UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| | |

| | |

Date of Report (Date of Earliest Event Reported): | | November 3, 2015 |

EXTERRAN HOLDINGS, INC.

__________________________________________

(Exact name of registrant as specified in its charter)

|

| | |

| | |

Delaware | 001-33666 | 74-3204509 |

_____________________ (State or other jurisdiction | _____________ (Commission | ______________ (I.R.S. Employer |

of incorporation) | File Number) | Identification No.) |

| | |

16666 Northchase Drive, | | |

Houston, Texas | | 77060 |

_________________________________ (Address of principal executive offices) | | ___________ (Zip Code) |

|

| | |

| | |

Registrant’s telephone number, including area code: | | (281) 836-7000 |

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On November 3, 2015, Exterran Holdings, Inc. issued a press release announcing our financial results for the quarter ended September 30, 2015. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and will not be incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), unless specifically identified therein as being incorporated therein by reference.

Item 7.01 Regulation FD Disclosure.

See “Item 2.02. Results of Operations and Financial Condition” above.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act and will not be incorporated by reference into any filing under the Exchange Act or the Securities Act unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press release dated November 3, 2015, announcing Exterran Holdings, Inc.’s results of operations for the quarter ended September 30, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | EXTERRAN HOLDINGS, INC. |

| | | | |

| | | | |

November 3, 2015 | | By: | | /s/ JON C. BIRO |

| | | | Jon C. Biro |

| | | | Senior Vice President and Chief Financial Officer |

| | | | |

Exhibit Index

|

| | |

| | |

Exhibit No. | | Description |

99.1 | | Press release dated November 3, 2015, announcing Exterran Holdings, Inc.’s results of operations for the quarter ended September 30, 2015. |

Exhibit 99.1

Exterran Holdings Reports Third-Quarter 2015 Results

| |

• | Spin-off of international services and global fabrication businesses expected to close today |

| |

• | EBITDA, as adjusted, of $155 million for the quarter, compared to $171 million for the third quarter 2014 |

HOUSTON, Nov. 3, 2015 - Exterran Holdings, Inc. (NYSE: EXH) today reported EBITDA, as adjusted (as defined below), of $155.1 million for the third quarter 2015, compared to $162.5 million for the second quarter 2015 and $170.6 million for the third quarter 2014.

Revenue was $649.5 million for the third quarter 2015, compared to $683.8 million for the second quarter 2015 and $723.8 million for the third quarter 2014.

Fabrication backlog was $516.2 million at September 30, 2015, compared to $600.5 million at June 30, 2015 and $839.9 million at September 30, 2014. Bookings were $177.0 million for the third quarter 2015, compared to $149.6 million for the second quarter 2015 and $334.2 million for the third quarter 2014.

On October 18, 2015, Exterran Holdings declared a regular dividend of $0.15 per share of common stock, a rate of $0.60 per share on an annualized basis, which was paid on October 30, 2015, to stockholders of record at the close of business on October 26, 2015.

“Despite challenging market conditions, we achieved solid performance across all our businesses in the third quarter 2015,” said Brad Childers, Exterran Holdings’ President and Chief Executive Officer. “Our production-related services businesses demonstrated a relatively stable top line and consistent gross margins, and our fabrication business captured a modest increase in bookings compared to the second quarter.

“Later today we expect to complete the separation transaction we announced in November 2014. This separation will allow both the U.S. services business and the international services and global fabrication businesses to capture more profit and growth, as well as generate more value for investors.”

During the third quarter of 2015, as a result of currency devaluation in Brazil and increases in the company’s Brazil subsidiary’s intercompany payables, Exterran recorded non-cash currency losses of $26.7 million. These currency losses, which are excluded from EBITDA, as adjusted, are included in other income (expense) on the condensed consolidated statement of operations and, as a result, impact net income (loss) from continuing operations attributable to Exterran stockholders, excluding items per diluted common share ($0.39 per share impact in the third quarter).

Net income (loss) from continuing operations attributable to Exterran stockholders, excluding items, for all periods excludes the benefit of proceeds from the two previously announced sales of Exterran Holdings’ previously-nationalized Venezuelan assets, the benefit of which was $24.0 million for the third quarter 2015, compared to $5.1 million for the second quarter 2015 and $23.2 million for the third quarter 2014. At September 30, 2015, Exterran was still due to receive approximately $96 million of principal payments from the sales of these assets. In October 2015, Exterran received an installment payment of $19.1 million related to the sale of its Venezuelan wholly-owned assets. Exterran has not recognized amounts payable to the company from PDVSA Gas relating to the sales of our previously nationalized assets and, therefore, this income will be recognized as income from discontinued operations in the fourth quarter 2015 when the proceeds were received.

