Current Report Filing (8-k)

July 01 2015 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 1, 2015

|

| | | | | | |

Commission File Number | | Exact Name of Registrant as specified in its charter | | State or Other Jurisdiction of Incorporation or Organization | | IRS Employer Identification Number |

1-9936 | | EDISON INTERNATIONAL | | California | | 95-4137452 |

1-2313 | | SOUTHERN CALIFORNIA EDISON COMPANY | | California | | 95-1240335 |

|

| | |

| |

|

2244 Walnut Grove Avenue (P.O. Box 976) Rosemead, California 91770 (Address of principal executive offices) | | 2244 Walnut Grove Avenue (P.O. Box 800) Rosemead, California 91770 (Address of principal executive offices) |

(626) 302-2222 (Registrant's telephone number, including area code) | | (626) 302-1212 (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

This current report and its exhibits include forward-looking statements. Edison International and Southern California Edison Company based these forward-looking statements on their current expectations and projections about future events in light of their knowledge of facts as of the date of this current report and their assumptions about future circumstances. These forward-looking statements are subject to various risks and uncertainties that may be outside the control of Edison International and Southern California Edison Company. Edison International and Southern California Edison Company have no obligation to publicly update or revise any forward-looking statements, whether due to new information, future events, or otherwise. This current report should be read with Edison International's and Southern California Edison Company's combined Annual Report on Form 10-K for the year ended December 31, 2014 and subsequent Quarterly Reports on Form 10-Q.

| |

Item 7.01 | Regulation FD Disclosure |

To support California’s greenhouse gas reduction targets, modernize the electric distribution system to accommodate two-way flows of energy, and facilitate customer choice of new technologies and services that reduce emissions and improve resilience, the California Public Utilities Commission ("CPUC") initiated a rulemaking to establish policies, procedures and rules to guide investor owned utilities in developing a Distribution Resources Plan ("DRP") proposal. On July 1, 2015, Southern California Edison Company ("SCE") filed its DRP with the CPUC.

The goal of the DRP is to facilitate the integration of Distributed Energy Resources ("DERs") at optimal locations within the distribution grid. DERs are defined as distributed renewable generation (such as rooftop and ground-mount solar), electric vehicle charging, energy storage, energy efficiency and demand response. The DRP includes three CPUC-mandated DER growth scenarios and analyses that estimate the amount of grid capacity that can accommodate DERs.

As part of its DRP filing, SCE provided an indicative forecast of capital investment. This forecast includes investments in distribution automation, substation automation, communications systems, technology platforms and applications and grid reinforcement. Subject to future CPUC guidance, SCE anticipates integrating authorization for revenues to support DRP operation and maintenance and capital spending into future general rate cases, beginning with its 2018-2020 general rate case, which will be filed on September 1, 2016. SCE also anticipates making initial investments to modernize the grid during 2015-2017. Such plans may be updated or revised based on developments and guidance received from the CPUC as a part of the DRP rule making.

SCE's DRP filing forecasts a range of capital expenditures through 2020 based on technology availability, pace of DER adoption and other factors as follows:

|

| | | | |

SCE DRP Capital Expenditure Estimates Outlined in July 1st DRP Filing |

Category |

Total GRC Period 2015-2017 | Total GRC Period 2018-2020 (Future GRC) |

2015 | 2016 | 2017 |

Distribution Automation | $500,000-$1 million | $3-5 million | $35-60 million | $185-320 million |

Substation Automation | $1.3-1.6 million | $5-10 million | $25-45 million | $185-320 million |

Communications Systems | $100,000-200,000 | $2-5 million | $5-10 million | $270-470 million |

Technology Platforms and Applications | $10-13 million | $65-100 million | $55-85 million | $215-375 million |

Grid Reinforcement | | | $140-215 million | $550-1,100 million |

Total | $11.9-15.8 million | $75-120 million | $260-415 million | $1,405-2,585 million |

Significant capital investment will be required to modernize and reinforce SCE’s distribution grid consistent with the DRP recommendations, in addition to continued distribution system reliability investment, anticipated electric vehicle and storage investments, continued transmission and generation maintenance capital investment and potential improvements in capital spending productivity. SCE expects overall capital spending to continue at least in the range of current capital spending forecasts, although the CPUC's approval in future general rate cases of all or part of the capital investment plan supporting SCE's DRP filing could result in higher spending. All of these capital investments will be subject to CPUC review and approval. The timing and amount of capital investments may vary depending upon implementation decisions, including scope and pace of adoption and GRC ratemaking decisions and other CPUC actions.

