UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 3, 2015

ARCHROCK, INC.*

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-33666 |

|

74-3204509 |

|

(State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

|

|

|

|

|

|

16666 Northchase Drive, |

|

|

|

|

|

Houston, Texas |

|

|

|

77060 |

|

(Address of principal executive offices) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (281) 836-8000

Exterran Holdings, Inc.

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

* The registrant was formerly named Exterran Holdings, Inc. Effective as of November 3, 2015, the registrant changed its name to Archrock, Inc.

Item 2.01 Completion of Acquisiton or Disposition of Assets.

On November 3, 2015, Archrock, Inc. (formerly named Exterran Holdings, Inc. prior to November 3, 2015) (“our,” “we” or “us”) completed the separation of our international services and global fabrication businesses into a stand-alone, publicly traded company named Exterran Corporation and distributed to holders of record of our common stock on October 27, 2015 (the “Record Date”) one share of Exterran Corporation common stock for every two shares of our common stock outstanding as of the Record Date (the “Spin-off”). Exterran Corporation is now an independent public company trading under the symbol “EXTN” on the New York Stock Exchange.

Following the Spin-off, we do not own any shares of Exterran Corporation common stock and we will no longer consolidate Exterran Corporation or its subsidiaries in our financial results. Our unaudited pro forma financial information giving effect to the Spin-off, and the related notes thereto, are attached as Exhibit 99.2 and are incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On November 4, 2015, we issued a press release announcing the completion of the spin-off. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated by reference into this Item 7.01.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and will not be incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(b) Pro Forma Financial Information. The unaudited pro forma condensed consolidated balance sheet of Archrock, Inc. dated as of June 30, 2015 and unaudited pro forma condensed consolidated statement of operations of Archrock, Inc. for the six months ended June 30, 2015 and for each of the three years ended December 31, 2014 and the related notes thereto are filed as Exhibit 99.2 to this Current Report on Form 8-K.

(d) Exhibits. See “Exhibit Index” attached to this Current Report on Form 8-K, which is incorporated by reference herein.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ARCHROCK, INC. |

|

|

|

|

|

|

|

|

November 4, 2015 |

By: |

/s/ KENNETH R. BICKETT |

|

|

|

Kenneth R. Bickett |

|

|

|

Vice President and Controller |

3

Exhibit Index

|

Exhibit No. |

|

Description |

|

99.1 |

|

Press release dated November 4, 2015. |

|

99.2 |

|

Unaudited pro forma condensed consolidated balance sheet of Archrock, Inc. dated as of June 30, 2015 and unaudited pro forma condensed consolidated statement of operations of Archrock, Inc. for the six months ended June 30, 2015 and for each of the three years ended December 31, 2014. |

4

Exhibit 99.1

For information, contact:

Media - Lisa Walsh, 281-836-8602

Investors - David Miller, 281-836-8895

Archrock, Inc. Completes Spin-Off of Exterran Corporation

· Exterran Partners renamed “Archrock Partners”

HOUSTON, Nov. 4, 2015 – Archrock, Inc. (NYSE: AROC) today announced the completion of the previously announced spin-off of the international services and global fabrication businesses of Exterran Holdings, Inc. into a new, publicly traded company, Exterran Corporation, through the distribution of all the shares of Exterran Corporation common stock to the holders of Exterran Holdings common stock. In connection with the completion of the spin-off, Exterran Holdings, Inc. was renamed Archrock, Inc. and will begin “regular way” trading on the New York Stock Exchange today under the symbol “AROC”. Following the completion of the spin-off, Archrock, Inc. is the leading provider of natural gas contract compression services to customers throughout the United States and a leading supplier of aftermarket services to customers that own compression equipment in the United States.

Archrock Partners, L.P. (NASDAQ: APLP), formerly known as Exterran Partners, L.P., today announced that its name has changed in connection with the spin-off and that its trading symbol on the Nasdaq Global Select Market has changed from EXLP to “APLP”. Archrock, Inc. continues to own an equity interest, including all of the general partner interest, in Archrock Partners. Archrock Partners is the leading provider of natural gas contract compression services to customers throughout the United States.

To effect the spin-off, each Exterran Holdings shareholder received one share of Exterran Corporation common stock for every two shares of Exterran Holdings common stock held as of 5:00 p.m., Eastern Time, on October 27, 2015, the record date for the spin-off. Exterran Corporation is now an independent, publicly traded company that will begin “regular way” trading on the NYSE today under the symbol “EXTN”.

