Essex Property Trust Stockholders Approve Issuance of Shares in Connection With BRE Merger

March 28 2014 - 4:01PM

Marketwired

Essex Property Trust Stockholders Approve Issuance of Shares in

Connection With BRE Merger

PALO ALTO, CA--(Marketwired - Mar 28, 2014) - Essex

Property Trust, Inc. (NYSE: ESS), a Maryland corporation ("Essex"),

announced that at its special meeting of stockholders held today,

stockholders approved the issuance of shares of Essex common stock

to the stockholders of BRE Properties, Inc. ("BRE") in connection

with the merger of BRE with and into BEX Portfolio, Inc. ("Merger

Sub"), a direct wholly owned subsidiary of Essex formerly known as

Bronco Acquisition Sub, Inc., pursuant to the Agreement and Plan of

Merger, dated as of December 19, 2013, by and among Essex, Merger

Sub and BRE (the "Merger Agreement"). Approximately 87.1% of the

outstanding shares of Essex common stock voted with respect to the

proposed issuance and of those outstanding shares that voted,

approximately 99.8% voted in favor of the issuance.

Subject to the satisfaction or waiver of the remaining

conditions to the closing of the merger set forth in the Merger

Agreement, the merger is expected to close on Tuesday, April 1,

2014. At the effective time of the merger, each former share

of BRE common stock will be converted into (i) 0.2971 shares of

Essex common stock and (ii) $12.33 in cash, without interest,

subject to adjustment, in the event of the payment of a special

distribution to BRE stockholders of record as of the close of

business on the last business day preceding the effective time of

the merger. As previously announced, BRE's board of directors

declared a special distribution of $5.15 per share of BRE common

stock payable to BRE stockholders of record as of the close of

business on the last business day preceding the effective time of

the merger (the "Special Dividend"). The Special Dividend is

conditioned upon the closing of the sale of certain interests in

assets of BRE to certain parties designated by Essex, which are

expected to occur on the business day prior to the closing of the

merger. The amounts distributed as a Special Dividend will

reduce the cash consideration payable by Essex in the merger.

Assuming completion of the merger, shares of BRE common stock

are expected to be delisted after the close of trading on April 1,

2014. Shares of Essex common stock will continue to trade

under the existing ticker symbol "ESS" on the New York Stock

Exchange.

About Essex Property

Trust, Inc. Essex Property Trust, Inc., an S&P 400

company, is a fully integrated real estate investment trust (REIT)

that acquires, develops, redevelops, and manages multifamily

residential properties in selected West Coast markets. Essex

currently has ownership interests in 163 apartment communities with

an additional 11 properties in various stages of active

development. Additional information about Essex can be found on the

Company's web site at www.essexpropertytrust.com.

Forward-Looking

Statements This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements which are

based on current expectations, estimates and projections about the

industry and markets in which Essex and BRE operate and beliefs of

and assumptions made by Essex management and BRE management,

involve uncertainties that could significantly affect the financial

results of Essex or BRE or the combined company. Words such as

"expects," "anticipates," "intends," "plans," "believes," "seeks,"

"estimates," variations of such words and similar expressions are

intended to identify such forward-looking statements, which

generally are not historical in nature. Such forward-looking

statements include, but are not limited to, statements about the

anticipated benefits of the business combination transaction

involving Essex and BRE, including future financial and operating

results, and the combined company's plans, objectives, expectations

and intentions. All statements that address operating performance,

events or developments that we expect or anticipate will occur in

the future -- including statements relating to expected synergies,

improved liquidity and balance sheet strength -- are

forward-looking statements. These statements are not guarantees of

future performance and involve certain risks, uncertainties and

assumptions that are difficult to predict. Although we believe the

expectations reflected in any forward-looking statements are based

on reasonable assumptions, we can give no assurance that our

expectations will be attained and therefore, actual outcomes and

results may differ materially from what is expressed or forecasted

in such forward-looking statements. Some of the factors that may

affect outcomes and results include, but are not limited to: (i)

national, regional and local economic climates, (ii) changes in

financial markets and interest rates, or to the business or

financial condition of Essex or its business, (iii) changes in

market demand for rental apartment homes and competitive pricing,

(iv) risks associated with acquisitions, including the proposed

merger with BRE, (v) maintenance of real estate investment trust

("REIT") status, (vi) availability of financing and capital, (vii)

risks associated with achieving expected revenue synergies or cost

savings, (viii) risks associated with the companies' ability to

consummate the merger on the terms described or at all and the

timing of the closing of the merger, and (ix) those additional

risks and factors discussed in reports filed with the SEC by Essex

and BRE from time to time, including those discussed under the

heading "Risk Factors" in their respective most recently filed

reports on Forms 10-K and 10-Q. Essex does not undertake any duty

to update any forward-looking statements appearing in this press

release.

Contact

Information Barb Pak Director of Investor Relations (650)

494-3700 bpak@essexpropertytrust.com

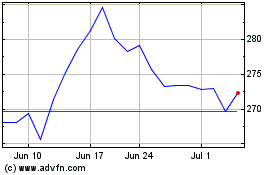

Essex Property (NYSE:ESS)

Historical Stock Chart

From Mar 2024 to Apr 2024

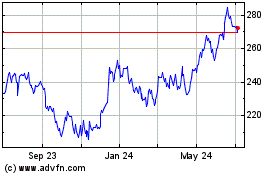

Essex Property (NYSE:ESS)

Historical Stock Chart

From Apr 2023 to Apr 2024