UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 27, 2015

|

| | | | | | |

Commission File Number | | Exact Name of Registrant as specified in its charter | | State or Other Jurisdiction of Incorporation or Organization | | IRS Employer Identification Number |

1-9936 | | EDISON INTERNATIONAL | | California | | 95-4137452 |

1-2313 | | SOUTHERN CALIFORNIA EDISON COMPANY | | California | | 95-1240335 |

|

| | |

| |

|

2244 Walnut Grove Avenue (P.O. Box 976) Rosemead, California 91770 (Address of principal executive offices) | | 2244 Walnut Grove Avenue (P.O. Box 800) Rosemead, California 91770 (Address of principal executive offices) |

(626) 302-2222 (Registrant's telephone number, including area code) | | (626) 302-1212 (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

This current report and its exhibits include forward-looking statements. Edison International and Southern California Edison Company based these forward-looking statements on their current expectations and projections about future events in light of their knowledge of facts as of the date of this current report and their assumptions about future circumstances. These forward-looking statements are subject to various risks and uncertainties that may be outside the control of Edison International and Southern California Edison Company. Edison International and Southern California Edison Company have no obligation to publicly update or revise any forward-looking statements, whether due to new information, future events, or otherwise. This current report should be read with Edison International's and Southern California Edison Company's combined Annual Report on Form 10-K for the year ended December 31, 2014 and subsequent Quarterly Reports on Form 10-Q. Additionally, Edison International and SCE provide direct links to SCE's regulatory filings with the CPUC and the FERC at www.edisoninvestor.com so that such filings are immediately available to all investors upon SCE filing with the relevant agency.

| |

Item 2.02 | Results of Operations and Financial Condition |

On October 27, 2015, Edison International issued a press release reporting its financial results and the financial results for its subsidiary, Southern California Edison Company, for the quarter ended September 30, 2015. A copy of the press release is attached as Exhibit 99.1. On the same day, members of Edison International's management will speak to investors via a financial teleconference. Senior management's prepared remarks and accompanying presentation are attached as Exhibit 99.2 and Exhibit 99.3. The information furnished in this Item 2.02 and Exhibits 99.1, 99.2, and 99.3 shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933.

| |

Item 7.01 | Regulation FD Disclosure |

Members of Edison International management will use the information in the presentation attached hereto as Exhibit 99.3 in meetings with institutional investors and analysts and at investor conferences. The attached presentation will also be posted on Edison International's website.

| |

Item 9.01 | Financial Statements and Exhibits |

See the Exhibit Index below.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| EDISON INTERNATIONAL |

| (Registrant) |

| |

| /s/ Mark C. Clarke |

| Mark C. Clarke |

| Vice President and Controller |

Date: October 27, 2015

|

| |

| SOUTHERN CALIFORNIA EDISON COMPANY |

| (Registrant) |

| |

| /s/ Connie J. Erickson |

| Connie J. Erickson |

| Vice President and Controller |

Date: October 27, 2015

EXHIBIT INDEX

|

| |

| |

Exhibit No. | Description |

| |

99.1 | Edison International Press Release dated October 27, 2015 |

| |

99.2 | Edison International Third Quarter 2015 Financial Results Conference Call Prepared Remarks dated October 27, 2015 |

| |

99.3 | Edison International Third Quarter 2015 Financial Results Conference Call Presentation dated October 27, 2015 |

| |

FOR IMMEDIATE RELEASE

Media relations contact:

Charles Coleman, (626) 302-7982

Investor relations contact:

Scott Cunningham, (626) 302-2540

Edison International Reports Third Quarter 2015 Results; Provides 2015 Earnings Guidance

ROSEMEAD, Calif., October 27, 2015 - Edison International (NYSE: EIX) today reported third quarter 2015 net income on a GAAP basis of $421 million, or $1.29 per share, compared to $480 million, or $1.47 per share, in the third quarter of 2014. On an adjusted basis, Edison International’s third quarter 2015 core earnings were $377 million, or $1.16 per share, compared to $496 million, or $1.52 per share, in the third quarter of 2014.

Southern California Edison's (SCE) third quarter 2015 core earnings decreased by $114 million, or $0.35 per share, from the third quarter 2014 primarily due to an estimated revenue refund of $233 million, or $0.42 per share, based on the proposed decision in SCE's 2015 General Rate Case (GRC) and lower income tax benefits, partially offset by higher Federal Energy Regulatory Commission (FERC)-related revenue from rate base growth. The revenue requirement ultimately adopted by the California Public Utilities Commission (CPUC) will be retroactive to January 1, 2015.

Edison International Parent and Other’s third quarter 2015 core losses increased by $5 million, or $0.01 per share, compared to third quarter 2014 core losses primarily due to lower income from Edison Capital's investments in affordable housing projects.

Edison International's third quarter 2015 core earnings exclude income of $1 million related to losses allocated to tax equity investors under the hypothetical liquidation at book value (HLBV) accounting method and $43 million, or $0.13 per share, from discontinued operations. Edison International's third quarter 2014 core earnings exclude losses of $16 million, or $0.05 per share, from discontinued operations.

“Third quarter earnings comparisons were impacted by the proposed decision on SCE’s 2015 General Rate Case,” said Ted Craver, chairman and chief executive officer of Edison International. “While the case is generally constructive overall, SCE has identified several important items that the CPUC should correct.”

Year-to-Date Earnings

For the nine months ended September 30, 2015, Edison International reported net income on a GAAP basis of $1,099 million, or $3.37 per share, compared to $1,192 million, or $3.66 per share, during the same period in 2014. On an adjusted basis, Edison International’s core earnings were $1,049 million, or $3.22 per share, compared to $1,142 million, or $3.50 per share, in the year-to-date period in 2014.

SCE’s core earnings for the nine months ended September 30, 2015 decreased $89 million, or $0.27 per share, from the same period in 2014, primarily due to lower revenue related to the 2015 GRC proposed decision and lower other income, partially offset by higher FERC-related revenue from rate base growth and earnings on funds used during construction. In addition, income tax benefits were lower in 2015.

Edison International Parent and Other’s year-to-date 2015 core losses increased $4 million, or $0.01 per share, compared to the same period in 2014 primarily due to income taxes and expenses.

Edison International Reports Third Quarter 2015 Financial Results

Page 2 of 8

Edison International's year-to-date 2015 core earnings exclude income of $7 million, or $0.02 per share, related to losses allocated to tax equity investors under the HLBV accounting method and $43 million, or $0.13 per share, from discontinued operations. Edison International's year-to-date 2014 core earnings exclude a charge of $96 million, or $0.29 per share, related to the SCE San Onofre Settlement Agreement and $146 million, or $0.45 per share, of income from discontinued operations.

Edison International uses core earnings, which is a non-GAAP financial measure that adjusts for significant discrete items that management does not consider representative of ongoing earnings. Edison International management believes that core earnings provide more meaningful comparisons of performance from period to period. Please see the attached tables for a reconciliation of core earnings to basic GAAP earnings.

2015 Earnings Guidance

The company announced core earnings guidance of $3.77 to $3.87 per share and basic earnings guidance of $3.92 to $4.02 per share for 2015. See the presentation accompanying the company’s conference call for further information including key guidance assumptions.