About Archrock

Archrock, Inc. is the leading provider of natural gas contract compression services to customers throughout the United States and a leading supplier of aftermarket services to customers that own compression equipment in the United States. Archrock is headquartered in Houston, Texas and operates in the major oil and gas producing regions in the United States with approximately 2,500 employees. Archrock owns an equity interest, including all of the general partner interest, in Archrock Partners, L.P. (NASDAQ: APLP). For more information, visit www.archrock.com.

About Archrock Partners

Archrock Partners, L.P., a master limited partnership, is the leading provider of natural gas contract compression services to customers throughout the United States. Archrock, Inc. (NYSE: AROC) owns an equity interest in Archrock Partners, including all of the general partner interest. For more information, visit www.archrock.com.

SOURCE

Archrock, Inc. and Archrock Partners, L.P.

1

Exhibit 99.2

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

On November 3, 2015, Archrock, Inc. (formerly named Exterran Holdings, Inc. prior to November 3, 2015) (“Archrock,” “our”, “we” or “us”) completed the spin-off of our international contract operations, international aftermarket services and global fabrication businesses into an independent, publicly traded company (“Exterran Corporation”), to our stockholders (the “Spin-off”). On November 3, 2015 (the “Distribution Date”), our stockholders of record as of the close of business on October 27, 2015 (the “Record Date”) received one share of Exterran Corporation common stock for every two shares of our common stock held as of the Record Date. Following the Spin-off, we do not beneficially own any shares of Exterran Corporation. We will report the financial results of Exterran Corporation prior to the Spin-off as discontinued operations beginning in our Annual Report on Form 10-K for the year ending December 31, 2015.

The Unaudited Pro Forma Condensed Consolidated Financial Statements (also referred to as the “pro forma financial statements”), were derived from our historical consolidated financial statements and give effect to the Spin-off. The pro forma financial statements were based on, and should be read in conjunction with, our:

· consolidated financial statements for each of the three years ended December 31, 2014 and the notes relating thereto, included in our 2014 Annual Report on Form 10-K;

· unaudited condensed consolidated financial statements for the six months ended June 30, 2015, and the notes relating thereto, included in our June 30, 2015 Quarterly Report on Form 10-Q.

The historical consolidated financial statements have been adjusted in the pro forma financial statements to give effect to pro forma events that are (a) directly attributable to the Spin-off, (b) factually supportable and (c) with respect to the pro forma statements of operations, expected to have a continuing impact on the consolidated results. The Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 30, 2015 gives effect to the Spin-off and related transactions as if they occurred on June 30, 2015. The Unaudited Pro Forma Condensed Consolidated Statements of Operations for the six months ended June 30, 2015 and each of the three years ended December 31, 2014 give effect to the Spin-off and related transactions as if they occurred on January 1, 2012.

The pro forma financial statements have been presented for informational purposes only and are based on available information and assumptions that management believes are reasonable under the circumstances. The pro forma financial statements are not necessarily indicative of our future results of operations and financial position had the Spin-off and related transactions occurred as of the dates indicated. In addition, the pro forma financial statements do not purport to project our future results of operations or financial position.

The pro forma financial statements give effect to the Spin-off and related transactions, including:

· The distribution of our net investment in Exterran Corporation as a reduction to our historical consolidated additional paid-in capital;

· As reflected in the “Spin-off of Exterran Corporation” column, the removal of assets, liabilities, equity and results of operations of Exterran Corporation, non-recurring transaction and pre-separation costs that are directly related to the Spin-off, certain of our general corporate overhead expenses previously allocated to Exterran Corporation that are not specifically related to the Exterran Corporation business and do not meet the requirements to be presented as a component of discontinued operations and differences between the separate return methodology used in the Exterran Corporation combined balance sheet and the anticipated transfer of current and deferred tax assets and liabilities in accordance with the tax matters agreement;

· The transfer of cash from Exterran Corporation to us of $539.0 million in connection with the Spin-off as if the Spin-off occurred on June 30, 2015;

· Our entry into a new senior secured revolving credit facility (“New Revolving Credit Facility”) and the incurrence of $173.7 million of borrowings under this facility; and

· Our repayment of the senior secured revolving credit facility (the “Credit Facility”) and $350.0 million aggregate principal amount of 7.25% senior notes (the “7.25% Notes”).

