SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 30, 2015

FTI CONSULTING, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Maryland |

|

001-14875 |

|

52-1261113 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1101 K Street NW, Washington, D.C. 20005

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (202) 312-9100

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 2.02. |

Results of Operations and Financial Condition |

On July 30, 2015, FTI Consulting,

Inc. (“FTI Consulting”) held a conference call relating to the press release issued on July 30, 2015 announcing financial results for the three- and six-months ended June 30, 2015 and updating guidance for the year ending

December 31, 2015. The text of the transcript of the conference call is furnished as Exhibit 99.1 hereto and incorporated by reference herein.

| ITEM 7.01. |

Regulation FD Disclosure |

FTI Consulting defines “Segment Operating Income

(Loss)” as a segment’s share of consolidated operating income (loss). FTI Consulting defines “Total Segment Operating Income (Loss)” as the total of Segment Operating Income (Loss) for all segments, which excludes unallocated

corporate expenses. FTI Consulting uses Segment Operating Income (Loss) for the purpose of calculating Adjusted Segment EBITDA. FTI Consulting defines “Adjusted EBITDA” as consolidated net income (loss) before income tax provision, other

non-operating income (expense), depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and loss on early extinguishment of debt, “Adjusted

Segment EBITDA” as a segment’s share of consolidated operating income before depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges,

and “Total Adjusted Segment EBITDA” as the total of Adjusted Segment EBITDA for all segments, which excludes unallocated corporate expenses. FTI Consulting defines “Adjusted EBITDA Margin” as Adjusted EBITDA as a percentage of

total revenues, and “Adjusted Segment EBITDA Margin” as Adjusted Segment EBITDA as a percentage of a segment’s share of revenue. Although Adjusted EBITDA, Adjusted Segment EBITDA, Total Adjusted Segment EBITDA, Adjusted EBITDA Margin

and Adjusted Segment EBITDA Margin are not measures of financial condition or performance determined in accordance with generally accepted accounting principles (“GAAP”), FTI Consulting believes that they can be useful supplemental

operating performance measures. FTI Consulting uses Adjusted Segment EBITDA to internally evaluate the financial performance of each of its segments because it believes it is a useful supplemental measure which reflects current core operating

performance and provides an indicator of the segment’s ability to generate cash. FTI Consulting also believes that these non-GAAP measures, when considered together with GAAP financial results, provide management and investors with a more

complete understanding of FTI Consulting’s operating results, including underlying trends, by excluding the effects of remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. In addition,

EBITDA is a common alternative measure of operating performance used by many of FTI Consulting’s competitors. It is used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in

FTI Consulting’s industry. Therefore, FTI Consulting also believes that these measures, considered along with corresponding GAAP measures, provide management and investors with additional information for comparison of its operating results to

the operating results of other companies.

FTI Consulting defines “Adjusted Net Income” and “Adjusted Earnings per Diluted

Share” (“Adjusted EPS”) as net income (loss) and earnings per diluted share, respectively, excluding the impact of remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and losses

on early extinguishment of debt. FTI Consulting uses Adjusted Net Income for the purpose of calculating Adjusted EPS and uses Adjusted EPS to assess total FTI Consulting operating performance on a consistent basis. FTI Consulting believes that this

non-GAAP measure, when considered together with its GAAP financial results, provides management and investors with a more complete understanding of its business operating results, including underlying trends, by excluding the effects of

remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and losses on early extinguishment of debt.

Non-GAAP financial measures are not defined in the same manner by all companies and may not be comparable to other similarly titled measures

of other companies. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in FTI Consulting’s Consolidated Statements of Comprehensive Income. Reconciliations of

GAAP to non-GAAP financial measures are included in the accompanying tables to the press release.

1

The information included herein, including Exhibit 99.1 furnished herewith, shall not be deemed

to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any

filing pursuant to the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such filing.

| ITEM 9.01. |

Financial Statements and Exhibits |

(d) Exhibits

|

|

|

| 99.1 |

|

Transcript of July 30, 2015 Conference Call of FTI Consulting, Inc. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, FTI Consulting, Inc. has duly caused this report to be signed

on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

FTI CONSULTING, INC. |

|

|

|

|

| Dated: August 3, 2015 |

|

|

|

By: |

|

/s/ DAVID JOHNSON |

|

|

|

|

|

|

David Johnson Chief Financial

Officer |

3

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Transcript of July 30, 2015 Conference Call of FTI Consulting, Inc. |

5

Exhibit 99.1

EDITED TRANSCRIPT

FCN -

Q2 2015 FTI Consulting Inc Earnings Call

EVENT DATE/TIME: JULY 30, 2015 / 01:00PM GMT

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

CORPORATE PARTICIPANTS

Mollie Hawkes FTI Consulting Incorporated - Head of IR

Steve Gunby FTI Consulting Incorporated - President and CEO

David Johnson FTI Consulting Incorporated - CFO

CONFERENCE CALL PARTICIPANTS

Randy

Reece Avondale Partners - Analyst

Tobey Sommer SunTrust Robinson Humphrey - Analyst

Joe Foresi Janney Montgomery Scott - Analyst

David Gold Sidoti & Company - Analyst

Paul Ginocchio Deutsche Bank - Analyst

Tim McHugh William Blair & Company - Analyst

Kevin McVeigh Macquarie Research - Analyst

PRESENTATION

Operator

Good day, everyone, and welcome to the FTI Consulting second quarter 2015 earnings conference call. As a reminder, today’s call is being recorded. And now

for opening remarks and introductions, I’ll turn the call over to Mollie Hawkes, Head of Investor Relations, at FTI Consulting. Please go ahead, man.

Mollie Hawkes - FTI Consulting Incorporated - Head of IR

Good morning. Welcome to the FTI Consulting conference call to discuss the Company’s second-quarter 2015 results as reported this morning. Management

will begin with formal remarks after which we’ll take your questions. Before we begin, I would like to remind everyone that this conference call may include forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934; that involve risks and uncertainties.

Forward-looking statements include statements

concerning plans, objectives, goals, strategies, future events, future revenues, future results and performance, expectations, plans or intentions related to financial performance, acquisitions, business trends and other information or other matters

that are not historical, including statements regarding estimates of our medium-term growth targets, future financial results and other matters. For a discussion of risks and other factors that may cause actual results or events to differ from those

contemplated by forward-looking statements, investors should review the Safe Harbor statement in the earnings press release we issued this morning.

A

copy of which is available on website at www.fticonsulting.com, as well as other disclosures under the heading of Risk Factors and Forward-Looking Information in our most recent Form 10-K and our other filings filed with the SEC. Investors are

cautioned not to place undue reliance on any forward-looking statements which speak only as of the date of this earnings call and will not be updated.

During the call, we will discuss certain non-GAAP financial measures, such as adjusted EBITDA, adjusted segment EBITDA, total adjusted segment EBITDA,

adjusted segment EBITDA margin, adjusted earnings per share and adjusted net income. For a discussion of these and other non-GAAP financial measures, as well as our reconciliation of non-GAAP financial measures to the most recently comparable GAAP

measures, investors should review the press release and the accompanying financial tables that we issued this morning.