Reconciliation of 2015 Core Earnings Guidance to Basic Earnings Guidance

|

| | | |

| 2015 Earnings Guidance as of October 27, 2015 |

| Low | Midpoint | High |

SCE | | $3.97 | |

EIX Parent & Other | | (0.15) | |

EIX Core EPS | $3.77 | $3.82 | $3.87 |

Non-Core Items1 | 0.15 | 0.15 | 0.15 |

EIX Basic EPS | $3.92 | $3.97 | $4.02 |

| | | |

1 Represents non-core items recorded for the nine months ended September 30, 2015. |

About Edison International

Edison International (NYSE:EIX), through its subsidiaries, is a generator and distributor of electric power and an investor in energy services and technologies, including renewable energy. Headquartered in Rosemead, Calif., Edison International is the parent company of Southern California Edison, one of the nation’s largest electric utilities.

Edison International Reports Third Quarter 2015 Financial Results

Page 3 of 8

Appendix

Use of Non-GAAP Financial Measures

Edison International’s earnings are prepared in accordance with generally accepted accounting principles used in the United States and represent the company’s earnings as reported to the Securities and Exchange Commission. Our management uses core earnings and core earnings per share (EPS) internally for financial planning and for analysis of performance. We also use core earnings and core EPS when communicating with analysts and investors regarding our earnings results to facilitate comparisons of the Company’s performance from period to period. Financial measures referred to as net income, basic EPS, core earnings, or core EPS also apply to the description of earnings or earnings per share.

Core earnings and core EPS are non-GAAP financial measures and may not be comparable to those of other companies. Core earnings and core EPS are defined as basic earnings and basic EPS excluding income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings. Basic earnings and losses refer to net income or losses attributable to Edison International shareholders. Core earnings are reconciled to basic earnings in the attached tables. The impact of participating securities (vested awards that earn dividend equivalents that may participate in undistributed earnings with common stock) for the principal operating subsidiary is not material to the principal operating subsidiary’s EPS and is therefore reflected in the results of the Edison International holding company, which is included in Edison International Parent and Other.

Risk Disclosure Statement

Forward-looking statements about the financial outlook for Edison International and its subsidiaries are included in this news release. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Edison International’s Form 10-K, most recent Form 10-Q, and other reports and presentations filed with the Securities and Exchange Commission which are available at: www.edisoninvestor.com. These forward-looking statements represent our expectations only as of the date of this news release, and Edison International assumes no duty to update them to reflect new information, events or circumstances.

Regulatory Filings Access

Edison International and SCE provide direct links to SCE's regulatory filings with the CPUC and the FERC at www.edisoninvestor.com so that such filings are available to all investors upon SCE filing with the relevant agency.

Reminder: Edison International Will Hold a Conference Call Today

When: Tuesday, October 27, 2015, 1:30 p.m. (Pacific Time)

Telephone Numbers: 1-800-369-2198 (US) and 1-773-756-4618 (Int'l) - Passcode: Edison

Telephone Replay: 1-800-570-8796 (US) and 1-203-369-3293 (Int’l) - Passcode: 85749

Telephone replay available through November 5, 2015

Webcast: www.edisoninvestor.com

Edison International Reports Third Quarter 2015 Financial Results

Page 4 of 8

Third Quarter and Year-to-Date Reconciliation of

Core Earnings Per Share to Basic Earnings Per Share

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | | | Nine months ended September 30, | | |

| 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

Earnings (loss) per share attributable to Edison International | | | | | | | | |

Continuing operations | | | | | | | | | | | |

SCE | $ | 1.19 |

| | $ | 1.54 |

| | $ | (0.35 | ) | | $ | 3.31 |

| | $ | 3.29 |

| | $ | 0.02 |

|

Edison International Parent and Other | (0.03 | ) | | (0.02 | ) | | (0.01 | ) | | (0.07 | ) | | (0.08 | ) | | 0.01 |

|

Discontinued operations | 0.13 |

| | (0.05 | ) | | 0.18 |

| | 0.13 |

| | 0.45 |

| | (0.32 | ) |

Edison International | 1.29 |

| | 1.47 |

| | (0.18 | ) | | 3.37 |

| | 3.66 |

| | (0.29 | ) |

Less: Non-core items | | | | | | | | | | | |

SCE | — |

| | — |

| | — |

| | — |

| | (0.29 | ) | | 0.29 |

|

Edison International Parent and Other | — |

| | — |

| | — |

| | 0.02 |

| | — |

| | 0.02 |

|

Discontinued operations | 0.13 |

| | (0.05 | ) | | 0.18 |

| | 0.13 |

| | 0.45 |

| | (0.32 | ) |

Total non-core items | 0.13 |

| | (0.05 | ) | | 0.18 |

| | 0.15 |

| | 0.16 |

| | (0.01 | ) |

Core earnings (losses) | | | | | | | | | | | |

SCE | 1.19 |

| | 1.54 |

| | (0.35 | ) | | 3.31 |

| | 3.58 |

| | (0.27 | ) |

Edison International Parent and Other | (0.03 | ) | | (0.02 | ) | | (0.01 | ) | | (0.09 | ) | | (0.08 | ) | | (0.01 | ) |

Edison International | $ | 1.16 |

| | $ | 1.52 |

| | $ | (0.36 | ) | | $ | 3.22 |

| | $ | 3.50 |

| | $ | (0.28 | ) |

Note: Diluted earnings were $1.28 and $1.46 per share for the three months ended September 30, 2015 and 2014, respectively, and $3.34 and $3.62 per share for the nine months ended September 30, 2015 and 2014, respectively.

Third Quarter and Year-to-Date Reconciliation of

Core Earnings to Basic Earnings (in millions) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | | | Nine months ended September 30, | | |

(in millions) | 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

Net income (loss) attributable to Edison International | | | | | | | | |

Continuing operations | | | | | | | | | | | |

SCE | $ | 389 |

| | $ | 503 |

| | $ | (114 | ) | | $ | 1,079 |

| | $ | 1,072 |

| | $ | 7 |

|

Edison International Parent and Other | (11 | ) | | (7 | ) | | (4 | ) | | (23 | ) | | (26 | ) | | 3 |

|

Discontinued operations | 43 |

| | (16 | ) | | 59 |

| | 43 |

| | 146 |

| | (103 | ) |

Edison International | 421 |

| | 480 |

| | (59 | ) | | 1,099 |

| | 1,192 |

| | (93 | ) |

Less: Non-core items | | | | | | | | | | | |

SCE | — |

| | — |

| | — |

| | — |

| | (96 | ) | | 96 |

|

Edison International Parent and Other | 1 |

| | — |

| | 1 |

| | 7 |

| | — |

| | 7 |

|

Discontinued operations | 43 |

| | (16 | ) | | 59 |

| | 43 |

| | 146 |

| | (103 | ) |

Total non-core items | 44 |

| | (16 | ) | | 60 |

| | 50 |

| | 50 |

| | — |

|

Core earnings (losses) | | | | | | | | | | | |

SCE | 389 |

| | 503 |

| | (114 | ) | | 1,079 |

| | 1,168 |

| | (89 | ) |

Edison International Parent and Other | (12 | ) | | (7 | ) | | (5 | ) | | (30 | ) | | (26 | ) | | (4 | ) |

