SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of April, 2014

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

Rua Coronel Dulcídio, 800

80420-170 Curitiba, Paraná

Federative Republic of Brazil

(5541) 3222-2027

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

MANNUAL FOR PARTICIPATION

IN GENERAL MEETINGS

59

th

Annual General Meeting

188

th

Extraordinary General Meeting

April 24, 2014

TABLE OF CONTENTS

|

|

|

|

1. Message from the Chairman of the Board of Directors

|

3

|

|

|

|

2. Guidance for Participation in the Joint General Meeting

|

4

|

|

Attending Shareholder

|

4

|

|

Shareholder Represented by Proxy

|

4

|

|

Holders of ADRs

|

4

|

|

|

|

3. Call Notice

|

5

|

|

|

|

4. Complementary Call Notice

|

6

|

|

|

|

5. Information on the matters to be examined and discussed at the 59

th

Annual

General Meeting

|

7

|

|

Analysis, discussion and voting on the Annual Management Report, balance

sheet and other financial statements for fiscal year 2013

|

7

|

|

Resolution on the Board of Executive Officer s proposal for the allocation on net

income for fiscal year 2013 including profit sharing payment and the

subsequent distribution of shareholders payment

|

8

|

|

Election of members of the Fiscal Council due to end of term of office

|

11

|

|

Establishment of the compensation of the Management and members of the

Fiscal Council

|

12

|

|

|

|

6. Information on the matters to be analyzed and discussed at the 188th

Extraordinary General Meeting

|

12

|

|

Amendment to the caput of Article 4, in accordance with the provision set forth in

paragraph 1 of Article 7, both of the Company's Bylaws, due to the conversion of

preferred shares classes A and B, as per shareholders' request

|

12

|

|

Replacement of a member of Copel s Board of Directors

|

14

|

|

|

|

7. Annexes

(Anexos - only in Portuguese)

|

|

|

I -

item 12.6 to 12.10 of CVM s Reference Form (annex 24 to CVM s Rule

480/2009)

|

|

|

II -

item 13 of CVM s Reference Form (annex 24 to CVM s Rule 480/2009)

|

|

1.

Message from the Chairman of the Board of Directors

Dear Shareholder:

It

is

with

immense

pleasure

that

I

present

to

you

this

Ma

n

ual

for

Participation in

t

he Annual

General

Meeting

of

the

C

o

mpanhia

Paranaense

d

e

Energia

-

Copel,

wi

t

h general

gui

d

ance

for

an

effective

participation

a

n

d

exercise

o

f

the

vote.

This

manu

a

l

has

been

prepared

based

on

Copel's

Corporate

Governance

policy, which

is

fo

u

nded

on

transparency

and

equity.

The

manual

aims

to

pr

e

s

ent,

in

a

clear

and

bri

e

f

way,

the

information related

to

t

h

e Compa

n

y’s Annual

General

Meeting,

se

e

k

ing

ther

e

by

to

contribute

for

the understanding

of

the

p

roposals

for

resolution

and

to

encourage

the

participation

of shareholde

r

s

in

the

events

of

the

a

n

nual

corpor

a

te

agenda

of

the

Comp

a

ny.

Copel’s 59

th

Annual General meeting (AGM) and 188

th

Extraordinary General Meeting (EGM) were called for April 24, 2014, at 2:30 p.m., at the Company’s headquarters located at Rua Coronel Dulcídio 800, in the city of Curitiba.

The

matters

to

be

pr

e

s

e

nted

in

the

AGM

for

resolution

of

s

h

areholders

are

describ

e

d in

the

Call

Notice

and

in

this

manual as well as the

types of

shares

g

ranting

the

right

to

vote

on

the

item

of

the

agenda.

Given

the

current number

of

Compa

n

y

shareholders, this

manual

seeks

to

encourage

and

enable participation

in

the

General

Meetings.

The

CEO,

one

repres

e

ntative of

t

he

Fisc

a

l

C

ouncil

and

one

repres

e

ntative of

t

h

e independent auditors

w

i

ll

attend

t

h

e

Joint

General

Meeting,

who

will

be

able

to

pr

ov

i

d

e further

clarification

requi

r

ed

on

any

matter

includ

e

d

in

the

agenda.

Your

participation is

ve

r

y

important,

conside

r

ing that

issues

relevant

to

the

Compa

n

y are

dealt

wi

t

h

in

the

meetings.

