UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 20-F

| ¨ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-15102

EMBRAER S.A.

(Exact name of Registrant as specified in its charter)

EMBRAER Inc.

(Translation

of Registrant’s name into English)

Federative Republic of Brazil

(Jurisdiction of incorporation)

Avenida Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

Eduardo Couto

Head of

Investor Relations

(55) 12 3927 4404

Investor relations department, (55) 12 3927 4404, investor.relations@embraer.com.br

(Name, Telephone, E-mail and/or facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act

|

|

|

| Title of each class: |

|

Name of each exchange on which registered |

| Common shares, without par value (represented by, and traded only in the form of, American Depositary Shares (evidenced by American

Depositary Receipts), with each American Depositary Share representing four common shares) |

|

New York Stock Exchange |

| 5.150% Notes due 2022 of

Embraer S.A. |

|

New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act

None.

Securities for which

there is a reporting obligation pursuant to Section 15(d) of the Act

Title of each class

6.375% Guaranteed Notes due 2017 of Embraer Overseas Ltd. Guaranteed by Embraer S.A.

6.375% Guaranteed Notes due 2020 of Embraer Overseas Ltd. Guaranteed by Embraer S.A.

Number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2014:

734,970,460 common shares, without par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is

not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its

corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was

required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated

filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer x

Accelerated Filer ¨

Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

|

|

|

|

| ¨ U.S. GAAP |

|

x International Financial Reporting Standards as issued

by the International Accounting Standards Board |

|

Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which

financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

TABLE OF CONTENTS

Part I

i

Part II

Part III

ii

INTRODUCTION

In this annual report, “Embraer,” “we,” “us,” “our” or the “Company” refer to Embraer

S.A. and its consolidated subsidiaries. All references herein to the “real,” “reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references to “US$,”

“dollars” or “U.S. dollars” are to United States dollars.

Presentation of Financial and Other Data

Financial Data

Our audited

consolidated financial statements as of and for the years ended December 31, 2014, 2013 and 2012 are included in this annual report.

Our consolidated financial statements have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by

the International Accounting Standards Board, or IASB.

After analyzing our operations and businesses with regard to the applicability of

International Accounting Standards, or IAS, 21 – “The Effects of Changes in Foreign Exchange Rates,” particularly in relation to the factors involved in determining our functional currency, management concluded that our functional

currency is the U.S. dollar. This conclusion was based on an analysis of the following factors, as set forth in IAS 21: (1) the currency that most influences sales prices of goods and services; (2) the currency of the country whose

competitive forces and regulations most determine the sale prices of our goods and services; (3) the currency that most influences labor, materials and other costs of providing goods and services; (4) the currency in which the funds for

financial operations are largely obtained; and (5) the currency in which revenue from operations is usually accumulated. Items included in the financial statements of each of our subsidiaries are measured using the currency of the primary

economic environment in which such subsidiary operates. Our audited consolidated financial statements included elsewhere in this annual report are presented in U.S. dollars, which is our presentation currency.

In our 2014, 2013 and 2012 consolidated financial statements, gains or losses resulting from the remeasurement of the monetary items and from

foreign currency transactions have been reported in the consolidated statement of income as a single line item.

For certain

purposes, such as providing reports to our Brazilian shareholders, filing financial statements with the Comissão de Valores Mobiliários (Brazilian securities commission), or CVM, and determining dividend payments and other

distributions and tax liabilities in Brazil, we have prepared, and will continue to be required to prepare, financial statements in accordance with Law No. 6,404 of December 15, 1976, as amended, or the Brazilian Corporate Law.

Because we list our common shares on the Novo Mercado segment of the BM&FBOVESPA S.A.–Bolsa de Valores,

Mercadorias e Futuros de São Paulo, or São Paulo Stock Exchange, as of January 2009 we have been required to translate our quarterly and annual financial statements into English. Foreign private issuers are not subject to the

quarterly reporting requirements of Exchange Act Rules 13a-13 and 15d-13. Accordingly, foreign private issuers that file annual reports on Form 20-F are only required to promptly furnish, in a Form 6-K, material information such as in a press

release that is (1) distributed to stockholders or filed with a national exchange, if made public by that exchange, or (2) required by its domestic laws to be made public.

Other Data and Backlog

In this

annual report:

| |

• |

|

some of the financial data reflects the effect of rounding; |

| |

• |

|

aircraft ranges are indicated in nautical miles; |

| |

• |

|

one nautical mile is equal to approximately 1.15 ordinary or “statute” miles, or approximately 1.85 kilometers; |

1

| |

• |

|

aircraft speeds are indicated in nautical miles per hour, or knots, or in Mach, which is a measure of the speed of sound; |

| |

• |

|

the term “regional jet” refers to narrow body jet aircraft with 30-60 passenger seats; |

| |

• |

|

the term “mid-capacity jet” refers to jet aircraft with 70-130 passenger seats—all of our regional and mid-capacity jet aircraft are sold in the commercial aviation segment; |

| |

• |

|

the term “commercial aircraft,” as it applies to Embraer, refers to our regional jets and mid-capacity jets; |

| |

• |

|

the terms “entry-level jet” and “light jet” refer to executive jets that usually carry from four to eight passengers and up to nine passengers, respectively, that are designed for short take-off

distances; |

| |

• |

|

the term “mid-light” refers to executive jets that usually carry up to nine passengers and can cover distances ranging from 1,700 to 3,000 nautical miles; |

| |

• |

|

the term “midsize” refers to executive jets that usually carry up to 12 passengers and can cover distances ranging from 3,000 to 3,300 nautical miles; |

| |

• |

|

the term “large” refers to executive jets that usually carry up to 19 passengers and can cover distances ranging from 3,900 to 5,600 nautical miles; |

| |

• |

|

the term “ultra-large jet” refers to executive jets that usually have longer ranges and over-sized cabin spaces and can carry up to 19 passengers; and |

| |

• |

|

the term “executive jets,” as it applies to Embraer, refers to our aircraft sold to companies, including fractional ownership companies, charter companies, air-taxi companies and high net-worth individuals.

|

We calculate our backlog as the sum of the contract values of all firm orders (i) for aircraft that has not yet been

delivered and (ii) for services and technologies contracted and not yet performed. A firm order is a firm commitment from a customer, represented by a signed contract. Options to acquire aircraft are not considered part of our backlog.

