Edison International (NYSE: EIX) today reported third quarter

2016 net income of $419 million, or $1.29 per share, compared to

$421 million, or $1.29 per share, in the third quarter of 2015.

There were no non-core items in the third quarter 2016 results. As

adjusted, third quarter 2015 core earnings were $377 million or

$1.16 per share.

SCE's third quarter 2016 net income increased by $46 million, or

$0.15 per share, from the third quarter 2015 primarily due to the

timing of the implementation of the 2015 General Rate Case (GRC)

proposed decision and incremental return on pole loading rate base,

partially offset by higher income tax expense.

SCE's 2015 earnings were impacted by the timing of the 2015 GRC

decision. During 2015, SCE recorded revenue refunds to customers

which totaled $451 million to reflect the final decision in the

2015 GRC. In the third quarter of 2015, SCE recorded a refund of

$233 million as a result of receiving the proposed GRC decision, of

which a total of $70 million ($41 million after-tax), or $0.13 per

share, was attributable to the first six months of 2015. In

addition, third quarter 2016 earnings included an increase in

revenue of approximately $46 million ($27 million after-tax),

or $0.08 per share, from the revenue escalation mechanism in the

2015 GRC decision.

Edison International Parent and Other’s third quarter 2016

losses from continuing operations increased by $5 million, or $0.02

per share, compared to third quarter 2015. The higher losses

reflected higher operating and development costs and lower revenue

and gross margin from the sale of solar systems at Edison Energy

Group.

Edison International Parent and Other's third quarter 2015

non-core items included income of $1 million related to losses (net

of distributions) allocated to tax equity investors under the

hypothetical liquidation at book value (HLBV) accounting method.

Additionally, during the third quarter 2015, Edison International

recorded $43 million, or $0.13 per share, of earnings from

discontinued operations.

“Third quarter results reflect the ongoing strength of SCE’s

earnings and we’ve reaffirmed our 2016 earnings guidance

accordingly,” said Pedro Pizarro, president and chief executive

officer of Edison International. “We continue to see a long-term

opportunity for above-average earnings and dividend growth based on

SCE infrastructure replacement and electric grid modernization

helping achieve California’s vision for a low-carbon economy.”

Year-to-Date Earnings

For the nine months ended September 30, 2016, Edison

International reported net income of $965 million, or $2.96 per

share, compared to $1,099 million, or $3.37 per share, during the

same period in 2015. On an adjusted basis, Edison International’s

core earnings were $961 million, or $2.95 per share, compared to

$1,049 million, or $3.22 per share, in the year-to-date period in

2015.

SCE’s net income for the nine months ended September 30, 2016

decreased $42 million, or $0.13 per share, from the same period in

2015, primarily due to $100 million, or $0.31 per share, of income

tax benefits from revisions to liabilities for uncertain tax

positions recorded in the second quarter of 2015, partially offset

by an increase in revenues of $142 million ($84 million after-tax),

or $0.26 per share, from the escalation mechanism in the 2015 GRC

decision and 2016 incremental return on the pole loading rate

base.

Edison International Parent and Other’s losses from continuing

operations from the nine months ended September 30, 2016 increased

by $48 million, or $0.15 per share, compared to same period 2015.

During the second quarter 2016, Edison International Parent and

Other recorded an after-tax charge of $13 million, or $0.04 per

share, related to the buy-out of an earn-out provision with the

former shareholders of a company acquired by Edison Energy at the

end of 2015. In addition, the increased losses also reflect higher

operating and development costs and lower revenue and gross margin

from the sale of solar systems at Edison Energy Group, as well as

losses at Edison Capital compared to income from investments in

affordable housing projects sold at the end of 2015.

Edison International's non-core items for the nine months ended

September 30, 2016 included income of $5 million, or $0.01 per

share, compared to income of $7 million, or $0.02 per share, for

the same period in 2015 related to losses (net of distributions)

allocated to tax equity investors under the HLBV accounting method.