Sincerely,

Mauricio Schulman

Chairman of the Board of Directors

2.

Guidance for Participation in the Joint General Meeting

Copel’s

sh

a

reholders

may

take

part

in

the

Ge

n

eral

Meeting

by

attending

the

meeting at

the

Company’s

headquarters

and

voting,

or

by

appo

i

nting

a

proxy

to

repr

es

e

n

t them,

as

described

bel

o

w.

Attending Shareholder

The

shareholder wishi

n

g

to

take

part

in

the

Joint

General

M

e

eting

shall

arrive

a few minutes

before

the

time

indicated in

the

Call

Notice

and

bear

the

followi

n

g documents:

·

Identity card (RG), Alien’s Identity Card (RNE), Brazilian Driver’s License (CNH) or an accreditation card issued by an official professional organization; and

·

Proof as Company shareholder issued by a depositary financial institution or a custodian agent or through the shareholding position issued by Copel.

Shareholder Represented by Proxy

The

share

h

older

who

is

not

able

to

attend

the

meeting

and

wishes

to

t

ake

part

in the

Joint General Meeting

may

appoint

a

proxy

with

powers

to

represent

him/her.

Pursuant

to

Article

126,

p

a

ragraph

1,

of

the

Brazilian

Corporation

Law

6,404/1976, the

proxy

s

hall

be

a

shareholder,

lawyer

or

manager

of

the

Compa

n

y

or

of

a financial

institution/investment

fund.

The

proxy

shall

have

been

appointed

not more

than

one

year

before

the

date

of

the

Joint General Meeting

.

The documents required are the following:

·

Power of attorney with special powers for representation at Copel’s General Meeting, bearing a notarized signature of the grantee (shareholder);

·

Bylaws or Article of Incorporation and instrument of election/appointment of the managers in the event of the grantee being a legal entity; and

·

Proof of ownership of the shares issued by the Company, conferred by the depositary financial institution and/or custodian.

Note:

the

documents

mentioned

in

the

second

item

above

shall

b

e forwarded

to

Copel’s

headquarters,

Diretoria

de

Finanças,

Relações

com Investidor

e

s

e

de

Controle

de

Participaçõe

s

,

Departamento de Acionistas e Custódia

,

at

Rua

Coron

e

l

Dulcício

nº

800

-

3

rd

floor,

prefe

r

ably

48

hours

prior

to

the

Meeting.

Holders of ADRs

The

financial

deposita

r

y

institution

of

American

Depositary

Receipts

(

ADRs)

in the

United

States,

The

Bank

of New

York

Mellon,

will

send

the

powers

of attorney to

the

holders of

ADRs,

so

that

they

exercise their

voting

right

at

the Joint General Meeting.

The

partici

p

ation

sh

a

ll

t

ake

place

t

hrough

Banco

Itaú

,

re

p

resentative

of

T

h

e Bank

of

New

York

Mellon

in

Brazil.

Should

the

r

e

be

any

d

oubt

conce

r

ning the

Joint General Meeting

procedures and

d

eadlines, please

con

t

act

the

Sh

a

reholders

and

Custody

Departme

n

t

(

Depart

a

mento de Acionistas

e

Custódi

a

)

at

the

tele

p

hone

number

(55

41)

3

331-4269

or

through the

e-mail

address

aci

o

nistas@co

p

el.com.

3.

Call Notice

The Shareholders of Companhia Paranaense de Energia - Copel are invited to attend the Annual and Extraordinary General Meeting to be held on

April 24, 2014

, at

2:30 p.m.

at the Company’s head office located at Rua Coronel Dulcídio, 800, Curitiba, to decide on the following agenda:

ANNUAL GENERAL MEETING

1.

To analyze, discuss and vote the 2013 Annual Management Report, the balance sheet and other financial statements related to fiscal year of 2013;

2.

To resolve on the Board of Executive Officers’ proposal for allocation of the 2012 net income in the amount of

R$1,072,559,550.70

— including profit sharing payment — and the subsequent payment in the amount of R$560,537,416.30, as follows:

·

Interest on equity replacing dividends, in the gross amount of

R$180,000,000.00

, which were declared and paid in advance on December 16, 2013;

·

Dividends in the amount of R$380,537,416.30, of which R$145,039,000.00 were already declared and paid in advance on December 16, 2013; the remaining part of the dividends in the amount of R$235,498,416.30 ─ whose payment shall occur within 60 days of the Annual General Shareholders’ meeting taking place on April 24, 2014 ─ shall be distributed as follows: R$0.82136 per common share (ON), R$1.27708 per class A preferred share (PNA) and R$0.90366 per class B preferred share (PNB);

3.

