SECURITIES & EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

NAME OF REGISTRANT: Allegiant Travel Co.

NAME OF PERSON RELYING ON EXEMPTION: Change to Win Investment Group

ADDRESS OF PERSON RELYING ON EXEMPTION: 1900 K Street, N.W., Suite 900, Washington, DC 20036

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934:

July 8, 2015

Dear ITT Shareholder,

We urge you to join us in voting against the re-election of directors Joanna T. Lau and Samuel L. Odle at ITT Educational Services’ (NYSE: ESI) annual meeting on July 27, 2015. Ms. Lau and Mr. Odle are the only directors standing for re-election at this year’s annual meeting who have served prior to April, 2015.1 These directors and the entire board have failed to properly oversee or demand accountability from ITT’s executives, and as a consequence have put shareholders at risk.

As we describe below, the board’s failure to properly oversee the accounting decisions, internal controls, and regulatory compliance more broadly have resulted in multiple enforcement actions by both state and federal prosecutors and regulators, culminating in an accounting fraud suit filed by the Securities and Exchange Commission (“SEC”).2 In response to the steady stream of bad news over the past year, ITT’s share price has fallen 75%, including nearly 40% over the past quarter.3 Nevertheless, the board has failed to hold either executives or its own members accountable, and has instead:

- Retained its classified board structure, denying shareholders a vote on all board members, while also promoting former Audit Committee Chairman John E. Dean to Executive Chairman.

- Increased pay significantly for both CEO Kevin M. Modany and CFO Daniel M. Fitzpatrick, despite the company’s dramatic share price decline.

- Retained Modany and Fitzpatrick until August 2015, and for 18 months thereafter as consultants, despite clear evidence that each officer misled the company’s shareholders, creditors, and independent auditor, as well as, potentially, the board itself.

These failures speak specifically to the roles that Ms. Lau and Mr. Odle play on the board, with Ms. Lau having served on the Audit Committee since 2003, and Mr. Odle serving on the Compensation and Nominating and Governance Committees since 2006, and chairing the latter since 2012.4 At this point shareholders have no option but to clearly signal to the board that such failures are unacceptable, by voting against the re-election of directors Lau and Odle.

The CtW Investment Group works with union-sponsored pension funds sponsored by affiliates of Change to Win to enhance long-term shareholder value through active ownership. These funds have over $250 billion in assets under management and are substantial ITT shareholders.

Audit Committee Oversight Fails to Ensure Proper Accounting Decisions, Effective Internal Controls, or Regulatory Compliance

ITT’s deteriorating performance stems ultimately from a host of regulatory enforcement actions taken in response to credible allegations of compliance failures by the company. These actions include a lawsuit filed by the Consumer Financial Protection Bureau, numerous suits and investigations by state attorneys general, the decisions by the US Department of Education to place the company on heightened cash monitoring, and finally the filing of an accounting fraud suit by the SEC in May.5 Moreover, the company was forced to delay the filing of its financial reports with the SEC as a result of multiple failures attributable to its internal audit function, including a disagreement with its former external auditor concerning the propriety of consolidating variable interest entities [“VIEs”] created in order to facilitate

private lending to ITT students, and inadequate internal controls related to the accounting and reporting for these VIEs.6

As described in ITT’s 2014 proxy statement, its former auditor, PWC, disagreed with management, the board, and the Audit Committee concerning both the consolidation of the VIEs and the internal controls environment, and it seems probable to us that these disagreements ultimately triggered PWC’s decision not to stand for reappointment as external auditor.7 Furthermore, the company’s acknowledgement that both its accounting decisions and internal controls were flawed in our view lends credence to the allegations of accounting fraud made in the SEC’s complaint against the company, Mr. Modany, and Mr. Fitzpatrick.