As of December 31, 2014, we had $136.9 million in foreign tax credit carryforward deferred tax assets. We recorded a valuation allowance of $7.2 million against these deferred tax assets in the fourth quarter of 2014 for foreign tax credits that expire in the year 2015. As of June 30, 2015, these deferred tax assets related to foreign tax credit carryforwards that can be used to reduce our income taxes payable in future periods. The foreign tax credit carryforwards will expire if they are not used within the 10-year carryforward period. Had the Spin-off not been completed, we consider it more likely than not that we would have had sufficient taxable income and foreign source taxable income in the future that would have allowed us to realize these deferred tax assets, net of the valuation allowance. However, upon completion of the Spin-off many of the foreign tax credit carryforwards will ultimately expire unused. Therefore, since we do not expect Exterran Corporation to generate sufficient taxable income and foreign source taxable income following the Spin-off, an additional valuation allowance ranging from $45 million to $65 million to reduce our foreign tax credit carryforward deferred tax assets is expected to be recorded in the fourth quarter of 2015. The unaudited pro forma condensed consolidated statements of operations do not reflect this charge.

1

ARCHROCK, INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

June 30, 2015

(In thousands)

|

|

|

Historical |

|

Spin-off of

Exterran

Corporation |

|

Pro Forma

Adjustments |

|

|

Archrock, Inc.

