UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 30, 2015

|

| | | | | | |

Commission File Number | | Exact Name of Registrant as specified in its charter | | State or Other Jurisdiction of Incorporation or Organization | | IRS Employer Identification Number |

1-9936 | | EDISON INTERNATIONAL | | California | | 95-4137452 |

1-2313 | | SOUTHERN CALIFORNIA EDISON COMPANY | | California | | 95-1240335 |

|

| | |

| |

|

2244 Walnut Grove Avenue (P.O. Box 976) Rosemead, California 91770 (Address of principal executive offices) | | 2244 Walnut Grove Avenue (P.O. Box 800) Rosemead, California 91770 (Address of principal executive offices) |

(626) 302-2222 (Registrant's telephone number, including area code) | | (626) 302-1212 (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

This current report and its exhibits include forward-looking statements. Edison International and Southern California Edison Company based these forward-looking statements on their current expectations and projections about future events in light of their knowledge of facts as of the date of this current report and their assumptions about future circumstances. These forward-looking statements are subject to various risks and uncertainties that may be outside the control of Edison International and Southern California Edison Company. Edison International and Southern California Edison Company have no obligation to publicly update or revise any forward-looking statements, whether due to new information, future events, or otherwise. This current report should be read with Edison International's and Southern California Edison Company's combined Annual Report on Form 10-K for the year ended December 31, 2014 and subsequent Quarterly Reports on Form 10-Q.

| |

Item 2.02 | Results of Operations and Financial Condition |

On July 30, 2015, Edison International issued a press release reporting its financial results and the financial results for its subsidiary, Southern California Edison Company, for the quarter ended June 30, 2015. A copy of the press release is attached as Exhibit 99.1. On the same day, members of Edison International's management will speak to investors via a financial teleconference. Senior management's prepared remarks and accompanying presentation are attached as Exhibit 99.2 and Exhibit 99.3. The presentation attached as Exhibit 99.3 will accompany management's comments on the financial teleconference. The information furnished in this Item 2.02 and Exhibits 99.1, 99.2, and 99.3 shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933.

| |

Item 7.01 | Regulation FD Disclosure |

Members of Edison International management will use the information in the presentation attached hereto as Exhibit 99.3 in meetings with institutional investors and analysts and at investor conferences. The attached presentation will also be posted on Edison International's website.

| |

Item 9.01 | Financial Statements and Exhibits |

See the Exhibit Index below.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| EDISON INTERNATIONAL |

| (Registrant) |

| |

| /s/ Mark C. Clarke |

| Mark C. Clarke |

| Vice President and Controller |

Date: July 30, 2015

|

| |

| SOUTHERN CALIFORNIA EDISON COMPANY |

| (Registrant) |

| |

| /s/ Connie J. Erickson |

| Connie J. Erickson |

| Vice President and Controller |

Date: July 30, 2015

EXHIBIT INDEX

|

| |

| |

Exhibit No. | Description |

| |

99.1 | Edison International Press Release dated July 30, 2015 |

| |

99.2 | Edison International Second Quarter 2015 Financial Results Conference Call Prepared Remarks dated July 30, 2015 |

| |

99.3 | Edison International Second Quarter 2015 Financial Results Conference Call Presentation dated July 30, 2015 |

| |

FOR IMMEDIATE RELEASE

Media relations contact:

Charles Coleman, (626) 302-7982

Investor relations contact:

Scott Cunningham, (626) 302-2540

Edison International Reports Second Quarter 2015 Results

ROSEMEAD, Calif., July 30, 2015 - Edison International (NYSE: EIX) today reported second quarter 2015 net income on a GAAP basis of $379 million, or $1.16 per share, compared to $536 million, or $1.64 per share, in the second quarter of 2014. On an adjusted basis, Edison International’s second quarter 2015 core earnings were $378 million, or $1.16 per share, compared to $352 million, or $1.08 per share, in the second quarter of 2014.

“SCE remains focused on improving its safety and operational performance and continues to invest at high levels to support system reliability, public safety and California’s renewables mandates,” said Ted Craver, chairman and chief executive officer of Edison International. “Earnings improved in the second quarter primarily from federal tax benefits, but until SCE receives a decision in its 2015 General Rate Case, comparative results are not meaningful.”

Southern California Edison's (SCE) second quarter 2015 core earnings increased by $22 million, or $0.07 per share, from the second quarter 2014 primarily due to a $100 million, or $0.31 per share, tax benefit from revisions to liabilities for uncertain tax positions. In addition, earnings benefited from higher Federal Energy Regulatory Commission (FERC)-related revenue from rate base growth and earnings on funds used during construction. These were partially offset by lower other income and other tax items. SCE continues to recognize revenue from CPUC activities in 2015 largely based on 2014 authorized base revenue requirements included in customer rates. The revenue requirement ultimately adopted by the CPUC will be retroactive to January 1, 2015.

During the second quarter of 2014, SCE recorded $29 million, or $0.09 per share, of income tax benefits from revisions to liabilities for uncertain tax positions and $14 million ($9 million after-tax), or $0.03 per share, of benefits related to generator settlements.

Edison International Parent and Other’s second quarter 2015 core losses decreased by $4 million, or $0.01 per share, compared to second quarter 2014 core losses primarily due to lower corporate expenses.

Edison International's second quarter 2015 core earnings exclude income of $1 million related to losses allocated to tax equity investors under the hypothetical liquidation at book value accounting method. Edison International's second quarter 2014 core earnings exclude income of $184 million, or $0.56 per share, from discontinued operations.

Year-to-Date Earnings

For the six months ended June 30, 2015, Edison International reported net income on a GAAP basis of $678 million, or $2.08 per share, compared to $712 million, or $2.18 per share, during the same period in 2014. On an adjusted basis, Edison International’s core earnings were $672 million, or $2.06 per share, compared to $646 million, or $1.98 per share, in the year-to-date period in 2014.

SCE’s core earnings for the six months ended June 30, 2015 increased $23 million, or $0.08 per share, from the same period in 2014, due to higher income tax benefits, FERC-related revenue from rate base growth and earnings on funds used during construction, partially offset by lower other income. Edison International Parent and Other’s year-to-date 2015 core losses were comparable to core losses in the same period of 2014.