Special Note Regarding Forward-Looking Statements

This annual report includes forward-looking statements, within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended,

or the Securities Act, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act, principally in Items 3 through 5 and Item 11 of this annual report. We have based these forward-looking statements largely

on our current expectations and projections about future events and industry and financial trends affecting our business. These forward-looking statements are subject to risks, uncertainties and assumptions, including, among other things:

| |

• |

|

general economic, political and business conditions, both in Brazil and in our other markets; |

| |

• |

|

changes in competitive conditions and in the general level of demand for our products; |

| |

• |

|

management’s expectations and estimates concerning our future financial performance, financing plans and programs, and the effects of competition; |

| |

• |

|

the effects of customers canceling, modifying and/or rescheduling contractual orders; |

| |

• |

|

the effect of changing priorities or reductions in the Brazilian federal government or international government defense budgets on our revenues; |

2

| |

• |

|

continued successful development and marketing of the EMBRAER 170/190 jet family, including the development of the new EMBRAER 170/190 generation, the E2, our line of executive jets (including the Phenom 100, Phenom

300, Lineage 1000, Legacy 650, Legacy 600, Legacy 450 and Legacy 500) and our defense and security aircraft and services; |

| |

• |

|

our level of indebtedness; |

| |

• |

|

anticipated trends in our industry, including but not limited to the continuation of long-term trends in passenger traffic and revenue yields in the airline industry; |

| |

• |

|

our short- and long-term outlook for the 30-130 seat commercial airline market; |

| |

• |

|

inflation and fluctuations in exchange rates; |

| |

• |

|

the impact of volatile fuel prices and the airline industry’s response; |

| |

• |

|

our ability to develop and deliver our products on a timely basis; |

| |

• |

|

availability of sales financing for our existing and potential customers; |

| |

• |

|

existing and future governmental regulation; |

| |

• |

|

our relationship with our workforce; and |

| |

• |

|

other risk factors, such as those set forth under “Item 3D. Key Information—Risk Factors.” |

The words “believe,” “may,” “will,” “forecast,” “estimate,” “plan,”

“continue,” “anticipate,” “intend,” “expect” and similar words herein are intended to identify forward-looking statements. We undertake no obligation to update publicly or revise any forward-looking statements

because of new information, future events or other factors. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this annual report might not occur. Our actual results and performance could differ

substantially from those anticipated in our forward-looking statements. As a result of various factors such as those risks described in “Item 3D. Key Information—Risk Factors,” undue reliance should not be placed on these

forward-looking statements.

3

Part I

| ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not

applicable.

| ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| 3A. |

Selected Financial Data and Other Data |

The following table

presents our selected financial data which has been derived from our consolidated audited financial statements prepared in accordance with IFRS as issued by the IASB and other data as of and for the years ended December 31, 2014, 2013, 2012,

2011 and 2010. The selected financial data for the years ended December 31, 2014, 2013 and 2012 is derived from our consolidated financial statements, which were audited by KPMG Auditores Independentes, an independent registered public

accounting firm, as stated in their report included in this annual report. The selected financial data for the years ended December 31, 2011 and 2010 was audited by PricewaterhouseCoopers Auditores Independentes, an independent registered

public accounting firm. You should read this selected financial data in conjunction with our audited consolidated financial statements and related notes thereto included elsewhere in this annual report. For information on our segment results, see

Note 39 to our audited consolidated financial statements for the year ended December 31, 2014.

Selected Financial Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year ended December 31, |

|

| Consolidated Statements of Income Data |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| |

|

(in US$ millions) |

|

| Revenue |

|

|

6,288.8 |

|

|

|

6,235.0 |

|

|

|

6,167.0 |

|

|

|

5,790.9 |

|

|

|

5,364.1 |

|

| Cost of sales and services |

|

|

(5,038.3 |

) |

|

|

(4,818.9 |

) |

|

|

(4,676.6 |

) |

|

|

(4,488.1 |

) |

|

|

(4,338.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

1,250.5 |

|

|

|

1,416.1 |

|

|

|

1,490.4 |

|

|

|

1,302.8 |

|

|

|

1,026.0 |

|

| Operating income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Administrative |

|

|

(207.5 |

) |

|

|

(210.5 |

) |

|

|

(279.2 |

) |

|

|

(261.3 |

) |

|

|

(197.5 |

) |

| Selling |

|

|

(419.9 |

) |

|

|

(454.4 |

) |

|

|

(480.4 |

) |

|

|

(418.6 |

) |

|

|

(374.1 |

) |

| Research |

|

|

(47.1 |

) |

|

|

(74.7 |

) |

|

|

(77.3 |

) |

|

|

(85.3 |

) |

|

|

(72.1 |

) |

| Other operating (expense) income, net |

|

|

(32.6 |

) |

|

|

36.9 |

|

|

|

(42.8 |

) |

|

|

(219.7 |

) |

|

|

9.4 |

|

| Equity in losses of associates |

|

|

(0.1 |

) |

|

|

— |

|

|

|

1.2 |

|

|

|

0.3 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit before financial income (expense) |

|

|

543.3 |

|

|

|

713.4 |

|

|

|

611.9 |

|

|

|

318.2 |

|

|

|

391.7 |

|

| Financial income (expense), net |

|

|

(24.5 |

) |

|

|

(96.4 |

) |

|

|

(6.8 |

) |

|

|

(90.5 |

) |

|

|

17.5 |

|

| Foreign exchange gain (loss), net |

|

|

(14.9 |

) |

|

|

(14.6 |

) |

|

|

8.7 |

|

|

|

20.1 |

|

|

|

(1.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit before taxes on income |