Pro Forma |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

23,325 |

|

$ |

(23,049 |

) |

$ |

538,993 |

|

(A) |

$ |

276 |

|

|

|

|

|

|

|

|

(538,993 |

) |

(B) |

|

|

|

|

|

|

|

|

|

173,655 |

|

(C) |

|

|

|

|

|

|

|

|

|

(173,655 |

) |

(C) |

|

|

|

Restricted cash |

|

1,490 |

|

(1,490 |

) |

|

|

|

— |

|

|

Accounts receivable, net of allowance |

|

502,547 |

|

(353,803 |

) |

|

|

|

148,744 |

|

|

Inventory, net |

|

400,845 |

|

(253,747 |

) |

|

|

|

147,098 |

|

|

Costs and estimated earnings in excess of billings on uncompleted contracts |

|

128,261 |

|

(128,261 |

) |

|

|

|

— |

|

|

Current deferred income taxes |

|

71,489 |

|

(49,978 |

) |

(2,869 |

) |

(D) |

18,642 |

|

|

Other current assets |

|

66,815 |

|

(58,632 |

) |

|

|

|

8,183 |

|

|

Current assets associated with discontinued operations |

|

397 |

|

(397 |

) |

|

|

|

— |

|

|

Total current assets |

|

1,195,169 |

|

(869,357 |

) |

(2,869 |

) |

|

322,943 |

|

|

Property, plant and equipment, net |

|

3,340,635 |

|

(952,385 |

) |

|

|

|

2,388,250 |

|

|

Goodwill |

|

3,738 |

|

— |

|

|

|

|

3,738 |

|

|

Intangible and other assets, net |

|

225,528 |

|

(196,891 |

) |

(4,633 |

) |

(E) |

143,424 |

|

|

|

|

|

|

|

|

3,772 |

|

(C) |

|

|

|

|

|

|

|

|

|

115,648 |

|

(D) |

|

|

|

Long-term assets associated with discontinued operations |

|

16,506 |

|

— |

|

|

|

|

16,506 |

|

|

Total assets |

|

$ |

4,781,576 |

|

$ |

(2,018,633 |

) |

$ |

111,918 |

|

|

$ |

2,874,861 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

Accounts payable, trade |

|

$ |

166,787 |

|

$ |

(123,095 |

) |

|

|

|

$ |

43,692 |

|

|

Accrued liabilities |

|

209,531 |

|

(131,471 |

) |

$ |

(2,376 |

) |

(B) |

75,684 |

|

|

Deferred revenue |

|

57,705 |

|

(53,333 |

) |

|

|

|

4,372 |

|

|

Billings on uncompleted contracts in excess of costs and estimated earnings |

|

61,010 |

|

(61,010 |

) |

|

|

|

— |

|

|

Current liabilities associated with discontinued operations |

|

929 |

|

(769 |

) |

|

|

|

160 |

|

|

Total current liabilities |

|

495,962 |

|

(369,678 |

) |

(2,376 |

) |

|

123,908 |

|

|

Long-term debt |

|

2,089,762 |

|

(891 |

) |

(536,617 |

) |

(B) |

1,556,026 |

|

|

|

|

|

|

|

|

(169,883 |

) |

(C) |

|

|

|

|

|

|

|

|

|

173,655 |

|

(C) |

|

|

|

Deferred income taxes |

|

177,597 |

|

(39,952 |

) |

112,779 |

|

(D) |

250,424 |

|

|

Other long-term liabilities |

|

86,579 |

|

(76,815 |

) |

|

|

|

9,764 |

|

|

Long-term liabilities associated with discontinued operations |

|

154 |

|

(154 |

) |

|

|

|

— |

|

|

Total liabilities |

|

2,850,054 |

|

(487,490 |

) |

(422,442 |

) |

|

1,940,122 |

|

|

Equity: |

|

|

|

|

|

|

|

|

|

|

|

Preferred stock |

|

— |

|

— |

|

|

|

|

— |

|

|

Common stock |

|

745 |

|

— |

|

|

|

|

745 |

|

|

Additional paid-in capital |

|

3,746,106 |

|

(1,521,070 |

) |

600,339 |

|

(G) |

2,825,375 |

|

|

Accumulated other comprehensive income |

|

8,249 |

|

(10,073 |

) |

|

|

|

(1,824 |

) |

|

Accumulated deficit |

|

(1,856,387 |

) |

— |

|

(10,979 |

) |

(E) |

(1,922,366 |

) |

|

|

|

|

|

|

|

(55,000 |

) |

(F) |

|

|

|

Treasury stock |

|

(72,180 |

) |

— |

|

|

|

|

(72,180 |

) |

|

Total Archrock stockholders’ equity |

|

1,826,533 |

|

(1,531,143 |

) |

534,360 |

|

|

829,750 |

|

|

Noncontrolling interest |

|

104,989 |

|

— |

|

|

|

|

104,989 |

|

|

Total equity |

|

1,931,522 |

|

(1,531,143 |

) |

534,360 |

|

|

934,739 |

|

|

Total liabilities and equity |

|

$ |

4,781,576 |

|

$ |

(2,018,633 |

) |

$ |

111,918 |

|

|

$ |

2,874,861 |

|

See accompanying notes to unaudited pro forma condensed consolidated financial statements

2

ARCHROCK, INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2015

(In thousands, except per share amounts)

|

|

|

Historical |

|

Spin-off of

Exterran

Corporation |

|

Pro Forma

Adjustments |

|

|

Archrock, Inc.