An informational presentation and a Questions and Answers document on SCE's DRP are attached hereto as Exhibits 99.1 and 99.2, respectively.

| |

Item 9.01 | Financial Statements and Exhibits |

See the Exhibit Index below.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| EDISON INTERNATIONAL |

| (Registrant) |

| |

| /s/ Mark C. Clarke |

| Mark C. Clarke |

| Vice President and Controller |

Date: July 1, 2015

|

| |

| SOUTHERN CALIFORNIA EDISON COMPANY |

| (Registrant) |

| |

| /s/ Connie J. Erickson |

| Connie J. Erickson |

| Vice President and Controller |

Date: July 1, 2015

EXHIBIT INDEX

|

| |

| |

Exhibit No. | Description |

| |

99.1 | Southern California Edison Company Distribution Resource Plan Presentation dated July 1, 2015 |

| |

99.2 | Southern California Edison Company Distribution Resource Plan Questions and Answers July 1, 2015 |

July 1, 2015 Exhibit 99.1 Distribution Resources Plan Overview

July 1, 2015 Exhibit 99.1 AB 327 required IOU submissions of Distribution Resources Plans (DRP) on July 1, 2015 to integrate increasing penetration of Distributed Energy Resources (DERs). Key provisions of the DRP filing include: • Methodology/Tools for identifying optimal locations for DERs (includes distributed generation, energy storage, electric vehicle charging, energy efficiency and demand response) • Enhance the electric system’s capability to integrate more DERs at the distribution level through modernization of system planning tools, design and operations • Technology recommendations (information technology, communications, system planning, voltage and frequency controls, etc.) SCE’s DRP includes a conceptual capital plan • Estimated scope of work, technology roadmap, timeline, and capital and expense cost estimates • Incremental to traditional general rate case expenditures; implementation recommendations proposed to be integrated into future general rate cases beginning with the 2018 filing • Overall capital spending expected to be at least in the range of current forecast levels, although could result in higher spending pending CPUC approval in future GRCs SCE Distribution Resources Plan 1

July 1, 2015 Exhibit 99.1 SCE Grid Modernization Road Map 2015 - 2017 2018 - 2020 2021 + Implement foundational information technology, communication systems, and system planning tools; begin grid reinforcement work Expand automation and improve communications and control with Distributed Energy Resources; continue grid reinforcement work Continue grid modernization, maximize benefits of Distributed Energy Resources and continue integrating into planning and operationsT e c h n o l o g y E x p e c t e d R e s u l t G R C C y c l e Prepare organization and workforce to execute incremental work Ramp up resources and develop talent pipeline Compliance, safety, and reliability; preparation for future grid state New business opportunities enabled; full deployment of grid modernization Prepare grid management systems to handle increased DER and support more grid transactions P e o p l e a n d P r oces s SCE’s July 1, 2015 DRP supports the Commission’s proposed phased approach, which would be implemented over future General Rate Case (GRC) cycles 2

July 1, 2015 Exhibit 99.1 SCE DRP Capital Expenditure Estimates Time Period Capital Expenditures CPUC Approval Mechanism 2015-2017 Distribution Automation $40-70 million • Proposed memorandum account to record associated revenue requirement until expenditures are authorized by CPUC Substation Automation $30-60 million Communications Systems $7-15 million Technology Platforms and Applications $130-200 million Grid Reinforcement $140-215 million Total $347-560 million 2018-2020 Distribution Automation $185-320 million • Request recovery in 2018 GRCSubstation Automation $185-320 million Communications Systems $270-470 million Technology Platforms and Applications $215-375 million Grid Reinforcement $550-1,100 million Total $1,405-2,585 million SCE anticipates capital spending to continue at least in the range of current forecast levels, although could result in higher spending pending CPUC approval in future GRCs 3

SCE Distribution Resource Plan Questions & Answers July 1, 2015

How will SCE secure CPUC approval of DRP-related capital investments?

| |

• | We anticipate integrating authorization for revenues to support operation and maintenance and capital spending into future general rate cases, beginning with the 2018-2020 General Rate Case, which will be filed on September 1, 2016. |

| |

• | We are also requesting a memorandum account to track the revenue requirement for costs that are incremental to our 2015 General Rate Case authorized revenues when determined. |

Are the 2015-2017 capital spending forecast amounts in the DRP filing included in the current SCE capital spending forecast in your most recent 10-Q and investor materials?

| |

• | No, they are not included. |

| |

• | It is premature to consider any updates to SCE’s 2015-2017 capital spending forecast until SCE receives a decision on its 2015-2017 general rate case. |

What level of load growth will be displaced by DERs?

| |

• | The load growth rate in the distribution system used for planning purposes is currently at 1.4% on average across the system. Depending on how aggressive DER penetration levels are, this could drop, but will vary from location to location and may be higher or lower depending on the actual amount of DER penetration and growth occurring locally. |

| |

• | Our investment strategy is primarily focused on the wires portion of the business. There is a small amount, less than 15% of our peak load, of legacy generation consisting mostly of low cost hydro and gas-fired generation. Our low level of generation investment greatly reduces the risk of potential stranded costs. |

| |

• | We are always concerned about potential under-recovery or disallowances of investments made on behalf of customers and therefore focus on making only prudent investments and, when possible, getting regulatory authority prior to making any investments. |

Do you expect that utilities will continue to be the Distribution System Operator?