Edison International | $ | 377 |

| | $ | 496 |

| | $ | (119 | ) | | $ | 1,049 |

| | $ | 1,142 |

| | $ | (93 | ) |

Edison International Reports Third Quarter 2015 Financial Results

Page 5 of 8

|

| | | | | | | | | | | | | | | | |

Consolidated Statements of Income | | Edison International | |

| | Three months ended September 30, | | Nine months ended September 30, |

(in millions, except per-share amounts, unaudited) | | 2015 | | 2014 | | 2015 | | 2014 |

Total operating revenue | | $ | 3,763 |

| | $ | 4,356 |

| | $ | 9,183 |

| | $ | 10,298 |

|

Purchased power and fuel | | 1,785 |

| | 2,182 |

| | 3,648 |

| | 4,563 |

|

Operation and maintenance | | 780 |

| | 802 |

| | 2,159 |

| | 2,245 |

|

Depreciation, decommissioning and amortization | | 506 |

| | 424 |

| | 1,451 |

| | 1,248 |

|

Property and other taxes | | 84 |

| | 77 |

| | 255 |

| | 235 |

|

Impairment and other charges | | — |

| | (3 | ) | | — |

| | 228 |

|

Total operating expenses | | 3,155 |

| | 3,482 |

| | 7,513 |

| | 8,519 |

|

Operating income | | 608 |

| | 874 |

| | 1,670 |

| | 1,779 |

|

Interest and other income | | 32 |

| | 40 |

| | 114 |

| | 109 |

|

Interest expense | | (138 | ) | | (141 | ) | | (420 | ) | | (422 | ) |

Other expenses | | (15 | ) | | (29 | ) | | (40 | ) | | (52 | ) |

Income from continuing operations before income taxes | | 487 |

| | 744 |

| | 1,324 |

| | 1,414 |

|

Income tax expense | | 82 |

| | 220 |

| | 195 |

| | 284 |

|

Income from continuing operations | | 405 |

| | 524 |

| | 1,129 |

| | 1,130 |

|

Income (loss) from discontinued operations, net of tax | | 43 |

| | (16 | ) | | 43 |

| | 146 |

|

Net income | | 448 |

| | 508 |

| | 1,172 |

| | 1,276 |

|

Preferred and preference stock dividend requirements of utility | | 28 |

| | 28 |

| | 84 |

| | 84 |

|

Other noncontrolling interests | | (1 | ) | | — |

| | (11 | ) | | — |

|

Net income attributable to Edison International common shareholders | | $ | 421 |

| | $ | 480 |

| | $ | 1,099 |

| | $ | 1,192 |

|

Amounts attributable to Edison International common shareholders: | | | | | | | | |

Income from continuing operations, net of tax | | $ | 378 |

| | $ | 496 |

| | $ | 1,056 |

| | $ | 1,046 |

|

Income (loss) from discontinued operations, net of tax | | 43 |

| | (16 | ) | | 43 |

| | 146 |

|

Net income attributable to Edison International common shareholders | | $ | 421 |

| | $ | 480 |

| | $ | 1,099 |

| | $ | 1,192 |

|

Basic earnings per common share attributable to Edison International common shareholders: | | | | | | | | |

Weighted-average shares of common stock outstanding | | 326 |

| | 326 |

| | 326 |

| | 326 |

|

Continuing operations | | $ | 1.16 |

| | $ | 1.52 |

| | $ | 3.24 |

| | $ | 3.21 |

|

Discontinued operations | | 0.13 |

| | (0.05 | ) | | 0.13 |

| | 0.45 |

|

Total | | $ | 1.29 |

| | $ | 1.47 |

| | $ | 3.37 |

| | $ | 3.66 |

|

Diluted earnings per common share attributable to Edison International common shareholders: | | | | | | | | |

Weighted-average shares of common stock outstanding, including effect of dilutive securities | | 328 |

| | 329 |

| | 329 |

| | 329 |

|

Continuing operations | | $ | 1.15 |

| | $ | 1.51 |

| | $ | 3.21 |

| | $ | 3.18 |

|

Discontinued operations | | 0.13 |

| | (0.05 | ) | | 0.13 |

| | 0.44 |

|

Total | | $ | 1.28 |

| | $ | 1.46 |

| | $ | 3.34 |

| | $ | 3.62 |

|

Dividends declared per common share | | $ | 0.4175 |

| | $ | 0.3550 |

| | $ | 1.2525 |

| | $ | 1.0650 |

|

Edison International Reports Third Quarter 2015 Financial Results

Page 6 of 8

|

| | | | | | | |

Consolidated Balance Sheets | Edison International | |

| | | |

(in millions, unaudited) | September 30,

2015 | | December 31,

2014 |

ASSETS | | | |

Cash and cash equivalents | $ | 134 |

| | $ | 132 |

|

Receivables, less allowances of $66 and $68 for uncollectible accounts at respective dates | 1,211 |

| | 790 |

|

Accrued unbilled revenue | 1,025 |

| | 632 |

|

Inventory | 270 |

| | 281 |

|

Derivative assets | 81 |

| | 102 |

|

Regulatory assets | 473 |

| | 1,254 |

|

Deferred income taxes | 152 |

| | 452 |

|

Other current assets | 446 |

| | 376 |

|

Total current assets | 3,792 |

| | 4,019 |

|

Nuclear decommissioning trusts | 4,388 |

| | 4,799 |

|

Other investments | 208 |

| | 207 |

|

Total investments | 4,596 |

| | 5,006 |

|

Utility property, plant and equipment, less accumulated depreciation and amortization of $8,407 and $8,132 at respective dates | 34,062 |

| | 32,859 |

|

Nonutility property, plant and equipment, less accumulated depreciation of $81 and $76 at respective dates | 140 |

| | 122 |

|

Total property, plant and equipment | 34,202 |

| | 32,981 |

|

Derivative assets | 188 |

| | 219 |

|

Regulatory assets | 8,121 |

| | 7,612 |

|

Other long-term assets | 371 |

| | 349 |

|

Total long-term assets | 8,680 |

| | 8,180 |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Total assets | $ | 51,270 |

| | $ | 50,186 |

|

Edison International Reports Third Quarter 2015 Financial Results

Page 7 of 8

|

| | | | | | | | |

Consolidated Balance Sheets | | Edison International | |

| | | | |

(in millions, except share amounts, unaudited) | | September 30,

2015 | | December 31,

2014 |

LIABILITIES AND EQUITY | | | | |

Short-term debt | | $ | 1,154 |

| | $ | 1,291 |

|

Current portion of long-term debt | | 295 |

| | 504 |

|

Accounts payable | | 1,330 |

| | 1,580 |

|

Accrued taxes | | 80 |

| | 81 |

|

Customer deposits | | 235 |

| | 221 |

|

Derivative liabilities | | 207 |

| | 196 |

|

Regulatory liabilities | | 888 |

| | 401 |

|

Other current liabilities | | 1,050 |

| | 1,205 |

|

Total current liabilities | | 5,239 |

| | 5,479 |

|

Long-term debt | | 10,957 |

| | 10,234 |

|

Deferred income taxes and credits | | 7,698 |

| | 7,313 |

|

Derivative liabilities | | 1,167 |

| | 1,052 |

|

Pensions and benefits | | 2,175 |

| | 2,155 |

|

Asset retirement obligations | | 2,822 |

| | 2,821 |

|

Regulatory liabilities | | 5,265 |

| | 5,889 |

|

Other deferred credits and other long-term liabilities | | 2,316 |

| | 2,255 |

|

Total deferred credits and other liabilities | | 21,443 |

| | 21,485 |

|

Total liabilities | | 37,639 |

| | 37,198 |

|

Commitments and contingencies | | | | |

Redeemable noncontrolling interest | | 11 |

| | 6 |

|

Common stock, no par value (800,000,000 shares authorized; 325,811,206 shares issued and outstanding at respective dates) | | 2,475 |