Pro Forma |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

North America contract operations |

|

$ |

400,520 |

|

$ |

— |

|

|

|

|

$ |

400,520 |

|

|

International contract operations |

|

235,941 |

|

(235,941 |

) |

|

|

|

— |

|

|

Aftermarket services |

|

177,690 |

|

(70,275 |

) |

|

|

|

107,415 |

|

|

Fabrication |

|

598,763 |

|

(598,763 |

) |

|

|

|

— |

|

|

|

|

1,412,914 |

|

(904,979 |

) |

|

|

|

507,935 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

Cost of sales (excluding depreciation and amortization expense): |

|

|

|

|

|

|

|

|

|

|

|

North America contract operations |

|

163,900 |

|

— |

|

|

|

|

163,900 |

|

|

International contract operations |

|

89,084 |

|

(89,084 |

) |

|

|

|

— |

|

|

Aftermarket services |

|

136,105 |

|

(49,484 |

) |

|

|

|

86,621 |

|

|

Fabrication |

|

507,972 |

|

(507,972 |

) |

|

|

|

— |

|

|

Selling, general and administrative |

|

170,560 |

|

(106,635 |

) |

|

|

|

63,925 |

|

|

Depreciation and amortization |

|

190,133 |

|

(75,581 |

) |

|

|

|

114,552 |

|

|

Long-lived asset impairment |

|

28,152 |

|

(10,489 |

) |

|

|

|

17,663 |

|

|

Restructuring and other charges |

|

24,394 |

|

(23,201 |

) |

|

|

|

1,193 |

|

|

Interest expense |

|

55,696 |

|

(826 |

) |

$ |

(15,081 |

) |

(H) |

39,789 |

|

|

Equity in income of non-consolidated affiliates |

|

(10,068 |

) |

10,068 |

|

|

|

|

— |

|

|

Other (income) expense, net |

|

8,846 |

|

(11,878 |

) |

|

|

|

(3,032 |

) |

|

|

|

1,364,774 |

|

(865,082 |

) |

(15,081 |

) |

|

484,611 |

|

|

Income before income taxes |

|

48,140 |

|

(39,897 |

) |

15,081 |

|

|

23,324 |

|

|

Provision for income taxes |

|

18,233 |

|

(20,502 |

) |

5,278 |

|

(I) |

3,009 |

|

|

Income from continuing operations |

|

29,907 |

|

(19,395 |

) |

9,803 |

|

|

20,315 |

|

|

Less: Income from continuing operations attributable to the noncontrolling interest |

|

(18,121 |

) |

— |

|

|

|

|

(18,121 |

) |

|

Income from continuing operations attributable to Archrock stockholders |

|

$ |

11,786 |

|

$ |

(19,395 |

) |

$ |

9,803 |

|

|

$ |

2,194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations attributable to Archrock common stockholders per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.17 |

|

|

|

|

|

|

$ |

0.03 |

|

|

Diluted |

|

$ |

0.17 |

|

|

|

|

|

|

$ |

0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding used in income from continuing operations attributable to Archrock common stockholders per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

68,381 |

|

|

|

|

|

|

68,381 |

|

|

Diluted |

|

68,667 |

|

|

|

|

|

|

68,667 |

|

See accompanying notes to unaudited pro forma condensed consolidated financial statements

3

ARCHROCK, INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

For the Year Ended December 31, 2014

(In thousands, except per share amounts)

|

|

|

Historical |

|

Spin-off of

Exterran

Corporation |

|

Pro Forma

Adjustments |

|

|

Archrock, Inc.

Pro Forma |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

North America contract operations |

|

$ |

729,103 |

|

$ |

— |

|

|

|

|

$ |

729,103 |

|

|

International contract operations |

|

493,853 |

|

(493,853 |

) |

|

|

|

— |

|

|

Aftermarket services |

|

392,774 |

|

(162,724 |

) |

|

|

|

230,050 |

|

|

Fabrication |

|

1,284,008 |

|

(1,284,008 |

) |

|

|

|

— |

|

|

|

|

2,899,738 |

|

(1,940,585 |

) |

|

|

|

959,153 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

Cost of sales (excluding depreciation and amortization expense): |

|

|

|

|

|

|

|

|

|

|

|

North America contract operations |

|

316,142 |

|

— |

|

|

|

|

316,142 |

|

|

International contract operations |

|

185,408 |

|

(185,408 |

) |

|

|

|

— |

|

|

Aftermarket services |

|

308,432 |

|

(120,181 |

) |

|

|

|

188,251 |

|

|

Fabrication |

|

1,058,462 |

|

(1,058,462 |

) |

|

|

|

— |

|

|

Selling, general and administrative |

|

377,754 |

|

(245,103 |

) |

|

|

|

132,651 |

|

|

Depreciation and amortization |

|

386,071 |

|

(173,803 |

) |

|

|

|

212,268 |

|

|

Long-lived asset impairment |

|

46,679 |

|

(3,851 |

) |

|

|

|

42,828 |

|

|

Restructuring and other charges |

|

7,553 |

|

(2,159 |

) |

|

|

|

5,394 |

|

|

Interest expense |

|

114,178 |

|

(1,905 |

) |

$ |

(28,349 |

) |

(H) |

83,924 |

|

|

Equity in income of non-consolidated affiliates |

|

(14,553 |

) |

14,553 |

|

|

|

|

— |

|

|

Other (income) expense, net |

|

1,747 |

|

(7,222 |

) |

|

|

|

(5,475 |

) |

|

|

|

2,787,873 |

|

(1,783,541 |

) |

(28,349 |

) |

|

975,983 |

|

|

Income (loss) before income taxes |

|

111,865 |

|

(157,044 |

) |

28,349 |

|

|

(16,830 |

) |

|

Provision for (benefit from) income taxes |

|

58,657 |

|

(86,723 |

) |

9,922 |

|

(I) |

(18,144 |

) |

|

Income from continuing operations |

|

53,208 |

|

(70,321 |

) |

18,427 |

|

|

1,314 |

|

|

Less: Income from continuing operations attributable to the noncontrolling interest |