|

|

503.9 |

|

|

|

602.4 |

|

|

|

613.8 |

|

|

|

247.8 |

|

|

|

408.1 |

|

| Income tax (expense) benefit |

|

|

(156.2 |

) |

|

|

(256.4 |

) |

|

|

(265.2 |

) |

|

|

(127.4 |

) |

|

|

(62.7 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

347.7 |

|

|

|

346.0 |

|

|

|

348.6 |

|

|

|

120.4 |

|

|

|

345.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Owners of Embraer |

|

|

334.7 |

|

|

|

342.0 |

|

|

|

347.8 |

|

|

|

111.6 |

|

|

|

330.2 |

|

| Noncontrolling interest |

|

|

13.0 |

|

|

|

4.0 |

|

|

|

0.8 |

|

|

|

8.8 |

|

|

|

15.2 |

|

4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year ended December 31, |

|

| Earnings per Share – Basic |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| |

|

(in US$, except for share data) |

|

| Net income attributable to owners of Embraer |

|

|

334.7 |

|

|

|

342.0 |

|

|

|

347.8 |

|

|

|

111.6 |

|

|

|

330.2 |

|

| Weighted average number of shares (in thousands) |

|

|

733,677 |

|

|

|

729,001 |

|

|

|

725,023 |

|

|

|

723,667 |

|

|

|

723,665 |

|

| Basic earnings per share – U.S. dollars |

|

|

0.4562 |

|

|

|

0.4691 |

|

|

|

0.4797 |

|

|

|

0.1542 |

|

|

|

0.4563 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year ended December 31, |

|

| Earnings per Share – Diluted |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| |

|

(in US$, except for share data) |

|

| Net income attributable to owners of Embraer |

|

|

334.7 |

|

|

|

342.0 |

|

|

|

347.8 |

|

|

|

111.6 |

|

|

|

330.2 |

|

| Weighted average number of shares (in thousands) – diluted |

|

|

733,677 |

|

|

|

729,001 |

|

|

|

725,023 |

|

|

|

723,667 |

|

|

|

723,665 |

|

| Dilution for the issuance of stock options (in thousands)(1) |

|

|

3.766 |

|

|

|

4.795 |

|

|

|

2.708 |

|

|

|

1.18 |

|

|

|

354 |

|

| Weighted average number of shares (in thousands) |

|

|

737,463 |

|

|

|

733,796 |

|

|

|

727,731 |

|

|

|

724,847 |

|

|

|

724,019 |

|

| Diluted earnings per share |

|

|

0.4538 |

|

|

|

0.4661 |

|

|

|

0.4780 |

|

|

|

0.1540 |

|

|

|

0.4562 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At December 31, |

|

| Consolidated Statement of Financial Position Data |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| |

|

(in US$ millions) |

|

| Cash and cash equivalents |

|

|

1,713.0 |

|

|

|

1,683.7 |

|

|

|

1,797.0 |

|

|

|

1,347.8 |

|

|

|

1,393.1 |

|

| Financial investments |

|

|

710.6 |

|

|

|

939.9 |

|

|

|

578.2 |

|

|

|

753.6 |

|

|

|

733.5 |

|

| Other current assets |

|

|

3,387.1 |

|

|

|

3,144.2 |

|

|

|

2,983.5 |

|

|

|

3,062.5 |

|

|

|

2,856.2 |

|

| Property, plant and equipment |

|

|

2,025.8 |

|

|

|

1,993.3 |

|

|

|

1,738.4 |

|

|

|

1,450.4 |

|

|

|

1,201.0 |

|

| Intangible assets |

|

|

1,260.9 |

|

|

|

1,109.1 |

|

|

|

958.8 |

|

|

|

808.3 |

|

|

|

716.3 |

|

| Other long-term assets |

|

|

1,313.6 |

|

|

|

1,272.3 |

|

|

|

1,425.0 |

|

|

|

1,426.1 |

|

|

|

1,490.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

10,411.0 |

|

|

|

10,142.5 |

|

|

|

9,480.9 |

|

|

|

8,848.7 |

|

|

|

8,391.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short-term loans and financing |

|

|

89.7 |

|

|

|

79.3 |

|

|

|

336.3 |

|

|

|

251.8 |

|

|

|

72.6 |

|

| Other current payables |

|

|

2,463.2 |

|

|

|

2,813.4 |

|

|

|

2,452.4 |

|

|

|

2,586.6 |

|

|

|

2,316.1 |

|

| Long-term loans and financing |

|

|

2,418.4 |

|

|

|

2,115.0 |

|

|

|

1,730.2 |

|

|

|

1,406.3 |

|

|

|

1,362.2 |

|

| Other long-term liabilities |

|

|

1,574.9 |

|

|

|

1,502.6 |

|

|

|

1,611.7 |

|

|

|

1,486.2 |

|

|

|

1,508.6 |

|

| Company shareholders’ equity |

|

|

3,764.8 |

|

|

|

3,533.3 |

|

|

|

3,258.3 |

|

|

|

3,007.3 |

|

|

|

3,028.4 |

|

| Noncontrolling interest |

|

|

100.0 |

|

|

|

98.9 |

|

|

|

92.0 |

|

|

|

110.5 |

|

|

|

103.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total shareholders’ equity |

|

|

3,864.8 |

|

|

|

3,632.2 |

|

|

|

3,350.3 |

|

|

|

3,117.8 |

|

|

|

3,131.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

|

10,411.0 |

|

|

|

10,142.5 |

|

|

|

9,480.9 |

|

|

|

8,848.7 |

|

|

|

8,391.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year ended December 31, |

|

| Other Consolidated Financial Data |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| |

|

(in US$ millions) |

|

| Net cash generated by operating activities |

|

|

482.3 |

|

|

|

564.6 |

|

|

|

693.0 |

|

|

|

480.1 |

|

|

|

873.8 |

|

| Net cash used in investing activities |

|

|

(671.5 |

) |

|

|

(764.0 |

) |

|

|

(617.3 |

) |

|

|

(602.0 |

) |

|

|

(288.3 |

) |

| Net cash generated by (used in) financing activities |

|

|

333.3 |

|

|

|

192.5 |

|

|

|

422.3 |

|

|

|

96.4 |

|

|

|

(802.2 |

) |

| Depreciation and amortization |

|

|

286.3 |

|

|

|

290.6 |

|

|

|

278.8 |

|

|

|

238.8 |

|

|

|

219.2 |

|

| (1) |

Refers to the effect of potentially dilutive shares. |

5

Other Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At and for the year ended December 31, |

|

| Other Data: |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| Aircraft delivered during period: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| To the Commercial Aviation Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ERJ 145 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