To elect the members of the Fiscal Council due to end of term of office; and

4.

To establish the compensation for the Management and members of the Fiscal Council.

EXTRAORDINARY GENERAL MEETING

1.

To amend the caput of Article 4, according to the provision set forth in paragraph 1 of Article 7, both of them in the Company’s Bylaws, due to the conversion of PNA shares into PNB shares, as per shareholders’ request

;

Notes:

a) Documents referring to the matters to be discussed at the Ordinary Shareholders’ Meeting, in addition to the Manual for Attendance in Meetings, are available for shareholders’ consultation at the Company’s headquarters as well as on its website (www.copel.com); b) Powers-of-attorney for the Ordinary Shareholders’ Meeting shall be filed at the Company’s head office, at the

Shareholders and Custody Department

of the Chief Financial, Investors’ Relations and Control of Holdings Office, at Rua Coronel Dulcídio, 800, 3º andar, Curitiba, at least forty-eight hours prior to the meeting.

Curitiba, March 24, 2014

Mauricio Schulman

Chairman of the Board of Directors

Publication

This Call Notice was published, pursuant to the Brazilian Corporation Law, in the Official Gazette of the State of Paraná and in the newspaper

Gazeta do Povo,

on March 24, 25 and 26, 2014 editions, being also available on the Company’s website (www.copel.com).

4.

Complementary Call Notice

The Shareholders of Companhia Paranaense de Energia - Copel are invited to attend the Annual and Extraordinary General Meeting to be held on

April 24, 2014

, at

2:30 p.m.

at the Company’s head office located at Rua Coronel Dulcídio, 800, Curitiba, to additionally decide on the following subject of the 188

th

Extraordinary General Meeting:

2.

Replacement of a member of Copel’s Board of Directors

Notes:

a) Documents referring to the matters to be discussed at the Ordinary Shareholders’ Meeting, in addition to the Manual for Attendance in Meetings, are available for shareholders’ consultation at the Company’s headquarters as well as on its website (www.copel.com); b) Powers-of-attorney for the Ordinary Shareholders’ Meeting shall be filed at the Company’s head office, at the

Shareholders and Custody Department

of the Chief Financial, Investors’ Relations and Control of Holdings Office, at Rua Coronel Dulcídio, 800, 3º andar, Curitiba, at least forty-eight hours prior to the meeting.

Curitiba, April 4, 2014

Mauricio Schulman

Chairman of the Board of Directors

Publication

This Call Notice was published, pursuant to the Brazilian Corporation Law, in the Official Gazette of the State of Paraná and in the newspaper

Gazeta do Povo,

on April 4, 7 and 8, 2014 editions, being also available on the Company’s website (www.copel.com).

5.

Information on the matters to be examined and discussed at the 59

th

Annual General Meeting

Below the Company’s Management presents some clarifications related to each item for resolution at the Annual General Meeting for the exercise of a conscious vote:

Analysis, discussion and voting on the Annual Management Report, balance sheet and other financial statements for the fiscal year 2013

Clarifications

The Management accounts are presented through the Annual Management Report and the Financial Statements prepared by Copel’s Board of Executive Officers.

The Annual Management Report presents information on the macroeconomic scenario and the Company’s financial performance and operations, with

comments

on the main accounts of the sta

t

ement of income for the year, in addition to information related

to

em

ployees,

social

r

e

spo

n

sibility, the capi

t

al

markets,

corpora

t

e governance,

etc.

On

the

ot

h

er

hand,

the

Financial

Statemen

t

s express

the

Compa

n

y’s

ec

onomic sit

u

ation

and

equity

changes

in

the

fiscal

year.

By analyzing

t

h

e

Financial

Statements,

it

is

possible

to

assess

the

equity situation,

l

i

quidity

in

d

exes,

profitability level

and

the

degree

of indebtedness

of

the

Company.

