Report of Foreign Issuer (6-k)

July 11 2016 - 4:22PM

Edgar (US Regulatory)

____________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of July 2016

Commission File Number: 001-15102

__________________________________

Embraer S.A.

__________________________________

Av. Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

¨

|

Embraer Projects Market Demand for 6,400 New Jet Deliveries in the 70-130+ Seat Segment

Farnborough, UK, July 11, 2016 –

Embraer has released today, at the Farnborough Airshow, its 2016-2035 Market Outlook, which details forecasted deliveries of new aircraft over the next 20 years. The company projects market demand for 6,400 new jets in the 70-130+ seat capacity category (2,300 units in the 70-90 seat segment and 4,100 units in the 90-130+ seat segment), worth USD 300 billion, by 2035.

The global 70-130+ seat jet fleet in service will increase from 2,670 aircraft in 2015 to 6,690 by 2035, the fastest growing segment among all aircraft seat capacities. Market growth will drive 63% of total demand and the remaining 37% will be delivered to replace ageing aircraft.

|

|

|

70-130+ Seat Jet Deliveries by Region

|

|

|

Region

|

Deliveries

|

Share

|

|

North America

|

2,020

|

31%

|

|

Asia Pacific

|

1,690

|

26%

|

|

Europe

|

1,160

|

18%

|

|

Latin America

|

690

|

11%

|

|

CIS

|

380

|

6%

|

|

Africa

|

230

|

4%

|

|

Middle East

|

230

|

4%

|

|

World (2016-2035)

|

6,400

|

|

|

System-wide demand for air transport — measured in revenue-passenger kilometers (RPKs) —is expected to grow on average at 4.7% annually by 2035, fueled by stronger domestic demand in Advanced Economies and improvements in the macro environment in a number of distressed economies in Emerging Markets.

While region-specific outlooks may vary considerably, globally, the prospect for growth remains bright over the next 20 years driven by a gradual move from a share-driven market strategy to one of disciplined capacity growth with a commitment to strong earnings and return on invested capital.

Oil price will continue to play an important role in the evolution of air passenger traffic and the deployment of aircraft capacity in the coming years. “Apart from the obvious near-term positive effect on airline balance sheets, the low price of oil may exacerbate the overcapacity problem by

|

|

PRESS OFFICES

|

|

|

|

|

|

Headquarters (Brazil)

|

North America

|

Europe

, Middle East and Africa

|

China

|

Asia

Pacific

|

|

Saulo Passos

press@embraer.com.br

Cell: +55 11 94254 4017

Tel.: +55

11

3040

1799

|

Alyssa Ten Eyck

aeyck@embraer.com

Cell: +1 954 383 0460

Tel.: +1 954 359 3847

|

press@embraer.com.br

Cell: +

11

94254

4017

Tel.: +

11

3040 1799

|

Mirage Zhong

mirage.zhong@bjs.embraer.com

Cell:

+86 185 1378 5180

Tel.: +86 10 6598 9988

|

Nilma Missir-Boissac

nilma.boissac@sin.embraer.com

Cell: +65 9012 8428

Tel.: +65 6305 9955

|

|

tempting airlines to stimulate demand with fuel cost pass-through. Greater control in matching aircraft capacity to market demand will be an ever-present strategy to keep revenues ahead of costs over the long run”, said John Slattery, President & CEO, Embraer Commercial Aviation.

Sound financial performance via higher profits and strong non-fuel cost discipline is one of the main pillars to long-term sustainability. Right-sized aircraft call for a new, smarter approach that maximizes opportunities and optimizes revenues and returns with a more prudent solution to seek out untapped opportunities and to increase capacity and flight frequency, while preserving unit revenues.

“The E-Jets lie at the heart of the 70-130+ seat segment. As the most efficient family of aircraft in the segment, they are perfectly positioned to maximize profitability for both airlines and leasing companies”, Slattery said.

About Embraer’s Market Outlook

Since 2004, when the 1

st

edition of Embraer’s Market Outlook was published, the company’s analysts have continuously refined their forecast models in order to identify and predict future trends. The process consists of two main steps: (1) a traffic demand forecast for the future evolution of RPKs by regions and sub-regions based on econometrics for the next 20 years and (2) an aircraft demand forecast that estimates the number of new aircraft deliveries from 30-seat turboprops to wide-bodies needed to support air transport demand growth during the same period.

The 2016-2035 full report is available at

http://www.embraermarketoutlook.com.

Follow us on Twitter: @EmbraerSA

About Embraer

Embraer is a global company headquartered in Brazil with businesses in commercial and executive aviation, defense & security. The company designs, develops, manufactures and markets aircraft and systems, providing customer support and services.

Since it was founded in 1969, Embraer has delivered more than 8,000 aircraft. About every 10 seconds an aircraft manufactured by Embraer takes off somewhere in the world, transporting over 145 million passengers a year.

Embraer is the leading manufacturer of commercial jets up to 130 seats. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe.

|

|

|

PRESS OFFICES

|

|

|

|

|

|

Headquarters (Brazil)

|

North America

|

Europe

, Middle East and Africa

|

China

|

Asia

Pacific

|

|

Saulo Passos

press@embraer.com.br

Cell: +55 11 94254 4017

Tel.: +55

11

3040

1799

|

Alyssa Ten Eyck

aeyck@embraer.com

Cell: +1 954 383 0460

Tel.: +1 954 359 3847

|

press@embraer.com.br

Cell: +

11

94254

4017

Tel.: +

11

3040 1799

|

Mirage Zhong

mirage.zhong@bjs.embraer.com

Cell:

+86 185 1378 5180

Tel.: +86 10 6598 9988

|

Nilma Missir-Boissac

nilma.boissac@sin.embraer.com

Cell: +65 9012 8428

Tel.: +65 6305 9955

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 11, 2016

|

|

|

|

|

|

|

Embraer S.A.

|

|

|

|

|

By:

|

|

/s/ José Antonio de Almeida Filippo

|

|

|

|

Name:

|

|

José Antonio de Almeida Filippo

|

|

|

|

Title:

|

|

Executive Vice-President and Chief Financial and Investor Relations Officer

|

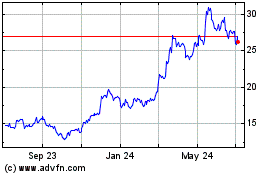

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

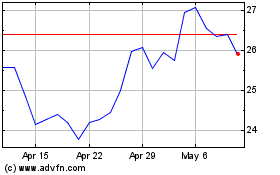

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024