6 |

|

| EMBRAER 170 |

|

|

1 |

|

|

|

4 |

|

|

|

1 |

|

|

|

1 |

|

|

|

9/2 |

(1) |

| EMBRAER 175 |

|

|

62 |

|

|

|

24 |

|

|

|

20 |

|

|

|

10 |

|

|

|

8 |

|

| EMBRAER 190 |

|

|

19 |

|

|

|

45 |

|

|

|

62 |

|

|

|

68 |

|

|

|

58 |

|

| EMBRAER 195 |

|

|

10 |

|

|

|

17 |

|

|

|

23 |

|

|

|

24 |

|

|

|

17 |

|

| To the Defense & Security Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Legacy 600 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

| Phenom 100 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| EMB 135 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

| EMBRAER 170 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| EMBRAER 190 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| EMB 145 AEW&C/RS/MP(2) |

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

— |

|

| EMB 312 Tucano/AL-X/ Super Tucano(2) |

|

|

7 |

|

|

|

6 |

|

|

|

14 |

|

|

|

— |

|

|

|

— |

|

| To the Executive Jets Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Legacy 600/650 |

|

|

18 |

|

|

|

23 |

|

|

|

19 |

|

|

|

13 |

|

|

|

10 |

|

| Legacy 500 |

|

|

3 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| EMBRAER 145/170/190 Shuttle |

|

|

— |

|

|

|

2 |

|

|

|

1 |

|

|

|

— |

|

|

|

3 |

|

| Phenom 100 |

|

|

19 |

|

|

|

30 |

|

|

|

29 |

|

|

|

41 |

|

|

|

100 |

|

| Phenom 300 |

|

|

73 |

|

|

|

60 |

|

|

|

48 |

|

|

|

42 |

|

|

|

26 |

|

| Lineage 1000 |

|

|

3 |

|

|

|

4 |

|

|

|

2 |

|

|

|

3 |

|

|

|

5 |

|

| To the General Aviation Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Light Propeller Aircraft |

|

|

38 |

|

|

|

60 |

|

|

|

62 |

|

|

|

54 |

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total delivered |

|

|

253 |

|

|

|

275 |

|

|

|

283 |

|

|

|

258 |

|

|

|

286 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aircraft in backlog at the end of period: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In the Commercial Aviation Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ERJ 145 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

| EMBRAER 170 |

|

|

5 |

|

|

|

1 |

|

|

|

10 |

|

|

|

6 |

|

|

|

10 |

|

| EMBRAER 175 |

|

|

172 |

|

|

|

188 |

|

|

|

35 |

|

|

|

46 |

|

|

|

40 |

|

| EMBRAER 190 |

|

|

65 |

|

|

|

73 |

|

|

|

109 |

|

|

|

162 |

|

|

|

157 |

|

| EMBRAER 195 |

|

|

7 |

|

|

|

17 |

|

|

|

31 |

|

|

|

35 |

|

|

|

41 |

|

| EMBRAER 175 – E2 |

|

|

100 |

|

|

|

100 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| EMBRAER 190 – E2 |

|

|

60 |

|

|

|

25 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| EMBRAER 195 – E2 |

|

|

50 |

|

|

|

25 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| In the Defense & Security Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EMB 145 AEW&C/RS/MP |

|

|

1 |

|

|

|

1 |

|

|

|

1 |

|

|

|

3 |

|

|

|

3 |

|

| EMB 312 Tucano/EMB 314/EP Super Tucano |

|

|

8 |

|

|

|

12 |

|

|

|

18 |

|

|

|

24 |

|

|

|

16 |

|

| LAS |

|

|

17 |

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| E99 |

|

|

5 |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| KC-390 |

|

|

28 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| VU-Y |

|

|

6 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| EMB 135 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Legacy 600/Phenom 100 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| EMBRAER 170/ EMBRAER 190 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| In the Executive Jets Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Legacy 450/500/600/650/Phenom 100/300/Lineage 1000/EMBRAER 170/190 Shuttle |

|

|

168 |

|

|

|

208 |

|

|

|

272 |

|

|

|

421 |

|

|

|

551 |

|

| In the General Aviation Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Light Propeller Aircraft |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total backlog (in aircraft) |

|

|

692 |

|

|

|

675 |

|

|

|

476 |

|

|

|

697 |

|

|

|

820 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total backlog (in millions) |

|

US$ |

20,920.2 |

|

|

US$ |

18,205.5 |

|

|

US$ |

12,462.2 |

|

|

US$ |

15,441.2 |

|

|

US$ |

15,543.2 |

|

| (1) |

Figures appearing after a forward slash (/) refer to aircraft delivered under operating leases. |

| (2) |

Recorded for under the percentage of completion method. |

6

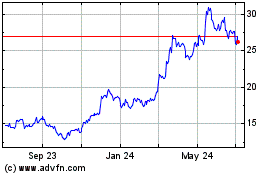

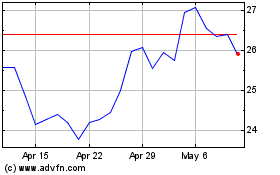

Exchange Rates

Brazil’s foreign exchange system allows the purchase and sale of currency and the international transfer of reais by any person or legal

entity, regardless of amount, subject to certain regulatory procedures.

Since 1999, the real/U.S. dollar exchange rate has

fluctuated considerably. In the past, the Central Bank has intervened occasionally to control unstable movements in foreign exchange rates. We cannot predict whether the Central Bank or the Brazilian federal government will continue to let the

real float freely or will intervene in the exchange rate market through a currency band system or otherwise. The real may depreciate or appreciate against the U.S. dollar substantially in the future. See “Item 3D. Key

Information—Risk Factors—Risks Relating to Brazil.”

