Bombardier Hopes Deal With Delta Will Boost CSeries Jets

June 01 2016 - 2:50PM

Dow Jones News

DUBLIN—Bombardier Inc. is looking to build on a landmark deal

with Delta Air Lines Inc. to win deals for its CSeries single-aisle

planes from budget carriers as it battles to cement its position as

a rival to Boeing Co. and Airbus Group SE.

"Are we looking at specific regions to try and penetrate? Yes.

Are we looking at different business plans to prove the aircraft

works in a low-cost environment? Yes," said Fred Cromer, president

of Bombardier Commercial Aircraft. He wouldn't project when any

deals would come through.

The April deal with Delta, the No. 2 U.S. airline by passenger

traffic, offered the Canadian transportation company a chance to

fortify its shaky order book with a firm deal for 75 CSeries jets

and options for 50 more.

The company is looking to sustain its commercial momentum. Air

Canada said in February that it would buy as many as 75 of the

planes. It joins Deutsche Lufthansa AG's Swiss International Air

Lines unit and Korean Air Lines Co. as the most widely recognized

buyers of the plane.

"It puts a different spin on the program in a very positive way,

which is now bringing even more inquiries into what is this plane,"

Mr. Cromer said.

Bombardier had struggled for years to win orders for the CSeries

planes amid fierce competition from Boeing and Airbus. John Leahy,

Airbus's chief operating officer for customers, played down the

significance of the deal, saying that based on industry rumors

about the deal's closely guarded price, Bombardier was losing up to

$7 million a plane on the transaction.

Bombardier Chief Executive Alain Bellemare said, "The contract

is totally typical for what you see when you launch a brand new

program." He said production costs remain high and that pricing is

aggressive to build a customer base. "Everybody in the industry has

the same experience," he said.

The pricing is consistent with long-term financial plans

Bombardier detailed to investors late last year, Mr. Cromer said.

The program should break even on a per-plane basis around 2020 or

2021, he said.

The CSeries is due to enter service in the coming weeks with

Swiss meeting its performance targets, Mr. Cromer said. Lufthansa

Chief Executive Carsten Spohr has said the plane is more efficient

than expected.

Mr. Cromer said Bombardier would continue to look for ways to

boost performance.

The Delta Air Lines deal means they won't be able to produce

planes for new customers for a couple of years. Bombardier is

gradually increasing production of the CSeries. It expects to ship

15 to 20 planes this year and about double that in 2017. Annual

output should reach around 120 aircraft a year toward the end of

the decade, Mr. Cromer said.

The company's five-year plan to generate positive cash flow from

the CSeries leaves the company burning resources over the next half

decade, relying on its established products to pay for the

program's losses. Bombardier announced Wednesday a deal for nine

Q400 turboprop aircraft for Canadian low-cost carrier WestJet's

fast-growing regional arm, Encore.

With the bulk of the multiyear development of the CSeries

nearing its end, Bombardier also could use freed-up engineering

resources to refine some of its more established planes, including

the CRJ series of regional jetliners.

Last month its principal rival in that market, Brazilian plane

maker Embraer SA, flew for the first time a more fuel-efficient

version of its regional plane. The plane is due to enter service in

the first half of 2018, adding pressure on Bombardier to keep its

models competitive.

Mr. Cromer said the new Embraer plane "will certainly provide an

opportunity for us to relook at the CRJ." The Canadian company

unveiled in May a new cabin for its planes and, Mr. Cromer said,

there is potential for more refinements. He didn't specify what

they might be.

Write to Robert Wall at robert.wall@wsj.com and Jon Ostrower at

jon.ostrower@wsj.com

(END) Dow Jones Newswires

June 01, 2016 14:35 ET (18:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

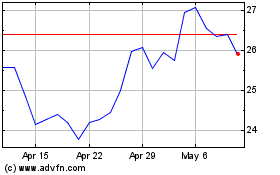

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

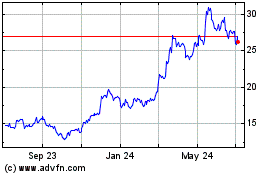

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024