It

is

worth

mentioning

t

h

at the

Com

p

any’s

financial

statements

have

been prepared

pursuant

to

the

accounti

n

g practices

adopted in Brazil which include those

set

forth

by

the

Brazilian

corporate laws, the pronouncements, guidance and interpretations issued by the Brazilian Accounting Practice Committee (CPC), approved by the Brazilian

Securities Commission (CVM) and the Federal Accounting Council (CFC). Copel’s

Financial

Statements

mainly

consolidate

electric

power

companies and,

acco

r

dingly, are

presented

in

compliance

with

the recommen

d

ations of

t

h

e

specific

l

e

gislation

ap

plied

to

the

electric

po

w

er public

utility

concession

a

ires.

The

Annual

Report

and

the

Financial

Statements

have been

approved

by the

Board

of

Executive

Officers,

the

Audit

Committee and

the

Board

of Directors. In addition, the

Fiscal

Council issued an opinion on them, and they were deemed

adequate

for

su

bm

ission

to

t

he

shareholders.

Furthermor

e

, the

Com

p

any’s

Fina

n

cial

Statements

were

audited

and received

a

favorable

opinion

by

KPMG Auditores Independentes,

t

he

Compa

n

y’s

independent auditors.

The

analysis of

the

Audit

Committee and

the

opinions of

the

Fiscal

Co

u

ncil and

of

the

External

Audit

are

attach

e

d

to

the

Fin

a

ncial

Statements.

Availability of Information

The

Annual

Report

and

the

Fina

n

cial

Statements

will

be

published

in the

Official

Gazette

of

the

State

of

Paraná,

in

the

newspaper

Gazeta

d

o Povo

on April 16, 2014, purs

u

ant

to

the

a

pplicable

l

a

ws, being also

available

at the Company’s

he

a

dquarters, at BM&Fbovespa - Securities, Commodities and

Fu

t

ures

Exchange,

and

on

Co

p

el’s

websi

t

e (www.copel.com).

Voting right

In this item of the agenda, only

holders

of

common shares

are

entitled to vote.

Resolution on the Board of Executive Officer’s proposal for the allocation on net income for fiscal year 2013 in the amount of R$1,072,59,550.70 — including profit sharing payment — and the subsequent distribution of resources in the amount of R$560,537,416.30, as follows:

·

Interest on equity replacing dividends, in the gross amount of

R$180,000,000.00

, which were declared and paid in advance on December 16, 2013;

·

Dividends in the amount of R$380,537,416.30, of which R$145,039,000.00 were already declared and paid in advance on December 16, 2013; the remaining part of the dividends in the amount of R$235,498,416.30 ─ whose payment shall occur within 60 days of the Annual General Shareholders’ meeting taking place on April 24, 2014 ─ shall be distributed as follows: R$0.82136 per common share (ON), R$1.27708 per class A preferred share (PNA) and R$0.90366 per class B preferred share (PNB);

Clarifications

The

allocation

of

net

income

consists

in

dete

r

mining the

portions

of

net income

to

b

e

appropria

t

ed

to

the

le

g

al

and

s

t

atu

t

ory

revenue reserves,

o

r to

be

distri

b

uted.

For the fiscal year 2014, the amount of said distribution is equivalent to 50% of net adjusted income, based on annual proposals from the Board of Executive Officers and the Board of Directors of the Company.

Allocation

Appropriation

From the net income for the fiscal year 2013, calculated in accordance with the Brazilian Corporation Law, in the amount of

R$1.072.559.550,70

(one billion, seventy two million, five hundred and fifty nine thousand, five hundred and fifty reais and seventy cents)

, the Board of Executive Officers proposes the following appropriations:

a)

R$53.627.977,54

(fifty-three million, six hundred and twenty-seven thousand, nine hundred and seventy-seven reais and fifty-four cents), equivalent to 5% of the net income, to create the Legal Reserve, in accordance with Article 40, item II, of the Bylaws;

b)

R$180.000.000,00

(one hundred and eighty million reais)

to pay for interest on capital, in partial replacement of compulsory minimum dividends, in compliance with articles 192 and 202 of Law nº 6,404/1976; article 9

th

, paragraph 7

th

, of Law nº 9,249, as of December 26, 1995; and article 6

th

and its paragraphs of the Bylaws, which were already declared and paid in advance on December 16, 2013, as proposed at the 2074

th

Meeting of the Board of Executive Officers, held on November 11, 2013, and ratified by the 119

th

Extraordinary Meeting of the Board of Directors, held on November 13, 2013;

c)