Edison International Reports Second Quarter 2015 Financial Results

Page 2 of 8

Edison International\'s year-to-date 2015 core earnings exclude income of $6 million, or $0.02 per share, related to losses allocated to tax equity investors under the hypothetical liquidation at book value accounting method. Edison International's year-to-date 2014 core earnings exclude a charge of $96 million, or $0.29 per share, related to the SCE San Onofre Settlement Agreement and $162 million, or $0.49 per share, of income from discontinued operations.

Edison International uses core earnings, which is a non-GAAP financial measure that adjusts for significant discrete items that management does not consider representative of ongoing earnings. Edison International management believes that core earnings provide more meaningful comparisons of performance from period to period. Please see the attached tables for a reconciliation of core earnings to basic earnings.

2015 Earnings Guidance

Edison International will provide 2015 earnings guidance after a final decision has been issued by the CPUC on the Southern California Edison 2015 General Rate Case. See the presentation accompanying the company’s conference call for further information.

About Edison International

Edison International (NYSE:EIX), through its subsidiaries, is a generator and distributor of electric power and an investor in energy services and technologies, including renewable energy. Headquartered in Rosemead, Calif., Edison International is the parent company of Southern California Edison, one of the nation’s largest electric utilities.

Edison International Reports Second Quarter 2015 Financial Results

Page 3 of 8

Appendix

Use of Non-GAAP Financial Measures

Edison International’s earnings are prepared in accordance with generally accepted accounting principles used in the United States and represent the company’s earnings as reported to the Securities and Exchange Commission. Our management uses core earnings and core earnings per share (EPS) internally for financial planning and for analysis of performance. We also use core earnings and core EPS when communicating with analysts and investors regarding our earnings results to facilitate comparisons of the Company’s performance from period to period. Financial measures referred to net income, basic EPS, core earnings, or core EPS also applies to the description of earnings or earnings per share.

Core earnings and core EPS are non-GAAP financial measures and may not be comparable to those of other companies. Core earnings and core EPS are defined as basic earnings and basic EPS excluding income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings. Basic earnings and losses refer to net income or losses attributable to Edison International shareholders. Core earnings are reconciled to basic earnings in the attached tables. The impact of participating securities (vested awards that earn dividend equivalents that may participate in undistributed earnings with common stock) for the principal operating subsidiary is not material to the principal operating subsidiary’s EPS and is therefore reflected in the results of the Edison International holding company, which is included in Edison International Parent and Other.

Risk Disclosure Statement

Forward-looking statements about the financial outlook for Edison International and its subsidiaries are included in this news release. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Edison International’s Form 10-K, most recent Form 10-Q, and other reports and presentations filed with the Securities and Exchange Commission which are available at: www.edisoninvestor.com. These forward-looking statements represent our expectations only as of the date of this news release, and Edison International assumes no duty to update them to reflect new information, events or circumstances.

Reminder: Edison International Will Hold a Conference Call Today

When: Thursday, July 30, 2015, 1:30 p.m. (Pacific Time)

Telephone Numbers: 1-800-369-2198 (US) and 1-773-756-4618 (Int'l) - Passcode: Edison

Telephone Replay: 1-888-567-0459 (US) and 1-402-998-1812 (Int’l) - Passcode: 85749

Telephone replay available through August 10, 2015

Webcast: www.edisoninvestor.com

Edison International Reports Second Quarter 2015 Financial Results

Page 4 of 8

Second Quarter and Year-to-Date Reconciliation of

Core Earnings Per Share to Basic Earnings Per Share

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | | | Six months ended June 30, | | |

| 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

Earnings (loss) per share attributable to Edison International | | | | | | | | |

Continuing operations | | | | | | | | | | | |

SCE | $ | 1.18 |

| | $ | 1.11 |

| | $ | 0.07 |

| | $ | 2.12 |

| | $ | 1.75 |

| | $ | 0.37 |

|

Edison International Parent and Other | (0.02 | ) | | (0.03 | ) | | 0.01 |

| | (0.04 | ) | | (0.06 | ) | | 0.02 |

|

Discontinued operations | — |

| | 0.56 |

| | (0.56 | ) | | — |

| | 0.49 |

| | (0.49 | ) |

Edison International | 1.16 |

| | 1.64 |

| | (0.48 | ) | | 2.08 |

| | 2.18 |

| | (0.10 | ) |

Less: Non-core items | | | | | | | | | | | |

SCE | — |

| | — |

| | — |

| | — |

| | (0.29 | ) | | 0.29 |

|

Edison International Parent and Other | — |

| | — |

| | — |

| | 0.02 |

| | — |

| | 0.02 |

|

Discontinued operations | — |

| | 0.56 |

| | (0.56 | ) | | — |

| | 0.49 |

| | (0.49 | ) |

Total non-core items | — |

| | 0.56 |

| | (0.56 | ) | | 0.02 |

| | 0.20 |

| | (0.18 | ) |

Core earnings (losses) | | | | | | | | | | | |

SCE | 1.18 |

| | 1.11 |

| | 0.07 |

| | 2.12 |

| | 2.04 |

| | 0.08 |

|

Edison International Parent and Other | (0.02 | ) | | (0.03 | ) | | 0.01 |

| | (0.06 | ) | | (0.06 | ) | | — |

|

Edison International | $ | 1.16 |

| | $ | 1.08 |

| | $ | 0.08 |

| | $ | 2.06 |

| | $ | 1.98 |

| | $ | 0.08 |

|

Note: Diluted earnings were $1.15 and $1.63 per share for the three months ended June 30, 2015 and 2014, respectively, and $2.06 and $2.17 per share for the six months ended June 30, 2015 and 2014, respectively.