|

(27,716 |

) |

— |

|

|

|

|

(27,716 |

) |

|

Income (loss) from continuing operations attributable to Archrock stockholders |

|

$ |

25,492 |

|

$ |

(70,321 |

) |

$ |

18,427 |

|

|

$ |

(26,402 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from continuing operations attributable to Archrock common stockholders per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.38 |

|

|

|

|

|

|

$ |

(0.40 |

) |

|

Diluted |

|

$ |

0.36 |

|

|

|

|

|

|

$ |

(0.40 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding used in income (loss) from continuing operations attributable to Archrock common stockholders per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

66,234 |

|

|

|

|

|

|

66,234 |

|

|

Diluted |

|

69,090 |

|

|

|

|

|

|

66,234 |

|

See accompanying notes to unaudited pro forma condensed consolidated financial statements

4

ARCHROCK, INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

For the Year Ended December 31, 2013

(In thousands, except per share amounts)

|

|

|

Historical |

|

Spin-off of

Exterran

Corporation |

|

Pro Forma

Adjustments |

|

|

Archrock, Inc.

Pro Forma |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

North America contract operations |

|

$ |

627,844 |

|

$ |

— |

|

|

|

|

$ |

627,844 |

|

|

International contract operations |

|

476,016 |

|

|

(476,016 |

) |

|

|

|

— |

|

|

Aftermarket services |

|

395,600 |

|

(160,672 |

) |

|

|

|

234,928 |

|

|

Fabrication |

|

1,660,944 |

|

(1,660,944 |

) |

|

|

|

— |

|

|

|

|

3,160,404 |

|

(2,297,632 |

) |

|

|

|

862,772 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

Cost of sales (excluding depreciation and amortization expense): |

|

|

|

|

|

|

|

|

|

|

|

North America contract operations |

|

282,489 |

|

— |

|

|

|

|

282,489 |

|

|

International contract operations |

|

196,944 |

|

(196,944 |

) |

|

|

|

— |

|

|

Aftermarket services |

|

309,418 |

|

(120,929 |

) |

|

|

|

188,489 |

|

|

Fabrication |

|

1,408,547 |

|

(1,408,547 |

) |

|

|

|

— |

|

|

Selling, general and administrative |

|

358,173 |

|

(239,322 |

) |

|

|

|

118,851 |

|

|

Depreciation and amortization |

|

327,505 |

|

(140,029 |

) |

|

|

|

187,476 |

|

|

Long-lived asset impairment |

|

28,637 |

|

(11,941 |

) |

|

|

|

16,696 |

|

|

Interest expense |

|

115,745 |

|

(3,551 |

) |

$ |

(27,246 |

) |

(H) |

84,948 |

|

|

Equity in income of non-consolidated affiliates |

|

(19,000 |

) |

19,000 |

|

|

|

|

— |

|

|

Other (income) expense, net |

|

(24,501 |

) |

1,966 |

|

|

|

|

(22,535 |

) |

|

|

|

2,983,957 |

|

(2,100,297 |

) |

(27,246 |

) |

|

856,414 |

|

|

Income before income taxes |

|

176,447 |

|

(197,335 |

) |

27,246 |

|

|

6,358 |

|

|

Provision for (benefit from) income taxes |

|

84,719 |

|

(102,559 |

) |

9,536 |

|

(I) |

(8,304 |

) |

|

Income from continuing operations |

|

91,728 |

|

(94,776 |

) |

17,710 |

|

|

14,662 |

|

|

Less: Income from continuing operations attributable to the noncontrolling interest |

|

(32,578 |

) |

— |

|

|

|

|

(32,578 |

) |

|

Income (loss) from continuing operations attributable to Archrock stockholders |

|

$ |

59,150 |

|

$ |

(94,776 |

) |

$ |

17,710 |

|

|

$ |

(17,916 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from continuing operations attributable to Archrock common stockholders per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.90 |

|

|

|

|

|

|

$ |

(0.28 |

) |

|

Diluted |

|

$ |

0.89 |

|

|

|

|

|

|

$ |

(0.28 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding used in income (loss) from continuing operations attributable to Archrock common stockholders per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

64,454 |

|

|

|

|

|

|

64,454 |

|

|

Diluted |

|

65,003 |

|

|

|

|

|

|

64,454 |

|

See accompanying notes to unaudited pro forma condensed consolidated financial statements

5

ARCHROCK, INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

For the Year Ended December 31, 2012

(In thousands, except per share amounts)

|

|

|

Historical |

|

Spin-off of

Exterran

Corporation |

|

Pro Forma

Adjustments |

|

|

Archrock, Inc.

