Report of Foreign Issuer (6-k)

January 18 2017 - 3:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of January 2017

Commission File Number: 001-15102

Embraer S.A.

Av. Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7): ☐

EMBRAER S.A.

EMBRAER EVALUATING AN OFFER OF NOTES

São José dos Campos, January 18, 2017 –

Embraer S.A. (NYSE: ERJ; BM&FBOVESPA: EMBR3) hereby announces that it has filed a

preliminary prospectus supplement with the U.S. Securities and Exchange Commission (the “SEC”) in connection with a proposed registered offering, through its wholly-owned subsidiary Embraer Netherlands Finance B.V., of senior unsecured

benchmark size U.S. Dollar-denominated 10-year notes. The notes will be fully and unconditionally guaranteed by Embraer. An offering of notes is subject to final internal approvals and market conditions.

The joint bookrunners are BB Securities, JP Morgan and Santander, who will arrange a series of fixed income investor meetings in the US and Europe commencing

on January 23rd, 2017.

Any offering will be made pursuant to an effective shelf registration statement (including a prospectus) filed with the SEC

for the offering to which this communication relates. Before you invest, you should read the preliminary prospectus supplement, the prospectus in that registration statement and other documents the Embraer has filed with the SEC for more complete

information about Embraer and the offering. You may get these documents for free by visiting EDGAR on the SEC Web site at

www.sec.gov

. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send

you the prospectus or any prospectus supplement for this offering if you request it by calling J.P. Morgan Securities LLC at +1 (866) 846-2874, Santander Investment Securities Inc. at +1 (855) 403-3636 (each toll-free in the United States)

or, if calling from outside the U.S., by collect calling BB Securities Ltd at +44 (20) 7367-5800 att. Operations Department.

For further

information, please contact:

+55-11-3040-6874 or

investor.relations@embraer.com.br

José Antonio de Almeida Filippo

Executive Vice-President and Chief Financial and Investor Relations Officer

This press release is not an offer to sell, nor a solicitation of an offer to buy the notes, nor shall there be any sale of the notes in any state or

jurisdiction in which the offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: January 18, 2017

|

|

|

|

|

|

|

Embraer S.A.

|

|

|

|

|

By:

|

|

/s/ José Antonio de Almeida Filippo

|

|

|

|

Name:

|

|

José Antonio de Almeida Filippo

|

|

|

|

Title:

|

|

Executive Vice-President and

Chief Financial and Investor

Relations

Officer

|

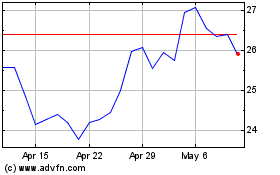

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

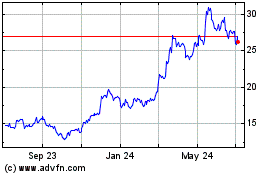

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024