El Paso Electric Company (NYSE:EE):

Overview

- For the second quarter of 2016, El Paso

Electric Company ("EE" or the "Company") reported net income of

$22.3 million, or $0.55 basic and diluted earnings per share. In

the second quarter of 2015, EE reported net income of $21.1

million, or $0.52 basic and diluted earnings per share.

- For the six months ended June 30, 2016,

EE reported net income of $16.5 million, or $0.41 basic and diluted

earnings per share. Net income for the six months ended June 30,

2015 was $24.5 million, or $0.61 basic and diluted earnings per

share.

“We are pleased with our second quarter results and the progress

that we have made. Although the impact of regulatory lag continues

to adversely affect our operating results, our performance for the

second quarter exceeded last year’s performance,” said Mary Kipp,

Chief Executive Officer. “Our region continues to experience solid

growth, and we set a new native system peak of 1,892 MW on July 14,

2016, which is 5.5%, or 98 MW, higher than the peak established in

2015. In fact, we have already experienced eight days this summer

in which our peak exceeded last year’s peak. In addition, the

recent sale of our interest in Four Corners means the Company no

longer owns any coal-fired generation, and we expect to have final

resolution of our pending Texas rate case soon."

Earnings Summary

The table and explanations below present the major factors

affecting 2016 net income relative to 2015 net income (in thousands

except per share data):

Quarter Ended Six

Months Ended

Pre-TaxEffect

After-TaxEffect

BasicEPS

Pre-TaxEffect

After-TaxEffect

BasicEPS

June 30, 2015 $ 21,072 $ 0.52 $ 24,530 $ 0.61 Changes in: Retail

non-fuel base revenues $ 3,065 1,992 0.05 $ 4,024 2,616 0.06

Investment and interest income 2,193 1,769 0.04 (132 ) (95 ) —

O&M at fossil-fuel generating plants 69 45 — (3,103 ) (2,016 )

(0.05 ) Interest on long-term debt (1,803 ) (1,171 ) (0.03 ) (1,919

) (1,247 ) (0.03 ) Depreciation and amortization (717 ) (466 )

(0.01 ) (2,445 ) (1,590 ) (0.04 ) Allowance for funds used during

construction (151 ) (148 ) — (3,053 ) (2,712 ) (0.07 ) Deregulated

Palo Verde Unit 3 (17 ) (12 ) — (978 ) (636 ) (0.02 ) Other 257 167

— (2,312 ) (1,503 ) (0.03 ) Changes in the effective tax rate (964

) (0.02 ) (871 ) (0.02 ) June 30, 2016 $ 22,284 $ 0.55

$ 16,476 $ 0.41

Regulatory Lag

The completion of Montana Power Station ("MPS") Units 1 & 2

(including common plant, transmission lines and substation) and the

Eastside Operations Center ("EOC") continues to have a negative

impact on the Company's financial results through June 30, 2016,

due to regulatory lag associated with the placement in service of

these assets without a corresponding increase in revenues. The

placement in service of MPS Unit 3 in May 2016 and the anticipated

completion of MPS Unit 4 in September 2016 will continue the

negative impact of regulatory lag until new and higher rates become

effective. As discussed in "2015 Texas Retail Case Filing"

below, interim rates subject to refund or surcharge were

implemented on April 1, 2016 in Texas. However, due to the

uncertainties surrounding the rate case, the Company did not

recognize the effects of the increased interim rates in our

Statements of Operations. The Company believes rates reflecting the

recovery of the investment in and related costs of MPS Units 1

& 2 and the EOC will be in place in the second half of 2016 in

Texas and New Mexico. The Company anticipates filing new rate cases

in Texas and New Mexico in early 2017 to reflect MPS Units 3 &

4 in rate base. The primary impact from these assets being placed

in service include a reduction in amounts capitalized for allowance

for funds used during construction ("AFUDC"), and increases in

depreciation, operations and maintenance ("O&M") expense,

property taxes and interest cost.

