarily driven by profiling work that you’re doing with debtor’s side or is it you guys are getting more engagements on the creditor’s side, or

if you can just parse out those projects at all?

Steve Gunby - FTI Consulting Inc - President and CEO

Historically, 10 years ago, this Company was seen as a creditor’s side shop and we have probably the leader creditor-side practice in

North America. But people don’t realize that the debtor’s side is significantly more than one-half of our revenue in the corp fin business. We’ve made huge strides on that debtor’s side, particularly in specific industry

verticals.

We have a terrific tech vertical, we have a terrific retail vertical. So you heard this past year about some of the places we were doing work

in those, so it’s a combination of both actually. But if you look through some of our past statements, you will see a lot of debtor’s side work and that might be a little bit more surprising to people who knew us 10 years ago. Does that

help?

Ato Garrett - Deutsche Bank - Analyst

Yes, that’s great. Thank you very much.

Operator

We’ll go next to Randy Reece of Avondale Partners.

Steve Gunby - FTI

Consulting Inc - President and CEO

Good morning, Randy.

Randy Reece - Avondale Partners - Analyst

I was just wondering if you were contemplating some changes in the investments that you have made in, let’s say, the selling side of the

business, if you could evaluate what you have done and the effectiveness of what you’ve done to date and what the next step is?

David Johnson

- FTI Consulting Inc - CFO

Origination.

Steve Gunby

- FTI Consulting Inc - President and CEO

Are you talking about origination side of the business?

14

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

Randy Reece - Avondale Partners - Analyst

Yes.

Steve Gunby

- FTI Consulting Inc - President and CEO

That varies a lot by segment. There are two things we have done, one which

we’ve done pretty well, the other one which we’re starting it a little more aggressively. The one that we’ve done pretty well is continue to acquire talent from the outside. We’re not doing acquisitions, but we’re really

have ramped up the lateral hire program selectively.

Obviously, we have been adding more junior staff than senior staff, consciously, to increase

leverage, but we have across all of our segments attracted a fair amount of talent latterly. Usually, at the more senior levels it takes a little while for those people to get busy. Junior people, you hope that they get busy within six months or at

worst 12 months.

The more senior people, it can take 12 or 18 months or even a little longer sometimes to get the full run rate. We feel very good about

those lateral hires and that is a process that we’re continuing to go through. The other side is just commercial excellence.

We really have not,

historically, had a lot of discussion internally about just what is the best program for leveraging the terrific set of relationships we have. We have such good professionals that the phone often rings. And like in many businesses like that, if the

phone doesn’t ring, it’s a different set of skills than simply answering the phone and being great professionals.

We’ve had some

conversation in here about the need to upgrade our discussions internally. We have this whole SMD meeting coming up. That’s going to be a primary focus on it. That’s an area where we have started to work, but we’ve got a long way

ahead.

And that’s with pure commercial excellence, as well as some of the stuff we have piloted this past year, which is around just leveraging the

terrific relationships we have in one segment across to other segments. That’s some places where we have made some investments and some progress, but we’re planning to turbo-charge over the next 24 months. Does that help, Randy?

Randy Reece - Avondale Partners - Analyst

Yes. Thank you.

Operator

At this time, we have no further questions. I would like to turn the call back over to our speakers for any additional or closing comments.

Steve Gunby - FTI Consulting Inc - President and CEO

Thank you very much for your time, your support. We know that this is not the quarter that we typically like to deliver, but I hope you walk

away from this in understanding that we, notwithstanding this quarter or the forecast for the rest of this year, we believe that this Company is headed in the right direction and will be. So many thanks for your support.

Operator

That does conclude our

conference for today. We thank you for your participation.

15

OCTOBER 29, 2015 / 01:00PM GMT, FCN - Q3 2015 FTI Consulting Inc Earnings Call

DISCLAIMER

In the conference calls upon which Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such

forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are

more specifically identified in the companies’ most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate

or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION

CONTAINED IN THIS TRANSCRIPT IS A TEXTUAL REPRESENTATION OF THE COMPANY’S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE

SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON IN ANY TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE COMPANY’S CONFERENCE

CALL ITSELF AND THE COMPANY’S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

16

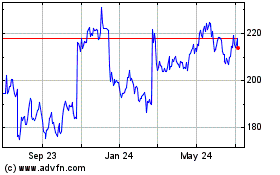

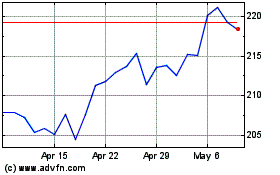

FTI Consulting (NYSE:FCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

FTI Consulting (NYSE:FCN)

Historical Stock Chart

From Apr 2023 to Apr 2024