Lastly, there are two items that

have been posted to our Investors Relations’ website this morning for your reference. These include a quarterly earnings call presentation that we will refer to during this morning’s call and an Excel and PDF of our historical, financial

and operating data which has been updated to include our second-quarter 2015 results.

2

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

With these formalities out of the way, I am joined today by Steve Gunby, our President and Chief Executive

Officer; and David Johnson, our Chief Financial Officer. At this time, I will turn the call over to our President and Chief Executive Officer, Steve Gunby.

Steve Gunby - FTI Consulting Incorporated - President and CEO

Thank you Molly. Let me join Molly and David in welcoming everyone to today’s call. As always, I’m going to do an introduction to the session here,

turn it over to David for some more details, and then we’ll open the floor for questions. This time, I’m going to be a little briefer so we have plenty of time for questions.

The second quarter, as a whole, as you’ve already seen, was a solid quarter. It’s very much in line with where our expectations were and I think

very much in line where most of your expectations were. What I’d like to do is dive down a little bit below that. As everyone on the call knows, each of our businesses, our big event businesses, that of elements that are market driven; they can

be extremely volatile in any short period of time.

So in any quarter, some of our businesses are going to perform better-than-expected and some of the

businesses will perform worse. In this quarter, like every quarter that I know of, has been no exception. Some businesses performed better; some performed worse but importantly, the results overall were very much in line with what we expected and I

believe, most of you. So from my perspective, this was a solid quarter.

As we’ve talked about in a number of calls, my focus primarily is not on the

quarterly earnings. Given the volatile nature of the individual businesses, quarterly earnings isn’t a clear measure of whether making progress towards our ultimate goal. The goal we need to be primarily focused on is whether we’re

building a business through the quarterly earnings, turning the value — turning this Company into a sustainable growth engine, a Company that you and our professionals can count on to grow year in and year out. Maybe not quarter in, and quarter

out, but year in and year out.

So what is more exciting to me than the solid quarter is that yet again, our team has made progress on a number of

critical dimensions for that long-term journey. David’s going to describe some of that progress in the sections, the segment by segment review, and we can answer any of your questions in Q&A.

Let me just highlight a couple of them. We are making progress on a number of initiatives that we talked about in each of the segment discussions in prior

calls. Not on every initiative, as we’ve discussed, we will never be making progress at the pace we would like on every initiative but we don’t need to. What we’re making progress on is a lot of those initiatives and that is very

gratifying and David, I think you’re going to talk about some of that going forward.

So let me focus on a different point here. This quarter, we are

finally making progress on another key initiative, which is to grow our headcount. As I’ve talked about on some prior calls, it took us a little while to get our headcount plans underway; it took awhile to fully commit and then it takes awhile

to actually realize those headcount plans.

We can always hire people. What we need to be hiring are the right sort of people, the people who can leverage

the tremendous professionals we have and help us grow our businesses. That takes a lot of work and it’s work that we hadn’t been investing in adequately for awhile. So we’ve gotten that commitment in our organization; we’ve got

the effort underway and finally, in this quarter, we begin to see results.

Our total billable headcount is up by 7% this quarter year over year and

that’s across the board some senior levels. But importantly also some hiring of the up-and-comers that create the vibrancy and the leverage and the future of our Company. There are variations segment by segment but all of the segments have made

progress to that.

The third point I’d point is that this quarter, we began to see the results of being thoughtful and prudent and disciplined with

respect to our capital. As we’ve talked about in prior conversations, one of our initiatives was to upgrade our M&A processes, which we’ve done. Again, we are willing to do deals; we are willing to do M&A. We hope we will be doing

that going forward. But it has to be in the right deals. With a disciplined process that makes the probability of success strong.

We have put such a

process in place and thus far, most of the deals that have come in front of us have not met that screen. And so, as a consequence, we’ve been disciplined with our cash and because we’ve been disciplined with our cash, that’s one

reason we have cash that is available to use, together with our credit facility to conceivably repurchase debt in the fourth quarter, which is a key element of being, supporting our earnings.

So for me, again, more important than the quarterly results is that we are driving the changes that can help to turn this Company into one that realizes its

potential and sustainable growth. There’s obviously a lot of work to do. Some of our segments are ahead of schedule; some of them are behind; some of our regions are ahead of schedule; some of them behind; some of our initiatives are ahead of

schedule; some of the behind. David will highlight elements of that and there’s obviously volatility in this business.

3

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

And so I’m sure and on occasion over the next while, we’ll disappoint on a different quarter, on a

given quarter. But as I’ve said, the experience we have to date and what I see in this business leaves me with tremendous conviction and the unbelievable set of people we have, the capabilities we have and the opportunities that we have.

And our ability and confidence and our ability to move this Company forward by simply realizing the potential of that team and so with that, let me turn this

call over to David for more details on the quarter and then I’ll join David for Q&A after his remarks. David?

David Johnson

- FTI Consulting Incorporated - CFO

Thanks Steve. I’ll turn first to slide 4. Revenues for Q2 were $449 million, down 1.1% from the

prior-year quarter. Now that includes a negative FX impact, which cut an estimated 3.1% from revenue growth. That is, we would have been otherwise up an estimated $9 million, or 2% year over year and 1.5% of that growth would — is organic.

Revenues were up sequentially from first-quarter 2015 by 3.9% and FX had no material impact on our sequential revenues or profit this quarter.

Fully

diluted GAAP EPS were $0.52 compared to $0.42 last year. EPS was increased $0.02 by the reversal of an acquisition-related contingent consideration liability. For our prior-year quarter included $0.14 special charge to eliminate our West Palm Beach

office and corporate plane lease. Thus, on an adjusted basis EPS was $0.50 compared to $0.55 a year ago and [$0.57] in the first quarter this year. Adjusted EBITDA was $55.5 million, or 12.4% of revenues; that compared to $59.9 million, 13.2% of

revenues in the second quarter 2014 and $58.7 million, 13.6% margin Q1 this year.

So turn to slide 5 and we’ll talk about the segments. Corporate

finance revenues increased 4.9% to $109 million compared to $104 million last year and that was net of an estimated 4 point drag from FX. Excluding the FX estimate, revenue increased by $9.3 million, or 8.9%, and that was driven by higher demand for

distressed and non-distressed service offerings in North America and higher demand for transaction advisory services in Europe, Middle East and Africa, or EMEA, which was partially offset by year-over-year decline in the Asia-Pacific restructuring

practice. Revenues were up sequentially 2.7% from Q1.

Adjusted segment EBITDA for the quarter was $22 million, or 20.2% of revenues compared to $19

million, or 18.4% of revenues prior-year quarter, and 22.5%, or 21.2% of segment revenues Q1. We were delighted to deliver a greater than 20 point margin for a second straight quarter in CorpFin. Again, just as in first quarter, this was driven by

improved demand for distressed services; those revenues in North America were up double-digits year over year and also up from first quarter albeit at a slower sequential growth rate compared to the first quarter.

