EOG Revenue Falls While Cost-Cutting Exceeds Goal

May 05 2016 - 7:03PM

Dow Jones News

By Josh Beckerman

EOG Resources Inc. posted a wider loss and a sharp revenue

decline in the first quarter, but the oil-and-gas producer said it

exceeded its goals for cost-cutting and U.S. oil production.

EOG, with a market value of more than $44 billion, is one of the

nation's top shale producers, operating in areas such as the Eagle

Ford field and the Delaware Basin. It has a smaller international

presence in locations including Trinidad and Tobago.

EOG said its lease and well expenses fell 29%, while total

operating expenses declined 20% to $1.99 billion from $2.49

billion.

The company said its move earlier this year to focus on "premium

drilling" operations helped it significantly improve average well

performance.

Amid a severe and prolonged pricing downturn, EOG said in

February that its 2016 capital budget would be about $2.4 billion

to $2.6 billion, representing a year-over-year decline of 45% to

50%.

For the quarter ended March 31, EOG posted a loss of $471.8

million, or 86 cents a share, compared with a loss of $169.7

million, or 31 cents a share, a year earlier. EOG's loss excluding

items was 83 cents a share, compared with a profit excluding items

of three cents a share a year earlier.

Net operating revenue fell 42% to $1.35 billion.

Analysts polled by Thomson Reuters expected a loss excluding

items of 84 cents a share on revenue of $1.67 billion.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

May 05, 2016 18:48 ET (22:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

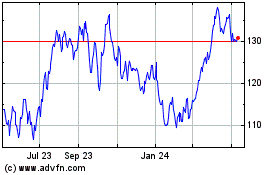

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Apr 2023 to Apr 2024