Second Quarter 2016

Income for the quarter ended June 30, 2016, when compared to the

quarter ended June 30, 2015, was positively affected by:

- Increased retail non-fuel base

revenues, primarily resulting from a 5.9% and 1.1% increase in kWh

sales from residential and small commercial and industrial

customers, respectively. These increases were driven principally by

a 1.5% increase in the average number of customers served and

warmer weather. Partially offsetting the increases were decreased

revenues from sales to public authorities and large commercial and

industrial customers reflecting a 3.5% and 2.8% decrease in kWh

sales, respectively.

- Increased investment and interest

income due to higher realized gains on securities sold from the

Company’s Palo Verde decommissioning trust in the second quarter of

2016 compared to the second quarter of 2015.

Income for the quarter ended June 30, 2016, when compared to the

quarter ended June 30, 2015, was negatively affected by:

- Increased interest on long-term debt

due to the interest accrued on $150 million aggregate principal

amount of senior notes issued in March 2016.

- Increased depreciation and amortization

related to an increase in depreciable plant, including MPS Unit 3,

which was placed in service on May 3, 2016, partially offset by a

change in the estimated useful life of certain intangible software

assets.

- Decreased AFUDC due to a reduction in

the AFUDC rate effective January 2016, partially offset by AFUDC

earned on construction costs related to MPS Units 3 and 4 in

2016.

- Change in the effective tax rate

largely due to the reduction of the domestic production

manufacturing deduction and changes in state taxes.

First Six Months of 2016

Income for the six months ended June 30, 2016, when compared to

the six months ended June 30, 2015, was negatively affected by:

- Decreased AFUDC due to a reduction in

the AFUDC rate effective January 2016 and lower balances of

construction work in progress ("CWIP"), primarily due to MPS Units

1 & 2 and the EOC being placed in service in March 2015,

partially offset by AFUDC earned on construction costs related to

MPS Units 3 & 4 in 2016.

- Increased O&M expenses related to

our fossil-fuel generating plants, primarily due to maintenance

outages on Four Corners Units 4 & 5 and Rio Grande Unit 7

during the first six months of 2016. These increases were partially

offset by a maintenance outage at Newman Unit 5 in 2015, with no

comparable expense in the same period in 2016.

- Increased depreciation and amortization

related to an increase in depreciable plant, primarily due to MPS

Units 1 & 2 and the EOC being placed in service in March 2015

and MPS Unit 3 being placed in service on May 3, 2016, partially

offset by a change in the estimated useful life of certain

intangible software assets.

- Increased interest on long-term debt

due to the interest accrued on $150 million aggregate principal

amount of senior notes issued in March 2016.

- Decreased deregulated Palo Verde Unit 3

revenues, primarily due to a 21.8% decrease in proxy market prices

reflecting a decline in the price of natural gas, partially offset

by increased generation due in part to a Palo Verde Unit 3 planned

2015 spring refueling outage that was completed in May 2015 with no

comparable outage in 2016.

- Change in the effective tax rate

largely due to the reduction of the domestic production

manufacturing deduction and changes in state taxes.

Income for the six months ended June 30, 2016, when compared to

the six months ended June 30, 2015, was positively affected by:

- Increased retail non-fuel revenues,

primarily resulting from a 3.8% and 1.5% increase in kWh sales from

our residential and small commercial and industrial customers,

respectively. These increases are driven principally by a 1.5% and

1.4%, respectively, increase in the average number of customers

served and warmer weather. Partially offsetting the increases were

decreased revenues from our large commercial and industrial

customers and sales to public authorities reflecting a 3.0% and

1.5% decrease in kWh sales, respectively.