Second Quarter and Year-to-Date Reconciliation of

Core Earnings to Basic Earnings (in millions) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | | | Six months ended June 30, | | |

(in millions) | 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

Net income (loss) attributable to Edison International | | | | | | | | |

Continuing operations | | | | | | | | | | | |

SCE | $ | 384 |

| | $ | 362 |

| | $ | 22 |

| | $ | 689 |

| | $ | 570 |

| | $ | 119 |

|

Edison International Parent and Other | (5 | ) | | (10 | ) | | 5 |

| | (11 | ) | | (20 | ) | | 9 |

|

Discontinued operations | — |

| | 184 |

| | (184 | ) | | — |

| | 162 |

| | (162 | ) |

Edison International | 379 |

| | 536 |

| | (157 | ) | | 678 |

| | 712 |

| | (34 | ) |

Less: Non-core items | | | | | | | | | | | |

SCE | — |

| | — |

| | — |

| | — |

| | (96 | ) | | 96 |

|

Edison International Parent and Other | 1 |

| | — |

| | 1 |

| | 6 |

| | — |

| | 6 |

|

Discontinued operations | — |

| | 184 |

| | (184 | ) | | — |

| | 162 |

| | (162 | ) |

Total non-core items | 1 |

| | 184 |

| | (183 | ) | | 6 |

| | 66 |

| | (60 | ) |

Core earnings (losses) | | | | | | | | | | | |

SCE | 384 |

| | 362 |

| | 22 |

| | 689 |

| | 666 |

| | 23 |

|

Edison International Parent and Other | (6 | ) | | (10 | ) | | 4 |

| | (17 | ) | | (20 | ) | | 3 |

|

Edison International | $ | 378 |

| | $ | 352 |

| | $ | 26 |

| | $ | 672 |

| | $ | 646 |

| | $ | 26 |

|

Edison International Reports Second Quarter 2015 Financial Results

Page 5 of 8

|

| | | | | | | | | | | | | | | | |

Consolidated Statements of Income | | Edison International | |

| | Three months ended June 30, | | Six months ended June 30, |

(in millions, except per-share amounts, unaudited) | | 2015 | | 2014 | | 2015 | | 2014 |

Total operating revenue | | $ | 2,908 |

| | $ | 3,016 |

| | $ | 5,420 |

| | $ | 5,943 |

|

Purchased power and fuel | | 1,078 |

| | 1,239 |

| | 1,864 |

| | 2,382 |

|

Operation and maintenance | | 743 |

| | 715 |

| | 1,380 |

| | 1,442 |

|

Depreciation, decommissioning and amortization | | 481 |

| | 414 |

| | 945 |

| | 824 |

|

Property and other taxes | | 82 |

| | 73 |

| | 171 |

| | 158 |

|

Impairment and other charges | | — |

| | — |

| | — |

| | 231 |

|

Total operating expenses | | 2,384 |

| | 2,441 |

| | 4,360 |

| | 5,037 |

|

Operating income | | 524 |

| | 575 |

| | 1,060 |

| | 906 |

|

Interest and other income | | 43 |

| | 46 |

| | 82 |

| | 69 |

|

Interest expense | | (138 | ) | | (139 | ) | | (281 | ) | | (281 | ) |

Other expenses | | (17 | ) | | (16 | ) | | (24 | ) | | (23 | ) |

Income from continuing operations before income taxes | | 412 |

| | 466 |

| | 837 |

| | 671 |

|

Income tax expense | | 6 |

| | 84 |

| | 113 |

| | 65 |

|

Income from continuing operations | | 406 |

| | 382 |

| | 724 |

| | 606 |

|

Gain from discontinued operations, net of tax | | — |

| | 184 |

| | — |

| | 162 |

|

Net income | | 406 |

| | 566 |

| | 724 |

| | 768 |

|

Preferred and preference stock dividend requirements of utility | | 28 |

| | 30 |

| | 56 |

| | 56 |

|

Other noncontrolling interests | | (1 | ) | | — |

| | (10 | ) | | — |

|

Net income attributable to Edison International common shareholders | | $ | 379 |

| | $ | 536 |

| | $ | 678 |

| | $ | 712 |

|

Amounts attributable to Edison International common shareholders: | | | | | | | | |

Income from continuing operations, net of tax | | $ | 379 |

| | $ | 352 |

| | $ | 678 |

| | $ | 550 |

|

Gain from discontinued operations, net of tax | | — |

| | 184 |

| | — |

| | 162 |

|

Net income attributable to Edison International common shareholders | | $ | 379 |

| | $ | 536 |

| | $ | 678 |

| | $ | 712 |

|

Basic earnings per common share attributable to Edison International common shareholders: | | | | | | | | |

Weighted-average shares of common stock outstanding | | 326 |

| | 326 |

| | 326 |

| | 326 |

|

Continuing operations | | $ | 1.16 |

| | $ | 1.08 |

| | $ | 2.08 |

| | $ | 1.69 |

|

Discontinued operations | | — |

| | 0.56 |

| | — |

| | 0.49 |

|

Total | | $ | 1.16 |

| | $ | 1.64 |

| | $ | 2.08 |

| | $ | 2.18 |

|

Diluted earnings per common share attributable to Edison International common shareholders: | | | | | | | | |

Weighted-average shares of common stock outstanding, including effect of dilutive securities | | 328 |

| | 329 |

| | 329 |

| | 329 |

|

Continuing operations | | $ | 1.15 |

| | $ | 1.07 |

| | $ | 2.06 |

| | $ | 1.68 |

|

Discontinued operations | | — |

| | 0.56 |

| | — |

| | 0.49 |

|

Total | | $ | 1.15 |

| | $ | 1.63 |

| | $ | 2.06 |

| | $ | 2.17 |

|

Dividends declared per common share | | $ | 0.4175 |

| | $ | 0.3550 |

| | $ | 0.8350 |

| | $ | 0.7100 |

|

Edison International Reports Second Quarter 2015 Financial Results

Page 6 of 8

|

| | | | | | | |

Consolidated Balance Sheets | Edison International | |

| | | |

(in millions, unaudited) | June 30,

2015 | | December 31,

2014 |

ASSETS | | | |

Cash and cash equivalents | $ | 139 |

| | $ | 132 |

|

Receivables, less allowances of $68 for uncollectible accounts at both dates | 768 |

| | 790 |

|

Accrued unbilled revenue | 853 |

| | 632 |

|

Inventory | 276 |

| | 281 |

|

Derivative assets | 79 |

| | 102 |

|

Regulatory assets | 1,066 |

| | 1,254 |

|

Deferred income taxes | 288 |

| | 452 |

|

Other current assets | 437 |

| | 376 |

|

Total current assets | 3,906 |

| | 4,019 |

|

Nuclear decommissioning trusts | 4,836 |

| | 4,799 |

|

Other investments | 210 |

| | 207 |

|

Total investments | 5,046 |

| | 5,006 |

|

Utility property, plant and equipment, less accumulated depreciation and amortization of $8,141 and $8,132 at respective dates | 33,594 |