Additionally, during the nine months ended September 30, 2016,

Edison International recorded $1 million of losses from

discontinued operations as compared to $43 million, or $0.13 per

share, of earnings in the same period of 2015.

Edison International uses core earnings, which is a non-GAAP

financial measure that adjusts for significant discrete items that

management does not consider representative of ongoing earnings.

Edison International management believes that core earnings provide

more meaningful comparisons of performance from period to period.

Please see the attached tables for a reconciliation of core

earnings to basic GAAP earnings.

Reaffirmed 2016 Earnings

Guidance

The company reaffirmed its earnings guidance for 2016 as

summarized in the following chart. See the presentation

accompanying the company’s conference call for further information

including key guidance assumptions.

2016 Earnings Guidance

2016 Earnings Guidance

2016 Earnings Guidance as of July 28,

2016 as of November 1, 2016 Low Mid

High Low Mid High EIX Basic EPS

$ 3.82 $ 3.92 $ 4.02

$ 3.87 $ 3.92 $ 3.97

Less: Non-core Items* 0.01 0.01 0.01 0.01 0.01 0.01

EIX Core

EPS $ 3.81 $ 3.91 $

4.01 $ 3.86 $ 3.91 $

3.96

* Non-core items recorded for the nine

months ended September 30, 2016.

About Edison International

Edison International (NYSE:EIX), through its subsidiaries, is a

generator and distributor of electric power, as well as a provider

of energy services and technologies, including renewable energy.

Headquartered in Rosemead, Calif., Edison International is the

parent company of Southern California Edison, one of the nation’s

largest electric utilities. Edison International is also the parent

company of Edison Energy Group, a portfolio of competitive

businesses that provide commercial and industrial customers with

energy management and procurement services and distributed solar

generation. Edison Energy Group companies are independent from

Southern California Edison.

Appendix

Use of Non-GAAP Financial

Measures

Edison International’s earnings are prepared in accordance with

generally accepted accounting principles used in the United States

and represent the company’s earnings as reported to the Securities

and Exchange Commission. Our management uses core earnings and core

earnings per share (EPS) internally for financial planning and for

analysis of performance of Edison International and Southern

California Edison. We also use core earnings and core EPS when

communicating with analysts and investors regarding our earnings

results to facilitate comparisons of the Company’s performance from

period to period. Financial measures referred to as net income,

basic EPS, core earnings, or core EPS also apply to the description

of earnings or earnings per share.

Core earnings and core EPS are non-GAAP financial measures and

may not be comparable to those of other companies. Core earnings

and core EPS are defined as basic earnings and basic EPS excluding

income or loss from discontinued operations and income or loss from

significant discrete items that management does not consider

representative of ongoing earnings. Basic earnings and losses refer

to net income or losses attributable to Edison International

shareholders. Core earnings are reconciled to basic earnings in the

attached tables. The impact of participating securities (vested

awards that earn dividend equivalents that may participate in

undistributed earnings with common stock) for the principal

operating subsidiary is not material to the principal operating

subsidiary’s EPS and is therefore reflected in the results of the

Edison International holding company, which is included in Edison

International Parent and Other.

Safe Harbor Statement

Statements contained in this release about future performance,

including, without limitation, operating results, rate base growth,

financial outlook, and other statements that are not purely

historical, are forward-looking statements. These forward-looking

statements reflect our current expectations; however, such

statements involve risks and uncertainties. Actual results could

differ materially from current expectations. Important factors that

could cause different results include, but are not limited to

the:

- ability of SCE to recover its costs in

a timely manner from its customers through regulated rates,

including regulatory assets related to San Onofre;

- decisions and other actions by the

CPUC, the FERC, the NRC and other regulatory authorities, including

the determinations of authorized rates of return or return on

equity, outcome of San Onofre CPUC proceedings and delays in

regulatory actions;

- risks associated with cost allocation,

including the potential movement of costs to bundled customers,

caused by the ability of cities, counties and certain other public

agencies to generate and/or purchase electricity for their local

residents and businesses, along with other possible customer bypass

or departure due to technological advancements in the generation,

storage, transmission, distribution and use of electricity, and

supported by public policy, government regulations and

incentives;