Again, we saw strength in energy, mining and mining services with matters like magnetization and in retail and consumer, where wins included A&P and Colt

Defense. We expect these sectors: retail, energy, mining to continue to provide more opportunities in the second half. This quarter, FTI was ranked in the top position by The Deal and out-of-court restructuring for the second consecutive quarter. We

continue to be pleased with our market position in distressed services. Moreover, we also remain very focused on building out our non-distressed offerings. In the second quarter, we benefited from this focus as North American non-distressed revenues

also increasing in the double digits compared to prior year and high single-digit sequentially.

We also had continued momentum from investments in our

European businesses that also supported second-quarter results. Transaction advisory services continued to gain traction in Europe and we expect that investment, combined with our European Tax practice, to turn EBITDA positive in 2015.

I’d also like to highlight the progress this segment is making in restoring headcount, as Steve said, in improving operating leverage. During the

quarter, this hiring focus resulted in about a 9% year-over-year increase in billable headcount. Those positive results were partially offset by softness in Asia-Pacific, largely, Australia, consistent with the last two quarters. Australia continues

to be impacted by topline pressure but we do expect mining and mining services sectors could provide a few opportunities in the second half. Overall, we do not anticipate a significant improvement in this practice in the near term.

To provide our outlook for this segment, we expect to see continued demand for our both our distressed and non-distressed offerings throughout the remainder

of the year and we anticipate revenues similar to first-half levels, with margins in the high teens in the third and the fourth quarter. In Forensic & Litigation Consulting, or FLC, we reported revenue of $126.1 million in the quarter; that

was an increase of 5.9% compared to $119 million in the prior-year quarter and that includes a 1.9% estimated negative impact from FX.

Excluding that

estimate, the revenue increase was $9.4 million, or 7.9%, driven by higher demand for hospital operations, revenue and success fees in Health Solutions and increased demand for our Global Construction Solutions and Investigations Services. This was

partially offset by declines in our disputes in Financial & Enterprise Data Analytics, or FEDA, practices. Revenues increased 2.3% sequentially, from $123.3 million in Q1.

FLC’s adjusted segment EBITDA was $20 million, or 15.8% of segment revenues compared to $22.3 million, or 18.7% from the prior-year quarter. On a

sequential basis, adjusted segment EBITDA was down $2.1 million from Q1.

4

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

The major drivers of the decrease in adjusted segment EBITDA and our margin were lower utilization, as we saw

some demand decline in certain practices, like FEDA, along with a continued increase in staffing to support our strategic growth initiatives. Two, a severance charge for the departure of a SMD, and three, to a lesser extent, higher outside services

and bad debt expense.

Again and worth noting, FLC had the highest year-over-year increase in billable headcount, up 110 professionals, or 10% year over

year. This business, like Corporate Finance/Restructuring, was one of our segments that was most negatively impacted by leverage degradation in 2011 and 2012. These are incredibly important investments. As we told you in the beginning of the year,

FLC is running hard to stay ahead of tough comparisons to the high level of activity they saw in 2014. They are still running hard but we now think they will not — they will likely not clearly the 2014 bar.

In our outlook, we expect to see revenue, margin and EBITDA production similar to the first half of 2015 in FLC. In particular, we see revenues similar to the

first quarter, and we see margins similar to the second quarter of 2015 in both of these third and the fourth quarters. This is a step back from our last forecast when we expected FLC’s second half to be stronger than the first half of the

year.

The stepdown in our outlook is driven by lowered second half revenue forecast as several practices have experienced greater difficulty than we had

originally forecast in replacing revenue from large matters that particularly benefited 2014. Despite this, we will continue to invest in headcount, both junior and senior, in the second half and we believe this incremental talent will be a very

important contributor to results, particularly as we enter 2016.

Second-quarter Economic Consulting revenues declined 7.3% to $108.7 million compared to

the $117.2 million prior-year quarter. That includes a 2.8% estimated negative FX impact but Econ also benefited 1.8% year over year from an acquisition. Excluding both, Econ revenues declined organically $7.4 million, or 6.3% year over year.

Sequentially, revenues increased 2.5% from $106 million in Q1.

M&A-related Antitrust revenue continues at high levels; examples include Siemen’s

$7.8 billion acquisition of Dresser-Rand and the Nokia, Alcatel-Lucent merger, though down somewhat from first-quarter. Financial and breach of contract revenues were up sharply, sequentially, but still down from last year’s level.

International Arbitration was also up, both sequentially and year over year.

Adjusted segment EBITDA in the quarter was $15.3 million, or 14.1% of

revenues, compared to $18 million, or 15.4% of revenues in the prior-year quarter and up from $11.6 million, or 10.9% of revenues in Q1. The decrease in adjusted segment EBITDA margin was due to lower utilization in the Antitrust &

Financial Economics practices, which was partially offset by higher realized bill rates and utilization in the segment’s energy services.

In our

outlook, we expect North American non-M&A-related Finance and Antitrust Litigation Services to continue at similar levels for the remainder of the year although we do see some encouraging signs emerging towards the end of the year. Based on what

we could see, our market share remains excellent, particularly in M&A-related Antitrust.

We expect continued success in International Arbitration and

our Energy business continues to grow. We hope to see revenues in the third quarter growing to an absolute level similar to third quarter 2014 and then pulling back with seasonality in the fourth quarter, again similar to 2014.

We are targeting EBITDA margins, consistent with the second-quarter levels that we reported today. In the second quarter, Technology segment revenues, of

$61.8 million increased 1.8% compared to $60.7 million prior-year quarter, including a 1 point decrease estimate from FX; including that estimate, revenue increased year over year $1.7 million, or 2.8%.

Sequentially, revenues increased 13.1% from $54.7 million in Q1. The increase in revenues was primarily due to an increase in M&A-related Second Request

work where we saw revenues triple sequentially. This strength was partially offset by a decline in cross-border investigations and reduced pricing for certain services during the quarter.

Our market leadership and expertise in Second Request continues to be a differentiator with clients. As most of you know, Second Request often arise on very

short notice and are closed within compressed timeframe. Because our second-quarter revenue growth was achieved without the same volume of complex lengthy global engagements that we experienced in 2014, we will have to continue to work hard to fill

our second half pipeline and will face tough comparisons versus the second half of 2014 as our Second Request engagements roll off.

Adjusted segment

EBITDA was $12.2 million, or 19.7% of segment revenues compared to $15.1 million, or 24.9% of segment revenues in the prior-year quarter. The decrease in adjusted segment EBITDA margin was due to lower realized pricing for certain services,

investment in global personnel to support future growth opportunities, and an increase in lower margin services as a percentage of total revenues.

5

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

Our expectations for 2015 continue to reflect significant investment in the technology segment, which we

believe is essential to continue to advance our strategic position. Our investments are targeted at three areas: one, software innovation for our existing retail offering as well as the development of new products targeting emerging client needs.

Two, expanded business development to create an even deeper presence in the corporate and public sectors as complements to our long-term involvement with

law firms and, three, increased scalability of our global capabilities to support our strategies of fulfilling our clients’ global and data privacy requirements with local personnel and local infrastructure. Over the last 12 months, these

investments are at a level well above what we invested in the same prior-year period.

Looking forward, we acknowledge that this segment can and will

produce volatile results. In our outlook, we continue to expect full-year segment EBITDA in technology to be down versus 2014. Based on the current pipeline, we expect third-quarter revenues to be in the range we achieved in the first three quarters

of 2014 and margins to be in the low to mid-20%s due to adjustments in mix.

