Report of Foreign Issuer (6-k)

July 29 2016 - 8:52AM

Edgar (US Regulatory)

____________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of July 2016

Commission File Number: 001-15102

__________________________________

Embraer S.A.

__________________________________

Av. Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

¨

EMBRAER S.A.

MATERIAL FACT

São José dos Campos, July 29, 2016 –

Embraer S.A. (NYSE: ERJ; BM&F BOVESPA: EMBR3) announces that it has revised its Executive Jet deliveries, Total Revenue, Revenue for Executive Jets and Other Segments, Adjusted EBIT and Adjusted EBIT Margin, Adjusted EBITDA and Adjusted EBITDA Margin, and Free Cash Flow guidance for 2016.

Adjusted values exclude the impact of a US$ 200 million loss contingency booked in 2Q16 related to the allegations of non-compliance with the U.S. Foreign Corrupt Practices Act.

Business conditions in the executive jets industry have proven to be more difficult than expected thus far in 2016, with continued pressure on new jet sales from high levels of used jet inventories and a highly competitive environment. In response, the Company has adopted a more cautious approach to 2016 executive jet delivery targets, now expecting 70 – 80 light jets and 35 – 45 large jets (from 75 – 85 and 40 – 50 previously).

As a result of lower executive jet deliveries, the Company now expects revenues in the Executive Jets segment to end 2016 within US$ 1.60 – US$ 1.75 billion (from US$ 1.75 – US$ 1.90 billion previously). With this impact combined with a US$ 50 million revenue reduction in the Other businesses segment as a result of a challenging business environment in Brazil, consolidated revenues for the year are now expected to stay within the range of US$ 5.8 – US$ 6.2 billion, a reduction from the previous range of US$ 6.0 – US$ 6.4 billion. With respect to Commercial Aviation as well as Defense & Security segments, Embraer’s revenues and delivery outlook remain unchanged.

|

|

|

|

|

|

|

|

|

2016 - DELIVERIES OUTLOOK

|

|

|

PREVIOUS

|

CURRENT

|

|

Commercial Aviation

|

105

|

-

|

110

|

105

|

-

|

110

|

|

Executive Jets - Light jets

|

75

|

-

|

85

|

70

|

-

|

80

|

|

Executive Jets - Large jets

|

40

|

-

|

50

|

35

|

-

|

45

|

|

|

|

|

|

|

|

|

|

2016 - NET REVENUES OUTLOOK (US$ BILLION)

|

|

|

PREVIOUS

|

CURRENT

|

|

Commercial Aviation

|

$3.45

|

-

|

$3.65

|

$3.45

|

-

|

$3.65

|

|

Executive Jets

|

$1.75

|

-

|

$1.90

|

$1.60

|

-

|

$1.75

|

|

Defense & Security

|

$0.70

|

-

|

$0.75

|

$0.70

|

-

|

$0.75

|

|

Others

|

$0.10

|

-

|

$0.10

|

$0.05

|

-

|

$0.05

|

|

EMBRAER

|

$6.00

|

-

|

$6.40

|

$5.80

|

-

|

$6.20

|

Given lower fixed cost dilution in the Executive Jet segment, Embraer’s guidance for consolidated Adjusted EBIT and Adjusted EBIT margin are now US$ 405-500 million (from US$ 480-545 million) and 7.0-8.0% (from 8.0-8.5%), respectively. Guidance for

Adjusted EBITDA and Adjusted EBITDA margin for 2016 are also reduced to US$ 735-840 million (from US$ 800-870 million) and 12.7-13.5% (from 13.3-13.7%), respectively.

|

|

|

|

|

|

|

|

|

2016 - ADJUSTED EBIT & EBITDA OUTLOOK (US$ MILLION)

|

|

|

PREVIOUS

|

CURRENT

|

|

EBIT

|

$480

|

-

|

$545

|

$405

|

-

|

$500

|

|

EBIT Margin

|

8.0%

|

-

|

8.5%

|

7.0%

|

-

|

8.0%

|

|

EBITDA

|

$800

|

-

|

$870

|

$735

|

-

|

$840

|

|

EBITDA Margin

|

13.3%

|

-

|

13.7%

|

12.7%

|

-

|

13.5%

|

In addition, as a consequence of the lower expected deliveries of Executive Jets in 2016 and current production schedules for the remainder of the year, the Company expects to carry additional finished goods inventory into 2017, thus driving a reduction of Free Cash Flow generation this year. Revised Guidance for 2016 Free Cash Flow is now for usage of no more than US$ 400 million, compared to previous Guidance of Free Cash Flow usage of no more than US$ 100 million previously. This revised Free Cash Flow outlook does not include any potential cash payments related to the loss contingency.

|

|

|

|

|

2016 - FREE CASH FLOW OUTLOOK

|

|

|

PREVIOUS

|

CURRENT

|

|

Free Cash Flow

|

> (US$ 100) million

|

> (US$ 400) million

|

It is important to note that Embraer will work to recover profitability in its Executive Jets segment in future quarters, adjusting costs and production to current demand levels. The Company’s 2016 Guidance for total investments remains unchanged: Research expenses of US$ 50 million, Development of US$ 325 million, and CAPEX of US$ 275 million.

José Antonio de Almeida Filippo

Executive Vice-President and Chief Financial Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July

29

, 2016

|

|

|

|

|

|

|

Embraer S.A.

|

|

|

|

|

By:

|

|

/s/ José Antonio de Almeida Filippo

|

|

|

|

Name:

|

|

José Antonio de Almeida Filippo

|

|

|

|

Title:

|

|

Executive Vice-President and Chief Financial and Investor Relations Officer

|

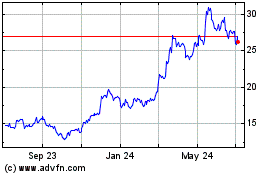

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

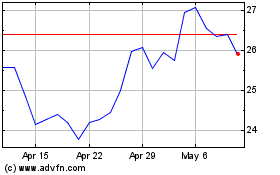

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024