- risks inherent in the construction of

transmission and distribution infrastructure replacement and

expansion projects, including those related to project site

identification, public opposition, environmental mitigation,

construction, permitting, power curtailment costs (payments due

under power contracts in the event there is insufficient

transmission to enable acceptance of power delivery), and

governmental approvals;

- ability to obtain sufficient insurance,

including insurance relating to SCE's nuclear facilities and

wildfire-related liability, and to recover the costs of such

insurance or in the absence of insurance the ability to recover

uninsured losses; and

- risks associated with the retirement

and decommissioning of nuclear generating facilities.

Other important factors are discussed under the headings “Risk

Factors” and “Management’s Discussion and Analysis” in Edison

International’s Form 10-K, most recent Form 10-Q, and other reports

filed with the Securities and Exchange Commission, which are

available on our website: www.edisoninvestor.com. These filings

also provide additional information on historical and other factual

data contained in this news release.

These forward-looking statements represent our expectations only

as of the date of this news release, and Edison International

assumes no duty to update them to reflect new information, events

or circumstances.

Reminder: Edison

International Will Hold a Conference Call Today

When:

Tuesday, November 1, 2016, 1:30 p.m.

(Pacific Time)

Telephone Numbers: 1-800-369-2198 (US) and 1-773-756-4618 (Int'l) -

Passcode: Edison Telephone Replay: 1-888-568-0514 (US) and

1-402-530-8003 (Int’l) - Passcode: 22316 Telephone replay available

through November 10, 2016 Webcast:

www.edisoninvestor.com

Third Quarter Reconciliation of Basic

Earnings Per Share to Core Earnings Per Share

Three months ended September 30, Nine months

ended September 30, 2016 2015 Change

2016 2015 Change Earnings (loss) per share

attributable to Edison International Continuing operations

SCE $ 1.34 $ 1.19 $ 0.15 $ 3.18 $ 3.31 $ (0.13 )

Edison International Parent and Other (0.05 ) (0.03 ) (0.02 ) (0.22

) (0.07 ) (0.15 ) Discontinued operations — 0.13

(0.13 ) — 0.13

(0.13 ) Edison International 1.29 1.29

— 2.96 3.37 (0.41 ) Less:

Non-core items SCE — — — — — — Edison International Parent and

Other — — — 0.01 0.02 (0.01 ) Discontinued operations —

0.13 (0.13 ) — 0.13

(0.13 ) Total non-core items — 0.13

(0.13 ) 0.01 0.15

(0.14 ) Core earnings (losses) SCE 1.34 1.19 0.15 3.18 3.31 (0.13 )

Edison International Parent and Other (0.05 ) (0.03 )

(0.02 ) (0.23 ) (0.09 ) (0.14 ) Edison

International $ 1.29 $ 1.16 $ 0.13

$ 2.95 $ 3.22 $

(0.27 )

Note: Diluted earnings were $1.27

and $1.28 per share for the three months ended September 30,

2016 and 2015, respectively and $2.94 and $3.34 per share for the

nine months ended September 30, 2016 and 2015, respectively.

Third Quarter Reconciliation of Basic

Earnings to Core Earnings (in millions)

Three months ended September 30, Nine months

ended September 30, (in millions) 2016 2015

Change 2016 2015 Change Net income (loss)

attributable to Edison International Continuing operations

SCE $ 435 $ 389 $ 46 $ 1,037 $ 1,079 $ (42 ) Edison

International Parent and Other (16 ) (11 ) (5 ) (71 ) (23 ) (48 )

Discontinued operations — 43 (43 )

(1 ) 43 (44 ) Edison International 419

421 (2 ) 965 1,099

(134 ) Less: Non-core items SCE — — — — — — Edison

International Parent and Other — 1 (1 ) 5 7 (2 ) Discontinued

operations — 43 (43 ) (1 )