While we are working hard to deliver fourth quarter performance at a similar

level to third quarter, we currently have less visibility into the fourth quarter than we might like and would not count on that in your modeled expectations. In Strategic Communication, second-quarter revenues decreased 18.6% to $43.4 million

compared to $53.3 million in the prior-year quarter.

Now that included an estimated 7.3% unfavorable impact from FX. Excluding FX, revenues decreased $6

million, or 11.3%. Now of that $6 million, the majority of the decrease of $4.3 million, or 8 points, was a result of lower pass-through income. The remaining $1.7 million decline in revenues was largely due to lower project-based revenues in North

America and EMEA and lower retainer-based revenues in North America.

Our North American business, which has a large Energy practice, was negatively

impacted year over year by client reactions to lower oil prices, which as we can demand in the energy industry for some of our more discretionary services. On a sequential basis, revenues were 3% higher compared to $42.1 million in Q1.

I know that many of you have expected significantly higher revenue since StratComm. In our view this is not a miss. We are transitioning to a higher-margin

model in this segment and we have consciously sought to eliminate less profitable revenue.

Combined with the impacts of FX and changes in pass-through

revenue because of very low or no contribution to profits, the revenue change in this quarter is small and is in line with our expectations. Adjusted segment EBITDA was $5.6 million, or 13% of segment revenues, compared to $5.8 million, or 10.9% of

segment revenues in the prior-year quarter and $5.8 million, or 13.7% of segment revenues in Q1. The increase in adjusted segment EBITDA margin was driven by improved revenue mix and lower pass-through income.

Margins also improved year over year from a reduced headcount and related cost-saving activities initiated in 2014, which was partially offset by higher bad

debt. In our outlook, we expect revenues in the second half of the year to be at the same levels as the second half of 2014 and EBITDA margins to be in the mid- to high teens.

As usual, I won’t spend a lot of time on the geographic breakdowns on slide 6. Suffice it to say, North America remains our primary engine, with

corporate finance driving results again this quarter. We are beginning to see our investments in Europe bear fruit, with positive contribution from CorpFin, FLC technology and Econ. Asia-Pacific remains weak, driven largely by Australia, and Latin

America had mixed results, with strength in FLC revenues offset by weakness elsewhere.

Turning to slide 7, our cash and cash equivalents were $240

million at quarter end compared to $94 million at June 30 last year. Net cash provided by operating activities for the quarter was $20.6 million compared to net cash last year of $33.7 million. DSOs were 104 at the end of June compared to 108

days in the prior-year quarter and up three days from March 2015.

Turning to our outlook commentary for 2015, now that we are halfway through the year,

we are adjusting our prior expectations for fiscal year 2015 revenues from the range we targeted in February of between $1.8 billion and $1.9 billion to a new range of between $1.75 billion to $1.85 billion. There are a few key drivers to this

change. We’ve adjusted back our outlook for revenue in FLC and Economic Consulting and Technology’s pipeline is uncertain.

As you know

Technology is a lumpy business and during the quarter, the 13.1% sequential increase in revenues was supported by increased M&A-related Second Request activity. While our Tech group has always been successful with replacing large projects, at

this point in time, our limited visibility into the fourth quarter, coupled with the lack of large cross-border investigations, leaves us with some caution about second half outlook. Similarly, we are narrowing our adjusted EPS range to be the

between $1.95 and $2.15.

I’ll give you some background on our thinking. Last month, we amended and extended our credit facility. As part of this

announcement of that deal, we spoke to our intentions to retire some of our fixed-rate debt, in line with the capital allocation strategy I discussed at our last earnings call.

6

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

In our press release, we stated our intention to, on or before October 1, 2015, subject to market

conditions and other factors, to retire $400 million of our 6.75% notes due 2020, funded by a combination of approximately $275 million of borrowings under the new facility and approximately $140 million of cash. We estimate that this will benefit

our fourth quarter adjusted EPS by about $0.08.

As a reminder, we will have a one-time expense for the early retirement of the 6.75% notes of

approximately $19 million. We exclude this type of non-recurring expense from adjusted EBITDA and adjusted EPS. So taking into account the $0.08 anticipated benefit in the fourth quarter, why are we not increasing our outlook but instead taking

$0.05 off the top of the range?

First, our 2015 expectations for FLC, Econ and Technology are lower compared to our views at the beginning of the year.

Second, fourth quarter is one of the most difficult for us to predict, particularly in Tech. So while we would like the $0.08 to be additive, it’s more likely than not that it will cover fourth quarter risk.

Third, we are not backing away from our commitment to invest in the business and our investments will fall more heavily in the second half. In addition, our

fourth quarter outlook also includes what will now be a recurring all SMD meeting for our 400-plus senior officers, similar to the meeting we held last November. That meeting was extremely successful. And we believe this is an investment we should

regularly make.

Consistent with last year, we anticipate the direct cost alone could be approximately $0.07 per share though this expense was always

contemplated in our budgets. So our unallocated corporate expense of the third quarter should be similar to levels in fourth quarter last year and fourth quarter should be $0.07 higher than that.

Finally, we’ve also been asked how to think about the benefit of the refinancing to 2016 earnings, which we estimate will be a further improvement of

$0.17 or more, again depending on your view of LIBOR, or $0.25 if you started with the base assumption that we otherwise wouldn’t retire debt and not make any use of our accumulated cash. When we set the goal of $2.50 per share or more for

2016, we created a set of ranges describing what we thought each of our segments might be able to do if focused on investing in organic growth.

We knew

not all of them would achieve their aspirations and we also knew the enterprise had other assets, principally as cash flow that also supported our confidence that we could do at least $2.50. We are not ready today to predict where each segment will

be in 2016. We usually speak to our new annual outlook in February.

However, we do know that with the benefit of the refinancing added to our strategies

for organic growth, we have an additional cushion to help us reach the $2.50 EPS threshold, giving us additional confidence that we can meet or exceed that goal. With that, we’ll now open up the call for your questions. Operator?

QUESTION AND ANSWER

Operator

(Operator Instructions)

Randy Reece, Avondale Partners.

Randy Reece - Avondale Partners - Analyst

Morning guys.

Steve Gunby - FTI

Consulting Incorporated - President and CEO

Morning Randy.

Randy Reece - Avondale Partners - Analyst

I was, first of all, wondering about your commentary on the fourth quarter. Is that influenced at all by your experience with the fourth quarter of last year?

7

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

Steve Gunby - FTI Consulting Incorporated - President and CEO

Well, it’s the only fourth quarter I’ve had here, so yes, I guess. It’s — matters and at the end of the year, with a fair amount of

volatility based on how people are doing versus their goals, whether they be litigators whether they be regulators, whether they be corporations. So for the experts who have to respond to their requirements sometimes unexpectedly, you can have a lot

of volatility on other things are powering through to December 31, with everybody going full speed as opposed to people finishing their objectives late November or early December so that does create some volatility for a reactive expert firm

like ours

Randy Reece - Avondale Partners - Analyst

That was my read of what you were saying. The changes in guidance, obviously, you don’t revisit annual guidance after the first quarter. I’m

wondering how much of your outlook changed between the first quarter conference call and now versus what was just a steady progression since you originally gave the annual guidance?