The following table sets forth the selling exchange rate,

expressed in reais per U.S. dollar, for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Exchange Rate of Reais to US$1.00 |

|

| Year ended December 31, |

|

Low |

|

|

High |

|

|

Average (1) |

|

|

Period-end |

|

| 2010 |

|

|

1.6554 |

|

|

|

1.8811 |

|

|

|

1.7601 |

|

|

|

1.6662 |

|

| 2011 |

|

|

1.5345 |

|

|

|

1.9016 |

|

|

|

1.6709 |

|

|

|

1.8758 |

|

| 2012 |

|

|

1.7024 |

|

|

|

2.1121 |

|

|

|

1.9588 |

|

|

|

2.0435 |

|

| 2013 |

|

|

1.9528 |

|

|

|

2.4457 |

|

|

|

2.1741 |

|

|

|

2.3426 |

|

| 2014 |

|

|

2.1974 |

|

|

|

2.7403 |

|

|

|

2.3547 |

|

|

|

2.6562 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Exchange Rate of Reais to US$1.00 |

|

| Month/period ended |

|

Low |

|

|

High |

|

|

Average (2) |

|

|

Period-end |

|

| October 31, 2014 |

|

|

2.391 |

|

|

|

2.534 |

|

|

|

2.448 |

|

|

|

2.444 |

|

| November 30, 2014 |

|

|

2.484 |

|

|

|

2.614 |

|

|

|

2.548 |

|

|

|

2.560 |

|

| December 31, 2014 |

|

|

2.561 |

|

|

|

2.74 |

|

|

|

2.639 |

|

|

|

2.656 |

|

| January 31, 2015 |

|

|

2.575 |

|

|

|

2.711 |

|

|

|

2.634 |

|

|

|

2.662 |

|

| February 28, 2015 |

|

|

2.869 |

|

|

|

2.881 |

|

|

|

2.816 |

|

|

|

2.878 |

|

| (1) |

Represents the average of the exchange rates on the last day of each month during the relevant periods. |

| (2) |

Represents the average of the exchange rates during the relevant periods. |

We will pay

any cash dividends and make any other cash distributions with respect to the common shares in reais. Accordingly, exchange rate fluctuations may affect the U.S. dollar amounts received by the holders of American Depositary Shares, or ADSs,

upon the conversion into U.S. dollars by the depositary of our ADS program of such distributions for payment to holders of ADSs. Fluctuations in the exchange rate between the real and the U.S. dollar may also affect the U.S. dollar equivalent

of the real price of our common shares on the São Paulo Stock Exchange.

7

| 3B. |

Capitalization and Indebtedness |

Not applicable.

| 3C. |

Reasons for the Offer and Use of Proceeds |

Not applicable.

Risks Relating to Embraer

A downturn in the commercial and executive aviation markets may reduce our sales and revenue, and, consequently, our profitability.

We expect that a substantial portion of our sales will be derived from sales of commercial aircraft and executive jets. Historically, these

markets have been cyclical due to a variety of factors that are both external and internal to the air travel industry, including general economic conditions.

Economic downturns in our industry may reduce air travel demand and corporate and personal spending, which may negatively impact our

Commercial Aviation and Executive Jets segments. Downturns may also lead to a decrease in the volume of financing available to our customers for aircraft purchases, particularly in the aforementioned segments. A continued downturn in general

economic conditions could result in further reductions in air travel and decreased orders for our aircraft. Our customers could also defer or cancel their purchases of our aircraft. We cannot predict the magnitude or duration of the impact that the

above events would have not only on the air transport industry as a whole and on our business in particular.

We depend on key customers.

In the Commercial Aviation segment, as of December 31, 2014, 78% of our firm orders in backlog for the EMBRAER 170/190 jet

family were from the airlines Skywest, American, United, Republic, JetBlue and Azul, and the leasing companies ILFC and Aldus. We believe that we will continue to depend on a select number of key customers, the loss of any one of which would reduce

our sales and our market share. Fewer sales would reduce our profitability.

Progressively, the commercial airline industry is seeking to

reduce costs and increase efficiency, and is experiencing a consolidation process through mergers and acquisitions and alliances through code-sharing arrangements. Although it is expected that such consolidations and alliances may result in the

creation of more stable and competitive airlines, they may also have the effect of reducing the number of existing and potential customers and, possibly, the number of aircraft purchases.

Financial difficulties, restructurings and bankruptcy proceedings of customer airlines can have a materially adverse effect on our results of

operations and financial position. . For more information, see “Item 5E – Off-Balance Sheet Agreements.”

In addition,

delays in payment cycles by significant customers can negatively affect our cash position and working capital, as occurred for example in the last quarter of 2014.

In our Defense & Security segment, the Brazilian Federal Government is our largest customer of defense aircraft products. Revenue

from sales to the Brazilian federal government accounted for more than 68.9% of segment revenue for the year ended December 31, 2014. A decrease in defense investments by the Brazilian federal government due to budgetary constraints or other

factors that are out of our control could decrease our Defense & Security revenue. We cannot assure that the Brazilian federal government will continue to acquire defense products and services from us in the future at the same rate or at

the same level.

8

We depend on key suppliers.

We do not manufacture all of the parts and components used in the production of our aircraft. More than -80% of the production costs of our

aircraft consist of materials and equipment purchased from our risk-sharing partners and other major suppliers. Risk-sharing arrangements are those in which suppliers are responsible for the design, development and manufacture of major components or

systems of our aircraft, such as wings, tail, fuselage, engines, hydraulic components, avionics and interior. Once risk-sharing partners have been selected and program development and aircraft production have begun, it is difficult to substitute

these partners. In some cases, the aircraft are designed specifically to accommodate a particular component, such as the engine, which cannot be substituted by another manufacturer without significant delays and expense. This dependence of ours on

these key suppliers makes us susceptible to the risks of performance, product quality and financial condition of these risk-sharing partners.

We cannot assure you that we will not experience significant delays in obtaining key equipment in our manufacturing process in the future.

Although we work closely with, and monitor the production process of, our risk-sharing partners and major suppliers, the failure of our risk-sharing partners and other major suppliers to meet our performance specifications, quality standards or

delivery schedules or to comply with regulatory requirements (including export control requirements) could affect our ability to deliver new aircraft to customers in a timely manner. In addition, a large amount of the equipment employed by the

aircraft industry is subject to export control regulations and, as such, deliveries are dependent on suppliers having secured the applicable export licenses.

Our aircraft sales are subject to cancellation provisions that may reduce our revenues, profitability, backlog and cash flow.