| | 32,859 |

|

Nonutility property, plant and equipment, less accumulated depreciation of $79 and $76 at respective dates | 132 |

| | 122 |

|

Total property, plant and equipment | 33,726 |

| | 32,981 |

|

Derivative assets | 194 |

| | 219 |

|

Regulatory assets | 8,009 |

| | 7,612 |

|

Other long-term assets | 358 |

| | 349 |

|

Total long-term assets | 8,561 |

| | 8,180 |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Total assets | $ | 51,239 |

| | $ | 50,186 |

|

Edison International Reports Second Quarter 2015 Financial Results

Page 7 of 8

|

| | | | | | | | |

Consolidated Balance Sheets | | Edison International | |

| | | | |

(in millions, except share amounts, unaudited) | | June 30,

2015 | | December 31,

2014 |

LIABILITIES AND EQUITY | | | | |

Short-term debt | | $ | 1,415 |

| | $ | 1,291 |

|

Current portion of long-term debt | | 204 |

| | 504 |

|

Accounts payable | | 1,294 |

| | 1,580 |

|

Accrued taxes | | 36 |

| | 81 |

|

Customer deposits | | 234 |

| | 221 |

|

Derivative liabilities | | 162 |

| | 196 |

|

Regulatory liabilities | | 454 |

| | 401 |

|

Other current liabilities | | 1,037 |

| | 1,205 |

|

Total current liabilities | | 4,836 |

| | 5,479 |

|

Long-term debt | | 11,265 |

| | 10,234 |

|

Deferred income taxes and credits | | 7,599 |

| | 7,313 |

|

Derivative liabilities | | 1,155 |

| | 1,052 |

|

Pensions and benefits | | 2,176 |

| | 2,155 |

|

Asset retirement obligations | | 2,825 |

| | 2,821 |

|

Regulatory liabilities | | 5,813 |

| | 5,889 |

|

Other deferred credits and other long-term liabilities | | 2,220 |

| | 2,255 |

|

Total deferred credits and other liabilities | | 21,788 |

| | 21,485 |

|

Total liabilities | | 37,889 |

| | 37,198 |

|

Commitments and contingencies | | | | |

Redeemable noncontrolling interest | | 3 |

| | 6 |

|

Common stock, no par value (800,000,000 shares authorized; 325,811,206 shares issued and outstanding at respective dates) | | 2,472 |

| | 2,445 |

|

Accumulated other comprehensive loss | | (56 | ) | | (58 | ) |

Retained earnings | | 8,909 |

| | 8,573 |

|

Total Edison International's common shareholders' equity | | 11,325 |

| | 10,960 |

|

Noncontrolling interests – preferred and preference stock of utility | | 2,022 |

| | 2,022 |

|

Total equity | | 13,347 |

| | 12,982 |

|

| | | | |

| | | | |

| | | | |

Total liabilities and equity | | $ | 51,239 |

| | $ | 50,186 |

|

Edison International Reports Second Quarter 2015 Financial Results

Page 8 of 8

|

| | | | | | | |

Consolidated Statements of Cash Flows | Edison International | |

| |

| Six months ended June 30, |

(in millions, unaudited) | 2015 | | 2014 |

Cash flows from operating activities: | | | |

Net income | $ | 724 |

| | $ | 768 |

|

Less: Income from discontinued operations | — |

| | 162 |

|

Income from continuing operations | 724 |

| | 606 |

|

Adjustments to reconcile to net cash provided by operating activities: | | | |

Depreciation, decommissioning and amortization | 987 |

| | 864 |

|

Allowance for equity during construction | (42 | ) | | (28 | ) |

Impairment and other charges | — |

| | 231 |

|

Deferred income taxes and investment tax credits | 101 |

| | 110 |

|

Other | 11 |

| | 11 |

|

EME settlement payments | — |

| | (225 | ) |

Changes in operating assets and liabilities: | | | |

Receivables | 32 |

| | (185 | ) |

Inventory | 5 |

| | (21 | ) |

Accounts payable | 130 |

| | 116 |

|

Prepaid and accrued taxes | (50 | ) | | 79 |

|

Other current assets and liabilities | (411 | ) | | (471 | ) |

Derivative assets and liabilities, net | 33 |

| | 64 |

|

Regulatory assets and liabilities, net | 241 |

| | (317 | ) |

Nuclear decommissioning trusts

| 41 |

| | 83 |

|

Other noncurrent assets and liabilities | (34 | ) | | (309 | ) |

Net cash provided by operating activities | 1,768 |

| | 608 |

|

Cash flows from financing activities: | | | |

Long-term debt issued or remarketed, net of discount and issuance costs of $16 and $4 at respective periods | 1,415 |

| | 396 |

|

Long-term debt matured or repurchased | (721 | ) | | (4 | ) |

Preference stock issued, net | — |

| | 269 |

|

Short-term debt financing, net | 125 |

| | 1,043 |

|

Cash contribution from redeemable noncontrolling interest | 7 |

| | — |

|

Dividends to noncontrolling interests | (56 | ) | | (54 | ) |

Dividends paid | (272 | ) | | (231 | ) |

Other | (25 | ) | | (51 | ) |

Net cash provided by financing activities | 473 |

| | 1,368 |

|

Cash flows from investing activities: | | | |

Capital expenditures | (2,197 | ) | | (1,856 | ) |

Proceeds from sale of nuclear decommissioning trust investments | 7,253 |

| | 3,750 |

|

Purchases of nuclear decommissioning trust investments | (7,301 | ) | | (3,838 | ) |

Other | 11 |

| | 12 |

|

Net cash used in investing activities | (2,234 | ) | | (1,932 | ) |

Net increase in cash and cash equivalents | 7 |

| | 44 |

|

Cash and cash equivalents at beginning of period | 132 |

| | 146 |

|

Cash and cash equivalents at end of period | $ | 139 |

| | $ | 190 |

|

Prepared Remarks of Edison International CEO and CFO

Second Quarter 2015 Financial Teleconference

July 30, 2015, 1:30 p.m. (PDT)

Ted Craver, Chairman and Chief Executive Officer, Edison International

Second quarter core earnings were $1.16 per share, up 8 cents per share from last year. However, until SCE receives a decision in its 2015 General Rate Case, comparisons of year-over-year results will not be very meaningful. Jim will have the details in his comments.