R$380.537.416,30

(three hundred and eighty million, five hundred and thirty-seven thousand, four hundred and sixteen reais and thirty cents)

to be added up to the amount for payment of compulsory minimum dividends, in compliance with articles 192 and 202 of Law nº 6,404/1976; article 9

th

, paragraph 7

th

, of Law nº 9,249, as of December 26, 1995; and article 6

th

and its paragraphs of the Bylaws, as well as for payment of additional dividends to the compulsory minimum dividends; of which R$145,039,000.00 (one hundred and forty five million, thirty-nine thousand reais) were already declared and paid in advance on December 16, 2013, as

proposed at the 2074

th

Meeting of the Board of Executive Officers, held on November 11, 2013, and ratified by the 119

th

Extraordinary Meeting of the Board of Directors, held on November 13, 2013;

·

Pursuant to the above-mentioned provisions set forth by the law and the Company’s Bylaws, the dividends are calculated based on the net income less the allocation to legal reserve.

Nevertheless, this calculation basis is added by the realization of equity valuation adjustments, which is addressed by item 28 of ICPC no. 10, so as to offset the impacts on the income from higher expenses with depreciation, resulting from the adoption of new accounting standards established by it, as well as by the CPC Accounting Standard no. 27 – Fixed Assets – which in 2013 amounted to net value of

R$102,143,259.43

(one hundred and two million, one hundred and forty-three thousand, two hundred and fifty-nine reais and forty-three cents).

This procedure reflects the Company’s policy for remuneration of shareholders, proposed by the 1943

rd

Board of Executive Officers’ Meeting held on March 21, 2011, ratified by the 132

nd

Annual Board of Directors’ Meeting held on March 23, 2011, and approved by the 56

th

Annual General Meeting held on April 28, 2011. Therefore, this policy will be adopted during the realization of the equity valuation adjustments reserve.

The amounts of the calculation basis and of the

compulsory minimum dividends are, respectively, R$1,121,074,832.59 (one billion, one hundred and twenty-one million, seventy-four thousand, eight hundred and thirty-two reais and fifty-nine cents) and R$280,268,708.15 (two hundred and eighty million, two hundred and sixty-eight thousand, seven hundred and eight reais and fifteen cents).

·

Pursuant to items 10,11 and 24 of ICPC no. 08 – Booking of the Proposal for Payment of Dividends – and item III of CVM Resolution 683 of August 30, 2012, the portion of the dividends herein proposed exceeding from the minimum mandatory dividends corresponds to R$264,160,916.92 (two hundred and sixty-four million, one hundred and sixty thousand, nine hundred and sixteen reais and ninety-two cents). Nevertheless, as proposed at the 2074

th

Meeting of the Board of Executive Officers, held on November 11, 2013, and ratified by the 119

th

Extraordinary Meeting of the Board of Directors, held on November 13, 2013, the Company paid the stakeholders in advance the amount of R$308,931,208.77 (three hundred and eight million, nine hundred and thirty-one thousand, two hundred and eight reais and seventy-seven cents),

net of income tax withheld at source. This amount paid in advance is superior to the minimum mandatory dividends in R$28,662,500.62 (twenty-eight million, six hundred and sixty-two thousand, five hundred reais and sixty-two cents), which resulted in negative adjustment of the original amount of the proposed dividends that exceeded the minimum mandatory dividends, whose adjusted amount is R$235,498,416.30 (two hundred and thirty-five million, four hundred and ninety-eight thousand, four hundred and sixteen reais and thirty cents). This amount will remain in reserve in the Company’s net equity under the line “Addition dividend proposed” until the resolution of the proposal by the 59

th

Annual General Meeting, when it will, if approved, be transferred to the “Current liabilities” line.

d)

R$560,537,416.29

(five hundred and sixty million, five hundred and thirty seven thousand, four hundred and sixteen reais and twenty nine cents) corresponding to the balance of net income for the year added by the realization of the

equity valuation reserve

, as Profit Retention Reserve, aiming to ensure the Company’s investment program, pursuant to Article 196 of Law 6,404/76.

·

The amount of establishment of the profit retention reserve corresponds to the balance of net income for the year (after legal reserve, interest on equity and dividends) added by the retained earnings account resulting from the realization of the equity valuation adjustments verified in the fiscal year 2013, which is addressed in item 28 of ICPC no. 10, in the amount of

R$ 102,143,259.43

(one hundred and two million, one hundred and forty-three thousand, two hundred and fifty-nine reais and forty-three cents)

.

