Aircraft Order Drought Fails to Dent Output Plans

November 09 2015 - 12:47PM

Dow Jones News

By Robert Wall

DUBAI--An unusual order drought at the Dubai Air Show and

difficult economic conditions in some key plane-buying-markets

isn't denting aircraft makers' interest in boosting production with

the demand in the U.S. and China proving resilient.

Orders for planes in places like Russia and Brazil has slumped

as a sharp drop in exports in these countries has buffeted their

economies and knocked demand for air travel. And conditions could

be worsening in other countries, too.

Boeing's chief jetliner salesman John Wojick said: "We are

starting to see some of that impact in other commodity-dependent

countries."

And that view is echoed at competitor Airbus. Still, chief plane

salesman John Leahy said planned production levels at the European

plane maker are sustainable, barring everything but a major

economic downturn. Airbus last month said it would raise

single-aisle aircraft output to 60 a month from 42 today.

If the global economy weakened, Airbus would likely be able to

hold production levels steady, not have to curtail them, Mr. Leahy

said.

China also remains resilient despite a slowdown in economic

growth. "The Chinese economy may be sliding, but that's not true

for aviation, at least not yet," Mr. Leahy said. He remains

confident in long term prospects and argues global air traffic will

double more quickly than the historical 15 years.

Boeing's Mr. Wojick said: "We think we can weather any potential

perturbations in the marketplace."

The Chicago-based plane maker, which is considering raising its

own narrow-body output from the planned 52 aircraft a month from

2017, would do so only if it is certain the higher build rate was

sustainable for several years, he said.

With airlines and Brazil, Russia and other markets struggling,

plane makers are eying deals from the U.S. where airlines this year

are headed for record profits, benefiting from lower fuel prices

and restructuring measures.

"In the U.S. we continue to see really strong demand," Mr.

Wojick said.

That's a view shared also by smaller plane makers.

Brazil's Embraer SA, the world's third-largest plane maker, is

in talks with major U.S. carriers to buy some of its regional jets

seating more than 100 passengers, further cementing its position in

the world's largest airliner market. "There is a huge opportunity

for us," said Paulo César de Souza e Silva, who heads Embraer's

commercial airplane unit.

Embraer in recent years enjoyed sales success from U.S. airlines

including American Airlines Group and United Continental Holdings

Inc., who placed orders for smaller versions of its planes. United

has indicated it could place an order for the 100-seat regional

jets from Embraer or rival Bombardier Inc.

A breakthrough deal for Embraer could come within the next six

months, Mr. César said, without identifying the potential buyer.

That could open the door to other deals. " If one airline orders

100-seaters, the other airlines will look at doing the same," he

said in an interview at the Dubai Air Show.

Rival Bombardier is hoping to win over some of those customers

for its CSeries narrow-body jets, said Fred Cromer, president of

the company's commercial airplane unit. Bombardier is targeting

Canadian approval for the first of its new CSeries planes, the

CS100, still by year-end, with the slightly larger CS300 that seats

about 130 passengers following about six months later.

The two smaller plane makers also are looking to raise output.

Mr. César said 2016 deliveries could top the 100 planes the company

expects to build next year. Bombardier will ship around 20 CSeries

planes next year and then gradually boost output to around 120 a

year around the decade's end.

Economic woes aren't entirely bad news for plane makers, either.

For Embraer, the fall in the value of the Brazilian currency has

provided a financial tailwind since the company has many of its

costs in the local currency even as it sells planes in dollars.

Still, Mr. César said the plane maker is reluctant to pass that

on in pricing discounts out of concern the currency trends could

reverse. Embraer suffered when the Brazilian currently rapidly

appreciated during the country's economic boom.

Write to Robert Wall at robert.wall@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 09, 2015 12:32 ET (17:32 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

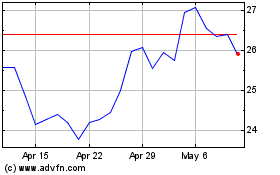

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

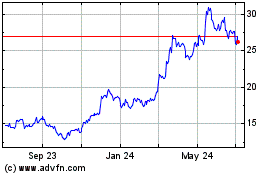

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024