In particular, the SEC complaint alleges that with respect to both VIEs the company failed to disclose material information to shareholders and other investors in a timely manner, and instead repeatedly made highly misleading disclosures that disguised the severity of the deterioration in the loan pools guaranteed by these VIEs. These allegedly misleading disclosures include:

- The failure of CFO Fitzpatrick to ensure that quarterly reports filed in 2012 accurately reflected the declining performance of one of the private loan programs guaranteed by a VIE (the PEAKS program), and instead allowing ITT’s filings to reflect the projections of an internal model that substantially understated defaults.8

- The failure of CEO Modany and CFO Fitzpatrick to disclose to shareholders (or other investors) that beginning at the end of the third quarter of 2012 and continuing through mid-2013, ITT began making payments on behalf of delinquent borrowers (under the PEAKS program) which enabled the company to temporarily evade much higher guarantee payments, further distorting investors’ view of the solvency of the VIEs and hence of the potential scope of ITT’s future obligations.9

- The failure of CEO Modany and CFO Fitzpatrick to clearly disclose that payments it was making with respect to another VIE (referred to variously as CUSO and 2009 RSA) did not in fact discharge the company’s obligation to the VIE, but only amounted to a minimum payment, with larger payments deferred until later periods.10

ITT’s response to the SEC complaint includess the boilerplate response that the company will “defend itself against the unjustified charges” and asserts that the SEC offers no documentation of an intent to deceive.11 However, we note that the SEC’s allegations are consistent with a poorly designed and maintained control environment concerning the VIEs, which the company has already acknowledged. For instance, ITT acknowledges that it failed to ensure “the completeness and accuracy of the data maintained by the servicer of the private education loans that are owned by [the VIEs],” that it failed to ensure “the timely identification and communication of information relevant to the private education loan programs to adequately “review ... assumptions and methodologies ...to project guarantee obligatoins" connected to one of its private loan programs.12

In response to the filing of the SEC suit, the company refers to an “Audit Committee Investigation that disputed key SEC allegations.”13 While the company has previously noted that the Audit Committee has been reviewing accounting decisions related to the VIEs, which resulted in the reversal of the company’s decision not to consolidate these entities as well as the recognition of internal controls deficiencies, we

This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card as it will not be accepted

have not been able to find any discussion of an investigation by the Audit Committee that disputes any of the SEC’s allegations.14 This is unfortunate, because in our view such an investigation by a genuinely independent committee is long overdue. Indeed, we find it difficult to understand how certain actions, such as the decision to make payments on behalf of borrowers, which had the effect of disguising the true level of delinquency in the PEAKS loan pool, rather than the contractually required (and much larger) payments to increase the parity ratio, could have passed muster with an independent, competent, and informed Audit Committee. We are instead forced to conclude that this Audit Committee (which Ms. Lau has served on it since 2003) lacks the independence required to take much more decisive action in order to protect shareholders.

Excessive Executive Pay in Spite of Huge Shareholder Losses

Lack of objectivity seems to have also affected the decisions made by the Compensation Committee over the past year. Both CEO Modany and CFO Fitzpatrick received significant increases in compensation in 2014 compared to 2013, despite the profound deterioration in the company’s operating performance and share price, over and on top of the flurry of investigations and enforcement actions referred to above. Overall, pay for these two executives increased by approximately 10%, with most of that increase stemming from increased issuance of options and restricted stock.15 For instance, the grant-date value of stock awarded to Mr. Modany increased by 45%, and the value of options granted to him increased by 38%. Mr. Fitzpatrick’s equity grants increased by comparable amounts.16 Mr. Modany and Mr. Fitzpatrick have both informed the board of their intention to resign their positions, but have agreed to stay on until August 31, 2015 and October 29, 2015, respectively, after which each will be retained as a consultant for 18 months during which time their equity grants will continue to vest.17 Mr. Fitzpatrick was also granted the same number of options and restricted stock units he had been awarded in 2014.18

ITT has no clawback policy in place19, which creates an unsatisfying and asymmetric situation: even though they are resigning under a cloud, both Mr. Modany and Mr. Fitzpatrick stand to realize gains on their accumulated equity grants, but should they be found to have violated state or federal law or regulation, the company lacks a mechanism whereby shareholders will not be able to recover any payments they received as a result of inaccurate or misleading disclosures. We believe that the Compensation Committee, including Mr. Odle, bears responsibility for these decisions, and this conclusion informs our decision to oppose his re-election.