Below is a breakdown of the allocations proposed herein.

|

Net income for the year

|

R$1,072,559,550.70

|

|

Realization of equity valuation adjustments

|

R$102,143,259.43

|

|

Legal reserve (5%)

|

R$(53,627,977.54)

|

|

= Calculation basis of mandatory minimum dividends

|

R$1,121,074,832.59

|

|

Interest on equity

|

R$(180,000,000.00)

|

|

Dividends

|

R$(380,537,416.30)

|

|

Profit retention reserve for investments

|

R$(560,537,416.29)

|

Payment of profit sharing and productivity incentives:

·

Federal Law 10,101 of December 19, 2000, State Law 16,560/2010 and State Decree no. 1978/2007 regulate profit sharing as a tool to integrate capital and labor and stimulate productivity, pursuant to Article 7, item XI, of Brazil’s constitution.

·

In compliance with the above-mentioned law, the Board of Executive Officers proposes the payment, as profit sharing, of R$ 78.000.000,00 (seventy-eighty million reais) to employees of wholly-owned subsidiaries. This amount is recorded in the Financial Statements under the “Personnel expenses” line, pursuant to item 26.2 of CVM/SNC/SEP Letter no. 1 of February 14, 2007.

Management’s Opinion

The

Management of

the

Comp

a

ny

conside

r

s

that

the

propositi

on

s addressed

h

erein

are in compliance

with

the la

w

s

in

fo

r

c

e

a

n

d

the Bylaws and

they

fulfill

the

i

nt

erests

of

t

he

Compa

n

y. For

this

reason,

said propositions

should

be

f

ully

approv

e

d

by

the

G

e

neral

Meeting.

Approvals

This matter was submitted to the analysis and approval of the Board of Executive Officers at its 2092

nd

meeting held on March 10, 2014; of the Audit Committee at its 109

th

meeting held on March 12, 2014; and of the Board of Directors at its 144

th

ordinary meeting held on March 12, 2014, having also received a favorable opinion from the Fiscal Council in its 353

rd

meeting held on March 13, 2014.

Fiscal Council Report

The members of the Fiscal Council of Companhia Paranaense de Energia - Copel, underwritten signed, acting according to their statutory tasks and legal responsibilities, have examined the Financial Statements, the Annual Management Report and the Board of Executive Officers’ proposal for allocation of the net income of the fiscal year ended on December 31, 2013, and based on the analysis done and on additional clarifications provided by the Board of Executive Officers, and, yet, considering the related report issued with no qualifications by KPMG Independent Auditors, concluded that the documents analysed, in all their relevant aspects, have been properly presented. For this reason, the Fiscal Council members have issued a

favourable opinion on their submission to the Shareholders’ analysis and subsequent resolution.

Curitiba, March 13, 2014. (a) Joaquim Antonio Guimarães de Oliveira Portes – Chairman; Nelson Leal Júnior; José Tavares da Silva Neto; Bruno Cabral Bergamasco; and Carlos Eduardo Parente de Oliveira Alves.

Election of the members of the Fiscal Council due to end of term of office

Clarifications

Copel’s

Fiscal

Council

o

perates

on

a

permanent

basis

and

i

t

s

main

duties are

overse

e

ing the

ma

n

agers’ acts,

ex

a

m

ining

and

giving

an

opinion

on the

Financi

a

l

Statemen

t

s and

reporting

its

conclusions to

the

Compa

n

y

’

s shareholde

r

s.

Pursuant

to

Article

34

of

the

C

o

mpany’s

Byl

a

ws,

the

shareholders elect the

m

e

mbers

of

the

Fiscal

Council

for

a

unified

term

of

office of

one

year, which,

in

the

case

of

this

Council,

expires

at

the Joint General Meeting of April 2014.