A portion of our aircraft firm orders is subject to significant contingencies before delivery. Prior to delivery, some of our purchase

contracts may be terminated, or all or a portion of a particular firm order may be canceled, for different reasons, including (i) extended delays in delivering aircraft or failure to obtain certification of the aircraft or otherwise meet

performance milestones and other requirements, (ii) the failure of a customer to honor its aircraft purchases or (iii) production rate shortfalls.

Our customers may also reschedule deliveries or cancel orders, particularly during an economic downturn. In 2014, we had revenue of US$14.5

million related to contractual penalties paid by customers due to contract cancellations, compared to contractual penalty revenues of US$40.8 million in 2013 and US$41.7 million in 2012. Material cancellations, delays or decreases in the number of

aircraft delivered in any year would reduce our sales and revenue, and, consequently, our profitability, cash flow and backlog.

Some of our

aircraft sales may be subject to financial and residual value guarantees and trade-in options that may require us to make significant cash disbursements.

For certain aircraft sales we guarantee the financial performance of a portion of the financing for, and the residual value of, some of our

aircraft that have already been delivered. Financial guarantees are provided to financing parties to support a portion of the payment obligations of purchasers of our aircraft under their financing arrangements to mitigate default-related losses.

These guarantees are collateralized by the financed aircraft.

Residual value guarantees typically ensure that, at the exercise date

(between 6 and 18 years after the aircraft delivery date), the relevant aircraft will have a residual market value equal to a percentage of the original sale price. Most of our residual value guarantees are subject to a limitation (a

“cap”) and, therefore, on average, our residual value guarantee exposure is limited to 17% of the original sale price. In the event of an exercise by a purchaser of its residual value guarantee, we will bear the difference, if any, between

the guaranteed residual value and the market value of the aircraft at the time of exercise, limited to the cap.

Assuming all customers

who are supported by off-balance sheet financial guarantees defaulted on their aircraft financing arrangements, and also assuming we were required to pay the full aggregate amount of outstanding financial and residual value guarantees and were

unable to remarket any of the aircraft to offset our obligations, our maximum exposure would have been US$687.7 million (or, subtracting provisions and liabilities already recorded in the amount of US$156.2 million as reflected in Note 25 to our

audited consolidated financial statements, US$531.5 million) under these guarantees as of December 31, 2014. As a result, we would be obligated to make substantial payments that may not be recoverable through proceeds from aircraft sales or

leases, particularly if we are not able to remarket any of the aircraft to offset our obligations or financing defaults occur with respect to a significant portion of our aircraft. The value of the underlying aircraft is more likely to decrease and

third parties are more likely to default during economic downturns. For further discussion see our exposure to these guarantees in Note 36 to our audited consolidated financial statements and “Item 5E – Off Balance Sheet Agreements.”

9

In addition, we sometimes provide trade-in options to our customers in purchase agreements for

new aircraft. These options provide customers with the right to trade in aircraft upon the purchase and acceptance of a new aircraft. In 2014, we accepted five aircraft, with a total invoiced value of US$43.9 million, for trade-in pursuant to

trade-in options. In the aggregate, we are currently subject to trade-in options relating to 12 aircraft, as a result of trade-ins tied to contractual obligations with customers and to their taking delivery of certain new aircraft. In addition,

other aircraft may become subject to trade-in due to new sales agreements. The trade-in price is determined based on the new aircraft sold, as well as other factors, including a market value assessment performed by independent third party

appraisers. We may be required to accept trade-ins at prices that are at market price of the aircraft, which would result in financial loss for us when we receive the aircraft.

We continuously re-evaluate our risk related to financial guarantees and trade-in obligations based on a number of factors, including the

estimated future market value of our aircraft based on third-party appraisals, information on similar aircraft remarketing in the secondary market and the credit rating of the customers.

In 2014, 2013 and 2012, we made provisions of US$238.0 million, US$293.5 million and US$584.4 million, respectively, related to exposure from

financial guarantees and residual value guarantees.

Any unexpected decrease in the market value of the aircraft covered by trade-in

rights or financial guarantees would decrease our ability to recover the amounts payable to satisfy our obligations and cause us to incur additional charges to income. If we are required to pay amounts related to such guarantees, we may not have

sufficient cash or other financial resources available to do so and may need to seek financing to fund these payments. We cannot assure you that the then-prevailing market conditions would allow us to resell or lease the underlying aircraft at its

anticipated fair value or in a timely manner. Consequently, honoring our financial guarantee or trade-in obligations could require us to make significant cash disbursements in a given year, which, in turn, would reduce our cash flow in that year.

Any decrease in Brazilian federal government-sponsored customer financing, or increases in government-sponsored financing that benefits our

competitors, may decrease the competitiveness of our aircraft.

Traditionally, aircraft original equipment manufacturers, or OEMs,

from time to time, have received support from governments through governmental export credit agencies, or ECAs, in order to offer competitive financing conditions to their customers, especially in periods of credit tightening from the traditional

lending market. After the “credit crunch” in 2008, the participation of ECAs grew in importance, playing a crucial role in the aviation industry.

In the past, much of this official government support was alleged to constitute unofficial subsidies causing market distortions, which gave

rise to disputes among governments at the World Trade Organization, or WTO. Since 2007, an agreement known as the Aircraft Sector Understanding, or ASU, developed by the Organization for Economic Co-operation and Development, or OECD, has provided

guidelines for the predictable, consistent and transparent use of government-supported export financing for the sale or lease of aircraft, in order to establish a “level-playing field.” ECAs from signatory countries are required to offer

terms and conditions no more favorable than those contained in the ASU’s base financial agreement when financing sales of aircraft that compete with those produced by the OEMs of their respective countries. The effect of the agreement is to

encourage aircraft purchasers to focus on the price and quality of aircraft products offered by OEMs rather than on the financial packages offered by their respective governments.

The Brazilian ECA, Banco Nacional de Desenvolvimento Econômico e Social (Brazilian Social and Economic Development Bank),

or BNDES, together with the Brazilian National Treasury Export Guarantee Fund, offer financing and export credit insurance to our customers under terms and conditions required by the ASU. Any reduction or restriction to the Brazilian export

financing program, and any increase in our customers’ financing costs for participation in this program, above those provided in the ASU’s base financial agreement, may cause the cost-competitiveness of our aircraft to decline. Other

external factors may also impact our competitiveness in the market, including, but not limited to, aircraft OEMs from countries which are not signatories to the ASU agreement offering attractive financing packages, or any new government subsidies

supporting any of our major competitors.