Net loss from continuing operations attributable to Exterran stockholders, excluding items, for the third quarter 2015 was $30.5 million, or $0.45 per diluted common share. In addition to excluding the benefit related to our nationalized Venezuelan assets discussed above, these amounts also exclude a $20.7 million tax benefit recognized for the credit for increasing research activities, non-cash long-lived asset impairment charges of $23.7 million related to our contract operations businesses and restructuring and other charges of $12.0 million, which included costs associated with the planned spin-off and our cost reduction plan driven by current market conditions. Net income from continuing operations attributable to Exterran stockholders, excluding items, was $15.6 million, or $0.22 per diluted common share, for the second quarter 2015, and $17.8 million, or $0.25 per diluted common share, for the third quarter 2014.

Net loss attributable to Exterran stockholders was $6.3 million, or $0.09 per diluted common share, for the third quarter 2015. Net loss attributable to Exterran stockholders was $1.4 million, or $0.02 per diluted common share, for the second quarter 2015, and net income attributable to Exterran stockholders was $34.1 million, or $0.48 per diluted common share, for the third quarter 2014.

The cash distribution to be received by Exterran Holdings based upon its limited partner and general partner interests in Exterran Partners, L.P. is $18.9 million for the third quarter 2015, compared to $18.5 million for the second quarter 2015 and $14.8 million for the third quarter 2014.

Conference Call Details

Exterran Holdings and Exterran Partners, L.P. will host a joint conference call on Tuesday, Nov. 3, 2015, to discuss their third-quarter 2015 financial results. The call will begin at 11:00 a.m. Eastern Time.

To listen to the call via a live webcast, please visit Exterran’s website at www.exterran.com. The call also will be available by dialing 800-446-2782 in the United States and Canada or +1-847-413-3235 for international calls. Please call approximately 15 minutes prior to the scheduled start time and reference Exterran conference call number 41044930.

A replay of the conference call will be available on Exterran’s website for approximately seven days. Also, a replay may be accessed by dialing 888-843-7419 in the United States and Canada or +1-630-652-3042 for international calls. The access code is 41044930#.

*****

EBITDA, as adjusted, a non-GAAP measure, is defined as net income (loss) excluding income (loss) from discontinued operations (net of tax), cumulative effect of accounting changes (net of tax), income taxes, interest expense (including debt extinguishment costs and gain or loss on termination of interest rate swaps), depreciation and amortization expense, impairment charges, restructuring and other charges, non-cash gains or losses from foreign currency exchange rate changes recorded on intercompany obligations, expensed acquisition costs and other items. EBITDA, as adjusted, excludes the benefit of the two previously announced sales of Exterran Holdings’ Venezuelan assets.

Gross Margin, a non-GAAP measure, is defined as total revenue less cost of sales (excluding depreciation and amortization expense). Gross margin percentage is defined as gross margin divided by revenue.

About Exterran Holdings

Exterran Holdings, Inc. is a global market leader in full service natural gas compression and a premier provider of operations, maintenance, service and equipment for oil and gas production, processing and transportation applications. Exterran Holdings serves customers across the energy spectrum-from producers to transporters to processors to storage owners. Headquartered in Houston, Texas, Exterran has approximately 10,000 employees and operates in approximately 30 countries. Exterran Holdings owns an equity interest, including all of the general partner interest, in Exterran Partners, L.P. (NASDAQ: EXLP), a master limited partnership, the leading provider of natural gas contract compression services to customers throughout the United States. For more information, visit www.exterran.com.

Forward-Looking Statements

All statements in this release (and oral statements made regarding the subjects of this release) other than historical facts are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties and factors, many of which are outside Exterran Holdings’ control, which could cause actual results to differ materially from such statements. Forward-looking information includes, but is not limited to: Exterran Holdings’ financial and operational strategies and ability to successfully effect those strategies; Exterran Holdings’ plan to conduct a separation of certain of its businesses, the possibility that the proposed transaction will be consummated, the timing of its consummation and the expected benefits from the proposed transaction; Exterran Holdings’ expectations regarding future economic and market conditions; Exterran Holdings’ financial and operational outlook and ability to fulfill that outlook; demand for Exterran Holdings’ products and services and growth opportunities for those products and services; and statements regarding amounts due from the sales of Exterran Holdings’ nationalized Venezuelan assets.