In accordance with the Brazilian Corporation Law (Law 6,404/1976), in order to take office,

a

l

l members of

the

Fiscal

Council

sh

a

ll

sign a clearance certificate declaring that they are not impeded

by

any

crimes

provided

for

by

law

from performing business activities,

a

nd

they

sh

a

ll

also

execute

the

Inv

e

stiture Inst

r

ument and

t

he Instruments of

Adhesion

to

the

Policies

for

Discl

o

s

ure of

Material Information

and

Maintenance

of

Confidentiality and

f

or

Trading

of Securities

issued

by

C

o

pel

itself,

s

e

t

forth

by

CVM

Rule

358/200

2

, through

which

they

undertake

to

c

o

mply

with

t

h

e

rules

ther

e

in.

Vacant positions and right to vote

Copel’s

Fiscal

Council

comprises five

sit

t

ing

members

and

an

e

q

ual number

of

alternates,

with

re-election

a

uthorized,

a

s

follows:

a)

three members and their respective alternates appointed by the state of Paraná

(only

holders

of

co

m

m

on

shares

have

voting

rights)

;

b)

one memb

e

r

and

his

resp

e

c

tive alter

n

ate

appointed by

the

minority holders

of

common s

h

ares

-

the

election

is

carried

out

separately

(controlling

shareholde

r

s may

not

vote),

and

only

the

minority

holders

o

f common

shares

are

e

nt

itled

to

vote.

The

candidate elect

e

d

shall

be

t

h

e one

who

o

btains

the

highest

representative

percentage

of

the

capital stock

of

t

h

e

Compa

n

y,

with

no

minimum

limit;

and

c)

one m

e

mber

and

his respective

alternate

appointed by the

holders

of

preferred

shares

– the election

is

carried

out

separately

(controlling

shareh

o

lders

may not vote),

and

only

the

holders

o

f preferred

shares

are

e

nt

itled

to

vote.

The

candidate elect

e

d

shall

be

t

h

e one

who

o

btains

the

highest

representative

percentage

of

the

capital stock

of

t

h

e

Compa

n

y,

with

no

minimum

limit.

Appointments

Pursuant to CVM Rule 481 of December 17, 2009, the majority shareholder shall appoint, at the Annual General Meeting, to fill the vacant positions to which he is entitled, for reelection, the following members of the Fiscal Council:

Sitting members:

Joaquim Antonio Guimarães de Oliveira Portes

Nelson Leal Junior

José Tavares da Silva Neto

Alternates (respectively):

Osni Ristow

Roberto Brunner

Gilmar Mendes Lourenço

As

the

law

does

not

make

ma

n

datory

the

early

submission of

th

e proposed

names

for

election,

the

other

shareholders may

nominate, at

t

h

is Joint General

Meeting, their

candidate

d

uring

the

analysis

of

the

matter, if

they

have

the

right

to

do

so,

according to

t

h

e

criteria

s

p

ecified in

it

e

m 4.5.1.

Annex I - item 12.6 to 12.10 of the Reference Form (only in portuguese)

Establishment of the compensation of the Management and members of the Fiscal Council

Clarifications

The Annual General

Meeting

shall

determine the

annual

compensation of

the

members of

the

Company’s

Board

of

Di

r

ectors and

Fiscal

Council.

Traditionall

y

,

the

policy

and

the

percentages

of

compensation

are

set forth

at

the

General

M

e

eting,

in

accordance with

the

proposal

submitted by

the

majority

shareholder,

which

envisages:

a)

the maintenance, for the Executive Officers, of the compensation proposed in the last fiscal year, adjusted to the new corporate organizational structure and by the National Consumers Prices Index (INPC) of the total period;

b)

for each sitting member of the Fiscal Council and of the Board of Directors: monthly compensation of fifteen percent (15%) of the compensation that, on average, is assigned to each Executive Officer, added by the specific gratification paid to the members of the Audit Committee;

Annex II – item 13 of CVM’s Reference Form (Management Compensation) (only in portuguese)

Voting right

In this item of the agenda, only holders of common shares are entitled to vote

.

6.

Information on the matters to be analyzed and discussed at the 188

th

Extraordinary General Meeting

Below the Company’s Management presents some clarifications related to the only item for resolution at the Extraordinary General Meeting for the exercise of a conscious vote:

Amendment to the caput of Article 4, in accordance with the provision set forth in paragraph 1 of Article 7, both of the Company's Bylaws, due to the conversion of preferred shares classes A and B, as per shareholders' request.