| | 2,445 |

|

Accumulated other comprehensive loss | | (55 | ) | | (58 | ) |

Retained earnings | | 9,180 |

| | 8,573 |

|

Total Edison International's common shareholders' equity | | 11,600 |

| | 10,960 |

|

Noncontrolling interests – preferred and preference stock of utility | | 2,020 |

| | 2,022 |

|

Total equity | | 13,620 |

| | 12,982 |

|

| | | | |

| | | | |

| | | | |

Total liabilities and equity | | $ | 51,270 |

| | $ | 50,186 |

|

Edison International Reports Third Quarter 2015 Financial Results

Page 8 of 8

|

| | | | | | | |

Consolidated Statements of Cash Flows | Edison International | |

| |

| Nine months ended September 30, |

(in millions, unaudited) | 2015 | | 2014 |

Cash flows from operating activities: | | | |

Net income | $ | 1,172 |

| | $ | 1,276 |

|

Less: Income from discontinued operations | 43 |

| | 146 |

|

Income from continuing operations | 1,129 |

| | 1,130 |

|

Adjustments to reconcile to net cash provided by operating activities: | | | |

Depreciation, decommissioning and amortization | 1,515 |

| | 1,312 |

|

Allowance for equity during construction | (63 | ) | | (45 | ) |

Impairment and other charges | — |

| | 228 |

|

Deferred income taxes and investment tax credits | 202 |

| | 303 |

|

Other | (5 | ) | | 14 |

|

EME insurance proceeds and settlement payments | (176 | ) | | (225 | ) |

Changes in operating assets and liabilities: | | | |

Receivables | (412 | ) | | (369 | ) |

Inventory | 10 |

| | (19 | ) |

Accounts payable | 164 |

| | 211 |

|

Prepaid and accrued taxes | (18 | ) | | 106 |

|

Other current assets and liabilities | (572 | ) | | (603 | ) |

Derivative assets and liabilities, net | 25 |

| | (68 | ) |

Regulatory assets and liabilities, net | 1,318 |

| | 41 |

|

Nuclear decommissioning trusts

| (249 | ) | | 100 |

|

Other noncurrent assets and liabilities | (35 | ) | | (89 | ) |

Net cash provided by operating activities | 2,833 |

| | 2,027 |

|

Cash flows from financing activities: | | | |

Long-term debt issued or remarketed, net of discount and issuance costs of $16 and $5 at respective periods | 1,415 |

| | 395 |

|

Long-term debt matured or repurchased | (761 | ) | | (405 | ) |

Preference stock issued, net | 319 |

| | 269 |

|

Preference stock redeemed | (325 | ) | | — |

|

Short-term debt financing, net | (112 | ) | | 1,138 |

|

Cash contribution from redeemable noncontrolling interest | 17 |

| | — |

|

Dividends to noncontrolling interests | (91 | ) | | (88 | ) |

Dividends paid | (408 | ) | | (347 | ) |

Other | (28 | ) | | (57 | ) |

Net cash provided by financing activities | 26 |

| | 905 |

|

Cash flows from investing activities: | | | |

Capital expenditures | (3,134 | ) | | (2,856 | ) |

Proceeds from sale of nuclear decommissioning trust investments | 12,915 |

| | 5,846 |

|

Purchases of nuclear decommissioning trust investments | (12,673 | ) | | (5,951 | ) |

Other | 35 |

| | 25 |

|

Net cash used in investing activities | (2,857 | ) | | (2,936 | ) |

Net increase (decrease) in cash and cash equivalents | 2 |

| | (4 | ) |

Cash and cash equivalents at beginning of period | 132 |

| | 146 |

|

Cash and cash equivalents at end of period | $ | 134 |

| | $ | 142 |

|

Prepared Remarks of Edison International CEO and CFO

Third Quarter 2015 Financial Teleconference

October 27, 2015, 1:30 p.m. (PDT)

Ted Craver, Chairman and Chief Executive Officer, Edison International

Today we reported core earnings of $1.16 per share. While this is well below last year’s third quarter core earnings of $1.52 per share, year-over-year third quarter earnings comparisons, as was the case with the first two quarters of the year, are not very useful. This is because of the way we have had to recognize revenue with the delay in SCE’s 2015 General Rate Case and how we are accounting for the recently released Proposed Decision.

We have said in the past that we would provide 2015 earnings guidance when we received a final GRC decision. However, with the noise in our quarterly earnings numbers, we thought it a disservice to investors to have them guessing about 2015 earnings. Therefore, we decided it was best to provide 2015 guidance at this time. So, today we introduced core earnings guidance for 2015 of $3.77 to $3.87 per share. This guidance has some key assumptions that Jim will review in his comments. Of course, should the final GRC decision differ substantially from the proposed decision, we may have to revisit our guidance. We plan to return to our normal practice of providing annual earnings guidance for 2016 when we report full-year 2015 results in late February.

One more comment on the General Rate Case: While we feel the GRC Proposed Decision is overall generally constructive, SCE identified several important issues in its October 8 comments to the CPUC. Jim will cover most of these but I want to touch on one in particular. The proposed decision attempts to recover certain tax repair benefits that were reflected in earnings in 2012 to 2014 through a permanent reduction to rate base of $344 million. We consider this retroactive ratemaking and a potential violation of Internal Revenue Service rules. We are hopeful that the CPUC will correct their legal error. If the Commission were to adopt the proposed decision’s retroactive treatment of repair deductions, then SCE would be forced to write-off some or all of the $380 million regulatory asset related to future recovery of taxes.

The final decision on SCE’s General Rate Case is currently scheduled for the November 5 CPUC meeting.

I assume most, if not all of you, are aware of the Administrative Law Judge’s Proposed Decision released yesterday on penalties related to SONGS ex parte communications. In short, the ALJ found in her PD that there were eight communications that were late reported to the Commission, and found two Rule 1.1 violations. The PD proposed a $16.74 million penalty on SCE. There are additional procedural steps yet to come on this issue, but we are thankful that this appears to be moving towards resolution. This has been a painful episode, including for Edison, and I feel obliged to make several comments on it.

First, I want to set the record straight on some misconceptions that are constantly being repeated. Contrary to the many reports, SCE has not engaged in “improper talks or communications with regulators” related to the SONGS OII. The important distinction is that the Judge found that we didn’t report in a timely manner permissible communications with regulators. The communications themselves were not found to be improper or illegal under the ex parte rules as certain parties have repeatedly and wrongly asserted.