43 (44 ) Total non-core items —

44 (44 ) 4 50 (46

) Core earnings (losses) SCE 435 389 46 1,037 1,079 (42 ) Edison

International Parent and Other (16 ) (12 ) (4 )

(76 ) (30 ) (46 ) Edison International $ 419

$ 377 $ 42 $ 961

$ 1,049 $ (88 )

Consolidated Statements of

Income

Edison International

Three months endedSeptember 30,

Nine months endedSeptember 30,

(in millions, except per-share amounts, unaudited) 2016

2015 2016 2015

Total operating revenue

$ 3,767 $ 3,763 $ 8,985 $

9,183 Purchased power and fuel 1,719 1,785 3,576 3,648

Operation and maintenance 740 780 2,090 2,159 Depreciation,

decommissioning and amortization 521 506 1,504 1,451 Property and

other taxes 92 84 269 255 Impairment and other charges —

— 21 —

Total operating

expenses 3,072 3,155 7,460

7,513

Operating income 695 608 1,525 1,670

Interest and other income 32 32 97 114 Interest expense (147 ) (138

) (431 ) (420 ) Other expenses (9 ) (15 ) (29 )

(40 )

Income from continuing operations before income

taxes 571 487 1,162 1,324 Income tax expense 122

82 113 195

Income from

continuing operations 449 405 1,049 1,129 Income (loss) from

discontinued operations, net of tax — 43

(1 ) 43

Net income 449 448 1,048 1,172

Preferred and preference stock dividend requirements of SCE 31 28

92 84 Other noncontrolling interests (1 ) (1 ) (9 )

(11 )

Net income attributable to Edison International

common shareholders $ 419 $ 421 $

965 $ 1,099

Amounts attributable to Edison

International common shareholders:

Income from continuing operations, net of tax $ 419 $ 378 $ 966 $

1,056 Income (loss) from discontinued operations, net of tax —

43 (1 ) 43

Net income

attributable to Edison International common shareholders $ 419

$ 421 $ 965 $ 1,099

Basic earnings per common share attributable to Edison

International common shareholders: Weighted-average shares of

common stock outstanding 326 326 326 326 Continuing operations $

1.29 $ 1.16 $ 2.96 $ 3.24 Discontinued operations —

0.13 — 0.13

Total $ 1.29

$ 1.29 $ 2.96 $ 3.37

Diluted earnings per common share attributable to Edison

International common shareholders: Weighted-average shares of

common stock outstanding, including effect of dilutive securities

329 328 329 329 Continuing operations $ 1.27 $ 1.15 $ 2.94 $ 3.21

Discontinued operations — 0.13 —

0.13

Total $ 1.27 $ 1.28

$ 2.94 $ 3.34

Dividends declared per

common share $ 0.4800 $ 0.4175

$ 1.4400 $ 1.2525

Consolidated Balance Sheets

Edison International (in millions, unaudited)

September 30,2016

December 31,2015

ASSETS

Cash and cash equivalents $ 84 $ 161 Receivables, less

allowances of $58 and $62 for uncollectible accounts at respective

dates 999 771 Accrued unbilled revenue 570 565 Inventory 310 267

Derivative assets 60 79 Regulatory assets 321 560 Other current

assets 261 251

Total current assets 2,605

2,654 Nuclear decommissioning trusts 4,376 4,331

Other investments 76 203

Total investments

4,452 4,534 Utility property, plant and equipment,

less accumulated depreciation and amortization of $8,753 and $8,548

at respective dates 36,064 34,945 Nonutility property, plant and

equipment, less accumulated depreciation of $96 and $85 at

respective dates 167 140

Total property, plant and

equipment 36,231 35,085 Derivative assets 67 84

Regulatory assets 7,844 7,512 Other long-term assets 358

360

Total long-term assets 8,269 7,956

Total assets $ 51,557 $ 50,229

Consolidated Balance Sheets

Edison International

(in millions, except share amounts, unaudited)