David Johnson - FTI Consulting Incorporated - CFO

Well, I think there was — we definitely had changes in mix of expectations between the full-year guidance and the first-year guidance and I think that was

reflected in some changes in terms of the revenue and margin outlooks for each individual business, but I would say the material change between where we were last quarter and where we are today is primarily in the FLC segment, some incremental

weakness in Economics and Technology but I think within the range of risks that we articulated before.

So the particular change in our outlook is that we

think the FLC segment is making tremendous progress is investing well and is on an excellent organic growth trend, they were hoping and we were hoping that they would have more success in replacing the second half revenue last year that came from

some of their large matters. And as those pull back or as those have pulled back over the course of the first half, I think they’re not going to be quite as successful in replacement but the underlying investment in growth trends, we think,

continues to be good

Randy Reece - Avondale Partners - Analyst

All right. Thank you very much.

Operator

Tobey Sommer, SunTrust.

Steve Gunby

- FTI Consulting Incorporated - President and CEO

Morning Tobey.

Tobey Sommer - SunTrust Robinson Humphrey - Analyst

Good morning. A question for you about the billable headcount growth in that endeavor to kind of revive the organic growth engine. What growth, on an

annualized basis, do you — would you have in mind even if it’s a range and so far, how does the take-up and uptick in productivity feel to you broadly, not talking about any specific segment? Thanks

Steve Gunby - FTI Consulting Incorporated - President and CEO

Yes, thanks very much. That’s a very good question. I don’t think we have settled on a long-term goal for headcount growth. I mean a lot of what

we’ve been focused on is rebuilding the pyramids that were — that shrunk over a number of years. And so what we’ve committed to this year is pretty clear and our plan going into next year are clear.

I think it’s a good question what the long-term goals are. I could imagine they are not far from what we’re doing right now but I think we, as a

management team, have to talk about that and settle on that as we go into our longer-term planning next year. But I think this quarter, 7% year on year, is not a crazy number for us to have in our minds as we’re going into the next while so

that’s, at least, maybe an interim answer for you. I mean, the long-term 2016 and 2021, we need to be thinking about as a team.

8

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

But I think we are of substantial ambitions to be a growth Company. We have a right to be a growth Company

and if we’re not going to rely on acquisitions as the primary driver of that, all great professional services firms that are not relying on acquisitions grow headcounts substantially. Some of them grow at 5%; some of them grow at 12%. Growing

7% a year seems well within that range so I don’t think it’s a crazy number but we haven’t settled on a long-term number.

With respect to

the productivity, it’s an obvious and important question. The truth is, when you start adding headcount, in general, your productivity goes down because you don’t — the new people don’t come in and instantaneously hit the ground

running as fast as the old folks were and that’s one of the reasons why firms don’t do it. Because if you’re going to manage next quarter, you don’t add it, right?

We could of — FLC didn’t need the new headcount for this quarter. What FLC needs the headcount is to build its pyramid and build its long-term

strategy and that’s what we’re committed to. The good news in professional services is it doesn’t take five years for people to become productive. Depending on the tenure of the people, it can be anywhere from six to nine months to 12

to 24 months to become productive.

But right now, we’re making a conscious investment and we think as part of the reason to be bullish about where

we can be in 2016 and 2017 as these people become productive, it’s going to help our business. Does that answer your question, Tobey, or help?

Tobey Sommer - SunTrust Robinson Humphrey - Analyst

It does. It does help. And then two follow-ups. If I were to think about the margins are — that the Company is delivering now, how much are those

investments in headcount weighing on the margin and relative to the 7% overall headcount increase, how would you characterize the rate of growth among senior revenue generators versus the base of the pyramid? Is it comparable or is there a different

rate of growth depending on which aspect of the pyramid we’re talking about?

Steve Gunby - FTI Consulting Incorporated -

President and CEO

Let me take the beginning of this and see if David has more to add. Look, I think the question of how much is a weigh on margin

depends on what your baseline is, right? So let me pick on FLC for a second. If you use last year as a baseline, then man, it’s weighing on margins, right? Our revenue is not up and our headcount is.

Headcount costs you money; that weighs on margins. But if you recall our conversation last year on FLC, what we said was that actually we were short on

headcount. We were running at an unsustainably high levels of utilization last year, with no capacity to grow the business because we were short on headcount and so if you measure against that baseline, of course, it weighs on it.

If you’re saying on a sustainable basis, am I willing to have a lower margin, you can’t run at that margin all the time, which is what we had last

year and you can’t grow from there. So it’s not a shareholder accretive level of utilization, so we’re willing to take lower utilizations than that as long as we then turn the head — the headcount growth over time into

productivity and revenue growth and EBITDA growth. And that’s what we’re planning to do so that’s at least a partial answer. David, anything you want to add to that?

David Johnson - FTI Consulting Incorporated - CFO

Well, on the other question, we don’t have the breakout by level in front of us but since our goal is to increase leverage, which by definition requires

the growth at the top to be slower than the top at the bottom, I’m almost certain it, with rare exception, the data would show that we’re growing junior headcount faster than senior headcount.

And the only exception would be a place where we’re just starting our practice and we might hire one or two senior people and then they build out their

team. Overall, I think that’s right

Tobey Sommer - SunTrust Robinson Humphrey - Analyst

Okay. Just a quick question. You mentioned M&A in your prepared remarks, yet establishing the organic growth is the first priority. Is there any shift to

the timing of your willingness to look at M&A or was that just a reminder that eventually you might do a deal?

9

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

Steve Gunby - FTI Consulting Incorporated - President and CEO

No shift at all, Tobey, it’s — what we have been looking at deals and have been since the day I joined and since before. We’re willing to look

at deals. What is different perhaps is the level of discipline that we’re looking at those deals with and so far, ones really haven’t really met the screen but we’re still in the situation that if we could do the transformative

fundamental deals that created this Company, or in certain cases, really substantially augment it with a set of people who are committed to staying here and building the business, we will do those deals.

It’s just that we’ve put in place a more disciplined process in a frothy market. We’ve not found ones that meet our — not only our

financial hurdles but our hurdles about attracting people who want to be here to build a business for the long term as opposed to short-term monetization objectives and so that’s why we’ve generated cash. Does that help?

Tobey Sommer - SunTrust Robinson Humphrey - Analyst

It does. Thank you very much.

Operator

Joe Foresi, Janney Montgomery Scott.

Joe

Foresi - Janney Montgomery Scott - Analyst

Hi. I had just a couple questions here just to start with the headcount additions. Where

particularly are you finding the talent that you’re looking for and usually in these businesses, you add headcount in anticipation of revenue growth. Where — maybe you could just point us to what area you think might be associated with the

headcount ramps?

