Asian Sky Still Bright, Plane Makers Say

February 16 2016 - 9:22AM

Dow Jones News

By Gaurav Raghuvanshi

SINGAPORE--Aircraft makers such as Boeing Co., Airbus Group SE

and Embraer SA say they aren't worried that the economic slowdown

in Asia, especially China, will hurt sales in the world's

fastest-growing aviation market.

Rather, some are still trying to keep up with demand.

"My biggest worry is not being able to build all the aircraft

that we've already sold," John Leahy, chief operating officer of

Airbus, said at a news conference at the Singapore Airshow on

Tuesday.

Financial markets have been spooked by China's slowing growth.

Last year, Beijing reported, the world's second-largest economy

grew at its slowest pace in 25 years, 6.9%--and many economists say

they believe the true figure is closer to 6%. But China is still

expanding faster than any other major economy. And China, India and

Southeast Asia remain the fastest-growing aviation markets in the

world.

Airbus predicts that over the next 20 years, the Asia Pacific

region will take delivery of 12,800 new aircraft, valued at US$2

trillion. That would constitute about 40% of its projected total

global demand of 32,600.

The Toulouse, France-based company expects the number of

passengers in Asia to keep growing 5.6% a year over the next 20

years. It remains bullish about China, where it expects to deliver

800 planes between now and 2020, and where Mr. Leahy said he

expects passenger growth to stay at 10% over the next few

years.

Arch rival Boeing predicts Asia will take delivery of 14,330

planes over the next 20 years, 38% of its projected global total.

"The Asia story will only get better," said Dinesh Keskar, senior

vice president of sales in Southeast Asia and India at Boeing.

Embraer, which builds smaller planes, predicts that over the 20

years the Asia-Pacific region will take delivery of 1,570 new jets

with seating for between 70 and 130 passengers.

"We are enjoying momentum in China," said John Slattery, chief

commercial officer at Embraer Commercial Aviation. Despite the

slight slowdown in China's gross domestic product, "the aviation

market continues to grow at double digits."

Asia Pacific commercial-aviation sales will grow 9.2% a year in

nominal U.S. dollar terms between now and 2020, outpacing the

global 7.5% rate, Rajiv Biswas, chief economist in Asia Pacific at

IHS Global, forecast in a recent report.

Sliding crude-oil prices have helped airlines cut costs. Fuel

accounts for nearly a third of the total expenses of airlines in

Asia, Mr. Biswas said.

No deliveries have been canceled or deferred by Asian customers,

Boeing and Embraer executives said in responses to queries from

reporters. Mr. Leahy said no customers are negotiating to reduce

orders "outside the normal course of business." Airbus reported

later Tuesday that Garuda Indonesia canceled an order for seven

A330 jets.

Airbus officials couldn't immediately be reached for comment.

Arif Wibowo, Garuda's chief executive, said the carrier is

evaluating offers from both Boeing and Airbus for the newest

variants of their planes and may order up to 30 widebody jets this

year. The company may swap some orders for older variants for the

latest ones, he said, before Airbus announced the cancellation of

the order for seven older models.

No big orders were announced on the first day of the Singapore

Airshow, which runs through the end of this week.

Airbus announced in October that it will increase production of

its best-selling A320 model by 2019 to 60 planes a month from the

current 42 A320s; it had previously disclosed plans to raise

monthly output to 50 planes next years. Boeing plans to lift

production of its rival 737 jetliner to 52 a month in 2018.

Asia is home to some of Airbus's biggest customers: India's

InterGlobe Aviation Ltd., which operates IndiGo, Malaysia's AirAsia

Bhd. and Indonesia's Lion Air Group have placed orders for hundreds

of planes in recent years.

Several analysts have said that Asian carriers may have been

getting ahead of themselves: Passenger growth for carriers in

Southeast Asia, for instance, lags behind fleet growth. AirAsia was

forced to defer some of its aircraft deliveries in 2014.

Write to Gaurav Raghuvanshi at gaurav.raghuvanshi@wsj.com

(END) Dow Jones Newswires

February 16, 2016 09:07 ET (14:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

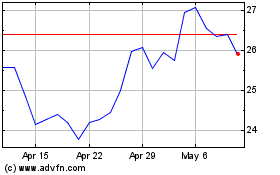

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

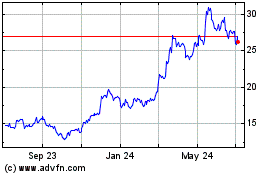

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024