Clarifications

Whereas according to the privilege provided for in paragraph 1 of Article 7 of the Bylaws of the Company, there was conversion of Preferred A shares in Preferred B shares, at the request of shareholders, and that this would also lead to adjustments in the main clause of Article 4, it is proposed that the same article, before these two settings, should read as follows:

“Article 4 - Underwritten paid up capital is R$6,910,000,000.00 (six billion, nine hundred and ten million reais) represented by 273,655,375 (two hundred seventy-three million, six hundred and fifty-five thousand, three hundred and seventy-five) shares, with no par value, composed of 145,031,080 (one hundred and forty-five million, thirty-one thousand and eighty) ordinary shares, and 128,624,295 (one hundred and twenty-eight million, six hundred and twenty-four thousand and two hundred and ninety-five) preferred shares, of which 381.509 (three hundred and eighty-one thousand, five hundred and nine) shares are class “A” shares and 128,242,786 (one hundred twenty-eight million, two hundred forty-two thousand, seven hundred and eighty-six) shares are class “B” shares.”

Previous text marking alterations being made:

“Article 4 - Underwritten paid up capital is R$6,910,000,000.00 (six billion, nine hundred and ten million reais) represented by 273,655,375 (two hundred seventy-three million, six hundred and fifty-five thousand, three hundred and seventy-five) shares, with no par value, composed of 145,031,080 (one hundred and forty-five million, thirty-one thousand and eighty) ordinary shares, and 128,624,295 (one hundred and twenty-eight million, six hundred and twenty-four thousand and two hundred and ninety-five) preferred shares, of which 381.509 (three hundred and eighty-one thousand, five hundred and nine)

381,702 (three hundred and eighty-one thousand, seven hundred and two)

shares are class “A” shares and 128,242,786 (one hundred twenty-eight million, two hundred forty-two thousand, seven hundred and eighty-six)

128,242,593 (one hundred twenty-eight million, two hundred forty-two thousand, five hundred and ninety-three)

shares are class “B” shares.”

Voting right

In this item of the agenda, only holders of common shares are entitled to vote.

Replacement of a member of Copel’s Board of Directors

Clarifications

Copel’s

Board

of

Directors

is

a

decisi

o

n-making

body,

comp

os

ed of

7

(seven)

or

9

(nine)

members,

B

razilian,

sh

a

reholders,

r

esiding

in

t

h

e country a

n

d

elected by the G

e

neral Assembly, pursuant to t

h

e Brazilian

C

o

rporation

L

a

w

(Law 6,404/76).

The Board of Directors has as its main duty the laying

down of the overall strategy for the Company business.

In accordance with Law 6,404/1976 (Brazilian Corporation Law), in order to take office, all Board members shall sign a clearance certificate declaring that they are not impeded by any crimes provided for by law from performing business activities, and they shall also execute the Investiture Instrument and the Instruments of Adhesion to the Policies for Disclosure of Material Information and Maintenance of Confi

d

entiality

and for

Trading

of

Securi

ti

es issued

by

Copel

i

t

self,

set

f

o

rth

by

CVM Rule

3

58/2002,

th

r

ough

which

they

undertake

to

co

m

ply

with

the rules

therei

n

.

Additionally, the members of the Board of Directors, in order to take office, shall sign a Management Consent Form as referred in the Corporate Governance Practices of Level 1 Regulation ("Level 1 Regulation") of BM&Fbovespa - Securities, Commodities and Futures Exchange, in compliance with article 33 of the Company’s Bylaws.

Under the current legislation, the State of Paraná, which is the major shareholder of the Company, can, at any time, appoint a new member for the Board of Directors to act as its representative and to fulfil any remaining term of office.

Thus, the State of Paraná hereby nominates Mr. Luiz Eduardo da Veiga Sebastiani as its representative in Copel’s Board of Directors for the 2013-2015 term of office, in replacement of Mr. Paulo Procopiak de Aguiar.

Annex I - item 12.6 to 12.10 of the Reference Form

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

COMPANHIA PARANAENSE DE ENERGIA – COPEL

|

|

|

|

|

|

By:

|

/

S

/ Lindolfo Zimmer

|

|

|

|

Lindolfo Zimmer

CEO

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

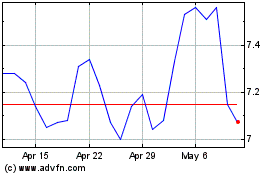

Companhia Parana De Energ (NYSE:ELP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Companhia Parana De Energ (NYSE:ELP)

Historical Stock Chart

From Apr 2023 to Apr 2024