Steve Gunby - FTI Consulting Incorporated - President and CEO

I’ll take it — where do we find them. It’s totally — lots of different places and Holly Paul is really working heavily with the various

segments to make sure we’re identifying all of the sources of talent. And some of it is headcount, entry-level headcount, which is pretty straightforward. You hire those on campuses but it’s also a lot of lateral higher headcount from

other firms; strong people from other firms who are attracted to the entrepreneurial nature of our firm, has been a great set of additions at the mid-levels

It’s been a great way to hire, what we call, senior consultants and directors and senior directors and managing directors. We’ve also hired some

laterally yet the SMD level although, as David pointed out, that’s proportionately less than the more junior ranks. So there’s a lot of different sources. I’m not sure I can point to one.

And then it obviously it varies by segment because the types of people we hire are different. In one segment, you hire an economist; in other segments, you

are hiring accountant, and other segments, you’re hiring lawyers and so forth and then by geography, the pools we use in Hong Kong are obviously different than the pools we use in London. I forgot the second part of your question, Joe.

Joe Foresi - Janney Montgomery Scott - Analyst

It was just that usually the headcount is associated with some expectation on either revenue ramp or those people becoming productive and I think you hit some

of your earlier comments in producing revenues themselves. So I’m just wondering what you’re seeing out there for catalyst that could drive the numbers a little bit higher?

10

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

Steve Gunby - FTI Consulting Incorporated - President and CEO

That’s a good question. Look, I think it really ties to the bets that we have talked about in other calls and David briefly alluded to. And even in the

segment, for example, that ha shrunk headcount year on year, Strat Comm, that we got out of some businesses that were very low margin. But we have bets that we believe in where we believe we have a right to win in Public Affairs and our Energy

business and so forth.

So where we have talented groups of people where we think we have a right to win where the market has shown us that we can grow,

we add headcount in those areas in anticipation of growth. And as somebody asked on a prior question, the initial add of those headcounts probably drives down productivity but the theory is that these will be the engines that support our growth in

2016 and 2017.

So you can look across all the segments with that lens. We talked about in FLC, the strength of some of our positions and investigations

and in construction, we’re making bets behind those. In CorpFin, we talked about distressed services where we have a right to win even in down market like retail but also non-distressed services, like the office of the CFO practice we have

where we’re having success in the marketplace.

So what we’ve asked every segment to do and every region is to identify the areas where they

feel we have a right to win and then we’ve agreed, as a management team, that we’re going to hire behind those right places, right to win in anticipation of demand, knowing that some places, it will take us longer than we want for the

demand to come here but that’s part of what you do to create a sustainable growth engine. Joe, did that help?

Joe Foresi

- Janney Montgomery Scott - Analyst

Yes, I think you’re getting to the essence of the question. I guess, as you look forward and I will just

end with this question, as you look forward through — as you look back at history, one of the things that have driven revenues in this particular business has been restructuring or downticks in bankruptcy. Clearly, you’re making progress

to get away from those key drivers but maybe you could just line up what you’re seeing in those individual businesses, two or three, that you think may be the largest contributor to growth based on the investments that you’re making at

this point?

Steve Gunby - FTI Consulting Incorporated - President and CEO

So I’m going to resist the two to three because it’s a little bit like — there aren’t too many families with 36 children, but identifying

your three favorite children if you had 36 children would be a recipe to get the other 33 to feel like they’re not loved. You understand what I’m saying? That’s a bit of a joke, but it’s true.

The truth is that organic growth is not a two-thing initiative. If you want to buy something, buying General Motors would be one of the two strategic thrusts

of the Company if did it, right? Because it would be so big; it would be all absorbing. When you’re talking about organic growth, what you’re asking for is professionals to look to where they have the right to win and say, where do I think

investment can help me thrive that business.

So it’s not even International Arbitration. It’s International Arbitration in London, investing

behind that where we are already have a strong position and then it’s creating an International Arbitration practice in Washington, where we don’t have one. It’s those series of bets that we have been identifying and that we are

— we have a collective set of — I don’t know if it’s 30, but it’s probably not far from that and what we do is we make the bets and we monitor them quarterly on how they’re going, and seeing how they’re going.

It’s the cumulative effect of those that is the driving and what we have to do is also replenish those quarter after quarter after quarter and add to

them. So we actually have 33 children that we all like and some of them are going to grow faster than others and then we’ll — I don’t know how to continue this metaphor so I’ll drop the metaphor. We’re not going to prune

children but we’ll prune bets as we need to and re-double down on other bets, on certain bets and do other ones. But it’s a lot of bets that drive the growth, not individual two big ones. Does that help, Joe?

Joe Foresi - Janney Montgomery Scott - Analyst

It does. Just to finish the thought, that with your 33 children, are they correlated to one type of movement and the economy, like historically when things

have gone poor, the Company would do very well or are they going to be non-cyclical? How do you think about because as analysts, we’re trying to anchor that with some catalyst that we could tie to that portfolio.

11

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

Steve Gunby - FTI Consulting Incorporated - President and CEO

Well, let me just say, I think they will be volatile but I don’t think they will be cyclical so let me just make the distinction. I mean, any one of our

businesses can be volatile because they’re tied to big events but what we’re doing is probably not tied to a particular economy cycle collectively.

I would say collectively what we’re doing in certain of our businesses is broadening our footprints. So CorpFin has a shot of succeeding even if the

bankruptcy markets are down.

And I think what we’re doing in Strat Comm is allowing it to succeed even if some of the Financial Communications

businesses are down. So I would say we’re not — we’re probably, on average, lessening the cyclicality of it but the individual bets, in themselves, are volatile. Cumulatively, we hope they somewhat measure, weigh off of each other and

allow for a sustainable growth trajectory. Does that help?

Joe Foresi - Janney Montgomery Scott - Analyst

It does. Thank you.

Operator

David Gold, Sidoti.

David Gold -

Sidoti & Company - Analyst

Hi, good morning.

Steve Gunby - FTI Consulting Incorporated - President and CEO

Morning David.

David Gold -

Sidoti & Company - Analyst

Just if I want to build a little bit. One of the things that you’ve spoken about over time and reference

to your — the many investments that you’re making bets, if you will, across the board. So I was curious at this point, if you can give a little bit of color maybe on a couple of the ones that have worked and maybe on a couple of the ones

that haven’t worked that you’ve decided to discontinue. Just so we can get a better sense of maybe what these bets look like?

Steve Gunby - FTI Consulting Incorporated - President and CEO

Well, I’ll give you a flavor. We haven’t had any crash and burn at this point, so that we’ve had to fully pull the plug on — that I can

think of, at least on any of those. There’s some that we’re monitoring closely at this point and I wouldn’t — and we will. But there are obviously differences. If you look at some of the bets we’ve talked about in CorpFin,

we said we were going to invest behind some core positions which we thought were terrific, like in our TMT practice, which is both a restructuring practice, but also a performance improvement business.

And we’ve added headcount there —I think they might be up 30% in headcount year on year, or at least will be by the end of the third quarter. And so

far, that’s been a terrific success, investing behind core positions we have in the marketplace and just taking the risk on the headcount. In that one, actually people have gotten employed faster than is typical. I think if you talk about,

again, staying in CorpFin, some of our bets in Europe, one of them and maybe I won’t describe which is which.

But one of them is totally on track.

Last year was a substantial hit to our P&L and this year, will be making this money. Another one in Europe that we talked about was a hit to our P&L last year and is substantially better this year but is probably a couple quarters behind

what we anticipated at this point.

