Amended Report of Foreign Issuer (6-k/a)

October 24 2016 - 3:11PM

Edgar (US Regulatory)

____________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K/A

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of October 2016

Commission File Number: 001-15102

__________________________________

Embraer S.A.

__________________________________

Av. Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

¨

EMBRAER S.A

MATERIAL FACT

São José dos Campos, October 24, 2016 –

Embraer S.A. (NYSE: ERJ; BM&F BOVESPA: EMBR3) announces to its shareholders and the market that it has finalized definitive agreements (Final Agreements) with the U.S. Department of Justice (DOJ) and the U.S. Securities and Exchange Commission (SEC) for the settlement

of the allegations of criminal and civil violations of the U.S. Foreign Corrupt Practices Act (FCPA). The Company also finalized

a term of undertaking (

termo de compromisso e de ajustamento de conduta

, TCAC) with the Brazilian Federal Public Prosecutor’s Office (

Ministério Público Federal

, MPF) and the Brazilian Securities and Exchange Commission (CVM) for the resolution of allegations of violations of certain

Brazilian laws.

Under the Final Agreements with the DOJ and the SEC:

|

·

|

We agreed to pay US$98.2 million to the SEC (of which up to US$20.0 million may be deducted if such amount is actually paid to the MPF and the CVM under the TCAC, as described below), as disgorgement of profits, and US$107.3 million to the DOJ, as penalty for one count of conspiracy to violate the anti-bribery and books and records provisions of the FCPA and one count of violating the internal controls provisions of the FCPA.

|

|

·

|

The DOJ agreed to defer prosecution for three years for the acts acknowledged by us in a deferred prosecution agreement (DPA), after which period the charges will be dismissed if the Company does not violate the terms of the DPA.

|

|

·

|

We agreed to an external and independent monitorship for a period of up to three years to assess compliance with the Final Agreements, especially regarding effectiveness of controls and procedures to reduce the risk of any FCPA violations.

|

Simultaneously with the Final Agreements, we finalized a TCAC with the MPF and the CVM to settle any potential claims that could be brought in court (

ação civil pública

) or through administrative proceedings (

processo administrativo sancionador

) in Brazil. The TCAC has also been approved by the relevant authorities and is fully effective.

Under the TCAC, we acknowledged violations of certain Brazilian laws between 2007 and 2011 and agreed to:

|

·

|

Pay a total of R$ 64 million to a Brazilian federal fund (Fundo de Defesa dos Direitos Difusos), as disgorgement of illegal profits, damages, and as a deterrent against similar practices. The amount payable under the TCAC is to be deducted from the amount payable under the Final Agreements.

|

|

·

|

Cooperate with the MPF and the CVM in lawsuits and administrative proceedings against individuals arising out of the acts acknowledged in the TCAC.

|

Under the TCAC, the MPF and the CVM acknowledged that (i) we voluntarily conducted a broad internal investigation, which assisted in uncovering facts that were the subject of criminal and administrative investigations, and (ii) we approached the Brazilian authorities pro-actively and in good faith, and they agreed that:

1

|

·

|

The MPF will not file suit (

ação civil pública

and

ação de improbidade administrativa

) against us arising out of the acts we have acknowledged and will terminate proceedings now underway.

|

|

·

|

The CVM will end an ongoing administrative proceeding arising out of the acts we have acknowledged.

|

|

·

|

The MPF and the CVM will inform other Brazilian federal agencies of the terms of the TCAC and cooperate with us in seeking that these agencies take the TCAC into consideration should other proceedings regarding the acknowledged acts be brought.

|

The Final Agreements and the TCAC represent the conclusion of the internal investigation of allegations of noncompliance with the FCPA and certain Brazilian laws in some aircraft sales outside Brazil.

José Antonio de Almeida Filippo

Executive Vice-President and Chief Financial Investor Relations Officer

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 24, 2016

|

|

|

|

|

|

|

Embraer S.A.

|

|

|

|

|

By:

|

|

/s/ José Antonio de Almeida Filippo

|

|

|

|

Name:

|

|

José Antonio de Almeida Filippo

|

|

|

|

Title:

|

|

Executive Vice-President and Chief Financial and Investor Relations Officer

|

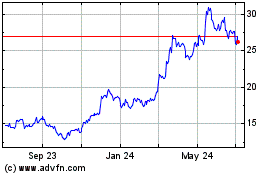

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

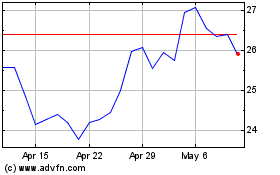

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024