September 30,2016

December 31,2015

LIABILITIES AND EQUITY Short-term debt $ 757 $ 695 Current

portion of long-term debt 881 295 Accounts payable 1,180 1,310

Accrued taxes 130 72 Customer deposits 264 242 Derivative

liabilities 223 218 Regulatory liabilities 1,030 1,128 Other

current liabilities 877 967

Total current

liabilities 5,342 4,927

Long-term

debt 10,407 10,883 Deferred income taxes

and credits 8,177 7,480 Derivative liabilities 1,070 1,100 Pensions

and benefits 1,776 1,759 Asset retirement obligations 2,592 2,764

Regulatory liabilities 6,020 5,676 Other deferred credits and other

long-term liabilities 2,168 2,246

Total

deferred credits and other liabilities 21,803

21,025

Total liabilities 37,552 36,835

Commitments and contingencies

Redeemable noncontrolling

interest — 6 Common stock, no par value (800,000,000 shares

authorized; 325,811,206 shares issued and outstanding at respective

dates) 2,503 2,484 Accumulated other comprehensive loss (51 ) (56 )

Retained earnings 9,362 8,940

Total Edison

International's common shareholders' equity 11,814

11,368 Noncontrolling interests – preferred and

preference stock of SCE 2,191 2,020

Total

equity 14,005 13,388

Total liabilities and equity $ 51,557 $

50,229

Consolidated Statements of Cash

Flows Edison International

Nine months endedSeptember 30,

(in millions, unaudited) 2016 2015

Cash flows from operating

activities:

Net income $ 1,048 $ 1,172 Less: (Loss) income from

discontinued operations (1 ) 43 Income from

continuing operations 1,049 1,129 Adjustments to reconcile to net

cash provided by operating activities: Depreciation,

decommissioning and amortization 1,575 1,515 Allowance for equity

during construction (58 ) (63 ) Deferred income taxes and

investment tax credits 127 202 Other 17 (5 ) Nuclear

decommissioning trusts (159 ) (249 ) EME settlement payments, net

of insurance proceeds (209 ) (176 ) Changes in operating assets and

liabilities: Receivables (235 ) (412 ) Inventory (43 ) 10 Accounts

payable 151 164 Prepaid and accrued taxes 56 (18 ) Other current

assets and liabilities (68 ) (572 ) Derivative assets and

liabilities, net 15 25 Regulatory assets and liabilities, net 189

1,318 Other noncurrent assets and liabilities 93 (35

)

Net cash provided by operating

activities

2,500 2,833

Cash flows from financing

activities:

Long-term debt issued or remarketed, net of discount and issuance

costs of $3 and $16 for respective periods 397 1,415 Long-term debt

matured (83 ) (761 ) Preference stock issued, net 294 319

Preference stock redeemed (125 ) (325 ) Short-term debt financing,

net 60 (112 ) Dividends to noncontrolling interests (98 ) (91 )

Dividends paid (469 ) (408 ) Other (76 ) (11 )

Net cash

provided by financing activities (100 ) 26

Cash flows from investing activities: Capital expenditures

(2,773 ) (3,134 ) Proceeds from sale of nuclear decommissioning

trust investments 2,075 2,507 Purchases of nuclear decommissioning

trust investments (1,916 ) (2,265 ) Life insurance policy proceeds

140 — Other (3 ) 35

Net cash used in investing

activities (2,477 ) (2,857 )

Net (decrease) increase

in cash and cash equivalents (77 ) 2 Cash and cash equivalents

at beginning of period 161 132

Cash and cash equivalents at end of

period

$ 84 $ 134

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161101006481/en/

Edison InternationalMedia relations

contact:Charles Coleman, 626-302-7982orInvestor relations

contact:Scott Cunningham, 626-302-2540

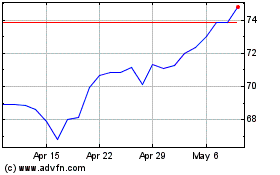

Edison (NYSE:EIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edison (NYSE:EIX)

Historical Stock Chart

From Apr 2023 to Apr 2024