Retail Non-fuel Base Revenues

Retail non-fuel base revenues increased $3.1 million, pre-tax,

or 2.1%, in the second quarter of 2016, compared to the second

quarter of 2015. This increase includes a $3.3 million increase in

revenues from residential customers and a $0.8 million increase in

revenues from small commercial and industrial customers reflecting

increases of 1.5% in the average number of customers served and

warmer weather. Cooling degree days increased 3.9% for the second

quarter of 2016, when compared to the second quarter of 2015. KWh

sales to residential customers and small commercial and industrial

customers increased by 5.9% and 1.1%, respectively, during the

second quarter of 2016, when compared to the second quarter of

2015. Retail non-fuel base revenues from sales to public

authorities and large commercial and industrial customers decreased

$0.6 million and $0.4 million, respectively, reflecting a 3.5% and

2.8%, respectively, decrease in kWh sales during the second quarter

of 2016, when compared to the second quarter of 2015. Non-fuel base

revenues and kWh sales for the second quarter of 2016 and 2015 are

provided by customer class on page 12 of this release.

For the six months ended June 30, 2016, retail non-fuel revenues

increased $4.0 million, pre-tax, or 1.6%, compared to the six

months ended June 30, 2015. This increase includes a $4.0 million

increase in revenues from residential customers and a $1.0 million

increase in revenues from small commercial and industrial customers

reflecting increases of 1.5% and 1.4%, respectively, in the average

number of customers served and warmer weather. KWh sales to

residential customers and small commercial and industrial customers

increased by 3.8% and 1.5%, respectively, during the first half of

2016, when compared to the first half of 2015. Retail non-fuel base

revenues from large commercial and industrial customers and sales

to public authorities each decreased by $0.5 million reflecting a

3.0% and 1.5%, respectively, decrease in kWh sales during the first

half of 2016, when compared to the first half of 2015. Non-fuel

base revenues and kWh sales for the first half of 2016 and 2015 are

provided by customer class on page 14 of this release.

2015 Rate Cases

2015 New Mexico Rate Case Filing

On May 11, 2015, the Company filed with the New Mexico Public

Regulation Commission ("NMPRC") in Case No. 15-00127-UT, for an

annual increase in non-fuel base rates of approximately $8.6

million or 7.1%. The filing also requested an annual reduction of

$15.4 million, or 21.5%, for fuel and purchased power costs.

Subsequently, the Company reduced its requested increase in

non-fuel base rates to approximately $6.4 million. On June 8, 2016,

the NMPRC issued its final order approving an annual increase in

non-fuel base rates of approximately $1.1 million and a decrease in

the Company's allowed return on equity to 9.48%. The final order

concludes that all of the Company's new plant in service was

reasonable and necessary and therefore would be recoverable in rate

base. The Company's rates were approved by the NMPRC effective July

1, 2016.

2015 Texas Retail Case Filing

On August 10, 2015, the Company filed with the City of El Paso,

other municipalities incorporated in its Texas service territory

and the Public Utility Commission of Texas ("PUCT") in Docket No.

44941, a request for an annual increase in non-fuel base revenues

of approximately $71.5 million. On January 15, 2016, the Company

filed its rebuttal testimony modifying the requested increase to

$63.3 million. The Company invoked its statutory right to have its

new rates relate back for consumption on and after January 12,

2016, which is the 155th day after the filing. The difference in

rates that would have been billed will be surcharged or refunded to

customers after the PUCT's final order in Docket No. 44941. The

PUCT has the authority to require the Company to surcharge or

refund such difference over a period not to exceed 18 months. On

January 21, 2016, the Company, the City of El Paso, the PUCT Staff,

the Office of Public Utility Counsel and Texas Industrial Energy

Consumers filed a joint motion to abate the procedural schedule to

facilitate settlement talks. This motion was granted.

On March 29, 2016, the Company and other settling parties to

PUCT Docket No. 44941 filed a Non-Unanimous Stipulation and

Agreement and motion to approve interim rates (the "Non-Unanimous

Settlement") with the PUCT. Four parties to the rate case opposed

the Non-Unanimous Settlement. Interim rates reflecting an annual

non-fuel base rate increase of $37 million were approved by the

PUCT effective April 1, 2016 subject to refund or surcharge.