While Exterran Holdings believes that the assumptions concerning future events are reasonable, it cautions that there are inherent difficulties in predicting certain important factors that could impact the future performance or results of its business. Among the factors that could cause results to differ materially from those indicated by such forward-looking statements are: local, regional, national and international economic conditions and the impact they may have on Exterran Holdings and its customers; changes in tax laws that impact master limited partnerships; conditions in the oil and gas industry, including a sustained decrease in the level of supply or demand for oil or natural gas or a sustained decrease in the price of oil or natural gas; delays, costs and difficulties that could impact the completion and expected results of the proposed separation transaction; Exterran Holdings’ ability to timely and cost-effectively execute larger projects; changes in political or economic conditions in key operating markets, including international markets; any non-performance by third parties of their contractual obligations; changes in safety, health, environmental and other regulations; and the performance of Exterran Partners.

These forward-looking statements are also affected by the risk factors, forward-looking statements and challenges and uncertainties described in Exterran Holdings’ Annual Report on Form 10-K for the year ended December 31, 2014, Exterran Corporation’s Registration Statement on Form 10 and those set forth from time to time in Exterran Holdings’ and Exterran Corporation’s filings with the Securities and Exchange Commission, which are available at www.exterran.com. Except as required by law, Exterran Holdings expressly disclaims any intention or obligation to revise or update any forward-looking statements whether as a result of new information, future events or otherwise.

SOURCE

Exterran Holdings, Inc.

|

| | | | | | | | | | | | |

EXTERRAN HOLDINGS, INC. |

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

(In thousands, except per share amounts) |

| | | | | | |

| | Three Months Ended |

| | September 30, | | June 30, | | September 30, |

| | 2015 | | 2015 | | 2014 |

| | | | | | |

Revenues: | | | | | | |

North America contract operations | | $ | 191,692 |

| | $ | 198,259 |

| | $ | 191,000 |

|

International contract operations | | 114,104 |

| | 115,250 |

| | 124,355 |

|

Aftermarket services | | 82,443 |

| | 90,834 |

| | 96,005 |

|

Fabrication | | 261,262 |

| | 279,489 |

| | 312,472 |

|

| | 649,501 |

| | 683,832 |

| | 723,832 |

|

| | | | | | |

Costs and expenses: | | | | | | |

Cost of sales (excluding depreciation and amortization expense): | | | | | | |

North America contract operations | | 77,927 |

| | 81,221 |

| | 82,453 |

|

International contract operations | | 41,114 |

| | 44,745 |

| | 47,983 |

|

Aftermarket services | | 63,773 |

| | 70,171 |

| | 75,510 |

|

Fabrication | | 226,925 |

| | 240,854 |

| | 251,401 |

|

Selling, general and administrative | | 82,124 |

| | 83,874 |

| | 94,806 |

|

Depreciation and amortization | | 94,924 |

| | 94,325 |

| | 98,256 |

|

Long-lived asset impairment | | 23,708 |

| | 15,420 |

| | 12,385 |

|

Restructuring and other charges | | 11,998 |

| | 19,604 |

| | 219 |

|

Interest expense | | 28,577 |

| | 28,398 |

| | 25,737 |

|

Equity in income of non-consolidated affiliates | | (5,084 | ) | | (5,062 | ) | | (4,951 | ) |

Other (income) expense, net | | 30,129 |

| | 1,005 |

| | 4,663 |

|

| | 676,115 |

| | 674,555 |

| | 688,462 |

|

| | | | | | |

Income (loss) before income taxes | | (26,614 | ) | | 9,277 |

| | 35,370 |

|

Provision for (benefit from) income taxes | | (3,605 | ) | | 1,742 |

| | 11,215 |

|

Income (loss) from continuing operations | | (23,009 | ) | | 7,535 |

| | 24,155 |

|

Income from discontinued operations, net of tax | | 18,776 |

| | 254 |

| | 18,003 |

|

Net income (loss) | | (4,233 | ) | | 7,789 |

| | 42,158 |

|

Less: Net income attributable to the noncontrolling interest | | (2,071 | ) | | (9,178 | ) | | (8,108 | ) |