In our recent filing, we maintained that seven of these eight communications were either not required, or outright not allowed, to be reported under the ex parte rules. The difference of opinion is the direct result of ambiguity in California’s overly complicated ex parte rules. Ambiguous rules require the parties to do their best to interpret them in practice, which creates risk. We believe the rules need to be clarified and simplified, so that we do not find ourselves underwriting the risk of after-the-fact reviews. It is worth noting that even the ALJ concluded in her PD that the ex parte rules were ambiguous, and cited that as a mitigating factor in calculating the penalty. As I said in an earnings call a few quarters ago, we look forward to working with President Picker to clarify the ex parte rules soon.

Many of the matters we deal with in our business involve tough judgement calls in contentious proceedings under ambiguous rules and conditions. We don’t particularly like it, but it comes with the territory. We expect controversy. We also expect a great deal of ourselves and our employees, because we provide such an essential service to society and we rely on the public trust.

That is why it is important that we do the right thing. We expect nothing less of ourselves. We want to earn the trust of our customers, the public, and the CPUC based on our conduct. While we aren’t perfect, and there will be times when we fail to live up to our own expectations and those of others, we must—and we do—set high standards of conduct for ourselves.

We have an obligation to be transparent and open, and we will redouble our efforts to conduct ourselves in this manner. We will also work hard to support President Picker’s efforts to clarify and improve the current poorly crafted ex parte rules. Strong efforts on both fronts will go a long way to avoiding a repeat of this in the future.

On a brighter note, we were pleased to report last week the settlement reached with Nuclear Electric Insurance Limited, known as NEIL, on insurance claims related to the shutdown of the San Onofre Nuclear Generating Station. The settlement is for $400 million and covers all insurance claims by the three owners of SONGS related to the events leading to the shutdown. All necessary approvals have been received from the owners and NEIL.

This is another important step in implementing the SONGS settlement approved unanimously by the CPUC last November. Consistent with the SONGS settlement, insurance recoveries will first pay associated legal costs, and then 95% will be allocated to customers and 5% to the owners. SCE customers will receive its allocation as a credit to the purchased power balancing account known as ERRA. Assuming payment from NEIL is received in the fourth quarter, then customer benefits should show up in their bills as a reduction in purchased power costs in 2016.

The larger claim against Mitsubishi Heavy Industries for the failed design of the replacement steam generators continues to proceed under binding arbitration through the International Chamber of Commerce. We still expect a decision on that case by late 2016. SCE’s share of the NEIL recoveries, and any MHI recoveries, including recovery of legal costs, will be treated as non-core. That is, they will not be included in our core earnings.

There is still much procedurally to be accomplished before the SONGS OII and related matters can be completed. We are hopeful that this is all moving toward a conclusion this year, or at worst, early next. We continue to believe that no new information has been presented to suggest that the SONGS settlement was anything other than independently-negotiated that warrants continued full support by the CPUC and customers.

I’d like to turn to a couple of items that address some of our longer-term growth opportunities, starting with SCE’s Distribution Resources Plan, or DRP. Since the July 1 filing, we have seen tremendous interest among stakeholders, and some encouraging early support from a number of parties on our conceptual, long-term approach. Appropriately, there will be concerns about cost and the pace of implementation of building a flexible 21st Century grid as outlined in the DRP. We are awaiting a more definitive schedule for the balance of the proceeding, which the CPUC indicates will be completed next spring. This should give SCE adequate time to incorporate DRP elements into its 2018 to 2020 General Rate Case, which we expect to file in the fall of 2016.

Moving on, the California legislature provided its own form of support for Governor Brown’s low-carbon goals and the DRP with the passage of Senate Bill 350. The Governor signed this bill into law earlier this month. SB 350 will move renewables targets to 50% of delivered energy from qualifying renewable resources by 2030. The current renewables target is 33% of delivered power by 2020. The new law provides some valuable implementation flexibility that will help us meet the goals at the lowest reasonable cost to our customers. It also provided legislative support for future utility investment in transportation electrification. This is one of the long-term growth opportunities that we see for SCE, just as we see similar opportunities around electric vehicle charging infrastructure and energy storage as complements to SCE’s wires-focused investment strategy.

One final comment: I continue to believe that we have an attractive multi-year dividend opportunity that complements a strong earnings growth outlook. The GRC proposed decision, the DRP, and SB 350 are all data points that underscore SCE’s growth potential. This in turn reaffirms the dividend growth opportunity I’ve discussed on recent earnings calls. We recognize that for a few years now we have been below our targeted payout ratio of 45-55 percent of

SCE’s earnings. We remain committed to moving well into that target range in steps, over time. Hopefully we will be well along the way to resolution on both the SONGS OII and the GRC before the Board’s usual December consideration of a dividend increase. Even if both are not fully resolved by then, I don’t see it impacting our ability to continue to implement our dividend policy.

Jim Scilacci, Executive Vice President and Chief Financial Officer, Edison International

I plan on covering third quarter and year-to-date results, SCE’s 2015 general rate case proposed decision, capital spending and rate base forecasts, a few other financial topics, and guidance.

Please turn to page 2 of the presentation.

Let me first address revenue recognition for the first six months and then for the third quarter.

For the first two quarters of this year, we recorded revenues largely based on 2014 authorized revenues which included a revenue deferral of $85 million or 16 cents a share related to incremental flow through tax repair deductions. Our accounting was based on management judgment that these revenues would likely be refunded to customers.

Having received the proposed decision, we updated our estimate of probable refunds to customers as part of our third quarter reporting. This in turn lowered third quarter revenues. The GRC-related revenue reduction was 42 cents per share. This is comprised of the two elements shown under key earnings drivers at the right of the slide.

As Ted noted, earnings comparisons will not be useful until we receive a final GRC decision and report full-year 2015 earnings. Of course, if the final GRC decision is different than the proposed decision, then there could be other related adjustments.

With that background, I’d like to walk through the key earnings drivers, starting with SCE. There are two key drivers of the 35 cent per share decline in SCE earnings. First, as I mentioned before, we recorded revenue largely based the GRC proposed decision, including a catch-up adjustment. Second, there were favorable cost and tax benefits realized in 2014 which did not recur in 2015.

Looking at revenue, I’ve highlighted the 42 cents per share related to the GRC proposed decision. 20 cents of this revenue reduction is from the flow through tax repair benefits to customers with a related offset in the form of higher tax repair deductions. The remaining decrease in GRC revenues are 22 cents per share. Also, we continue to see revenue increases from a growing FERC rate base and higher operating costs. This is a positive 2 cents per share.

Lastly, please note that the revenue variance is net of SONGS for comparability. The SONGS details are footnoted.

Moving to O&M, SCE had 3 cents per share in higher costs this quarter versus the third quarter of last year. This includes a penny per share in additional severance at SCE.

Depreciation is 2 cents per share higher primarily due to transmission and distribution investments. Net financing costs provided a 2 cent per share benefit primarily due to higher earnings from AFUDC.

Turning to taxes, I’ve already covered the 20 cents per share from 2015 repair deductions. Most of the remaining variance relates to the 11 cents per share in earnings for incremental tax repair deductions recorded last year.

All in, SCE’s third quarter core earnings are $1.19 per share, down 35 cents per share from last year.

For the holding company, costs are a penny per share higher than last year, largely on lower income from Edison Capital. I’ll come back to Edison Capital later in my remarks.

Non-core earnings in the quarter of 13 cents per share largely relate to EME bankruptcy tax benefits and insurance recoveries.

Please turn to page 3.

