UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 2, 2015

EnerSys

(Exact name of registrant as specified in its charter)

Commission File Number: 1-32253

|

| | |

| | |

Delaware | | 23-3058564 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification No.) |

2366 Bernville Road, Reading, Pennsylvania 19605

(Address of principal executive offices, including zip code)

(610) 208-1991

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On November 2, 2015, EnerSys issued an earnings press release discussing its financial results for the second quarter of fiscal 2016. The press release, attached as Exhibit 99.1 hereto and incorporated herein by reference, is being furnished to the SEC and shall not be deemed to be "filed" for any purpose.

Item 8.01. Other Events

On November 2, 2015, EnerSys issued a press release announcing that its Board of Directors had declared a quarterly cash dividend of $0.175 per share, payable on December 24, 2015 to stockholders of record as of December 11, 2015. The press release, attached hereto as Exhibit 99.2, is incorporated by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 Press Release, dated November 2, 2015, of EnerSys regarding the financial results for the second quarter of fiscal 2016.

99.2 Press Release, dated November 2, 2015, of EnerSys regarding a quarterly cash dividend.

Signature(s)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | |

| | EnerSys | |

| | | |

Date: November 2, 2015 | By: | /s/ Michael J. Schmidtlein | |

| | Michael J. Schmidtlein | |

| | Chief Financial Officer | |

| | | |

| | | |

| | | |

| | | |

Exhibit Index

|

| | |

Exhibit No.

| | Description

|

EX-99.1 | | Press Release, dated November 2, 2015, of EnerSys regarding the financial results for the second quarter of fiscal 2016. |

EX-99.2 | | Press Release, dated November 2, 2015, of EnerSys regarding a quarterly cash dividend. |

Exhibit 99.1 PRESS RELEASE, DATED NOVEMBER 2, 2015, OF ENERSYS REGARDING FINANCIAL

RESULTS FOR THE SECOND QUARTER FISCAL 2016

EnerSys Reports Second Quarter Fiscal 2016 Results

Reading, PA, USA, November 2, 2015 -- EnerSys (NYSE: ENS) the global leader in stored energy solutions for industrial applications, announced today results for its second quarter of fiscal 2016, which ended on September 27, 2015.

Net earnings attributable to EnerSys stockholders (“Net earnings”) for the second quarter of fiscal 2016 were $40.0 million, or $0.87 per diluted share, including an unfavorable highlighted net of tax impact of $0.10 per share from a charge of $2.0 million for restructuring plans, $2.9 million for legal proceedings charge, net, $0.6 million for ERP system implementation and $0.2 million for fees related to acquisition activities, partially offset by a tax benefit of $1.0 million related to accelerated stock-based compensation of senior executives.

The Net earnings of $0.87 per diluted share compares to Net earnings of $1.16 per diluted share for the second quarter of fiscal 2015, which included a favorable highlighted net of tax impact of $0.10 per share impact from a legal accrual reversal, net of professional fees of $9.9 million and gain of $2.0 million in connection with the disposition of our equity interest in Altergy, pursuant to a legal settlement, offset by charges of $1.4 million for restructuring and other exit costs, $5.3 million for stock-based compensation of senior executives, $0.5 million for ERP system implementation and $0.1 million for fees related to acquisition activities.

Excluding these highlighted items, adjusted Net earnings per diluted share for the second quarter of fiscal 2016, on a non-GAAP basis were $0.97, which exceeds the guidance of $0.92 to $0.96 per diluted share given by the Company on August 5, 2015. These earnings compare to the prior year second quarter adjusted Net earnings of $1.06 per diluted share. Please refer to the section included herein under the heading “Reconciliation of Non-GAAP Financial Measures” for a discussion of the Company’s use of non-GAAP adjusted financial information.

Net sales for the second quarter of fiscal 2016 were $569.1 million, a decrease of 10% from the prior year second quarter net sales of $629.9 million and a 1% sequential quarterly increase from the first quarter of fiscal 2016 net sales of $562.1 million. The 10% decrease compared to prior year quarter was largely the result of a 9% decrease due to foreign currency translation impact and a 3% decrease in organic volume, partially offset by a 1% increase each from pricing and acquisitions. The 1% increase in the current quarter compared to the first quarter of fiscal 2016 was the result of a 1% increase each from pricing and acquisitions, partially offset by a 1% foreign currency translation impact.

