Report of Foreign Issuer (6-k)

July 30 2015 - 6:11AM

Edgar (US Regulatory)

____________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of July 2015

Commission File Number: 001-15102

__________________________________

Embraer S.A.

__________________________________

Av. Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EMBRAER S.A.

MATERIAL FACT

São José dos Campos, July 30, 2015 – Embraer S.A. (NYSE: ERJ; BM&F BOVESPA: EMBR3) announces that it has revised its Total Revenue, Revenue for Defense and Security Segment, EBIT Margin and EBITDA Margin guidance for 2015.

The Company is revising its 2015 Guidance for Total Revenues, EBIT margin, and EBITDA margin. Consolidated Revenues for the year are now expected to stay within a range of US$ 5.8 – US$ 6.3 billion, a reduction from the previous range of US$ 6.1 – US$ 6.6 billion. The decline in Revenue guidance for the year is due to a US$ 300 million reduction in expected revenues in the Defense & Security segment, which Embraer now expects to end 2015 within US$ 800 – US$ 950 million. This reduction is driven by the combination of the negative impact of continued devaluation of the Brazilian real versus the U.S. dollar and a slower pace of development work on certain Defense & Security contracts.

Despite lower revenues for the year, the Company’s guidance for EBIT and EBITDA remains unchanged, within a range of US$ 490 – US$ 560 million and US$ 730 – US$ 860 million, respectively, due primarily to the positive impact from the devaluation of the real versus the U.S. dollar on Embraer’s consolidated margins. EBIT margin guidance is now revised up to 8.5% – 9,0% from a previous range of 8.0% – 8.5%, and EBITDA margin guidance raised to 12.6% - 13.6% from 12.0 – 13.0%

| |

|

|

|

|

|

|

| 2015 - NET REVENUE OUTLOOK (US$ BILLION) |

| |

PREVIOUS |

CURRENT |

| Commercial Aviation |

$3.20 |

- |

$3.40 |

$3.20 |

- |

$3.40 |

| Executive Jets |

$1.70 |

- |

$1.85 |

$1.70 |

- |

$1.85 |

| Defense & Security |

$1.10 |

- |

$1.25 |

$0.80 |

- |

$0.95 |

| Others |

$0.10 |

- |

$0.10 |

$0.10 |

- |

$0.10 |

| EMBRAER |

$6.10 |

- |

$6.60 |

$5.80 |

- |

$6.30 |

| |

|

|

|

|

| 2015 - EBIT & EBITDA OUTLOOK (US$ MILLION) |

| |

PREVIOUS |

CURRENT |

| EBIT |

$490 |

- $560 |

$490 |

- $560 |

| EBIT Margin |

8,0% |

- 8,5% |

8,5% |

- 9,0% |

| EBITDA |

$730 |

- $860 |

$730 |

- $860 |

| EBITDA Margin |

12,0% |

- 13,0% |

12,6% |

- 13,6% |

The Company reiterates all other aspects of its 2015 Guidance.

ABOUT EMBRAER

Embraer S.A. (NYSE: ERJ; BM&FBOVESPA: EMBR3) is the world’s largest manufacturer of commercial jets up to 120 seats, and one of Brazil’s leading exporters. Embraer’s headquarters are located in São José dos Campos, São Paulo, and it has offices, industrial operations and customer service facilities in Brazil, China, France, Portugal, Singapore, and the U.S. Founded in 1969, the Company designs, develops, manufactures and sells aircraft and systems for the commercial aviation, executive aviation, and defense and security segments. It also provides after sales support and services to customers worldwide. For more information, please visit www.embraer.com.br.

This document may contain projections, statements and estimates regarding circumstances or events yet to take place. Those projections and estimates are based largely on current expectations, forecasts of future events and financial trends that affect Embraer’s businesses. Those estimates are subject to risks, uncertainties and suppositions that include, among others: general economic, political and trade conditions in Brazil and in those markets where Embraer does business; expectations of industry trends; the Company’s investment plans; its capacity to develop and deliver products on the dates previously agreed upon, and existing and future governmental regulations. The words “believe”, “may”, “is able”, “will be able”, “intend”, “continue”, “anticipate”, “expect” and other similar terms are intended to identify potentialities. Embraer does not undertake any obligation to publish updates nor to revise any estimates due to new information, future events or any other facts. In view of the inherent risks and uncertainties, such estimates, events and circumstances may not take place. The actual results may therefore differ substantially from those previously published as Embraer expectations.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 30, 2015

|

|

|

|

|

|

|

Embraer S.A. |

|

|

|

|

By: |

|

/s/ José Antonio de Almeida Filippo |

|

|

|

Name: |

|

José Antonio de Almeida Filippo |

|

|

|

Title: |

|

Executive Vice-President and Chief Financial and Investor Relations Officer |

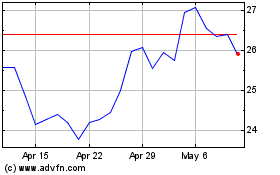

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

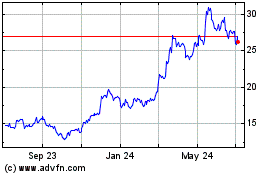

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024