We added this slide to simplify the explanation of our third quarter core earnings. As you can see, the key difference on this slide versus the prior slide is that we netted out the impact of lower revenues and income tax benefits related to repair deductions in 2015. As indicated on this slide, the two key drivers are the lower revenues based on the GRC proposed decision of 22 cents and the 11 cents of 2014 incremental repair deductions. That gets to 33 of the 35 cents reduction in third quarter SCE earnings.

Please turn to page 4.

For year to date earnings, GRC-related revenue is 58 cents per share lower, reflecting the 42 cents for the third quarter and the 16 cents in the first half of the year. Again this is a mix of lower tax repair revenues – 36 cents per share - which is offset in taxes – and the third quarter revenue adjustment of 22 cents per share.

Most of the costs items continue their trends and for the year-to-date we also have higher depreciation and O&M and lower financing costs from higher AFUDC earnings. You’ll also see the significant impacts in both years related to changes in uncertain tax positions and lower tax benefits in other areas. Last year, we also had the generator settlements and other items that are absent this year. All in, year-to-date SCE core earnings are $3.31 per share, down 27 cents from last year.

Page 5 has a similar waterfall chart of year-to-date core earnings.

Please turn to page 6.

This slide compares the key revenue and rate base differences between the 2015 GRC proposed decision and SCE’s updated request. The revenue adjustments we recorded in the third quarter largely reflect three quarters’ worth of the proposed decision’s authorized annual revenue.

Please turn to page 7.

This slide summarizes the most important issues identified in SCE’s comments on the GRC proposed decision. Ted has already talked about the tax repair deduction issue. Next is the

customer deposit issue. Since the 2003 GRC, the CPUC has treated customer deposits as a rate base offset. However, PG&E and SDG&E do not have this adjustment. The third item is a proposed reduction in the pole loading program. The proposed decision did not approve approximately $100 million of capital, which has a 2015 rate base impact of approximately $73 million. Putting aside the rate base adjustment for repair deductions, the proposed decision would adopt 92 percent of our requested capital. This is higher than previous GRCs, and of course, this percentage could change with a final decision.

I will note two other key issues. The principal one is incentive compensation. The proposed decision recommended significant reductions in authorized revenues related to incentive compensation for the entire workforce, even though the jointly sponsored SCE and ORA compensation study concluded SCE’s total compensation is, on average, 5% below market. We are strong believers in a pay-for-performance compensation philosophy and incentive-based compensation for all employees, not just executives, is a fundamental element of that philosophy. This reduction is larger than experienced in prior cases.

Lastly, there is a $10 million disallowance for a contract termination payment dating back to SCE’s commercial rooftop solar initiative. We believe the termination payment is reasonable and benefited customers substantially.

In accounting for the quarter, the revenue adjustments track the proposed decision except for two items – the tax item and the solar program contract cancellation disallowance. I’ll pick this up later when I discuss the rate base forecast and earnings guidance.

Please turn to page 8.

Pages 8 and 9 update forecasted capital expenditures and rate base for the GRC proposed decision and known FERC-related capital expenditure changes.

SCE is experiencing licensing and permitting delays with a few of its transmission projects, notably the West of Devers project. As a result, the timing of expenditures have moved out beyond 2017. Once SCE files its 2018 GRC application and we update our cap ex and rate base forecasts, these delayed expenditures will appear back in our forecast. The FERC

adjustments are shown on the right of the slide; the balance of reductions is related to the GRC proposed decision; largely infrastructure replacement, inspection and maintenance and non-electric facility capital projects.

Historically, we have shown what we call a “Request” level of capital expenditures and rate base, and a lower “Range” level. As you can see on the charts on pages 8 and 9, we have replaced the word “Request” with the word “Outlook”. For CPUC capital, we now forecast that we spend all authorized dollars for 2015 through 2017. For FERC capital, we have continued our practice of reducing Outlook expenditures by 12 percent to arrive at the “Range” level of expenditures. Once we file our 2018 general rate case, we will revert back to using both Request and Range monikers.

As a reminder, the CPUC capital expenditures do not include any Distribution Resources Plan expenditures. We have asked the Commission to approve a memorandum account so we can track costs associated with the DRP spending. So if we were to spend all authorized CPUC amounts provided in the GRC proposed decision, then we would need to have the DRP memo account in place in order to be allowed to seek cost recovery in the next GRC.

Beyond 2017, we still believe that long-term capital spending will continue to run at least $4 billion annually, and spending could be higher depending upon CPUC approval in future rate cases.

Please turn to page 9.

Based on our revised capital spending forecast from the prior slide, we have updated our rate base forecast. The updated rate base forecast yields compound annual growth rates of 8 per cent from 2015 through 2017. The prior forecast was 7 to 9 percent annually. Consistent with our accounting for the proposed decision, we have not factored in the proposed $344 million reduction in rate base related to the disputed tax repair deduction issue in this forecast. If the final GRC decision adopts the rate base adjustment, then in each of the years, rate base would decline by the adjustment amount.

Please turn to page 10.

As expected, the CPUC cost of capital mechanism did not trigger any change in allowed ROE for 2016. Though the spot Moody’s Baa Utility Index rate moved quite a bit, the moving average dampened the full-year impact. Starting October 1, we began the new measurement period, starting with the moving average where the spot rate ended on September 30 at 5.45%. We are currently scheduled to file our next cost of capital application in April 2016.

Please turn to page 11.

This page covers a handful of other financial topics. SCE’s weighted-average common equity component for regulatory purposes was 49.5 percent at September 30, increasing from 48.9 percent we reported in the second quarter. This excess equity gives us additional financial flexibility.

Next, you will recall that SCE’s fuel and purchased power balancing account, or ERRA, had been deeply under collected as recently as year-end 2014. With a previous rate increase, SONGS settlement refunds, and lower natural gas costs, the balancing account has moved to an over-collected position of $112 million as of September 30. When SCE receives the NEIL settlement proceeds, expected in the fourth quarter, they will be credited to ERRA.

Turning to the holding company, last month we renewed an EIX holding company shelf registration to provide us flexibility to access the capital markets as needed for liquidity and general corporate purposes. EIX commercial paper outstanding was $738 million at September 30, compared to a total EIX credit facility of $1.18 billion.

Also, earlier this month we reached agreement to sell our remaining affordable housing portfolio at Edison Capital. Terms of the transaction have not been disclosed pending final due diligence and negotiations. In any case, the amounts are not material and the transaction will be treated as non-core. For the past few years, Edison Capital’s earnings have helped offset holding company costs.

Please turn to page 12.

This page provides detail of our 2015 earnings guidance that Ted discussed. We have followed the same approach we have used for the past several years. We start with SCE rate

base earnings. We used the $23.1 billion weighted average rate base outlook as shown on page 10. Based on SCE’s authorized capital structure and flat share count that gets us $3.56 per share of rate base earnings.

We then identify 41 cents per share of SCE items that take earnings higher. The principal item is the 31 cents per share revision to uncertain tax positions recorded in the second quarter. We have also discussed AFUDC being a net positive factor for the year, rather than just offsetting costs not recovered by general rate case revenues. We continue to estimate 5 cents of energy efficiency earnings in the fourth quarter as previously disclosed. We have recorded severance costs of 3 cents year-to-date. The balance of all other items is a positive penny a share, including the ex parte proposed penalty. We have estimated full-year holding company costs at 15 cents, getting us to the midpoint of $3.82 per share.