The Company’s operating results for its business segments for the second quarters of fiscal 2016 and 2015 are as follows:

|

| | | | | | | |

| Quarter ended |

| ($ millions) |

| September 27, 2015 | | September 28, 2014 |

Net sales by segment | | | |

Americas | $ | 322.5 |

| | $ | 333.2 |

|

EMEA | 189.4 |

| | 233.3 |

|

Asia | 57.2 |

| | 63.4 |

|

| | | |

Total net sales | $ | 569.1 |

| | $ | 629.9 |

|

| | | |

Operating earnings | | | |

Americas | $ | 49.4 |

| | $ | 42.9 |

|

EMEA | 17.1 |

| | 26.1 |

|

Asia | 0.1 |

| | 4.5 |

|

Restructuring and other exit charges - EMEA | (1.9 | ) | | (1.8 | ) |

Restructuring charges - Asia | (0.7 | ) | | — |

|

Competition investigations and related legal charges - EMEA | (4.0 | ) | | — |

|

Reversal of legal accrual, net of fees - Americas | 0.8 |

| | 16.2 |

|

ERP system implementation - Americas | (1.0 | ) | | (0.7 | ) |

Stock-based compensation of senior executives (Americas $3.7, EMEA $2.7, Asia $0.7) | — |

| | (7.1 | ) |

Acquisition activity expense - Americas | — |

| | (0.1 | ) |

Acquisition activity expense - Asia | (0.2 | ) | | — |

|

| | | |

Total operating earnings | $ | 59.6 |

| | $ | 80.0 |

|

EMEA - Europe, Middle East and Africa

Net earnings for the six months of fiscal 2016 were $88.4 million, or $1.91 per diluted share, including an unfavorable net of tax impact of $0.06 per share from a charge of $2.9 million for restructuring plans, $2.9 million for legal proceedings charge, net, $1.1 million for ERP system implementation and $0.4 million for fees related to acquisition activities, partially offset by a gain of $3.3 million relating to the sale of a facility in our Asia segment and a tax benefit of $1.0 million related to accelerated stock-based compensation of senior executives.

Net earnings for the six months of fiscal 2015 were $105.5 million, or $2.15 per diluted share, including a favorable net of tax impact of $0.07 per share from a legal accrual reversal, net of professional fees of $9.9 million and gain of $2.0 million in connection with the disposition of our equity interest in Altergy, pursuant to a legal settlement, offset by charges of $2.7 million for restructuring and other exit costs, $5.3 million for stock-based compensation of senior executives, $0.5 million for ERP system implementation and $0.3 million for fees related to acquisition activities.

Adjusted Net earnings for the six months of fiscal 2016, on a non-GAAP basis, were $1.97 per diluted share. This compares to the prior year six months adjusted Net earnings of $2.08 per diluted share. Please refer to the section included herein under the heading “Reconciliation of Non-GAAP Financial Measures” for a discussion of the Company's use of non-GAAP adjusted financial information.

Net sales for the six months of fiscal 2016 were $1,131.2 million, a decrease of 11% from the net sales of $1,264.0 million in the comparable period in fiscal 2015. The 11% decrease was largely the result of a 9% decrease due to foreign currency translation impact and a 3% decrease in organic volume, partially offset by a 1% increase from acquisitions.

The Company's operating results for its business segments for the six months of fiscal years 2016 and 2015 are as follows:

|

| | | | | | | |

| Six months ended |

| ($ millions) |

| September 27, 2015 | | September 28, 2014 |

Net sales by segment | | | |

Americas | $ | 639.5 |

| | $ | 664.1 |

|

EMEA | 386.1 |

| | 475.3 |

|

Asia | 105.6 |

| | 124.6 |

|

| | | |

Total net sales | $ | 1,131.2 |

| | $ | 1,264.0 |

|

| | | |

Operating earnings | | | |

Americas | $ | 95.7 |

| | $ | 84.4 |

|

EMEA | 37.7 |

| | 54.7 |

|

Asia | 0.1 |

| | 8.1 |

|

Restructuring charges - Americas | (0.6 | ) | | — |

|

Restructuring and other exit charges - EMEA | (2.5 | ) | | (3.6 | ) |

Restructuring charges - Asia | (0.7 | ) | | — |

|

Competition investigations and related legal charges - EMEA | (4.0 | ) | | — |

|

Reversal of legal accrual, net of fees - Americas | 0.8 |

| | 16.2 |

|

Gain on sale of facility - Asia | 4.3 |

| | — |

|

Stock-based compensation of senior executives (Americas $3.7, EMEA $2.7, Asia $0.7) | — |