And we’re talking and we’re supporting it but we still believe in those bets so it’s that some of them

are like the TMT once which are home runs and the one of the ones in Europe. Some of them are like the one I described where there are a few quarters behind where we monitor, and then you monitor them and you say, was this a bad bet or are we just a

few quarters behind? If it’s a few quarters behind, you say, okay, we just — we stick with this.

12

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

And I would say most of them have fallen into one of those camps as opposed to any of that can think that

says, boy, that was stupid to start. We should pull the plug on them. We probably will have those going forward but so far, that’s where we are, David. Does that help?

David Gold - Sidoti & Company - Analyst

It does. And then along those lines, given the success, is there a point where the upside from the bets basically overtakes the downside the costs where on a

net basis, we should see some contribution and then as a result, compares to that in margin improvement?

Steve Gunby - FTI

Consulting Incorporated - President and CEO

Well, at least, you should see it in terms of EPS improvement and then I think, look, the truth is

part of the progress this year over last year is that. I mean, we already had some investment in last year, which some of it is turning from negative to neutral. Now we’re putting other investments behind it this year so I haven’t done the

full weighting.

But the targets for this year are obviously higher than last year and then our aspirations for next year are substantially higher than

they are and that is that phenomenon. Now we will always have a cost of the bets made in that year for the future and that’s built in there but the goal for this is for sure to have the value of this outweigh the cost and that’s the

trajectory of growth that we expect to drive. And thus far, I’m feeling, look, would I wish everything were succeeding? Absolutely. Would I wish lots of stuff going faster than it is absolutely. Do I — but re things working? Yes, they are

and that’s what leaves me with confidence and where we’re trying to take the Company. Does that help, Dave?

David Gold

- Sidoti & Company - Analyst

It does, it does. And then just lastly, the $0.02 of re-measurement gain on the contingent

consideration; can you speak to what that was related to?

David Johnson - FTI Consulting Incorporated - CFO

We had an Internet obligation that was contractually extinguished so that — the measure of going from something to nothing is a gain.

David Gold - Sidoti & Company - Analyst

Sure, sure, but can you say what the earn out related to or which acquisition it was?

David Johnson - FTI Consulting Incorporated - CFO

No, we’re not disclosing the specific deal

Steve Gunby - FTI Consulting Incorporated - President and CEO

Obviously, it’s financially beneficial to us.

David Gold - Sidoti & Company - Analyst

Sure, sure. Okay. Thank you both.

Steve

Gunby - FTI Consulting Incorporated - President and CEO

Thank you. Have a good day.

13

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

Operator

Paul Ginocchio, Deutsche Bank.

Steve

Gunby - FTI Consulting Incorporated - President and CEO

Good morning Paul.

Paul Ginocchio - Deutsche Bank - Analyst

Good morning. First on the SMD severance in FLC; was that just a senior rainmaker or was that also an internal change in management of that organization? And

then second, with the acceleration headcount hiring, have you caught up with what you need to do to achieve 2016? Are you back on track after a slower first quarter? Thanks.

Steve Gunby - FTI Consulting Incorporated - President and CEO

Well, the — on the first one, the — other than the named executive, we don’t identify individuals in the P&L and then could you repeat the

second question?

Paul Ginocchio - Deutsche Bank - Analyst

Well, just on the first one, I’m just trying to figure is it just a rainmaker or are you — have you made some changes to how you want to run the FLC

division? And then on the second one, was just have you caught up with the headcount hiring now that you’ve seen some good acceleration in the second quarter. I know that you had said that after the first, when you’re little bit behind.

I’m just wondering if you’re now back on track for 2016 based on deceleration and headcount hiring you saw in the second quarter.

Steve Gunby - FTI Consulting Incorporated - President and CEO

I would say we’re on track. The — I don’t think anybody is stopping and in fact, that’s one of the lessons of recruiting is if you ever

just pulled to the side of the road, you lose more than just that quarter’s production. You get out of the market and you lose your muscles so, but I would say that CorpFin and FLC, in particular, are now caught up to being on track but they

need to continue to hire, based on their growth plans.

And again, on the first one, I’m sorry, obviously was a SMD because it’s a large comp

number but outside of named executives, we don’t go into individuals.

Paul Ginocchio - Deutsche Bank - Analyst

Got it. Thank you.

Operator

Tim McHugh with William Blair.

Steve

Gunby - FTI Consulting Incorporated - President and CEO

Good morning Tim.

14

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

Tim McHugh - William Blair & Company - Analyst

Morning. I just wanted to ask about the Technology margins. I guess you talked about a number of investments that are obviously pressuring margins, but

there’s also a pricing pressure element to it. So can you give us some context for the, I guess the market-driven impact on margins there versus I guess the heightened level of investment? So that we get a sense of how much of each is impacting

that segment?

David Johnson - FTI Consulting Incorporated - CFO

The — it’s — there’s a lot of different pieces in there so difficult to tease out and sometimes you can make investment to go into a lower

margin business and so how do you dissect that between a strategic decision as opposed to one that the market is driving. But I would say the overall context, which I think is very similar to what we saw in the first quarter is that our Technology

practice, which we think is the best in the world, is particularly good at very large, complex global engagements that involve multiple countries, multiple regimes, use of our capabilities across the world.

And those require a high level of service, responsively, and they’re high utilization and they tend to be better margins. When those are a larger part of

our mix, we’re going to have higher profitability. When they’re a lower part of our mix, and we’re more in to the more competitive markets where other people have capabilities that we have as opposed to the big ones where we think

we’re pretty unique.

We’re going to be more exposed to the pricing pressure that is definitely a ubiquitous feature of the discovery business

these days. So I think second quarter, we definitely had less of the stuff where we were less — we’re in a less competitive market and more of the stuff where we’re in a more competitive market so it was definitely a driver as it was

the first quarter.

It’s one of the reasons why our business our visibility in fourth quarter is a little low because our folks usually do a very

good job of finding business we don’t know which kind of business they’re going to find. So there’s, one, the question of can they feel the pipeline where, again, they’ve always had great success but then the second is what kind

of business we fill the pipeline with?

Tim McHugh - William Blair & Company - Analyst

Okay, and then you talked about making a number of different bets. And I guess and I recognize it takes time to know which one of those happening and you have

to do more of that to drive growth but I guess implicit is that in knowing the right areas to make those bets. And I guess how do you feel at this point, given I guess 12 to 18 months in each year, 10 years that you have a feel for, f or where is a

right place to turn up and down those needles. And with that context, what’s the — do you have a better sense of the medium-term margin that is that you — this business can achieve even when making this healthy set of bets on future

growth?

Steve Gunby - FTI Consulting Incorporated - President and CEO

Tim, I think I obviously feel and I think David feels that we have a better intuitive sense of which bets are worth making now than we did when we were new to

the Company. But I’ll tell you my big takeaway here is not that we have too many bad bets or not that many good bets. I think the truth is that we are learning, as a Company, to identify all the good bets.

