EOG Resources Posts Loss as Revenue Falls 2.5%

November 03 2016 - 10:27PM

Dow Jones News

By Josh Beckerman

Shale driller EOG Resources Inc. reported another quarterly loss

but made progress in productivity and cost reductions.

EOG raised its 2016 capital spending guidance by $200 million to

the range of $2.6 billion to $2.8 billion, excluding

acquisitions.

Shares rose 1.75% in after-hours trading to $93.69.

In September, Houston-based EOG agreed to buy Yates Petroleum

Corp. for roughly $2.34 billion.

Over all, EOG posted a loss of $190 million, or 35 cents a

share, compared with a loss of $4.08 billion, or $7.47 a share, a

year earlier. The 2015 quarter included $4.1 billion of impairment

charges. Loss excluding items was 40 cents a share, compared with a

profit excluding items of 2 cents a share a year earlier.

Revenue fell 2.5% to $2.12 billion.

Analysts polled by Thomson Reuters expected a loss excluding

items of 31 cents a share on revenue of $1.92 billion.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

November 03, 2016 22:12 ET (02:12 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

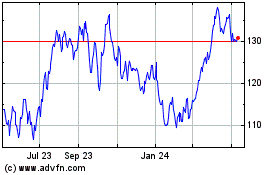

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Apr 2023 to Apr 2024