10

From 2004 through 2014, approximately 22% of our Commercial Aviation deliveries was subject to

official export credits support by the BNDES and the Export Guarantee Fund (Fundo de Garantia à Exportação), or FGE, a special fund linked to the Ministry of Finance and managed by the BNDES to foster exports. In 2013 and

2014, approximately 43% and 47%, respectively, of our Commercial Aviation deliveries were supported by the Brazilian ECA Program. We cannot ensure that the Brazilian federal government, for policy reasons or otherwise, will not reduce or discontinue

this type of funding for the financing of our aircraft or that other sources of funding will be available to our customers. The loss or significant reduction of funds available to our customers, without an adequate substitute, could lead to a

reduction in sales of our aircraft.

We may face a number of challenges resulting from the development of new products and the possible pursuit of

strategic growth opportunities.

Our products require a high level of research, development and production expenditures. Our main

ongoing project is the development of the E-Jets E2 family, comprising three new airplanes, the E175-E2, E190-E2, and E195-E2. We estimate our total investment in this project will be US$1.7 billion through 2020. Our investment in the Legacy 450/500

executive jets is estimated at US$750.0 million and is expected to be invested through 2015, in property, plant and equipment and development for the Legacy 450/500 programs, which we launched in April 2008. The first Legacy 500 executive jet was

delivered in October 2014, and the Legacy 450 is expected to enter into service in 2015. We cannot assure you that our products will be accepted by our customers and the market, and if any of our new products does not meet customer expectations or

market demand, our business would be materially and adversely affected. In addition, as we continue to develop new products, we may need to reallocate existing resources and coordinate with new suppliers and risk-sharing partners. Finally, cost

overruns and delays in the development and delivery of new products would materially and adversely affect us.

We have in the past and may

pursue strategic growth opportunities, including joint ventures, acquisitions or other transactions, to expand our business or enhance our products and technology. We may face a number of challenges, including difficulties in identifying appropriate

candidates, assimilating their operations and personnel and maintaining internal standards and controls, as well as the diversion of our management’s focus from our ongoing business. We cannot assure you that we will be able to meet these

challenges or that our business will not face disruptions.

We may suffer from a lack of qualified personnel.

From time to time, there is significant competition within the aviation industry for skilled personnel in general and engineers in particular.

To the extent such competition reoccurs, we may be unable to recruit and retain the necessary number of highly skilled engineers and other personnel we require. Failure to coordinate our resources in a timely manner or to attract and retain skilled

personnel could slow down our development efforts and cause delays in production and deliveries of our aircraft, which would negatively affect us.

We may be required to refund cash contributions in connection with the production or development of our aircraft if certain milestones for our aircraft

are not reached.

We have arrangements with our risk-sharing partners, pursuant to which they have contributed to us, in cash over

the years, a total of US$873.5 million since the beginning of the development of the EMBRAER 170/190, Phenom 100/300 Legacy 450/500 jet families and the E2 jet family through December 31, 2014. Cash contributions would have to be refunded by us

to the risk-sharing partners to the extent we had failed to fulfill certain agreed-upon milestones. The full amount of these cash contributions were nonrefundable during 2014, as we had met all the required milestones.

Although, currently, no cash contributions from our risk-sharing partners are refundable, we may enter into similar arrangements, and if we

are unable to meet certain milestones agreed upon with our risk-sharing partners, we may be required to refund cash contributions for which we have not established provisions.

11

We face significant international competition, which may adversely affect us.

The worldwide commercial aircraft manufacturing industry is highly competitive. Along with Boeing, Airbus and Bombardier, all large

international companies, we are one of the leading manufacturers of commercial aircraft in the world. Certain of these competitors may have greater financial, marketing and other resources than we have. Although we have attained a significant share

of the market for our commercial aircraft products, we cannot assure you that we will be able to maintain our current market share. Our ability to maintain our market share and remain competitive in the commercial aircraft manufacturing market over

the long term requires continued enhancement of our products’ technology and performance. In addition, tariff and other entry barriers may hinder our growth in certain markets. Our primary competitor in the regional and mid-capacity jet markets

is Bombardier Inc., a Canadian company, which has significant technological capabilities and financial and marketing resources. Additionally, Chinese, Russian and Japanese companies are also developing mid-capacity jets and already have firm orders

in backlog.

As a relatively new entrant to the business jet market, we face significant competition from companies with longer operating

histories and established reputations in this industry. Some of our competitors in the business jet market have a longer track record and a more established customer base and, as a result, may reach the market with their products before we do and

may frustrate our efforts to gain greater market share. In addition, the level of pre-owned aircraft for sale continues to pressure new aircraft demand in this segment and may impact the value of the used aircraft we own in our portfolio. We cannot

assure you that we will continue to increase our market share in the business jet market segment, or that we will not experience a reduction in our current market share in this segment.

Intellectual property violations may negatively affect us.

We rely upon patent, copyright, trademark and trade secret laws, and agreements with our employees, customers, suppliers and other parties, to

establish and maintain our intellectual property rights in technology and products used in our operations. Despite these efforts to protect our intellectual property rights, any of our direct or indirect intellectual property rights could be

challenged, invalidated or circumvented. In addition, although we believe that we lawfully comply with the intellectual property rights granted to others, we may be accused of infringement on occasion and could have claims asserted against it in the

future. These claims could harm our reputation, lead to fines and penalties and prevent us from offering certain products or services. Any claims or litigation in this area, whether we ultimately win or lose, could be time-consuming and costly, hurt

our reputation or require us to enter into licensing arrangements. We may not be able to enter into these licensing arrangements on acceptable terms. If a claim of infringement were successful against us, an injunction might be ordered against us,

causing further damages.

We are subject to environmental, health and safety risks.