I mean the truth was even in the tough years of this Company, there were people in adjacent spaces springing up in areas that we should be winning in and our

FLC business is fabulous and Investigations. Monitoring is right next to it. We do a little bit of Monitoring but we did invest behind the capability of the people that do the monitoring and other people stepped into that void. Now we’re

investing in that. A bunch of the stuff we’re doing in Performance Improvement and CorpFin, we had a right to do.

It’s the same sort of

capability we’re the best in the world in doing some of this stuff we’re doing and we’re just discovering that and investing behind it and I think we’re just scratching the surface of that. So I believe that this concept of

finding the real opportunities in betting behind them can be a sustainable growth engine for this Company for a lot of years here, Tim, and that’s part of the core reason I’m excited to be here.

And the issue is more about getting as many of our professionals thinking that way versus running 80 hours a week executing on the work they have to do which

is, of course, one of the problems when you’re in an event business since when you get busy, you get really busy and you’re not focused on correctly, so you’re not focused on our business. You’re focused on your clients’

business and that’s, obviously, the right thing for grade professionals to do but we’re trying to change the culture.

So I’m not worried

about we will have some bad bets and we’ll have some bets that turn out slower but I’m not worried about running out of good bets or the ability to distinguish between the two. You’d know pretty quickly if it’s bad and you can

actually know ex-ante whether you have a right to win. If you’re going into a space where everybody in the world, there’s 62,000 competitors and know that you can’t have somebody articulate a reason why to hire us versus them,

that’s not a good bet.

15

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

If you are the clearly the leading guys in the space and your clients tell you that and there’s lots of

people you haven’t talked to in that space because you’ve been too busy, the notion of spending some time to get some more capacity and calling on the people we haven’t called on sounds like a pretty good bet.

Now maybe it takes you awhile to penetrate those markets so I think it’s not that hard and the second part of your question was about the margins. Look,

you know I’ve been steadfastly resisting saying what the margin target is because I think we’d — I wouldn’t be excited of having a 30% margin business that was half the size of today. And I’d be very excited about having

today’s margin business organically grown that was 50% higher than today because you’d have EPS that would be substantially higher and we would have delivered for the shareholders.

So would we — obviously we all love higher margins when we can get them in — but what we’re driving is trying to drive the combination of

creating an environment that professionals are delighted to join and shareholder value. And that’s what we are committed to and that’s why we do talk about aspirational targets about EPS. We haven’t talked about aspirational targets

with respect to margins but you keep asking, Tim, so I appreciate the question.

Operator

Kevin McVeigh with Macquarie.

Steve

Gunby - FTI Consulting Incorporated - President and CEO

Morning Kevin.

Kevin McVeigh - Macquarie Research - Analyst

Good morning. In terms of the hiring, just any thoughts as to the structure of the pyramid overall in terms of the — will the leverage be what has been

traditional in terms of SMD to associate or just any thoughts around the ratio there? And then just transferable skill sets amongst the different segments?

Steve Gunby - FTI Consulting Incorporated - President and CEO

I think, look, most of our movement thus far, I’d say almost all of our movement thus far has been to return our pyramids within the individual segments

and subsegments to historical levels. It’s not been about taking a historical 6-to-1 leverage business to a 14-to-1 leverage. It’s been around 6-to-1 leverage that business that got down to 4.8 and taking it back to 6 and so that’s

where we are.

Now whether that adds up to the same leverage across the Company as historically obviously depends on the mix. If you look within FLC, the

FEDA, the Data Analytics business is a high leverage business where you have a lot of very smart analysts who can do stuff on a computer that you and I wouldn’t understand and high ratio those. If you’re in the disputes part of FLC, it

tends to be focused on people who can go on the stand supported by some people.

So the — depending on the mix of the business, the overall leverage

of this Company could change. Will we be experimenting with different leverage models within the various subsegments as we go forward? Probably. It’s still something that Company should do but that’s actually not been the thrust so far;

it’s been rebuilding the pyramid. Does that help?

Kevin McVeigh - Macquarie Research - Analyst

Yes, that’s very helpful. I just want to make sure I had a quick — the additional cushion from — to refinancing, that wasn’t considered in

the initial 2016 goals so that gives you additional cushion or how should we think about that?

Steve Gunby - FTI Consulting

Incorporated - President and CEO

I always — that $2.50 a share was first announced during Investor Day, which — and let me be clear. I

was thought about one of the key pillar killers of the pillars of this Company is the cash flow that it generates and now how we use that cash flow wasn’t clear there at that point in time because I didn’t know whether we were going to

find great acquisitions or stock plummets, in which case you repurchase shares or whether you’re going to retire debt or whatever and I hadn’t thought that through.

16

JULY 30, 2015 / 01:00PM GMT, FCN - Q2 2015 FTI Consulting Inc Earnings Call

And I didn’t — I was waiting until I also had a CFO to help think through that, and David joined

shortly after Investor Day but, look, one of the key pillars of this Company is that we have great cash flow, at least if we use it wisely. And that is a key part of the story and that was in my mind on the $2.50 always as — because you’re

making a lot of investments elsewhere in order to turn this Company into a sustainable engine.

One of the things you can use to offset some of those

investments is whatever use that cash can become turned into so that was always in my mind as we thought through this and it is in my mind going forward as we think about we haven’t given aspirational targets for beyond 2016 but obviously,

we’re looking to turn this Company into a sustainable growth engine and part of that story is making sure we take the cash that the Company generates and use it wisely to support growth. Does that help?

Kevin McVeigh - Macquarie Research - Analyst

Very. Thank you.

Operator

At this time, I’ll turn the call back to management for closing remarks.

Steve Gunby - FTI Consulting Incorporated - President and CEO

David, anything else?

David Johnson

- FTI Consulting Incorporated - CFO

No. Well, thank you all very much for joining us and hope the rest of your summer is good. And we

look forward to seeing all of you soon.

Steve Gunby - FTI Consulting Incorporated - President and CEO

And let me just say thank you again for all the attention that you guys paid to us and sometimes your contributions to our thinking. We’re on a journey

here, a journey that I’m positive on. This is a great Company. We’re trying to figure out ways to realize the potential of this great Company and the thoughtful comments you guys supply from time to time are very much appreciated. So

thanks and have a great rest of the summer.

Operator

This does conclude today’s conference. We thank you for your participation.

DISCLAIMER

FTI Consulting, Inc. reserves the right to make changes to documents, content, or other information on this web site without obligation to

notify any person of such changes.

In the conference calls upon which Transcripts are based, companies may make projections or other

forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement

based on a number of important factors and risks, which are more specifically identified in the companies’ most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements

are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE COMPANY’S CONFERENCE CALL AND WHILE

EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR

OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED IN THE TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE COMPANY’S CONFERENCE CALL ITSELF AND THE COMPANY’S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

17

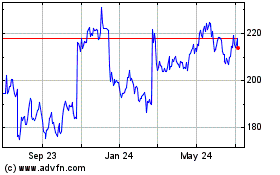

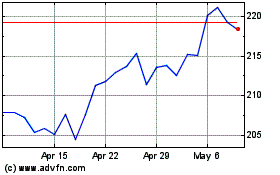

FTI Consulting (NYSE:FCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

FTI Consulting (NYSE:FCN)

Historical Stock Chart

From Apr 2023 to Apr 2024