Subsequent to filing the Non-Unanimous Settlement, the rate case

was subject to numerous procedural matters, including a May 19,

2016 ruling by the PUCT that the Company’s initial notice did not

adequately contemplate the treatment of residential customers with

solar generation contained in the Non-Unanimous Settlement.

At a June 10, 2016 pre-hearing conference, all parties to the

case renewed discussions to attempt to reach a unanimous settlement

of all issues and avoid further litigation. On July 21, 2016, the

Company filed a Joint Motion to Implement Uncontested Amended and

Restated Stipulation and Agreement with the PUCT, which was

unopposed by parties to the rate case in Docket No. 44941 (the

"Unopposed Settlement").

The terms of the Unopposed Settlement include: (i) an annual

non-fuel base rate increase of $37 million, lower annual

depreciation expense of approximately $8.5 million, a return on

equity of 9.7% for AFUDC purposes, and including substantially all

new plant in service in rate base; (ii) an additional annual

non-fuel base rate increase of $3.7 million related to Four Corners

Generating Station costs; (iii) removing the separate treatment for

residential customers with solar generation; and (iv) allowing the

Company to recover most of the rate case expenses up to a date

certain. The Unopposed Settlement is subject to approval by the

PUCT. The settlement documents were filed with ALJs assigned to

oversee the Company's Texas Rate case, who have returned the

settled case to the PUCT for approval. It is anticipated that the

Unopposed Settlement will be considered by the PUCT at its meeting

scheduled for August 18, 2016. The costs of serving residential

customers with solar generation will be addressed in a future

proceeding.

Given the uncertainties regarding the ultimate resolution of

this rate case, the Company did not recognize the impacts of the

Unopposed Settlement in the Statements of Operations for the second

quarter of 2016. At this time, the Company believes the revenue and

other impacts of the Unopposed Settlement for financial reporting

purposes will be recognized during the second half of 2016.

Regardless of the ultimate timing and amounts, new rates will

relate back to consumption on and after January 12, 2016.

Commercial Operation of Montana Power Station Unit 3 and

Construction of Unit 4

On May 3, 2016, the Company placed into commercial operation the

third generating unit at MPS and the related common facilities and

transmission systems at a cost of approximately $81.3 million. The

88-MW simple cycle aero-derivative combustion turbine is powered by

natural gas and has quick start capabilities which allows the unit

to go from off-line to full output in less than 10 minutes, thus

increasing overall power grid stability, and work in concert with

the Company's renewable energy sources. This unit will generate

enough energy to power more than 40,000 homes in the Company's

growing service territory. MPS Unit 4, identical to the other three

MPS units, is expected to reach commercial operation September

2016.

Completion of the Sale of Four Corners

On February 17, 2015, the Company and Arizona Public Service

Company ("APS") entered into an asset purchase agreement, providing

for the purchase by APS of the Company's interests in Units 4 &

5 of the Four Corners Power Plant. On July 6, 2016, the closing of

the transaction occurred, after which the Company no longer owns

any coal-fired generation. At the closing, the Company received

approximately $4.2 million in cash, subject to post-closing

adjustments. No significant gain or loss was recorded upon the

closing of the sale.

Quarterly Cash Dividend

On May 26, 2016, the Board of Directors approved an increase to

the quarterly cash dividend to $0.31 per share of common stock from

our previous quarterly rate of $0.295 per share. This represents an

increase in the annualized cash dividend from $1.18 to $1.24 per

share. The dividend increase commenced with the June 30, 2016

dividend payment. On July 21, 2016, the Board of Directors declared

a quarterly cash dividend of $0.31 per share payable on September

30, 2016 to shareholders of record as of the close of business on

September 14, 2016.

Capital and Liquidity

In March 2016, we issued $150 million in aggregate principal

amount of 5.00% Senior Notes due December 1, 2044 to repay

outstanding short-term borrowings on our Revolving Credit Facility

("RCF") used for working capital and general corporate purposes,

which may include funding capital expenditures. We continue to

maintain a strong capital structure in which common stock equity

represented 42.3% of our capitalization (common stock equity,

long-term debt, current maturities of long-term debt and short-term

borrowings under the RCF). At June 30, 2016, we had a balance of

$9.6 million in cash and cash equivalents. Based on current

projections, we believe that we will have adequate liquidity

through our current cash balances, cash from operations and

available borrowings under our RCF to meet all of our anticipated

cash requirements for the next 12 months.