| | (7.1 | ) |

ERP system implementation - Americas | (1.8 | ) | | (0.7 | ) |

Acquisition activity expense - Americas | (0.2 | ) | | (0.1 | ) |

Acquisition activity expense - Asia | (0.2 | ) | | (0.2 | ) |

| | | |

Total operating earnings | $ | 128.6 |

| | $ | 151.7 |

|

"Our adjusted earnings per share of $0.97 for our second quarter exceeded the range of our previous guidance of $0.92 to $0.96,” stated John D. Craig, chairman and chief executive officer of EnerSys. “We continue to experience a global reserve power spending pause and have taken actions to reduce our manufacturing and SG&A costs until our order rate picks up. Our current order intake and backlog remain positive in motive power. Our third quarter guidance for non-GAAP adjusted Net earnings per diluted share is $0.90 to $0.94, which excludes an expected charge of $0.06 from our ongoing restructuring programs, ERP system implementation and acquisition expenses.”

Reconciliation of Non-GAAP Financial Measures

This press release contains financial information determined by methods other than in accordance with U.S. Generally Accepted Accounting Principles, ("GAAP"). EnerSys' management uses the non-GAAP measure “adjusted Net Earnings” in their analysis of the Company's performance. This measure, as used by EnerSys in past quarters and years, adjusts Net Earnings determined in accordance with GAAP to reflect changes in financial results associated with the Company's restructuring initiatives and other highlighted charges and income items. Management believes the presentation of this financial measure reflecting these non-GAAP adjustments provides important supplemental information in evaluating the operating results of the Company as distinct from results that include items that are not indicative of ongoing operating results; in particular, those charges that the Company incurs as a result of restructuring activities, impairment of goodwill and indefinite-lived intangibles and those charges and credits that are not directly related to operating unit performance, such as fees and expenses related to acquisition activities, stock-based compensation of senior executives, significant legal proceedings, ERP system implementation and tax valuation allowance changes. Because these charges are not incurred as a result of ongoing operations or are incurred as a result of a potential or previous acquisition, they are not a helpful measure of the performance of our underlying business particularly in light of their unpredictable nature. This non-GAAP disclosure has limitations as an analytical tool, should not be viewed as a substitute for Net Earnings determined in accordance with GAAP, and should not be considered in isolation or as a substitute for analysis of the Company's results as reported under GAAP, nor is it necessarily comparable to non-GAAP performance measures that may be presented by other companies. Management believes that this non-GAAP supplemental information will be helpful in understanding the Company's ongoing operating results. This supplemental presentation should not be construed as an inference that the Company's future results will be unaffected by similar adjustments to Net Earnings determined in accordance with GAAP.

Included below is a reconciliation of non-GAAP adjusted financial measures to preliminary amounts. Non-GAAP adjusted Net earnings are calculated excluding restructuring and other highlighted charges and credits. The following tables provide additional information regarding certain non-GAAP measures:

|

| | | | | | | | | |

| Quarter ended | |

| September 27, 2015 | | | September 28, 2014 | |

| (in millions, except share and per share amounts) | |

Net earnings reconciliation | | | | | |

As reported Net earnings | $ | 40.0 |

| | | $ | 56.3 |

| |

Non-GAAP adjustments, net of tax: | | | | | |

Restructuring charges | 2.0 |

| (1) | | 1.4 |

| (1) |

Legal proceedings charge / (reversal of legal accrual, net of fees) | 2.9 |

| (2) | | (9.9 | ) | (2) |

Gain on disposition of equity interest in Altergy | — |

| | | (2.0 | ) | (2) |

ERP system implementation | 0.6 |

| (3) | | 0.5 |

| (3) |

Stock-based compensation of senior executives | — |

| | | 5.3 |

| (4) |

Acquisition activity expense | 0.2 |

| (6) | | 0.1 |

| (6) |

Tax benefit related to stock-based compensation of senior executives | (1.0 | ) | (7) | | — |