Pro Forma |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

North America contract operations |

|

$ |

596,011 |

|

$ |

— |

|

|

|

|

$ |

596,011 |

|

|

International contract operations |

|

463,957 |

|

(463,957 |

) |

|

|

|

— |

|

|

Aftermarket services |

|

385,861 |

|

(145,048 |

) |

|

|

|

240,813 |

|

|

Fabrication |

|

1,348,417 |

|

(1,348,417 |

) |

|

|

|

— |

|

|

|

|

2,794,246 |

|

(1,957,422 |

) |

|

|

|

836,824 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

Cost of sales (excluding depreciation and amortization expense): |

|

|

|

|

|

|

|

|

|

|

|

North America contract operations |

|

284,703 |

|

— |

|

|

|

|

284,703 |

|

|

International contract operations |

|

184,608 |

|

(184,608 |

) |

|

|

|

— |

|

|

Aftermarket services |

|

303,590 |

|

(107,273 |

) |

|

|

|

196,317 |

|

|

Fabrication |

|

1,191,937 |

|

(1,191,937 |

) |

|

|

|

— |

|

|

Selling, general and administrative |

|

375,647 |

|

(247,747 |

) |

|

|

|

127,900 |

|

|

Depreciation and amortization |

|

346,177 |

|

(164,499 |

) |

|

|

|

181,678 |

|

|

Long-lived asset impairment |

|

136,614 |

|

(5,197 |

) |

|

|

|

131,417 |

|

|

Restructuring and other charges |

|

6,471 |

|

(3,892 |

) |

|

|

|

2,579 |

|

|

Interest expense |

|

134,376 |

|

(5,318 |

) |

$ |

(32,974 |

) |

(H) |

96,084 |

|

|

Equity in income of non-consolidated affiliates |

|

(51,483 |

) |

51,483 |

|

|

|

|

— |

|

|

Other (income) expense, net |

|

506 |

|

(5,638 |

) |

|

|

|

(5,132 |

) |

|

|

|

2,913,146 |

|

(1,864,626 |

) |

(32,974 |

) |

|

1,015,546 |

|

|

Loss before income taxes |

|

(118,900 |

) |

(92,796 |

) |

32,974 |

|

|

(178,722 |

) |

|

Benefit from income taxes |

|

(45,755 |

) |

(31,279 |

) |

11,541 |

|

(I) |

(65,493 |

) |

|

Loss from continuing operations |

|

(73,145 |

) |

(61,517 |

) |

21,433 |

|

|

(113,229 |

) |

|

Less: Income from continuing operations attributable to the noncontrolling interest |

|

(2,317 |

) |

— |

|

|

|

|

(2,317 |

) |

|

Loss from continuing operations attributable to Archrock stockholders |

|

$ |

(75,462 |

) |

$ |

(61,517 |

) |

$ |

21,433 |

|

|

$ |

(115,546 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations attributable to Archrock common stockholders per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(1.19 |

) |

|

|

|

|

|

$ |

(1.82 |

) |

|

Diluted |

|

$ |

(1.19 |

) |

|

|

|

|

|

$ |

(1.82 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding used in loss from continuing operations attributable to Archrock common stockholders per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

63,436 |

|

|

|

|

|

|

63,436 |

|

|

Diluted |

|

63,436 |

|

|

|

|

|

|

63,436 |

|

See accompanying notes to unaudited pro forma condensed consolidated financial statements

6

ARCHROCK, INC.

NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(A) Reflects the receipt of cash transferred from Exterran Corporation to us of $539.0 million in connection with the Spin-off, which assumes the Spin-off occurred on June 30, 2015.

(B) Reflects our use of the $539.0 million in cash transferred from Exterran Corporation to repay $356.5 million outstanding under our existing Credit Facility, $180.1 million of the $350.0 million aggregate principal amount outstanding under the 7.25% Notes and $2.4 million of accrued and unpaid interest under the existing Credit Facility and 7.25% Notes. The adjustment assumes a repayment date of June 30, 2015.