Cash flows from operations for the six months ended June 30,

2016 were $40.7 million, compared to $60.4 million for the six

months ended June 30, 2015. The primary factors affecting the

decrease in cash flows from operations were a reduction in earnings

arising from regulatory lag and decreases in the net

over-collection of fuel revenues. The growth in accounts

receivable, primarily reflecting the implementation of interim

rates in Texas, is offset by the deferral of the related revenues.

A component of cash flows from operations is the change in net

over-collection and under-collection of fuel revenues. The

difference between fuel revenues collected and fuel expense

incurred is deferred to be either refunded (over-recoveries) or

surcharged (under-recoveries) to customers in the future. During

the six months ended June 30, 2016, the Company had a fuel

under-recovery of $2.0 million compared to an over-recovery of fuel

costs of $10.8 million during the six months ended June 30, 2015.

At June 30, 2016, we had a net fuel over-recovery balance of $2.0

million, including an over-recovery of $1.1 million in New Mexico

and an over-recovery of $1.0 million in Texas and an under-recovery

of $0.1 million in the Federal Energy Regulatory Commission

("FERC") jurisdiction.

During the six months ended June 30, 2016, our primary capital

requirements were for the construction and purchase of electric

utility plant, payment of common stock dividends, and purchases of

nuclear fuel. Capital requirements for new electric utility plant

were $102.8 million for the six months ended June 30, 2016 and

$147.0 million for the six months ended June 30, 2015. Capital

expenditures for 2016 are expected to be approximately $234

million. Capital requirements for purchases of nuclear fuel were

$20.5 million for the six months ended June 30, 2016, and

$22.4 million for the six months ended June 30, 2015.

On June 30, 2016, we paid a quarterly cash dividend of $0.31 per

share, or $12.5 million, to shareholders of record as of the close

of business on June 15, 2016. We paid a total of $24.5 million in

cash dividends during the six months ended June 30, 2016. At the

current dividend rate, we expect to pay cash dividends of

approximately $49.6 million during 2016.

No shares of common stock were repurchased during the six months

ended June 30, 2016. As of June 30, 2016, a total of 393,816 shares

remain available for repurchase under the Company's currently

authorized stock repurchase program. The Company may in the future

make purchases of its common stock in open market transactions at

prevailing prices and may engage in private transactions where

appropriate.

We maintain the RCF for working capital and general corporate

purposes and financing of nuclear fuel through the Rio Grande

Resources Trust (the "RGRT"). The RGRT, the trust through which we

finance our portion of nuclear fuel for Palo Verde, is consolidated

in the Company's financial statements. The RCF has a term ending

January 14, 2019. The maximum aggregate unsecured borrowing

currently available under the RCF is $300 million. We may increase

the RCF by up to $100 million (up to a total of $400 million)

during the term of the agreement, upon the satisfaction of certain

conditions, more fully set forth in the agreement, including

obtaining commitments from lenders or third party financial

institutions. The total amount borrowed for nuclear fuel by the

RGRT, excluding debt issuance costs, was $129.6 million at June 30,

2016, of which $34.6 million had been borrowed under the RCF, and

$95.0 million was borrowed through the issuance of senior notes.

Borrowings by the RGRT for nuclear fuel, excluding debt issuance

costs, were $128.1 million as of June 30, 2015, of which $18.1

million had been borrowed under the RCF and $110.0 million was

borrowed through the issuance of senior notes. Interest costs on

borrowings to finance nuclear fuel are accumulated by the RGRT and

charged to us as fuel is consumed and recovered through fuel

recovery charges. At June 30, 2016, $67.0 million was outstanding

under the RCF for working capital and general corporate purposes,

which may include funding capital expenditures. At June 30, 2015,

$110.0 million was outstanding under the RCF for working capital

and general corporate purposes. Total aggregate borrowings under

the RCF at June 30, 2016 were $101.6 million with an additional

$197.9 million available to borrow.