| |

Non-GAAP adjusted Net earnings | $ | 44.7 |

| | | $ | 51.7 |

| |

| | | | | |

Outstanding shares used in per share calculations | | | | | |

Basic | 44,944,027 |

| | | 46,133,637 |

| |

Diluted | 46,005,399 |

| | | 48,537,276 |

| |

| | | | | |

Non-GAAP adjusted Net earnings per share: | | | | | |

Basic | $ | 1.00 |

| | | $ | 1.12 |

| |

Diluted | $ | 0.97 |

| | | $ | 1.06 |

| |

| | | | | |

Reported Net earnings per share: | | | | | |

Basic | $ | 0.89 |

| | | $ | 1.22 |

| |

Diluted | $ | 0.87 |

| | | $ | 1.16 |

| |

Dividends per common share | $ | 0.175 |

| | | $ | 0.175 |

| |

The following table provides the regional allocation of the non-GAAP adjustments shown in the reconciliation above:

|

| | | | | | | | | | | | | | | | |

| | Quarter ended |

| | September 27, 2015 | | September 28, 2014 |

| | Pre-tax | | Net of tax | | Pre-tax | | Net of tax |

| | ($ millions) | | ($ millions) |

(1) Restructuring and other exit charges - EMEA | | $ | 1.9 |

| | $ | 1.3 |

| | $ | 1.8 |

| | $ | 1.4 |

|

(1) Restructuring - Asia | | 0.7 |

| | 0.7 |

| | — |

| | — |

|

(2) Competition investigations and related legal charges - EMEA | | 4.0 |

| | 3.4 |

| | — |

| | — |

|

(2) Reversal of legal accrual, net of fees - Americas | | (0.8 | ) | | (0.5 | ) | | (16.2 | ) | | (9.9 | ) |

(2) Gain on disposition of equity interest in Altergy - Americas | | — |

| | — |

| | (2.0 | ) | | (2.0 | ) |

(3) ERP system implementation - Americas | | 1.0 |

| | 0.6 |

| | 0.7 |

| | 0.5 |

|

(4) Stock-based compensation of senior executives - Americas | | — |

| | — |

| | 3.7 |

| | 2.8 |

|

(4) Stock-based compensation of senior executives - EMEA | | — |

| | — |

| | 2.7 |

| | 2.0 |

|

(4) Stock-based compensation of senior executives - Asia | | — |

| | — |

| | 0.7 |

| | 0.5 |

|

(6) Acquisition activity expense - Americas | | — |

| | — |

| | 0.1 |

| | 0.1 |

|

(6) Acquisition activity expense - Asia | | 0.2 |

| | 0.2 |

| | — |

| | — |

|

(7) Tax benefit related to stock-based compensation of senior executives | | (1.0 | ) | | (1.0 | ) | | — |

| | — |

|

Total Non-GAAP adjustments | | $ | 6.0 |

| | $ | 4.7 |

| | $ | (8.5 | ) | | $ | (4.6 | ) |

|

| | |

| | |

| EMEA - Europe, Middle East and Africa |

|

| | | | | | | | | |

| Six months ended | |

| September 27, 2015 | | | September 28, 2014 | |

| (in millions, except share and per share amounts) | |

Net earnings reconciliation | | | | | |

As reported Net earnings | $ | 88.4 |

| | | $ | 105.5 |

| |

Non-GAAP adjustments, net of tax: | | | | | |

Restructuring charges | 2.9 |

| (1) | | 2.7 |

| (1) |

Legal proceedings charge / (reversal of legal accrual, net of fees) | 2.9 |

| (2) | | (9.9 | ) | (2) |

Gain on disposition of equity interest in Altergy | — |

| | | (2.0 | ) | (2) |

ERP system implementation | 1.1 |

| (3) | | 0.5 |

| (3) |

Stock-based compensation of senior executives | — |

| | | 5.3 |

| (4) |

Gain on sale of facility | (3.3 | ) | (5) | | — |

| |

Acquisition activity expense | 0.4 |

| (6) | | 0.3 |

| (6) |

Tax benefit related to stock-based compensation of senior executives | (1.0 | ) | (7) | | — |