To the right we have included key guidance assumptions. We have excluded the shareholder portion of the NEIL settlement proceeds and related litigation costs. We consider these revenues non-core. Our guidance tracks our accounting for the GRC proposed decision so it excludes the $344 million rate base adjustment for repair deductions and the solar termination payment disallowance.

-###-

October 27, 2015 Third Quarter 2015 Financial Results

October 27, 2015 1 Forward-Looking Statements Statements contained in this presentation about future performance, including, without limitation, operating results, asset and rate base growth, capital expenditures, financial outlook, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10- K, most recent form 10-Q, and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation.

October 27, 2015 2 Q3 2015 Q3 2014 Variance Core Earnings Per Share (EPS)1 SCE $1.19 $1.54 ($0.35) EIX Parent & Other (0.03) (0.02) (0.01) Core EPS1 $1.16 $1.52 ($0.36) Non-Core Items2 SCE $ – $ – $ – EIX Parent & Other – – – Discontinued Operations 0.13 (0.05) 0.18 Total Non-Core $0.13 ($0.05) $0.18 Basic EPS $1.29 $1.47 ($0.18) Diluted EPS $1.28 $1.46 ($0.18) SCE Key Core EPS Drivers Lower revenue3 ($0.40) - Lower GRC revenue – tax repairs4 (0.20) - Lower GRC revenue – other4 (0.22) - FERC revenue and other 0.02 Higher O&M (0.03) Higher depreciation (0.02) Lower net financing costs 0.02 Income taxes 0.08 - Higher authorized tax repair deductions4 0.20 - 2014 incremental tax repair deductions (0.11) - Lower tax benefits (0.01) Total ($0.35) Third Quarter Earnings Summary 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Refer to “Management Overview” in the September 30, 2015 Form 10-Q for discussion of non-core items 3. Excludes San Onofre revenue of $0.09, which was offset by amortization of regulatory assets of $(0.13), interest expense of $(0.01), O&M of $0.04, income taxes of $0.02 and other of $(0.01) 4. During the third quarter of 2015, SCE recorded revenue subject to refund of $233 million $(0.42). Higher authorized tax repair deductions were $0.20 per share which is reflected in the revenue subject to refund. Lower operating costs and other income tax benefits were reflected in the 2015 GRC thereby reducing authorized revenue as compared to 2014 EIX Key Core EPS Drivers Lower income from Edison Capital ($0.02) Income taxes and expenses 0.01 Total ($0.01)

October 27, 2015 3 $1.16 (0.20) (0.03) (0.02) (0.12) (0.01) 0.02 $1.52 Q3 2014 Core EPS Lower Revenue Higher O&M Higher Depreciation Lower Net Financing Costs Higher Income Taxes EIX Parent & Other Q3 2015 Core EPS Key Drivers of Q3 2015 Core EPS Lower revenues reflect 2015 GRC Proposed Decision 1 1 Note: See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 1. Lower GRC revenue – tax repairs of $(0.20) are netted against higher authorized tax repair deductions of $0.20 on this graph; these items do not have an earnings impact ($ per share)

October 27, 2015 4 YTD 2015 YTD 2014 Variance Core Earnings Per Share (EPS)1 SCE $3.31 $3.58 ($0.27) EIX Parent & Other (0.09) (0.08) ($0.01) Core EPS1 $3.22 $3.50 ($0.28) Non-Core Items2 SCE $ – ($0.29) $0.29 EIX Parent & Other 0.02 – 0.02 Discontinued Operations 0.13 0.45 (0.32) Total Non-Core $0.15 $0.16 ($0.01) Basic EPS $3.37 $3.66 ($0.29) Diluted EPS $3.34 $3.62 ($0.28) YTD 2015 Earnings Summary 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Refer to “Management Overview” in the September 30, 2015 Form 10-Q for discussion of non-core items 3. Excludes San Onofre revenue of $0.15, which was offset by amortization of regulatory assets of $(0.25), interest expense of $(0.02), O&M of $0.11, income taxes of $0.02 and other of $(0.01) 4. During the nine months of 2015, SCE recorded revenue subject to refund of $318 million $(0.58). Higher authorized tax repair deductions were $0.36 per share which is reflected in the revenue subject to refund. Lower operating costs and other income tax benefits were reflected in the 2015 GRC thereby reducing authorized revenue as compared to 2014 5. Includes San Onofre impact of $(0.01) primarily due to property and sales tax refund of $0.02 related to replacement steam generators for the nine months ended September 30, 2014 SCE Key Core EPS Drivers Lower revenue3 ($0.43) - Lower GRC revenue – tax repairs4 (0.36) - Lower GRC revenue – other4 (0.22) - FERC revenue and other 0.15 Higher O&M (0.02) Higher depreciation (0.11) Lower net financing costs 0.08 Income taxes 0.28 - Higher authorized tax repair deductions4 0.36 - 2014 incremental tax repair deductions (0.26) - 2015 change in uncertain tax positions 0.31 - 2014 change in uncertain tax positions (0.09) - Lower tax benefits (0.04) Other items (0.07) - Property taxes and other5 (0.04) - Generator settlements (0.03) Total ($0.27) EIX Key Core EPS Drivers Income taxes and expenses ($0.01) Total ($0.01)

October 27, 2015 5 Key Drivers of YTD 2015 Core EPS $3.22 (0.07) (0.02) (0.11) (0.08) (0.04) (0.03) (0.01) 0.08 $3.50 YTD 2014 Core EPS Lower Revenue Higher O&M Higher Depreciation Lower Net Financing Costs Higher Income Taxes Property Taxes and Other Generator Settlements EIX Parent & Other YTD 2015 Core EPS Note: See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 1. Lower GRC revenue – tax repairs of $(0.36) are netted against higher authorized tax repair deductions of $0.36 on this graph; these items do not have an earnings impact 1 1 ($ per share)

October 27, 2015 6 On September 18, 2015, the CPUC issued a proposed decision which is supportive of SCE strategy to increase infrastructure investment consistent with capital plan while mitigating customer rate impacts through productivity and lower operating costs • 2015 revenue requirement proposed decision of $5.159 billion - $353 million reduction from SCE’s 2015 request - $474 million decrease from presently authorized base rates • 2015 capital spending reduced $300 million in 2015 from SCE’s request • 2015 rate base proposed decision of $17.467 billion, $709 million below SCE’s request Year SCE Update Testimony 5/11/15 (Table II-4) Proposed Decision 9/18/15 Difference Base Revenue Requirement 2015 $5.512 $5.159 ($0.353) 2016 $5.748 $5.429 ($0.319) 2017 $6.067 $5.704 ($0.363) CPUC Rate Base 2015 $18.176 $17.467 ($0.709) 2016 $19.933 $19.229 ($0.704) 2017 $21.603 $20.725 ($0.878) ($ billions) 2015 General Rate Case Proposed Decision