Net income (loss) attributable to Exterran stockholders | | $ | (6,304 | ) | | $ | (1,389 | ) | | $ | 34,050 |

|

| | | | | | |

Basic income (loss) per common share(1): | | | | | | |

Income (loss) from continuing operations attributable to Exterran common stockholders | | $ | (0.37 | ) | | $ | (0.03 | ) | | $ | 0.24 |

|

Income from discontinued operations attributable to Exterran common stockholders | | 0.28 |

| | 0.01 |

| | 0.27 |

|

Net income (loss) attributable to Exterran common stockholders | | $ | (0.09 | ) | | $ | (0.02 | ) | | $ | 0.51 |

|

Diluted income (loss) per common share(1): | | | | | | |

Income (loss) from continuing operations attributable to Exterran common stockholders | | $ | (0.37 | ) | | $ | (0.03 | ) | | $ | 0.23 |

|

Income from discontinued operations attributable to Exterran common stockholders | | 0.28 |

| | 0.01 |

| | 0.25 |

|

Net income (loss) attributable to Exterran common stockholders | | $ | (0.09 | ) | | $ | (0.02 | ) | | $ | 0.48 |

|

| | | | | | |

Weighted average common shares outstanding used in income (loss) per common share: | | | | | | |

Basic | | 68,560 |

| | 68,514 |

| | 66,432 |

|

Diluted | | 68,560 |

| | 68,514 |

| | 70,406 |

|

| | | | | | |

Dividends declared and paid per common share | | $ | 0.15 |

| | $ | 0.15 |

| | $ | 0.15 |

|

| | | | | | |

(1) Basic and diluted net income (loss) attributable to Exterran common stockholders per common share was computed using the two-class method to determine the net income (loss) per share for each class of common stock and participating security (restricted stock and certain of our stock settled restricted stock units) according to dividends declared and participation rights in undistributed earnings. Accordingly, we have excluded net income attributable to participating securities from our calculation of basic and diluted net income (loss) attributable to Exterran common stockholders per common share. |