| |

Non-GAAP adjusted Net earnings | $ | 91.4 |

| | | $ | 102.4 |

| |

| | | | | |

Outstanding shares used in per share calculations | | | | | |

Basic | 44,588,971 |

| | | 46,516,470 |

| |

Diluted | 46,380,887 |

| | | 49,131,757 |

| |

| | | | | |

Non-GAAP adjusted Net earnings per share: | | | | | |

Basic | $ | 2.05 |

| | | $ | 2.20 |

| |

Diluted | $ | 1.97 |

| | | $ | 2.08 |

| |

| | | | | |

Reported Net earnings per share: | | | | | |

Basic | $ | 1.98 |

| | | $ | 2.27 |

| |

Diluted | $ | 1.91 |

| | | $ | 2.15 |

| |

Dividends per common share | $ | 0.35 |

| | | $ | 0.35 |

| |

The following table provides the regional allocation of the non-GAAP adjustments shown in the reconciliation above:

|

| | | | | | | | | | | | | | | | |

| | Six months ended |

| | September 27, 2015 | | September 28, 2014 |

| | Pre-tax | | Net of tax | | Pre-tax | | Net of tax |

| | ($ millions) | | ($ millions) |

(1) Restructuring - Americas | | $ | 0.6 |

| | $ | 0.4 |

| | $ | — |

| | $ | — |

|

(1) Restructuring and other exit charges - EMEA | | 2.5 |

| | 1.8 |

| | 3.6 |

| | 2.7 |

|

(1) Restructuring - Asia | | 0.7 |

| | 0.7 |

| | — |

| | — |

|

(2) Competition investigations and related legal charges - EMEA | | 4.0 |

| | 3.4 |

| | — |

| | — |

|

(2) Reversal of legal accrual, net of fees - Americas | | (0.8 | ) | | (0.5 | ) | | (16.2 | ) | | (9.9 | ) |

(2) Gain on disposition of equity interest in Altergy - Americas | | — |

| | — |

| | (2.0 | ) | | (2.0 | ) |

(3) ERP system implementation - Americas | | 1.8 |

| | 1.1 |

| | 0.7 |

| | 0.5 |

|

(4) Stock-based compensation of senior executives - Americas | | — |

| | — |

| | 3.7 |

| | 2.8 |

|

(4) Stock-based compensation of senior executives - EMEA | | — |

| | — |

| | 2.7 |

| | 2.0 |

|

(4) Stock-based compensation of senior executives - Asia | | — |

| | — |

| | 0.7 |

| | 0.5 |

|

(5) Gain on sale of facility - Asia | | (4.3 | ) | | (3.3 | ) | | — |

| | — |

|

(6) Acquisition activity expense - Americas | | 0.2 |

| | 0.2 |

| | 0.1 |

| | 0.1 |

|

(6) Acquisition activity expense - Asia | | 0.2 |

| | 0.2 |

| | 0.2 |

| | 0.2 |

|

(7) Tax benefit related to stock-based compensation of senior executives | | (1.0 | ) | | (1.0 | ) | | — |

| | — |

|

Total Non-GAAP adjustments | | $ | 3.9 |

| | $ | 3.0 |

| | $ | (6.5 | ) | | $ | (3.1 | ) |

|

| | |

| | |

| EMEA - Europe, Middle East and Africa |

Summary of Earnings (Unaudited)

(In millions, except share and per share data)