| |

• | Yes, but the CPUC will be reviewing this issue. |

How do the ranges of forecasted capital expenditures tie to the three scenarios described in the DRP? Should we think about the low end of the range tied to the slowest adoption case and the high end of the range tied to the fastest adoption case?

| |

• | The ranges are based on a broad deployment plan to modernize the grid primarily over the next 10-15 years. The ranges are based on variability due to some level of uncertainty of technology availability, the pace at which new grid assets can be deployed and expected changes in actual vs. estimated costs. Our forecasted capital expenditures are not directly tied to the three scenarios. |

| |

• | There are two basic groups of forecasted expenditures. |

| |

◦ | The first group includes foundational capital investment in the distribution system and supporting information technology infrastructure that would be needed under any scenario in order to better enable meaningfully higher penetration of DERs. One example is IT investments required to support DERs' integration into the technology platforms used by engineers and operators to plan and manage the distribution system. Another example is the conversion of our older 4 kV and other lower voltage parts of our system that are not conducive to two-way power flow to accommodate generation coming from distributed generation at customer locations back to the system. |

| |

◦ | The second group includes investments needed to segment our circuits or enhance networking capability of our system to accommodate deeper penetration of DERs. The scenarios with higher penetration of DERs include more of these types of investments, based on improvements needed for a greater number of circuits. |

How do you see the outlook for SCE’s rate base and earnings growth given your statements about ~$4 billion per year in SCE investment?

| |

• | We have not given specific rate base forecasts beyond the current 2015-2017 general rate case period. |

| |

• | We do see a long-term earnings and dividend growth opportunity at these sustained or potentially increasing levels of capital investment. |

Are you concerned about the potential pressure investments of this level will have for customer rates?

| |

• | We are always concerned about balancing the needs for a reliable grid and meeting California’s public policy objectives while keeping rate increases to a moderate level. That is one of the reasons we will continue to work on productivity and efficiency improvements, to help moderate the impact of sustained levels of needed capital investment on customer rates. |

When do you expect to get approval of your plan?

| |

• | We would hope to get sufficient direction to incorporate the required investment into our 2018-2020 General Rate Case filing which will be made in the fall of 2016. |

What are the key milestones in implementing your recommendations?

| |

• | We anticipate extensive review by the CPUC and input from many stakeholders. |

| |

• | The CPUC has issued a preliminary schedule, which states that approval of DRPs are anticipated March 2016. |

| |

• | We will look for early approval of memorandum account treatment of certain early stage investments that we have recommended, but it is possible that our request for a memorandum account may not be acted upon until March 2016, although there is no assurance that such request will be granted. |

What are SCE’s plans for investing in conventional and renewable generation during the DRP implementation period?

| |

• | We have no plans to build utility-scale conventional or renewable generation in rate base. We prefer to rely on the competitive market to build those assets and recover the costs through either the merchant market or long-term contracts. This is consistent with California's public policy as well. |

| |

• | We could build some distribution-level generation in rate base under some scenarios but we have no current plans in this regard. The DRP capital expenditure forecasts do not include any generation investment. |

How much of the SCE distribution system is 4kV vs. 12 kV and how much conversion to 12kV is envisioned in the DRP?

| |

• | 1086 of our 4636 circuits are at 4kV and below. |

| |

• | Some of the envisioned investment in 4kV circuit upgrades to a higher voltage is included in the DRP. However, some of the investment in our forecasts would come out of regular GRC reliability investment. |

Can you give us some guidance on the total capital program related to the DRP and the timeframe given you only go to 2020 in the filing?

| |

• | We are not disclosing any guidance beyond the numbers in the DRP. However, we do expect this to be a long-term capital program. |

| |

• | The amount and timing of capital investments beyond 2020 will depend upon the experience of implementing the DRP proposal and CPUC actions prior to 2020. |

| |

• | We expect any future DRP-related work to fit within our overall capital spending target levels, although the CPUC's approval in future general rate case proceedings of all or part of the capital investment plan supporting our DRP filing could result in higher spending. |

How could SCE capital investments change within the overall capital spending outlook?

| |

• | We anticipate the need for capital spending for system reliability purposes to continue at levels comparable to those requested in our 2015-1017 General Rate Case. |

| |

• | Future transmission capital investment will depend both on the California Independent System Operator’s recommendations for future transmission investment and the mix of investment directed to us vs. being subject to competitive solicitation under FERC Order 1000. |

| |

• | We also have some flexibility in the timing of our potential up to 290 MW in energy storage investments authorized under AB 2514. While our proposed Charge Ready program for electric vehicle charging infrastructure is proposed for completion by 2020, it is premature to speculate whether additional charging infrastructure investment opportunities will exist after that. |

| |

• | Our continued focus on operational excellence could yield capital investment productivity and other savings which would allow for an increased scope of work within forecast capital investment target levels. |

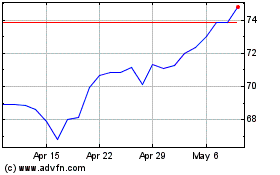

Edison (NYSE:EIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edison (NYSE:EIX)

Historical Stock Chart

From Apr 2023 to Apr 2024