Our products, as well as our manufacturing and service activities, are subject to environmental laws and regulations in each of the

jurisdictions in which we operate, governing, among other things: product performance or content; energy use and greenhouse gas emission; air; water and noise pollution; the use, storage, transportation, labeling and disposal or release of hazardous

substances, human health risks arising from the exposure to hazardous or toxic materials; and the remediation of soil and groundwater contamination on or under our properties (whether or not caused by us), or on or under other properties and caused

by our current or past operations. Environmental regulatory requirements, or enforcements thereof, may become more stringent and we way incur additional costs to be compliant with such future requirements or enforcements.

Investigations by U.S. government authorities under the Foreign Corrupt Practices Act and related inquiries may result in substantial fines and other

adverse effects.

In September 2010, we received a subpoena from the Securities and Exchange Commission, or SEC, and associated

inquiries from the U.S. Department of Justice, or DOJ, concerning possible non-compliance with the U.S. Foreign Corrupt Practices Act, or FCPA, in relation to certain aircraft sales outside of Brazil. We retained outside counsel to conduct an

internal investigation, have cooperated with the SEC and the DOJ, and have voluntarily expanded our investigations. The U.S. government inquiries, related inquiries and developments in other countries, and our own internal investigations are

continuing. Any action in these or related inquiries, proceedings or other developments, or any agreement we enter into to settle the same, may result in substantial fines and other sanctions and adverse consequences. See “Item 8A –

Consolidated Statements and other Financial Information – Legal Proceedings.”

12

Risks Relating to the Commercial Airline Industry

Scope clause restrictions in airline pilot contracts may limit demand for regional and mid-capacity jets in the U.S. market.

A key limiting factor in demand for regional and mid-capacity jets is the existence of scope clauses contained in airline pilot contracts.

These scope clauses are union-negotiated restrictions on the number and/or size of regional and mid-capacity jets that a particular carrier may operate. Current scope clause restrictions, which are more prevalent in the United States, include

restrictions on the weight of aircraft and number of 76 seat commercial aircraft in an airline’s fleet operated by regional carriers. As a result, our opportunities for near-term growth in the U.S. regional jet market in the 76 seat jet

category may be limited. The continuation or further tightening of scope clauses could also lead some of our customers who have purchased options to acquire our regional and mid-capacity jets not to exercise those options. We cannot assure you that

current restrictions will be lessened, or will not be expanded, including by amending these scope clauses to cover larger-sized commercial aircraft. Furthermore, although scope clauses are less prevalent outside the United States, we cannot assure

you that scope clauses will not become more prevalent or restrictive, or that some other form of restriction will not take effect, in Europe or in other markets.

The supply of pilots to the airline industry may be limited.

New FAA regulations may reduce the supply of qualified pilot candidates eligible for hiring by the airline industry. A first officer in

domestic operations must now hold an airline transport pilot certificate and an airplane type rating for the aircraft to be flown. An airline transport pilot certificate requires that a pilot be 23 years of age and have 1,500 hours total time as a

pilot. Due to this legislation, there may be a growing scarcity of new entrant pilots who meet the new experience qualifications, impacting mainly regional carriers as they are the normal entry airlines for new pilots, and the majors are expected to

hire many of their experienced pilots. Any further inability to recruit, train and retain qualified pilots may materially impact our customers’ operations.

We are subject to stringent certification and regulatory requirements, which may adversely affect us.

Our civil aviation products are subject to regulation in Brazil and in each jurisdiction where our customers are located. The aviation

authority in Brazil, known as the Agência Nacional de Aviação Civil – ANAC (National Civil Aviation Agency), or Brazilian Aviation Authority, as well as authorities in other countries in which our customers are

located, most notably the U.S. Federal Aviation Administration, or the FAA, and the European Aviation Safety Agency, or the EASA, must certify our civil aviation products before we can deliver them to our customers. We cannot assure you that we will

be able to obtain certification of our aircraft on a timely basis or at all. In addition, complying with the requirements of regulatory authorities can be both expensive and time-consuming. If we fail to obtain a required certification from an

aviation authority for any of our aircraft, that aviation authority can prohibit the use of that aircraft within its jurisdiction until certification has been obtained. Changes in government regulations and certification procedures could also delay

our start of production as well as entry of a new product into a new market. Despite our continuous efforts to strictly observe and comply with all aviation certification and other regulatory requirements, we cannot predict how future laws or

changes in the interpretation, administration or enforcement of such laws will affect us. We may be required to spend significantly more money to comply with these laws or to respond to these changes.

We and our customers are also subject to extensive Brazilian federal, state and local and foreign environmental protection laws and

regulations concerning matters such as discharge and emission of substances into the environment, the disposal of hazardous wastes, the remediation and abatement of contaminants and other activities affecting the environment. We currently have

several ongoing comprehensive programs to reduce the effects of our operations on the environment. For more information, see “Item 4E. Information on the Company—Property, Plant and Equipment.” Changes to current environmental

regulations may demand that we spend additional amounts to enhance our environmental compliance programs. In addition, environmental regulations, such as those requiring the reduction of greenhouse gas emissions, are becoming one of the main drivers

of airline fleet decisions, potentially causing our customers to change their purchasing plans or requiring us to make additional capital investments to adapt to new requirements.

13

The various products manufactured and sold by us must also comply with relevant health and safety

and substances and preparations related laws and regulations in the jurisdictions in which we operate. Although we seek to ensure that our products meet the highest quality standards, increasingly stringent and complex laws and regulations, new

scientific discoveries, delivery of defective products or the obligation to notify or provide regulatory authorities or others with required information (such as under the EU regulation known as “REACH,” which addresses the production and

use of chemical substances) may force us to adapt, redesign, redevelop, recertify and/or eliminate products from the markets in which we operate. Seizures of non-compliant products may be required, and we may incur administrative, civil or criminal

penalties. In the event of an accident or other serious incident involving a product, we may be required to conduct investigations and undertake remedial activities.

Any accidents or catastrophic events involving our aircraft could adversely affect us.

We believe that our reputation and the safety record of our aircraft are important selling points for our products. However, the safe operation

of our aircraft depends to a significant degree on a number of factors largely outside our control, including our customers’ proper maintenance and repair of our aircraft and pilot skill. The occurrence of one or more accidents or catastrophic

events involving one of our aircraft could adversely affect our reputation and future sales, as well as the market price of our common shares and the ADSs.

Risks Relating to Brazil