|

| | | | | | | |

| Quarter ended |

| September 27, 2015 | | September 28, 2014 |

Net sales | $ | 569.1 |

| | $ | 629.9 |

|

Gross profit | 155.0 |

| | 162.5 |

|

Operating expenses | 89.6 |

| | 96.9 |

|

Restructuring charges | 2.6 |

| | 1.8 |

|

Legal accrual / (reversal of legal accrual, net of fees) | 3.2 |

| | (16.2 | ) |

Operating earnings | 59.6 |

| | 80.0 |

|

Earnings before income taxes | 53.8 |

| | 79.1 |

|

Net earnings attributable to EnerSys stockholders | $ | 40.0 |

| | $ | 56.3 |

|

| | | |

Net earnings per common share attributable to EnerSys stockholders: | | | |

Basic | $ | 0.89 |

| | $ | 1.22 |

|

Diluted | $ | 0.87 |

| | $ | 1.16 |

|

Dividends per common share | $ | 0.175 |

| | $ | 0.175 |

|

Weighted-average number of common shares used in per share calculations: | | | |

Basic | 44,944,027 |

| | 46,133,637 |

|

Diluted | 46,005,399 |

| | 48,537,276 |

|

|

| | | | | | | |

| Six months ended |

| September 27, 2015 | | September 28, 2014 |

Net sales | $ | 1,131.2 |

| | $ | 1,264.0 |

|

Gross profit | 305.4 |

| | 325.1 |

|

Operating expenses | 174.1 |

| | 186.0 |

|

Restructuring charges | 3.8 |

| | 3.6 |

|

Legal accrual / (reversal of legal accrual, net of fees) | 3.2 |

| | (16.2 | ) |

Gain on sale of facility | (4.3 | ) | | — |

|

Operating earnings | 128.6 |

| | 151.7 |

|

Earnings before income taxes | 115.8 |

| | 144.9 |

|

Net earnings attributable to EnerSys stockholders | $ | 88.4 |

| | $ | 105.5 |

|

| | | |

Net earnings per common share attributable to EnerSys stockholders: | | | |

Basic | $ | 1.98 |

| | $ | 2.27 |

|

Diluted | $ | 1.91 |

| | $ | 2.15 |

|

Dividends per common share | $ | 0.35 |

| | $ | 0.35 |

|

Weighted-average number of common shares used in per share calculations: | | | |

Basic | 44,588,971 |

| | 46,516,470 |

|

Diluted | 46,380,887 |

| | 49,131,757 |

|

EnerSys also announced that it will host a conference call to discuss the Company's second quarter fiscal year 2016 financial results and provide an overview of the business. The call will conclude with a question and answer session.

The call, scheduled for Wednesday, November 4, 2015 at 9:00 a.m. Eastern Time, will be hosted by John D. Craig, Chairman and Chief Executive Officer, David M. Shaffer, President & Chief Operating Officer, and Michael J. Schmidtlein, Chief Financial Officer.

The call will also be Webcast on EnerSys' website. There will be a free download of a compatible media player on the Company’s web site at http://www.enersys.com.

The conference call information is:

|

| |

Date: | Wednesday, November 4, 2015 |

Time: | 9:00 a.m. Eastern Time |

Via Internet: | http://www.enersys.com |

Domestic Dial-In Number: | 877-359-9508 |

International Dial-In Number: | 224-357-2393 |

Passcode: | 21398899 |

A replay of the conference call will be available from 12:30 p.m. on November 4, 2015 through midnight on December 4, 2015.

The replay information is:

|

| |

Via Internet: | http://www.enersys.com |

Domestic Replay Number: | 855-859-2056 |

International Replay Number: | 404-537-3406 |

Passcode: | 21398899 |

For more information, contact Thomas O'Neill, Vice President and Treasurer, EnerSys, P.O. Box 14145, Reading, PA 19612-4145, USA. Tel: 610-236-4040; Web site: www.enersys.com.

EDITOR'S NOTE: EnerSys, the global leader in stored energy solutions for industrial applications, manufactures and distributes reserve power and motive power batteries, battery chargers, power equipment, battery accessories and outdoor equipment enclosure solutions to customers worldwide. Motive power batteries and chargers are utilized in electric forklift trucks and other commercial electric powered vehicles. Reserve power batteries are used in the telecommunication and utility industries, uninterruptible power supplies, and numerous applications requiring stored energy solutions including medical, aerospace and defense systems. Outdoor equipment enclosure products are utilized in the telecommunication, cable, utility, transportation industries and by government and defense customers. The company also provides aftermarket and customer support services to its customers from over 100 countries through its sales and manufacturing locations around the world.

More information regarding EnerSys can be found at www.enersys.com.

Caution Concerning Forward-Looking Statements

This press release, and oral statements made regarding the subjects of this release, contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, or the Reform Act, which may include, but are not limited to, statements regarding EnerSys’ earnings estimates, intention to pay quarterly cash dividends, return capital to stockholders, plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts, including statements identified by words such as “believe,” “plan,” “seek,” “expect,” “intend,” “estimate,” “anticipate,” “will,” and similar expressions. All statements addressing operating performance, events, or developments that EnerSys expects or anticipates will occur in the future, including statements relating to sales growth, earnings or earnings per share growth, order intake, backlog, payment of future cash dividends, execution of its stock buy back program, judicial or regulatory proceedings, and market share, as well as statements expressing optimism or pessimism about future operating results or benefits from either its cash dividend or its stock buy back programs, are forward-looking statements within the meaning of the Reform Act. The forward-looking statements are based on management's current views and assumptions regarding future events and operating performance, and are inherently subject to significant business, economic, and competitive uncertainties and contingencies and changes in circumstances, many of which are beyond the Company’s control. The statements in this press release are made as of the date of this press release, even if subsequently made available by EnerSys on its website or otherwise. EnerSys does not undertake any obligation to update or revise these statements to reflect events or circumstances occurring after the date of this press release.