Today, I will touch on several policy and growth topics, but first a comment on SONGS. We are disappointed about the renewed uncertainty surrounding the SONGS settlement. Most of the recent procedural moves and various motions have come from individuals and organizations that have consistently opposed the settlement since it was first announced over a year ago. It was more troubling to have one of the six signatories of the settlement, The Utility Reform Network, advise the CPUC in late June that it no longer supported the settlement. Interestingly, in TURN’s announcement, it acknowledged that the terms of the settlement were good for customers and that the outcome of any litigated reconsideration process may not differ substantially from terms of the settlement. TURN is an important voice on consumer matters before the CPUC, so we must hope that its failure to adhere to its obligations under the SONGS settlement represents an aberration.

We have now responded to all requests for information from the CPUC’s administrative law judges regarding the challenges to the SONGS settlement. We are hopeful they will rule on the outstanding issues soon. Prolonging this period of uncertainty is not good for anyone. We continue to believe strongly that the settlement met all the required standards for last November’s unanimous Commission approval. We believe that the SONGS settlement was the product of good faith, arm’s-length negotiations that resulted in a fair and reasonable outcome for our customers.

Let me turn to some regulatory policy developments. The CPUC recently ruled on residential rate design reform as required by Assembly Bill 327. Their recent unanimous decision was the product of significant debate and compromise among the Commissioners. We didn’t get everything we advocated for. We would have liked to see more progress in increasing the proportion of revenues collected through fixed charges, which would better match our actual costs of serving residential customers, but the minimum bill will be raised from $1.80 to $10.00. Also, we preserved the opportunity to revisit a more meaningful fixed charge in the future. We achieved rate reform that places approximately 96% of our

retail customers’ kilowatt hours into a two tier rate structure-very similar to what we recommended. About 4% of our retail customers’ kilowatt hours will be subject to a surcharge for high usage.

The Commissioners invested a tremendous amount of time and effort in this phase of the proceeding, and we appreciated the unanimous agreement that getting residential rates closer to the true cost of service was an important tenant in producing fairness amongst customers. Attention will now turn to the portion of the CPUC proceeding on net energy metering, which relates to how customers who opt for rooftop solar are credited for their own generation. Parties will be filing their Net Energy Metering proposals next week.

Turning to a different subject, we have received broad support for SCE’s Charge Ready Program. This is the program we announced last October to invest in infrastructure to support transportation electrification. On July 9, a settlement with most of the parties was filed with the CPUC on the $22 million pilot phase of the program. Importantly, both TURN and the Office of Ratepayer Advocates are parties to the settlement, as are environmental organizations and electric vehicle charger equipment companies. The principal change to our original application in the settlement is to expense rather than capitalize the rebates that SCE would provide customers for the vehicle chargers installed. While it didn’t change the amount recommended for the pilot program, we expect that if this provision is adopted for the full program, the rate base opportunity will now be $225 million of the total $342 million estimate for the program. We look forward to Commission action on the pilot and subsequently on the full program.

The final topic I want to cover is SCE’s Distribution Resources Plan, or DRP, filed with the CPUC on July 1. We consider this plan to be one of our most important filings this year, and probably of several years. We endeavored to not simply answer the Commission’s initial questions about integration of distributed energy resources, but also to lay out our vision for how the grid of the future will facilitate customer choice of new technologies and support California’s policies to move to a low-carbon economy.

The goal of the Distribution Resources Plan is to facilitate the integration of Distributed Energy Resources at optimal locations within the distribution grid, and to upgrade the distribution grid to better enable a “plug and play” approach for adding Distributed Energy Resources and new technologies more broadly across our system. These resources include distributed renewable generation (such as rooftop and ground mount solar), electric vehicle charging, energy storage, energy efficiency and demand response. California views these resources as enablers in achieving its low-carbon objectives over the next several decades. At the expected adoption rate for these distributed resources, the electric grid will require substantial investment in modernization and upgrades.

As part of its filing, SCE provided an initial view of the range of possible capital investments to achieve the goals of the DRP. Assuming CPUC support, this provides some indication of our view of the investment required for the long-term program which will likely go well into the next decade. Jim will talk about some of the financial details and how we see this working with the GRC process.

As I’ve just indicated, significant capital investment will be required to modernize and upgrade SCE’s distribution grid consistent with the DRP recommendations. This is in addition to continued distribution system reliability investment, anticipated electric vehicle charging and storage investments, continued transmission and generation maintenance capital investment, and potential improvements in capital spending productivity. All of this is consistent with our lower risk, wires-focused investment strategy.

Taken together, we expect overall SCE capital spending to be at least $4 billion annually for the foreseeable future. Depending on the State’s preferences on the pace of adoption and on approval of DRP-related work in future general rate cases, capital spending could be higher.

Jim Scilacci, Executive Vice President and Chief Financial Officer, Edison International

This afternoon I will cover second quarter and year to date results and several other topics. Please turn to page 2 of the presentation.

I will lead off my comments with a general statement about attempting to compare 2015 to 2014 earnings. Because SCE has yet to receive a 2015 general rate case decision, the utility is recording revenues largely based upon 2014 authorized levels. In the quarter SCE receives a final GRC decision, we will record a cumulative adjustment retroactive to January 1, 2015. Earnings comparisons will not be useful until we report full-year 2015 earnings. In the meantime, we believe the simplified rate base approach is the best starting point to model full-year earnings.

As Ted said, second quarter core earnings are $1.16 per share. Consistent with our first quarter approach, we did defer revenues to offset incremental repair deductions pending the outcome of the 2015 General Rate Case. The amount of deferred revenue this quarter was 9 cents per share with the offsetting benefit in taxes. You can see this in the summary of SCE drivers on the slide. On a year to date basis, SCE has now deferred 16 cents of revenue from incremental repair deductions.

Because of the large delta between expected and forecast repair deductions for 2015, last May SCE made a filing with the CPUC to update its repair deductions for the 2015-2017 GRC period. With the May filing, SCE’s updated 2015 revenue request would result in a $121 million revenue decrease from authorized revenues. For the two post-test years, the year over year revenue changes would be an increase of $236 million and $320 million for 2016 and 2017 respectively. We have no insight as to the timing of a proposed GRC decision. On July 24, SCE did respond to questions raised by the ALJ concerning our May filing regarding repair deductions. The questions related to the coordination of ratemaking between CPUC and FERC.