October 27, 2015 7 $80 million compensation expense reduction • Reductions in short-term incentives even though total compensation is 5% below market $10 million commercial solar program disallowance • Contract early termination payment resulted in over $200 million in customer savings 2015 General Rate Case Proposed Decision (cont.) Key Open Rate Base Items Other Key Open Items $344 million tax adjustment • Attempts to recapture incremental 2012- 14 tax repair benefits • Retroactive ratemaking, an illegal taking, and likely IRS normalization violation $180 million exclusion of customer deposits • SCE proposal is consistent with CPUC standard practices and treatment of other utilities $73 million pole loading capital spending reduction • 20% reduction in joint pole replacements and 3% cost reduction ($100 million capital expenditure reduction)

October 27, 2015 8 SCE 2015-2017 Capital Expenditures • Incorporates CPUC 2015 GRC proposed decision • Outlook adjusted for delays in FERC spending of approximately $50 million in 2015 and $350 million in 2016 related to shift in project schedules out in time Note: Forecasted capital spending subject to timely receipt of permitting, licensing, and regulatory approvals. The forecasted capital spending includes CPUC, FERC and other spending Range case includes a 12% reduction of FERC expenditures in 2016 and 2017 ($ billions) 2015-17 Total Outlook $3.9 $3.8 $4.1 $11.8 Range $3.9 $3.7 $4.0 $11.6 $3.9 $3.8 $4.1 2015 2016 2017 Distribution Transmission Generation $11.6 – $11.8 Billion Capital Program for 2015-2017 2018+ Capital Spending Outlook • SCE anticipates long-term capital spending to continue at least in the range of ~$4 billion annually, although could result in higher spending pending CPUC approval in future GRCs

October 27, 2015 9 SCE 2015-2017 Rate Base • Includes updated FERC capital spending forecast (rate base reductions of $0.1, $0.3 and $0.6 billion in 2015, 2016 and 2017 respectively) and GRC proposed decision rate base adjustments, except for $344 million rate base reduction for repair deduction tax treatment - If tax treatment is adopted in GRC final decision, then each year’s forecast is reduced by same amount • FERC rate base includes Construction Work in Progress (CWIP) and is approximately 22% of SCE’s rate base outlook by 2017 • Excludes SONGS regulatory asset ($ billions) Outlook Range $23.1 $24.9 $26.7 $23.1 $25.0 $26.9 2015 2016 2017 Note: Weighted-average year basis, 2015-2017 CPUC rate base proposed decision and consolidation of CWIP projects. Rate base forecast range reflects capital expenditure forecast range Rate base calculated under current tax law 8% Average Annual Rate Base Growth for 2015-2017 2018+ Rate Base Outlook • Sustained growth tied to long-term capital spending outlook

October 27, 2015 10 CPUC and FERC Cost of Capital 3 4 5 6 7 10/1/12 10/1/13 10/1/14 10/1/15 10/1/16 R a t e ( % ) CPUC Adjustment Mechanism Moody’s Baa Utility Index Spot Rate Moving Average (10/1/14 – 9/30/15) = 4.82% 100 basis point +/- Deadband Starting Value – 5.00% CPUC – 48% common equity and Return on Equity (ROE) adjustment mechanism has been extended through 2016 • Weighted average authorized cost of capital – 7.90% • ROE adjustment based on 12-month average of Moody’s Baa utility bond rates, measured from Oct. 1 to Sept. 30 • If index exceeds 100 bps deadband from starting index value, authorized ROE changes by half the difference • Starting index value based on trailing 12 months of Moody’s Baa index as of September 30, 2012 – 5.00% • Application in April 2016 for 2017 Cost of Capital – adjustment mechanism continues in the interim FERC – comparable to CPUC 10.45% ROE • Includes 9.30% base + 50 bps CAISO participation plus project incentives • Moratorium on filing ROE changes expired July 1, 2015 • FERC Formula recovery mechanism in effect through December 31, 2017

October 27, 2015 11 Other Financial Topics Topic Update Comments SCE EIX Holding Company Shelf registration refiled • Flexibility to term-out commercial paper borrowings ($738 million outstanding at Sept. 30 (vs. $545 million at June 30) • Second EME settlement payment of $204 million made on September 30 Edison Capital sale agreement • Agreement reached to sell its remaining affordable housing investments; expected to close in Q4 • Business exit; proceeds reflected in non-core earnings Weighted-average equity percentage 9/30/15 6/30/15 9/30/14 • Expect to remain above 48% regulatory minimum49.5% 48.9% 48.3% ERRA balancing account1 $112 ($543) ($1,570) • NEIL settlement proceeds of $313 million to be refunded to ERRA ($ millions, except percent) 1. Over-collection/(under-collection)

October 27, 2015 12 $3.56 3.56 3.82 $3.82 (0.15) 0.41 SCE 2015 EPS from Rate Base Forecast 2015 SCE Variances EIX Parent & Other 2015 Core EIX EPS Midpoint Guidance 2015 Core and Basic Earnings Guidance 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Non-core items recorded for the nine months ended September 30, 2015 3. $380 million regulatory asset related to recovery of repair deductions and $10 million solar termination payment 4. AFUDC benefits net certain SCE costs (such as philanthropy, executive compensation, and certain other allocated costs) not authorized by GRC proposed decision Low Midpoint High SCE $3.97 EIX Parent & Other (0.15) EIX Core EPS1 $3.77 $3.82 $3.87 Non-Core Items2 0.15 0.15 0.15 EIX Basic EPS $3.92 $3.97 $4.02 • Change in uncertain tax positions - $0.31 • AFUDC net benefits4 - $0.07 • Energy efficiency - $0.05 • Severance –$(0.03) • Ex-parte penalty & Other - $0.01 ($ per share) 2015 Earnings Guidance as of October 27, 2015 Key Assumptions • Revenues based largely on GRC proposed decision other than two open regulatory items3 • Weighted-average 2015 rate base of $23.1 billion (see Rate Base Forecast) • Authorized capital structure – 48% equity; 10.45% CPUC and FERC ROE • 325.8 million common shares outstanding • Energy efficiency earnings of $0.05 per share • No change in tax policy • Includes proposed ex-parte penalty • Excludes SONGS NEIL settlement benefit

October 27, 2015 13 Appendix

October 27, 2015 14 Earnings Non-GAAP Reconciliations Reconciliation of EIX Core Earnings to EIX GAAP Earnings Earnings Attributable to Edison International Core Earnings SCE EIX Parent & Other Core Earnings Non-Core Items SCE EIX Parent & Other Discontinued operations Total Non-Core Basic Earnings Q3 2014 $503 (7) $496 $ − – (16) $(16) $480 Q3 2015 $389 (12) $377 $ – 1 43 $44 $421 Note: See Use of Non-GAAP Financial Measures in Appendix YTD 2014 $1,168 (26) $1,142 $(96) – 146 $50 $1,192 YTD 2015 $1,079 (30) $1,049 $ – 7 43 $50 $1,099 ($ millions)

October 27, 2015 15 Use of Non-GAAP Financial Measures Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including sale of certain assets, and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. EIX Investor Relations Contact Scott Cunningham, Vice President (626) 302‐2540 scott.cunningham@edisonintl.com Allison Bahen, Senior Manager (626) 302‐5493 allison.bahen@edisonintl.com

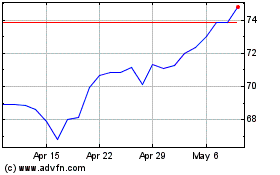

Edison (NYSE:EIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edison (NYSE:EIX)

Historical Stock Chart

From Apr 2023 to Apr 2024