|

| | | | | | | | | | | | |

EXTERRAN HOLDINGS, INC. |

UNAUDITED SUPPLEMENTAL INFORMATION |

(In thousands, except percentages) |

| | | | | | |

| | Three Months Ended |

| | September 30, | | June 30, | | September 30, |

| | 2015 | | 2015 | | 2014 |

| | | | | | |

Revenues: | | | | | | |

North America contract operations | | $ | 191,692 |

| | $ | 198,259 |

| | $ | 191,000 |

|

International contract operations | | 114,104 |

| | 115,250 |

| | 124,355 |

|

Aftermarket services | | 82,443 |

| | 90,834 |

| | 96,005 |

|

Fabrication | | 261,262 |

| | 279,489 |

| | 312,472 |

|

| | $ | 649,501 |

| | $ | 683,832 |

| | $ | 723,832 |

|

| | | | | | |

Gross Margin (1): | | | | | | |

North America contract operations | | $ | 113,765 |

| | $ | 117,038 |

| | $ | 108,547 |

|

International contract operations | | 72,990 |

| | 70,505 |

| | 76,372 |

|

Aftermarket services | | 18,670 |

| | 20,663 |

| | 20,495 |

|

Fabrication | | 34,337 |

| | 38,635 |

| | 61,071 |

|

Total | | $ | 239,762 |

| | $ | 246,841 |

| | $ | 266,485 |

|

| | | | | | |

Selling, General and Administrative | | $ | 82,124 |

| | $ | 83,874 |

| | $ | 94,806 |

|

% of revenue | | 13 | % | | 12 | % | | 13 | % |

| | | | | | |

EBITDA, as Adjusted (1) | | $ | 155,060 |

| | $ | 162,453 |

| | $ | 170,648 |

|

% of revenue | | 24 | % | | 24 | % | | 24 | % |

| | | | | | |

Capital expenditures | | $ | 96,073 |

| | $ | 114,397 |

| | $ | 147,529 |

|

Less: Proceeds from sale of PP&E | | (2,508 | ) | | (10,438 | ) | | (6,337 | ) |

Net Capital expenditures | | $ | 93,565 |

| | $ | 103,959 |

| | $ | 141,192 |

|

| | | | | | |

Gross Margin Percentage: | | | | | | |

North America contract operations | | 59 | % | | 59 | % | | 57 | % |

International contract operations | | 64 | % | | 61 | % | | 61 | % |

Aftermarket services | | 23 | % | | 23 | % | | 21 | % |

Fabrication | | 13 | % | | 14 | % | | 20 | % |

Total | | 37 | % | | 36 | % | | 37 | % |

| | | | | | |

Total Available Horsepower (at period end): | | | | | | |

North America contract operations | | 4,267 |

| | 4,246 |

| | 4,125 |

|

International contract operations | | 1,209 |

| | 1,216 |

| | 1,268 |

|

Total | | 5,476 |

| | 5,462 |

| | 5,393 |

|

| | | | | | |

Total Operating Horsepower (at period end): | | | | | | |

North America contract operations | | 3,580 |

| | 3,618 |

| | 3,588 |

|

International contract operations | | 961 |

| | 938 |

| | 952 |

|

Total | | 4,541 |

| | 4,556 |

| | 4,540 |

|

| | | | | | |

Average Operating Horsepower: | | | | | | |

North America contract operations | | 3,600 |

| | 3,652 |

| | 3,514 |

|

International contract operations | | 952 |

| | 948 |

| | 952 |

|

Total | | 4,552 |

| | 4,600 |

| | 4,466 |

|

| | | | | | |

Horsepower Utilization (at period end): | | | | | | |

North America contract operations | | 84 | % | | 85 | % | | 87 | % |

International contract operations | | 79 | % | | 77 | % | | 75 | % |

Total | | 83 | % | | 83 | % | | 84 | % |

| | | | | | |

| | September 30, | | June 30, | | September 30, |

| | 2015 | | 2015 | | 2014 |

Fabrication Backlog: | | | | | | |

Compression & accessory | | $ | 110,586 |

| | $ | 150,981 |

| | $ | 174,540 |

|

Production & processing equipment | | 379,187 |

| | 389,037 |

| | 549,961 |

|

Installation | | 26,419 |

| | 60,479 |

| | 115,374 |

|

Total | | $ | 516,192 |

| | $ | 600,497 |

| | $ | 839,875 |

|

| | | | | | |

Balance Sheet: | | | | | | |

Debt - Parent level | | $ | 680,738 |

| | $ | 707,391 |

| | $ | 737,720 |

|

Debt - Exterran Partners, L.P. | | 1,395,166 |

| | 1,382,371 |

| | 1,220,013 |

|

Total consolidated debt | | $ | 2,075,904 |

| | $ | 2,089,762 |

| | $ | 1,957,733 |

|

Exterran stockholders' equity | | $ | 1,816,737 |

| | $ | 1,826,533 |

| | $ | 1,793,778 |

|

| | | | | | |

(1) Management believes EBITDA, as adjusted, and gross margin provide useful information to investors because these non-GAAP measures, when viewed with our GAAP results and accompanying reconciliations, provide a more complete understanding of our performance than GAAP results alone. Management uses these non-GAAP measures as supplemental measures to review current period operating performance, comparability measures and performance measures for period to period comparisons. In addition, management uses EBITDA, as adjusted, as a valuation measure. |

|

| | | | | | | | | | | | |

EXTERRAN HOLDINGS, INC. |

UNAUDITED SUPPLEMENTAL INFORMATION |

(In thousands, except per share amounts) |

| | | | | | |

| | Three Months Ended |

| | September 30, | | June 30, | | September 30, |

| | 2015 | | 2015 | | 2014 |

| | | | | | |

Reconciliation of GAAP to Non-GAAP Financial Information: | | | | | | |

Net income (loss) | | $ | (4,233 | ) | | $ | 7,789 |

| | $ | 42,158 |

|

Income from discontinued operations, net of tax | | (18,776 | ) | | (254 | ) | | (18,003 | ) |

Income (loss) from continuing operations | | (23,009 | ) | | 7,535 |

| | 24,155 |

|

Depreciation and amortization | | 94,924 |

| | 94,325 |

| | 98,256 |

|

Long-lived asset impairment | | 23,708 |

| | 15,420 |

| | 12,385 |

|

Restructuring and other charges | | 11,998 |

| | 19,604 |

| | 219 |

|

Investment in non-consolidated affiliates impairment | | 33 |

| | — |

| | — |

|

Proceeds from sale of joint venture assets | | (5,117 | ) | | (5,062 | ) | | (4,951 | ) |