The major item impacting second quarter results is a 31 cent per share tax benefit from reducing liabilities for uncertain tax positions. During the quarter, we received an IRS report for tax years 2010 to 2012. Based on this report, we updated our estimated liabilities for uncertain tax positions which flow directly through to earnings. We had a similar benefit of 9 cents last year related to updating our uncertain tax positions for other tax years. Both of these are highlighted in the SCE key earnings drivers. Historically, we have classified a change in estimate of an uncertain tax positions, both positive and negative, as part of core earnings and highlight significant changes that affect period over period comparisons. These items are not part of the simplified earnings model that we have discussed in the past and are subject to future revisions based on audits, new information and other developments related to our tax positions.

Excluding the 31 cent per share tax benefit, second quarter core earnings are 85 cents per share, with SCE contributing 87 cents per share, offset by a 2 cent per share loss at EIX holding company.

In the core EPS drivers table, we’ve netted out SONGS-related impacts on revenues, O&M and depreciation. On this basis, revenues are lower by 3 cents per share due to the 9 cent per share deferred revenue I mentioned earlier and partially offset by a 6 cent per share benefit from higher FERC-related and other revenues.

Looking at costs, O&M has a penny per share positive variance as we continue our cost management focus. SCE second quarter results included 2 cents per share in severance costs this year and a penny per share last year. On a year over year basis, the difference is minimal because of rounding. Depreciation expense increased by 6 cents per share, reflecting SCE’s ongoing wires investments. SCE benefitted by lower net financing costs by 3 cents per share. This relates primarily to higher AFUDC equity earnings.

Turning to taxes, I’ve already discussed most of the major items. These include the uncertain tax positions this year and last year as well as the 9 cents per share of incremental repair deductions that is the offset to the 9 cents of revenue so no net earnings impact. The balance is lower tax benefits year-over-year of 12 cents per share mainly related to lower flow through tax benefits than last year, revisions to estimated liabilities for net operating losses, interest and state income taxes.

The remaining 7 cent per share negative variance includes benefits from last year that did not recur in 2015, such as generator settlements and a San Onofre property tax refund.

For the EIX holding company, losses were a penny lower than a year ago, due to lower corporate expenses and higher income from affordable housing projects. We continue to wind down the Edison Capital low-income housing portfolio.

Please turn to page 3.

I don’t plan to review the year-to-date financial results in detail, but the earnings analysis is consistent with the second-quarter results. As I have said previously, comparisons pending a 2015 GRC decision are not meaningful.

Please turn to page 4.

You’ll see that the uptick in interest rates is reflected in the trend of the Moody’s Utility Bond Index shown as the green line. The 12-month moving average line, shown in blue, is moving back towards the 5 percent base rate. Given the short time period remaining on the 12-month measurement period, it is likely that SCE’s CPUC return on common equity will remain at 10.45 percent during 2016. At FERC, the moratorium on filing a ROE change expired July 1.

I’d also like to touch on a few other SCE-related financial matters that are not shown on the slide.

First, SCE’s weighted-average equity component for regulatory purposes was 48.9 percent at June 30, compared to 48.4 percent at the end of the first quarter. SCE is required to maintain a 48 percent common equity layer on a rolling 13-month basis.

Second, SCE continues to make good progress on reducing its fuel and purchased power under collection. As of June 30 of last year, SCE’s ERRA balancing account was under collected by over $1.6 billion. As of June 30 of this year, the ERRA under collection was $543 million. The $1 billion reduction was from three primary reasons:

1.SONGS settlement refunds credited against to the ERRA balancing account;

2.The 2014 ERRA rate increase; and

3.Lower-than-expected power and natural gas prices.

At the July 23rd Commission conference, the CPUC approved SCE’s access to the SONGS 2 and 3 nuclear decommissioning trusts for costs incurred from the June 2013 plant shutdown through the end of 2014. These costs amount to $340 million and the full amount will be refunded to customers via a credit to the ERRA under collection pursuant to the SONGS settlement. This morning, SCE filed a settlement in the 2015 ERRA proceeding. As part of this settlement, SCE has agreed to forgo any 2015 ERRA rate adjustment. We now expect that the ERRA under collection will be fully recovered before year end.

Lastly, earlier this month, both SCE and EIX extended the terms of their respective credit agreements by a year, to July 2020 for $2.6 billion at SCE and $1.18 billion at EIX. The remainder, $150 million for SCE and $68 million for EIX, will mature in July 2019. There are no material changes to terms and conditions.

Please turn to page 5.

SCE’s capital spending forecast is unchanged from the first quarter. Ted has already discussed the long-term growth opportunity around the Distribution Resources Plan, but I want to add a couple of financial specifics.

Please turn to page 6.

SCE has preliminarily estimated up to $560 million in potential DRP capital expenditures during the 2015-2017 forecast period. These proposed expenditures are largely weighted toward 2017. SCE has requested a memorandum account for the 2015-2017 revenue requirement of these investments to avoid any retroactive ratemaking issues. DRP investments that are made within authorized levels for the 2015-2017 GRC period, will not have any incremental earnings impact. If our total investments exceed the amount authorized due to the DRP spending, and if a memorandum account is authorized, then we would seek to recover the associated revenue requirement as part of SCE’s 2018 General Rate Case.

Please turn to page 7.

The rate base forecast for the 2015-2017 GRC period is unchanged from the first quarter.

Please turn to page 8.

This chart provides 2015 financial assumptions and has been updated for year-to-date amounts related to the revenue recognition on repair deductions that I covered earlier.

Please turn to page 9.

I’d like to finish with a recap our investment thesis. The DRP filing and ongoing grid investments that Ted discussed strengthens the long-term growth thesis for SCE. Future capital spending at the $4 billion level implies very roughly a $2 billion per year increase in rate base. We are planning to grow our dividend meaningfully as we move back to our target payout ratio of 45% to 55% of SCE earnings in steps and over time. Lastly, we will prudently manage our capital structure and have no plans for external common equity.

-###-

July 30, 2015 Second Quarter 2015 Financial Results

July 30, 2015 1 Forward-Looking Statements Statements contained in this presentation about future performance, including, without limitation, operating results, asset and rate base growth, capital expenditures, financial outlook, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10- K, most recent form 10-Q, and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation.