Poor Governance Practice Undermine Accountability

Given the numerous internal audit related failures that have emerged over the past year, as well as the even more numerous enforcement actions taken against the company by state and federal regulators, we believe that the Nominating and Governance Committee should have been moved to recommend significant changes in the board’s composition and structure. In particular, we believe that the

Nominating and Governance Committee should have recommended declassifying board elections, which would give shareholders a vote on all directors every year and thus enable shareholders to hold accountable those directors primarily responsible for the board’s oversight failures. Additionally, we believe that the Nominating and Governance Committee should have pressed the board to adopt a clawback policy with respect to compensation, given the clear potential that the company and its current CEO and CFO may be found to have mislead investors. Finally, we are puzzled by the board’s decision to promote director John E. Dean to the position of Executive Chairman, following Mr.

Modany’s resignation from that position in August 2014.20 Mr. Dean had been chair of the Audit

This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card as it will not be accepted

Committee for many years prior, and so in our view bears responsibility for that Committee’s failure to properly oversee the audit and internal controls functions. While the board has committed to replacing Mr. Dean with an independent director in the future, we are not optimistic that this will result in identifying a Chairman willing and able to hold executives accountable and ensure effective oversight of key company functions. As Mr. Odle has been Chairman of the Nominating and Governance Committee since 2012, we consider him particularly culpable for these decisions.

In order to protect shareholder investments in ITT going forward, we urge our fellow shareholders to join us in opposing the re-election of directors Joanna T. Lau and Samuel L. Odle at this year’s annual meeting on July 27, 2015.

Dieter Waizenegger

Executive Director, CtW Investment Group

1 ITT Proxy statement filed on form DEF14A with the SEC on June 12, 2015. C. David Brown, who joined the board in April 2015 is also standing for election.

2 United State Securities and Exchange Commission v. ITT Educational Services Inc., Kevin M. Modany, and Daniel M. Fitzpatrick, United States District Court Southern District of Indiana, Case No. 15-CV-00758. The case is pending.

3 Data from Google Finance, July 7 2014-July 6 2015.

4 ITT Proxy statement filed on form DEF14A with the SEC on March 13, 2013, pg. 10. 5 ITT 10-K filed with the SEC on May 29, 2015, pg. F-52 – F-59.

6 For instance, ITT filed amended 10-Qs for the first three quarters of 2013, and a 10-K for 2013, on October 16, 2014. It filed quarterly reports for the first two quarters of 2014 in on November 19 and 26, respectively. See also, ITT Proxy Statement filed on form DEF14A on November 24, 2014, subtitle “Change In Independent Registered Public Accounting Firm.”

7 See ITT 2014 Proxy Statement op. cit. 8 SEC v. ITT et. al., pg. 12-14 9 SEC v. ITT et. al., pg. 15-23 10 SEC v. ITT et. al., pg. 28-32 11 ITT 8-K filed with the SEC on May 14, 2015.

12 ITT 2014 Proxy Statement on form DEF14A, op. cit., p. 13. 13 8-K filed May 14, 2015.

14 This effort involved full text searches of all ITT SEC filings for “audit committee investigation” in various combinations, as well as searches of the news and governance sections of ITT’s web site.

15 ITT 2015 Proxy Statement on form DEF14A filed with the SEC on June 12, 2015 pg. 37.

| 16 |

Ibid. |

| 17 |

Ibid, pg. 30-31, 9.. |

| 18 |

Ibid, pg. 29. |

| 19 |

Ibid, pg. 35. |

| 20 |

ITT 2014 Proxy Statement on form DEF14A filed with the SEC on November 24, 2014 |

This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card as it will not be accepted

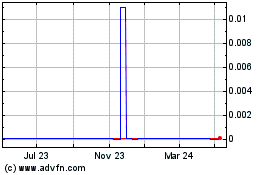

ITT Educational Services (CE) (USOTC:ESINQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

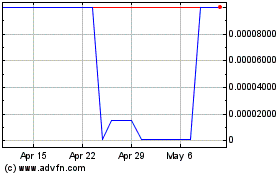

ITT Educational Services (CE) (USOTC:ESINQ)

Historical Stock Chart

From Apr 2023 to Apr 2024