Combination Creates the Pre-Eminent West Coast

Multifamily REIT

Essex Property Trust, Inc. (NYSE: ESS) and BRE Properties, Inc.

(NYSE: BRE) announced today the completion of the merger of the two

companies, forming a combined company with equity market

capitalization of approximately $11.1 billion and a total market

capitalization of approximately $16.2 billion. The common stock of

the combined company will trade under the symbol ESS on the New

York Stock Exchange.

“We are excited to consummate the merger and move forward to

combine these two great organizations to form the leading West

Coast multifamily REIT,” said Michael Schall, President and Chief

Executive Officer of Essex. “The integration effort is proceeding

as planned, which we believe will result in a stronger platform for

sustainable growth, superior service for our residents, and

expanded career opportunities for our employees. I want to thank

the employees of both companies for their hard work, dedication and

support.”

“We are pleased that our stockholders have expressed

overwhelming support and approval for this merger,” said Constance

B. Moore, Chief Executive Officer of BRE. “The combined portfolio

of Essex and BRE will provide substantial value for our

stockholders through enhanced operations, improvements in the costs

of capital and synergistic opportunities. On behalf of BRE’s Board

and management, I want to thank our stockholders for their

invaluable support throughout this process.”

Transaction Details

Under the terms of the agreement, each share of BRE common stock

has been converted into 0.2971 newly issued shares of Essex common

stock plus $7.18 in cash, without interest. The cash consideration

was adjusted as a result of the authorization and declaration of a

special distribution to the stockholders of BRE of $5.15 per share

of BRE common stock. Former Essex stockholders hold approximately

63% of the combined company’s common stock, and former BRE

stockholders hold approximately 37% of the combined company’s

common stock.

On March 31, 2014, BRE formed three new joint ventures with two

separate third-party institutional joint venture partners and

contributed 17 BRE properties with an aggregate estimated value of

approximately $888 million to the joint ventures. As a result of

the contribution of the properties to the joint ventures and the

merger, Essex Portfolio, L.P. and its subsidiaries now hold a 50%

interest in each of the joint ventures. Additionally, BRE received

proceeds from approximately $475 million in mortgage financings of

the properties contributed to the joint ventures. As a result of

the closing of these joint ventures, BRE authorized the payment of

the special distribution described above. The special distribution

will be paid on or about April 9, 2014 to BRE stockholders of

record as of the close of business on March 31, 2014.

Leadership and Organization

Irving F. Lyons, III, former Chairman of the Board of BRE, and

Thomas E. Robinson and Thomas P Sullivan, former directors of BRE,

have joined Essex’s Board of Directors in connection with the

merger. George Marcus will serve as Chairman of the Board of the

combined company. Michael Schall, Essex’s President and Chief

Executive Officer, will serve as President and Chief Executive

Officer of the combined company.

Anticipated Synergies and Accretion

Annual synergies are expected to be in an amount sufficient to

offset the expected increase in property taxes due to Proposition

13. The combined company is expected to benefit from the

elimination of duplicative costs associated with supporting a

public company platform and leveraging of Essex’s platform and

systems. The savings are expected to be realized upon the full

integration, which is expected within an 18-month period following

the closing of the merger.

Essex anticipates the transaction to be accretive on a run rate

basis to Core Funds from Operation (FFO) on a per diluted share

basis of approximately $0.05-$0.08 annually.

Advisors

UBS Investment Bank acted as lead financial advisor to Essex.

Citigroup acted as financial advisor to Essex. Goodwin Procter LLP

acted as legal advisor to Essex.

Wells Fargo Securities acted as exclusive financial advisor and

Latham & Watkins LLP acted as legal advisor to BRE.

About Essex Property Trust

Essex Property Trust, Inc., an S&P 500 company, is a fully

integrated real estate investment trust (REIT) that acquires,

develops, redevelops, and manages apartment communities located in

highly desirable, supply-constrained markets. As of April 1, 2014,

after giving effect to the merger, Essex has ownership interests in

233 multifamily properties with an additional 15 properties in

various stages of development. Additional information about Essex

can be found on the Company's web site at

www.essexpropertytrust.com.

“Safe Harbor” Statement under the Private Securities

Litigation Reform Act of 1995:

This press release may include “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements which are based on

current expectations, estimates and projections about the industry

and markets in which Essex operate and beliefs of and assumptions

made by Essex management, involve uncertainties that could

significantly affect the financial results of Essex. Words such as

“expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,”

“estimates,” variations of such words and similar expressions are

intended to identify such forward-looking statements, which

generally are not historical in nature. Such forward-looking

statements include, but are not limited to, statements about the

anticipated benefits of the business combination transaction

involving Essex, including future financial and operating results

(such as FFO), and the combined company’s plans, objectives,

expectations and intentions. All statements that address operating

performance, events or developments that we expect or anticipate

will occur in the future — including statements relating to

expected synergies, improved liquidity and balance sheet strength —

are forward-looking statements. These statements are not guarantees

of future performance and involve certain risks, uncertainties and

assumptions that are difficult to predict. Although we believe the

expectations reflected in any forward-looking statements are based

on reasonable assumptions, we can give no assurance that our

expectations will be attained and therefore, actual outcomes and

results may differ materially from what is expressed or forecasted

in such forward-looking statements. Some of the factors that may

affect outcomes and results include, but are not limited to: (i)

national, regional and local economic climates, (ii) changes in

financial markets and interest rates, or to the business or

financial condition of either company or business (iii) changes in

market demand for rental apartment homes and competitive pricing,

(iv) risks associated with acquisitions, including the integration

of the combined companies’ businesses, (v) maintenance of real

estate investment trust (“REIT”) status, (vi) availability of

financing and capital, (vii) risks associated with achieving

expected revenue synergies or cost savings, (viii) risks associated

with the companies’ ability to consummate the merger on the terms

described or at all and the timing of the closing of the merger,

and (ix) those additional risks and factors discussed in reports

filed with the Securities and Exchange Commission (“SEC”) by Essex

from time to time, including those discussed under the heading

“Risk Factors” in its most recently filed reports on Forms 10-K and

10-Q. Essex does not undertake any duty to update any

forward-looking statements appearing in this press release.

BRE Properties, Inc.Stephanie Andre, 415-445-6530orEssex

Property Trust, Inc.Barb Pak, 650-494-3700Director of Investor

Relations

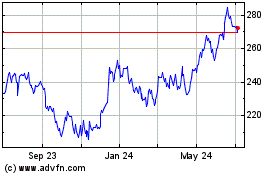

Essex Property (NYSE:ESS)

Historical Stock Chart

From Mar 2024 to Apr 2024

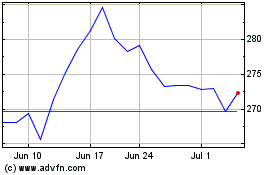

Essex Property (NYSE:ESS)

Historical Stock Chart

From Apr 2023 to Apr 2024