July 30, 2015 2 Q2 2015 Q2 2014 Variance Core Earnings Per Share (EPS)1 SCE $1.18 $1.11 $0.07 EIX Parent & Other (0.02) (0.03) 0.01 Core EPS1 $1.16 $1.08 $0.08 Non-Core Items2 SCE $ – $ – $ – EIX Parent & Other – – – Discontinued Operations – 0.56 (0.56) Total Non-Core $ – $0.56 $(0.56) Basic EPS $1.16 $1.64 $(0.48) Diluted EPS $1.15 $1.63 $(0.48) Second Quarter Earnings Summary 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Non-core items for the quarter ended June 30, 2014, included $0.56 income from discontinued operations related to the EME settlement 3. SCE deferred revenues of $0.09 related to incremental repair deductions pending the outcome of the 2015 GRC 4. Excludes San Onofre revenue of $0.04, which was offset by amortization of regulatory assets of $(0.06) and O&M of $0.02 5. Includes non-San Onofre severance of $0.02 and $0.01 for the quarters ended June 30, 2015 and 2014, respectively 6. Includes San Onofre property tax refund of $0.01 related to replacement steam generators for the quarter ended June 30, 2014 EIX Key Core EPS Drivers Lower corporate expenses $0.01 SCE Key Core EPS Drivers Lower revenue3,4 $(0.03) - CPUC GRC revenue deferral (0.09) - FERC revenue and other 0.06 Lower O&M5 0.01 Higher depreciation (0.06) Lower net financing costs 0.03 Income taxes 0.19 - 2015 change in uncertain tax positions 0.31 - 2014 change in uncertain tax positions (0.09) - Incremental repair deductions3 0.09 - Lower tax benefits (0.12) Other items (0.07) - Generator settlements (0.03) - Higher property taxes6 (0.02) - Other (0.02) Total $0.07

July 30, 2015 3 YTD 2015 YTD 2014 Variance Core Earnings Per Share (EPS)1 SCE $2.12 $2.04 $0.08 EIX Parent & Other (0.06) (0.06) – Core EPS1 $2.06 $1.98 $0.08 Non-Core Items2 SCE $ – $(0.29) $0.29 EIX Parent & Other 0.02 – 0.02 Discontinued Operations – 0.49 (0.49) Total Non-Core $0.02 $0.20 $(0.18) Basic EPS $2.08 $2.18 $(0.10) Diluted EPS $2.06 $2.17 $(0.11) YTD 2015 Earnings Summary 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Non-core items for the six months ended June 30, 2014, included $0.29 charge related to San Onofre settlement and $0.49 income from discontinued operations related to the EME settlement and revised tax estimate of EME deconsolidation 3. SCE deferred revenues of $0.16 related to incremental repair deductions pending the outcome of the 2015 GRC 4. Excludes San Onofre revenue of $0.06, which was offset by amortization of regulatory assets of $(0.12), interest expense of $(0.01) and O&M of $0.07 5. Includes San Onofre property tax refund of $0.01 related to replacement steam generators for the six months ended June 30, 2014 6. Includes non-San Onofre severance of $0.02 and $0.01 for the six months ended June 30, 2015 and 2014, respectively SCE Key Core EPS Drivers Lower revenue3,4 $(0.02) - CPUC GRC revenue deferral (0.16) - FERC revenue and other 0.14 Higher depreciation (0.10) Lower net financing costs 0.05 Income taxes 0.21 - 2015 change in uncertain tax positions 0.31 - 2014 change in uncertain tax positions (0.09) - Incremental repair deductions3 0.16 - Lower tax benefits (0.17) Other items (0.06) - Generator settlements (0.03) - Property taxes and other5 (0.03) Total6 $0.08

July 30, 2015 4 CPUC and FERC Cost of Capital 3 4 5 6 7 10/1/12 10/1/13 10/1/14 10/1/15 10/1/16 Rat e (% ) CPUC Adjustment Mechanism Moody’s Baa Utility Index Spot Rate Moving Average (10/1/14 – 4/1/15) = 4.69% 100 basis point +/- Deadband Starting Value – 5.00% CPUC – 48% common equity and Return on Equity (ROE) adjustment mechanism has been extended through 2016 • Weighted average authorized cost of capital – 7.90% • ROE adjustment based on 12-month average of Moody’s Baa utility bond rates, measured from Oct. 1 to Sept. 30 • If index exceeds 100 bps deadband from starting index value, authorized ROE changes by half the difference • Starting index value based on trailing 12 months of Moody’s Baa index as of September 30, 2012 – 5.00% • Application in April 2016 for 2017 Cost of Capital – adjustment mechanism continues in the interim FERC – comparable to CPUC 10.45% ROE • Includes 9.30% base + 50 bps CAISO participation plus project incentives • Moratorium on filing ROE changes expired July 1, 2015 • FERC Formula recovery mechanism in effect through December 31, 2017

July 30, 2015 5 SCE Capital Expenditures Forecast • No change from prior forecast • Growth driven by infrastructure replacement, reliability investments, distribution resources plan investments and public policy requirements Note: Forecasted capital spending subject to timely receipt of permitting, licensing, and regulatory approvals. Forecast range reflects an average variability of 12% ($ billions) 2015-17 Total Request $4.1 $4.6 $4.4 $13.1 Range $3.6 $4.0 $3.9 $11.5 $4.1 $4.6 $4.4 2015 2016 2017 Distribution Transmission Generation $11.5 – $13.1 billion forecasted capital program 2015-2017

July 30, 2015 6 SCE DRP Capital Expenditure Estimates Time Period Capital Expenditures CPUC Approval Mechanism 2015-2017 Distribution Automation $40-70 million • Proposed memorandum account to record associated revenue requirement until expenditures are authorized by CPUC Substation Automation $30-60 million Communications Systems $7-15 million Technology Platforms and Applications $130-200 million Grid Reinforcement $140-215 million Total $347-560 million 2018-2020 Distribution Automation $185-320 million • Request recovery in 2018 GRC Substation Automation $185-320 million Communications Systems $270-470 million Technology Platforms and Applications $215-375 million Grid Reinforcement $550-1,100 million Total $1,405-2,585 million SCE anticipates capital spending to continue at least in the range of current forecast levels, although could result in higher spending pending CPUC approval in future GRCs