We received approval from the NMPRC on October 7, 2015, and from

the FERC on October 19, 2015, to issue up to $310 million in new

long-term debt and to guarantee the issuance of up to $65 million

of new debt by the RGRT to finance future purchases of nuclear fuel

and to refinance existing nuclear fuel debt obligations. We

also requested approval from the FERC to continue to utilize our

existing RCF without change from the FERC’s previously approved

authorization. The FERC authorization is effective from November

15, 2015 through November 15, 2017. The approvals granted in these

cases supersede prior approvals. Under this authorization, on March

24, 2016, the Company issued $150 million in aggregate principal

amount of 5.00% Senior Notes due December 1, 2044. The proceeds

from the issuance of these senior notes, after deducting the

underwriters' commission, were $158.1 million. These proceeds

include accrued interest of $2.4 million and a $7.1 million premium

before expenses. The effective interest rate is approximately

4.77%. The net proceeds from the sale of these senior notes were

used to repay outstanding short-term borrowings under the RCF.

These senior notes constitute an additional issuance of the

Company’s 5.00% Senior Notes due 2044, of which $150 million was

previously issued on December 1, 2014, for a total principal amount

outstanding of $300 million.

2016 Earnings Guidance

As discussed above, the Company filed rate cases in New Mexico

and Texas on May 11, 2015 and August 10, 2015, respectively. The

Company received a final order in the New Mexico rate case on June

8, 2016 and filed the Unopposed Settlement with the PUCT on July

21, 2016 for the Texas rate case. Therefore, the Company has

decided to provide earnings guidance for 2016 with a range of $2.20

to $2.50 per basic share. The middle of the range assumes normal

weather for the remainder of the year and that the PUCT approves

the Unopposed Settlement during the second half of 2016.

The Company's guidance assumes normal operating conditions for

the remainder of 2016. Other key factors and assumptions underlying

the guidance can be found in the second quarter 2016 earnings

presentation slides on the Company's website at http://www.epelectric.com.

Conference Call

A conference call to discuss the second quarter 2016 financial

results is scheduled for 10:30 A.M. Eastern Time, on August 3,

2016. The dial-in number is 888-337-8198 with a conference ID

number of 6337142. The international dial-in number is

719-325-2494. The conference leader will be Lisa Budtke, Director

Treasury Services and Investor Relations. A replay will run through

August 17, 2016 with a dial-in number of 888-203-1112 and a

conference ID number of 6337142. The replay international dial-in

number is 719-457-0820. The conference call and presentation slides

will be webcast live on the Company's website found at http://www.epelectric.com. A replay of the webcast

will be available shortly after the call.

Safe Harbor

This news release includes statements that are forward-looking

statements made pursuant to the safe harbor provisions of the

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. This

information may involve risks and uncertainties that could cause

actual results to differ materially from such forward-looking

statements. Additional information concerning factors that could

cause actual results to differ materially from those expressed in

forward-looking statements is contained in EE's most recently filed

periodic reports and in other filings made by EE with the U.S.

Securities and Exchange Commission (the "SEC"), and include, but is

not limited to: (i) uncertainty regarding the actions and timing of

matters in the Company's Texas rate case pending before the PUCT;

(ii) increased prices for fuel and purchased power and the

possibility that regulators may not permit EE to pass through all

such increased costs to customers or to recover previously incurred

fuel costs in rates; (iii) full and timely recovery of capital

investments and operating costs through rates in Texas and New

Mexico; (iv) uncertainties and instability in the general economy

and the resulting impact on EE's sales and profitability; (v)

changes in customers' demand for electricity as a result of energy

efficiency initiatives and emerging competing services and

technologies, including distributed generation; (vi) unanticipated

increased costs associated with scheduled and unscheduled outages

of generating plant; (vii) the size of our construction program and

our ability to complete construction on budget and on time; (viii)

potential delays in our construction schedule due to legal

challenges or other reasons; (ix) costs at Palo Verde;