Although EnerSys does not make forward-looking statements unless it believes it has a reasonable basis for doing so, EnerSys cannot guarantee their accuracy. The foregoing factors, among others, could cause actual results to differ materially from those described in these forward-looking statements. For a list of other factors which could affect EnerSys’ results, including earnings estimates, see EnerSys’ filings with the Securities and Exchange Commission, "Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations," including "Forward-Looking Statements," set forth in EnerSys’ Quarterly Report on Form 10-Q for the period ended September 27, 2015. No undue reliance should be placed on any forward-looking statements.

Exhibit 99.2

EnerSys Announces Quarterly Dividend

Reading, PA, USA, November 2, 2015 – EnerSys (NYSE: ENS) the global leader in stored energy solutions for industrial applications, announced today its Board of Directors has declared a quarterly cash dividend of $0.175 per share of common stock payable on December 24, 2015 to holders of record as of December 11, 2015.

For more information, contact Thomas O'Neill, Vice President and Treasurer, EnerSys, P.O. Box 14145, Reading, PA 19612-4145, USA. Tel: 610-236-4040; Web site: www.enersys.com.

EDITOR'S NOTE: EnerSys, the global leader in stored energy solutions for industrial applications, manufactures and distributes reserve power and motive power batteries, battery chargers, power equipment, battery accessories and outdoor equipment enclosure solutions to customers worldwide. Motive power batteries and chargers are utilized in electric forklift trucks and other commercial electric powered vehicles. Reserve power batteries are used in the telecommunication and utility industries, uninterruptible power supplies, and numerous applications requiring stored energy solutions including medical, aerospace and defense systems. Outdoor equipment enclosure products are utilized in the telecommunication, cable, utility, transportation industries and by government and defense customers. The company also provides aftermarket and customer support services to its customers from over 100 countries through its sales and manufacturing locations around the world.

More information regarding EnerSys can be found at www.enersys.com.

Caution Concerning Forward-Looking Statements

This press release, and oral statements made regarding the subjects of this release, contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, or the Reform Act, which may include, but are not limited to, statements regarding EnerSys’ earnings estimates, intention to pay quarterly cash dividends, return capital to stockholders, plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts, including statements identified by words such as “believe,” “plan,” “seek,” “expect,” “intend,” “estimate,” “anticipate,” “will,” and similar expressions. All statements addressing operating performance, events, or developments that EnerSys expects or anticipates will occur in the future, including statements relating to sales growth, earnings or earnings per share growth, payment of future cash dividends, execution of its stock buy back program, and market share, as well as statements expressing optimism or pessimism about future operating results or benefits from either its cash dividend or its stock buy back programs, are forward-looking statements within the meaning of the Reform Act. The forward-looking statements are based on management's current views and assumptions regarding future events and operating performance, and are inherently subject to significant business, economic, and competitive uncertainties and contingencies and changes in circumstances, many of which are beyond the Company’s control. The statements in this press release are made as of the date of this press release, even if subsequently made available by EnerSys on its website or otherwise. EnerSys does not undertake any obligation to update or revise these statements to reflect events or circumstances occurring after the date of this press release.

Although EnerSys does not make forward-looking statements unless it believes it has a reasonable basis for doing so, EnerSys cannot guarantee their accuracy. The foregoing factors, among others, could cause actual results to differ materially from those described in these forward-looking statements. For a list of other factors which could affect EnerSys’ results, including earnings estimates, see EnerSys’ filings with the Securities and Exchange Commission, "Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations," including "Forward-Looking Statements," set forth in EnerSys’ Quarterly Report on Form 10-Q for the period ended September 27, 2015. No undue reliance should be placed on any forward-looking statements.

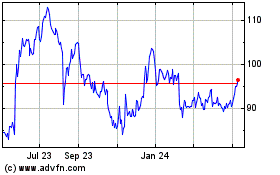

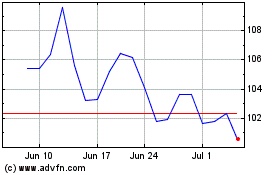

Enersys (NYSE:ENS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enersys (NYSE:ENS)

Historical Stock Chart

From Apr 2023 to Apr 2024