Interest expense | | 28,577 |

| | 28,398 |

| | 25,737 |

|

Loss on currency exchange rate remeasurement of intercompany balances | | 27,551 |

| | 491 |

| | 2,766 |

|

Expensed acquisitions costs | | — |

| | — |

| | 866 |

|

Provision for (benefit from) income taxes | | (3,605 | ) | | 1,742 |

| | 11,215 |

|

EBITDA, as adjusted (1) | | 155,060 |

| | 162,453 |

| | 170,648 |

|

Selling, general and administrative | | 82,124 |

| | 83,874 |

| | 94,806 |

|

Equity in income of non-consolidated affiliates | | (5,084 | ) | | (5,062 | ) | | (4,951 | ) |

Investment in non-consolidated affiliates impairment | | (33 | ) | | — |

| | — |

|

Proceeds from sale of joint venture assets | | 5,117 |

| | 5,062 |

| | 4,951 |

|

Loss on currency exchange rate remeasurement of intercompany balances | | (27,551 | ) | | (491 | ) | | (2,766 | ) |

Expensed acquisitions costs | | — |

| | — |

| | (866 | ) |

Other (income) expense, net | | 30,129 |

| | 1,005 |

| | 4,663 |

|

Gross Margin (1) | | $ | 239,762 |

| | $ | 246,841 |

| | $ | 266,485 |

|

| | | | | | |

Net income (loss) attributable to Exterran stockholders | | $ | (6,304 | ) | | $ | (1,389 | ) | | $ | 34,050 |

|

Income from discontinued operations, net of tax | | (18,776 | ) | | (254 | ) | | (18,003 | ) |

Research and Development Tax Credit | | (20,677 | ) | | — |

| | — |

|

Items, after-tax: | | | | | | |

Long-lived asset impairment (including the impact on noncontrolling interest) | | 12,281 |

| | 9,025 |

| | 6,379 |

|

Restructuring and other charges (including the impact on noncontrolling interest) | | 8,039 |

| | 13,278 |

| | 88 |

|

Investment in non-consolidated affiliates impairment | | 33 |

| | — |

| | — |

|

Proceeds from sale of joint venture assets | | (5,117 | ) | | (5,062 | ) | | (4,951 | ) |

Expensed acquisition costs (including the impact on noncontrolling interest) | | — |

| | — |

| | 199 |

|

Net income (loss) from continuing operations attributable to Exterran stockholders, excluding items | | $ | (30,521 | ) | | $ | 15,598 |

| | $ | 17,762 |

|

| | | | | | |

Diluted income (loss) from continuing operations attributable to Exterran common stockholders | | $ | (0.37 | ) | | $ | (0.03 | ) | | $ | 0.23 |

|

Adjustment for items, after-tax, per common share (2) | | (0.08 | ) | | 0.25 |

| | 0.02 |

|

Diluted net income (loss) from continuing operations attributable to Exterran common stockholders per common share, excluding items (1)(2) | | $ | (0.45 | ) | | $ | 0.22 |

| | $ | 0.25 |

|

| | | | | | |

(1) Management believes EBITDA, as adjusted, diluted net income (loss) from continuing operations attributable to Exterran common stockholders per common share, excluding items, and gross margin provide useful information to investors because these non-GAAP measures, when viewed with our GAAP results and accompanying reconciliations, provide a more complete understanding of our performance than GAAP results alone. Management uses these non-GAAP measures as supplemental measures to review current period operating performance, comparability measures and performance measures for period to period comparisons. In addition, management uses EBITDA, as adjusted, as a valuation measure. |

|

(2) Diluted net income (loss) from continuing operations attributable to Exterran common stockholders per common share, excluding items, was computed using the two-class method to determine the net income (loss) per share for each class of common stock and participating security (restricted stock and certain of our stock settled restricted stock units) according to dividends declared and participation rights in undistributed earnings. Accordingly, we have excluded net income from continuing operations attributable to participating securities, excluding items, of $0.1 million, $0.4 million and $0.2 million for the three months ended September 30, 2015, June 30, 2015 and September 30, 2014, respectively, from our calculation of diluted net income (loss) from continuing operations attributable to Exterran common stockholders per common share, excluding items. |

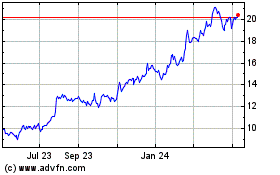

Archrock (NYSE:AROC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Archrock (NYSE:AROC)

Historical Stock Chart

From Apr 2023 to Apr 2024