Report of Foreign Issuer (6-k)

July 29 2016 - 7:19AM

Edgar (US Regulatory)

____________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of July 2016

Commission File Number: 001-15102

__________________________________

Embraer S.A.

__________________________________

Av. Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

¨

EMBRAER S.A.

MATERIAL FACT

São José dos Campos, July 29, 2016 –

Embraer S.A. (NYSE:

ERJ

; BM&F BOVESPA: EMBR3) announces to its shareholders and the market, pursuant to its Material Fact as of May 19, 2015, that the negotiations with the U.S. Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) for the settlement

of the allegations of non-compliance with the U.S. Foreign Corrupt Practices Act (FCPA) have significantly progressed, to the point that Embraer is recognizing a US$ 200 million loss contingency in the quarter ended June 30, 2016, reflecting the likely outcome of this matter. The amount of the contingency is an estimate and has not been finally determined.

In addition to the monetary consequences, a final settlement with the DOJ and SEC is likely to include: (1) a deferred prosecution agreement (DPA), under which the prosecution of criminal charges against Embraer will be deferred for the term of the DPA, and dismissed upon the expiration of the term of the DPA, and (2) an imposition of an independent monitor to assess the Company's compliance with the terms of any agreement that may be reached with the U.S. authorities. These may not be the only non-monetary consequences contained in any final settlement.

The negotiations with the U.S. authorities are ongoing and thus subject to change. There is no assurance that Embraer will ultimately reach a final settlement of these matters with the U.S. government agencies. Related proceedings and developments in other countries are ongoing and could result in additional fines, which may be substantial, and possibly other substantial sanctions and adverse consequences.

José Antonio de Almeida Filippo

Executive Vice-President and Chief Financial Investor Relations Officer

.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SIGNATURES

Date: July 2

9

, 2016

|

|

|

|

|

|

|

Embraer S.A.

|

|

|

|

|

By:

|

|

/s/ José Antonio de Almeida Filippo

|

|

|

|

Name:

|

|

José Antonio de Almeida Filippo

|

|

|

|

Title:

|

|

Executive Vice-President and Chief Financial and Investor Relations Officer

|

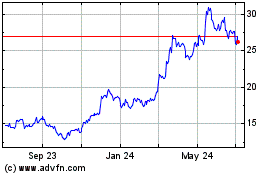

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

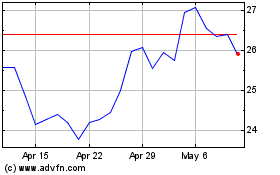

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024