(C) Represents indebtedness of approximately $173.7 million under the New Revolving Credit Facility we would expect to incur in connection with the Spin-off if it occurred on June 30, 2015. Proceeds from such borrowings are expected to be used to fund the repayment of $169.9 million for the remaining principle balance of the existing Credit Facility and 7.25% Notes in excess of the cash transferred from Exterran Corporation to us and debt issuance costs of $3.8 million related to the New Revolving Credit Facility.

(D) Reflects adjustments to reclassify current and deferred income tax balances retained by Archrock due to the netting of assets and liabilities within a single tax jurisdiction.

(E) Represents expected debt extinguishment costs, including the write-off unamortized debt issuance costs, of approximately $11.0 million related to the repayment of our existing Credit Facility and 7.25% Notes.

(F) Reflects an estimated valuation allowance that is expected to be recorded upon completion of the Spin-off of $55 million, which represents the mid-point of our estimated additional valuation allowance range of between $45 million to $65 million. Since we do not expect Exterran Corporation to generate sufficient taxable income and foreign source taxable income following the Spin-off, this valuation allowance to reduce our foreign tax credit carryforward deferred tax assets is expected to be recorded in the fourth quarter of 2015. The unaudited pro forma condensed consolidated statements of operations do not reflect this charge.

(G) Reflects adjustments to stockholders’ equity as a result of the adjustments described in notes (A) - (F) above.

(H) Represents adjustments to interest expense for (1) the reduction of interest expense, including amortization of deferred financing costs, as a result of repayment of the outstanding balance under our existing Credit Facility and 7.25% Notes in conjunction with the Spin-off and (2) the incremental interest expense attributable to the New Revolving Credit Facility, with an expected borrowing capacity of $350.0 million, assumes a LIBOR rate of approximately 0.2%, an applicable margin of 2.25% and commitment fees of 0.4% on indebtedness of $173.7 million and letters of credit outstanding of $3.0 million. The interest rates for pro forma purposes are based on assumptions of the rates to be effective on the completion of the Spin-off. A one-eighth percent change in assumed interest rates for the New Revolving Credit Facility would have a pro forma impact of $0.2 million annually. Amortization of deferred financing costs assumes the capitalization of debt issuance costs of $3.8 million which will be amortized on a straight-line basis over the five year term of the New Revolving Credit Facility, which approximates the effective interest method. Debt extinguishment costs relating to the repayment of our existing Credit Facility and 7.25% Notes is expected to be approximately $11.0 million; such costs were excluded from the unaudited pro forma condensed consolidated statements of operations. The components of the adjustment to interest expense for each period presented are listed below (in thousands):

|

|

|

Six Months Ended

June 30, |

|

Years Ended December 31, |

|

|

|

|

2015 |

|

2014 |

|

2013 |

|

2012 |

|

|

Reduction (increase) in interest expense related to: |

|

|

|

|

|

|

|

|

|

|

Repayment of existing Credit Facility |

|

$ |

(4,727 |

) |

$ |

(7,642 |

) |

$ |

(6,597 |

) |

$ |

(12,415 |

) |

|

Repayment of 7.25% Notes |

|

(13,180 |

) |

(26,360 |

) |

(26,360 |

) |

(26,354 |

) |

|

Borrowing under New Revolving Credit Facility Notes |

|

2,449 |

|

4,899 |

|

4,957 |

|

5,041 |

|

|

Amortization of deferred financing costs under New Revolving Credit Facility |

|

377 |

|

754 |

|

754 |

|

754 |

|

|

Interest expense adjustment |

|

$ |

(15,081 |

) |

$ |

(28,349 |

) |

$ |

(27,246 |

) |

$ |

(32,974 |

) |

(I) Represents the tax effect of pro forma adjustments to income from continuing operations before income taxes using the U.S. federal statutory rate of 35% for all periods presented.

7

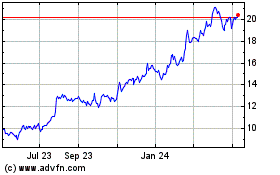

Archrock (NYSE:AROC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Archrock (NYSE:AROC)

Historical Stock Chart

From Apr 2023 to Apr 2024