July 30, 2015 7 SCE Rate Base Forecast • No change from prior forecast • FERC rate base includes Construction Work in Progress (CWIP) and is approximately 23% of SCE’s rate base forecast by 2017 • Excludes SONGS regulatory asset ($ billions) Request Range $23.1 $25.0 $26.9 $23.6 $26.0 $28.4 2015 2016 2017 Note: Weighted-average year basis, 2015-2017 CPUC rate base requests and consolidation of CWIP projects. Rate base forecast range reflects capital expenditure forecast range 7-9% average annual rate base growth for 2015-2017

July 30, 2015 8 2015 Financial Assumptions ($ billions) SCE Capital Expenditures SCE Authorized Cost of Capital Other SCE Items CPUC Return on Equity 10.45% CPUC Capital Structure 48% equity 43% debt 9% preferred FERC Return on Equity Comparable to CPUC ROE EIX will provide 2015 earnings guidance after a final decision on the SCE 2015 General Rate Case Distribution $16.0 Transmission 5.4 Generation 2.2 Request $23.6 Range $23.1 Distribution $3.1 Transmission 0.8 Generation 0.2 Request $4.1 Range $3.6 SCE Weighted Average Rate Base • SONGS regulatory asset financing completed January 2015 • Energy efficiency potential up to $0.05 per share • Revenues recorded at 2014 levels until 2015 GRC decision is received (retroactive to January 1, 2015) • $0.16 per share deferred revenues in YTD period for incremental repair deductions pending 2015 GRC decision

July 30, 2015 9 EIX Strategy Should Produce Superior Value Sustainable Earnings and Dividend Growth Positioned for Transformative Change Rate Base and Core Earnings Growth • 7 – 9% average annual rate base growth through 2017 Constructive Regulatory Structure • Decoupling • Balancing accounts • Forward-looking ratemaking Sustainable Dividend Growth • Target payout ratio: 45-55% of SCE core earnings • Returning to target payout ratio in steps over time produces above industry-average dividend growth SCE Focus on Lower-Risk Energy Delivery • Wires assets represent over 90% of utility plant as of December 31, 20141 SCE Growth Drivers Beyond 2017 • Public safety and reliability • Distribution Resources Plan • Electric vehicle charging and storage • State environmental policy • Transmission Edison Energy Competitive Strategy • Integrate emerging technologies and business models to expand electrification and serve commercial and industrial customers 1. Includes assets classified as transmission, distribution and general plant

July 30, 2015 10 Appendix

July 30, 2015 11 SCE Customer Demand Trends Kilowatt-Hour Sales (millions of kWh) Residential Commercial Industrial Public authorities Agricultural and other Subtotal Resale Total Kilowatt-Hour Sales Customers Residential Commercial Industrial Public authorities Agricultural Railroads and railways Interdepartmental Total Number of Customers Number of New Connections Area Peak Demand (MW) 2012 30,563 40,541 8,504 5,196 1,676 86,480 1,735 88,215 4,321,171 549,855 10,922 46,493 21,917 83 24 4,950,465 22,866 21,996 2011 29,631 39,622 8,490 5,206 1,318 84,267 3,071 87,338 4,301,969 546,936 11,370 46,684 22,086 82 22 4,929,149 19,829 22,443 2013 29,889 40,649 8,472 5,012 1,885 85,907 1,490 87,397 4,344,429 554,592 10,584 46,323 21,679 99 23 4,977,729 27,370 22,534 Note: See 2014 Edison International Financial and Statistical Reports for further information 2014 30,115 42,127 8,417 4,990 2,025 87,674 1,312 88,986 4,368,897 557,957 10,782 46,234 21,404 105 22 5,005,401 29,879 23,055 YTD 2015 12,782 20,104 3,792 2,264 864 39,806 414 40,220 4,381,124 559,594 10,893 46,343 21,401 118 22 5,019,495 12,626 N/A

July 30, 2015 12 SCE 2015 CPUC General Rate Case November 2013, 2015 GRC Application A.13-11-003 sets 2015 – 2017 base revenue requirement • Includes operating costs and CPUC jurisdictional capital • Excludes fuel and purchased power (and other utility cost-recovery activities), cost of capital, and FERC jurisdictional transmission 2015 revenue requirement request of $5.512 billion • $121 million decrease from presently authorized base rates based on May 11th update filing • Post test year requested year-over-year increase of $236 million in 2016 and additional increase of $320 million in 2017 Request consistent with SCE strategy to ramp up infrastructure investment consistent with capital plan while mitigating customer rate impacts through productivity and lower operating costs Current CPUC schedule does not specify a proposed decision timeframe Nov 12 GRC Application Aug 18 Intervener Testimony Sept 29 Evidentiary Hearings 2013 2014 Feb 11 Prehearing Conference Jan 13 Update Hearing 2015 Aug 4 ORA Testimony Nov 25 Opening Briefs Dec 11 Reply Briefs Final Decision Expected May 11 Update Filing

July 30, 2015 13 Earnings Non-GAAP Reconciliations ($ millions) Reconciliation of EIX Core Earnings to EIX GAAP Earnings Earnings Attributable to Edison International Core Earnings SCE EIX Parent & Other Core Earnings Non-Core Items SCE EIX Parent & Other Discontinued operations Total Non-Core Basic Earnings Q2 2014 $362 (10) $352 $ − – 184 $184 $536 Q2 2015 $384 (6) $378 $ – 1 – $1 $379 Note: See Use of Non-GAAP Financial Measures in Appendix YTD 2014 $666 (20) $646 $(96) – 162 $66 $712 YTD 2015 $689 (17) $672 $ – 6 – $6 $678

July 30, 2015 14 Use of Non-GAAP Financial Measures Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including sale of certain assets, and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. EIX Investor Relations Contact Scott Cunningham, Vice President (626) 302-2540 scott.cunningham@edisonintl.com Allison Bahen, Senior Manager (626) 302-5493 allison.bahen@edisonintl.com

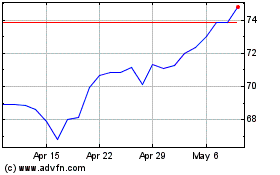

Edison (NYSE:EIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edison (NYSE:EIX)

Historical Stock Chart

From Apr 2023 to Apr 2024