UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 13, 2015

EnerSys

(Exact name of registrant as specified in its charter)

Commission File Number: 1-32253

|

| | |

| | |

Delaware | | 23-3058564 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification No.) |

2366 Bernville Road, Reading, Pennsylvania 19605

(Address of principal executive offices, including zip code)

(610) 208-1991

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.06. Material Impairments

On March 13, 2015, EnerSys (the “Company”) issued a press release announcing it expects to record a non-cash impairment charge of approximately $25 million in the fourth quarter of fiscal 2015 to reduce the carrying value of the Company’s goodwill, which had a book value of $403 million at December 28, 2014.

The press release, attached hereto as Exhibit 99.1, is incorporated by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 Press Release, dated March 13, 2015, of EnerSys regarding a non-cash impairment charge.

Signature(s)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | EnerSys |

| | |

| | |

Date: March 13, 2015 | By: | /s/ Richard W. Zuidema |

| | Richard W. Zuidema |

| | Executive Vice President |

| | |

| | |

Exhibit Index

|

| | |

Exhibit No. | | Description |

EX-99.1 | | Press Release, dated March 13, 2015, of EnerSys regarding a non-cash impairment charge. |

Exhibit 99.1

EnerSys Announces Preliminary Non-Cash Intangible Impairment Charge

Reading, PA, USA, March 13, 2015 -- EnerSys (NYSE: ENS) the global leader in stored energy solutions for industrial applications, announced today that it expects to record a fourth quarter non-cash goodwill impairment charge of approximately $25 million to reduce the carrying value of the Company's goodwill, which had a book value of $403 million at December 28, 2014.

The reasons for the charge are certain reporting units in the Americas have been negatively impacted by the slowdown in the enclosure business resulting from lower capital spending by a major customer in the telecommunications market and the cancellation of certain programs with a major contractor serving the aerospace and defense markets.

The Company is finalizing its annual goodwill impairment testing, which commenced on the first day of the fourth quarter of fiscal 2015, which was December 29, 2014, and estimates that the charge is expected to be approximately $25 million, with minimal expected tax benefit. Upon completion of the annual goodwill impairment testing, the final charge will be recorded and reported in the Company’s Annual Report on Form 10-K for the fiscal year ending March 31, 2015.

The impact on the Company's reported net earnings per diluted share as a result of this charge is expected to be approximately $0.54 per share. The guidance for non-GAAP adjusted net earnings per diluted share for the fourth quarter issued in the Company's press release on February 4, 2015 remains unchanged. That guidance was $1.10 to $1.14 and excluded highlighted charges. This impairment charge is also excluded from the guidance.

While the goodwill impairment charge will reduce the Company's reported results under US GAAP, it will be non-cash in nature and will not affect the Company’s liquidity, cash flows from operating activities and debt covenants, nor will it have any impact on future operations.

A description of the Company’s accounting policies and practices related to goodwill and other intangible assets can be found in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2014 and Quarterly Report on Form 10-Q for the fiscal period ended December 28, 2014.

For more information, contact Thomas O'Neill, Vice President and Treasurer, EnerSys, P.O. Box 14145, Reading, PA 19612-4145, USA. Tel: 610-236-4040; Web site: www.enersys.com.

EDITOR'S NOTE: EnerSys, the global leader in stored energy solutions for industrial applications, manufactures and distributes reserve power and motive power batteries, battery chargers, power equipment, battery accessories and outdoor equipment enclosure solutions to customers worldwide. Motive power batteries and chargers are utilized in electric forklift trucks and other commercial electric powered vehicles. Reserve power batteries are used in the telecommunication and utility industries, uninterruptible power supplies, and numerous applications requiring stored energy solutions including medical, aerospace and defense systems. Outdoor equipment enclosure products are utilized in the telecommunication, cable, utility, transportation industries and by government and defense customers. The company also provides aftermarket and customer support services to its customers from over 100 countries through its sales and manufacturing locations around the world.

More information regarding EnerSys can be found at www.enersys.com.

Caution Concerning Forward-Looking Statements

This press release, and oral statements made regarding the subjects of this press release, contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, or the Reform Act, which may include, but are not limited to, statements regarding EnerSys’ annual goodwill impairment testing for fiscal 2015, earnings estimates, plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts, including statements identified by words such as “believe,” “plan,” “seek,” “expect,” “intend,” “estimate,” “anticipate,” “will,” and similar expressions. All statements addressing operating performance, events, or developments that EnerSys expects or anticipates will occur in the future, including statements relating to its annual goodwill impairment testing for fiscal 2015, as well as statements expressing optimism or pessimism about future operating results or benefits, are forward-looking statements within the meaning of the Reform Act. The forward-looking statements are based on management's current views and assumptions regarding future events and operating performance, and are inherently subject to significant business, economic, and competitive uncertainties and contingencies and changes in circumstances, many of which are beyond the Company’s control. The statements in this press release are made as of the date of this press release, even if subsequently made available by EnerSys on its website or otherwise. EnerSys does not undertake any obligation to update or revise these statements to reflect events or circumstances occurring after the date of this press release.

Although EnerSys does not make forward-looking statements unless it believes it has a reasonable basis for doing so, EnerSys cannot guarantee their accuracy. The foregoing factors, among others, could cause actual results to differ materially from those described in these forward-looking statements. For a list of other factors which could affect EnerSys’ results, including earnings estimates, see EnerSys’ filings with the Securities and Exchange Commission, including "Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations," and "Forward-Looking Statements," set forth in EnerSys’ Quarterly Report on Form 10-Q for the fiscal period ended December 28, 2014. No undue reliance should be placed on any forward-looking statements.

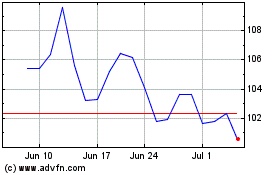

Enersys (NYSE:ENS)

Historical Stock Chart

From Mar 2024 to Apr 2024

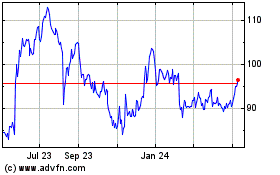

Enersys (NYSE:ENS)

Historical Stock Chart

From Apr 2023 to Apr 2024