(x) deregulation and competition in the electric utility

industry; (xi) possible increased costs of compliance with

environmental or other laws, regulations and policies;

(xii) possible income tax and interest payments as a result of

audit adjustments proposed by the IRS or state taxing authorities;

(xiii) uncertainties and instability in the financial markets

and the resulting impact on EE's ability to access the capital and

credit markets; (xiv) possible physical or cyber attacks,

intrusions or other catastrophic events; and (xv) other

factors of which we are currently unaware or deem immaterial. EE's

filings are available from the SEC or may be obtained through EE's

website, http://www.epelectric.com.

Any such forward-looking statement is qualified by reference to

these risks and factors. EE cautions that these risks and factors

are not exclusive. Management cautions against putting undue

reliance on forward-looking statements or projecting any future

results based on such statements or present or prior earnings

levels. Forward-looking statements speak only as of the date of

this news release, and EE does not undertake to update any

forward-looking statement contained herein.

El Paso Electric Company Statements of

Operations Quarter Ended June 30, 2016 and 2015 (In

thousands except for per share data) (Unaudited)

2016 2015

Variance Operating revenues $ 217,865 $

219,508 $ (1,643 )

Energy expenses: Fuel 43,143

49,813 (6,670 ) Purchased and interchanged power 13,610

11,742 1,868 56,753 61,555 (4,802 )

Operating revenues net of energy expenses 161,112

157,953 3,159

Other operating expenses: Other

operations 56,817 57,656 (839 ) Maintenance 20,426 19,857 569

Depreciation and amortization 23,852 23,135 717 Taxes other than

income taxes 15,320 15,433 (113 ) 116,415

116,081 334

Operating income 44,697

41,872 2,825

Other income (deductions):

Allowance for equity funds used during construction 2,133 2,268

(135 ) Investment and interest income, net 3,591 1,398 2,193

Miscellaneous non-operating income 145 507 (362 ) Miscellaneous

non-operating deductions (890 ) (1,271 ) 381 4,979

2,902 2,077

Interest charges (credits):

Interest on long-term debt and revolving credit facility 18,298

16,495 1,803 Other interest 272 354 (82 ) Capitalized interest

(1,253 ) (1,261 ) 8 Allowance for borrowed funds used during

construction (1,375 ) (1,391 ) 16 15,942 14,197

1,745

Income before income taxes 33,734 30,577

3,157

Income tax expense 11,450 9,505 1,945

Net income $ 22,284 $

21,072 $ 1,212 Basic

earnings per share $ 0.55 $

0.52 $ 0.03 Diluted

earnings per share $ 0.55 $

0.52 $ 0.03 Dividends

declared per share of common stock $ 0.310 $ 0.295

$ 0.015

Weighted average number of shares

outstanding 40,345 40,270 75

Weighted average number of

shares and dilutivepotential shares outstanding

40,399 40,303 96

El Paso

Electric Company Statements of Operations Six Months

Ended June 30, 2016 and 2015 (In thousands except for per

share data) (Unaudited)

2016 2015 Variance

Operating revenues $ 375,674 $ 383,254 $ (7,580 )

Energy

expenses Fuel 77,462 87,542 (10,080 ) Purchased and

interchanged power 23,256 22,917 339 100,718

110,459 (9,741 )

Operating revenues net of energy

expenses 274,956 272,795 2,161

Other

operating expenses: Other operations 115,204 113,255 1,949

Maintenance 37,941 35,417 2,524 Depreciation and amortization

47,145 44,700 2,445 Taxes other than income taxes 30,132

29,591 541 230,422 222,963 7,459

Operating income 44,534 49,832 (5,298 )

Other income (deductions): Allowance for equity funds used

during construction 4,469 6,543 (2,074 ) Investment and interest

income, net 6,520 6,652 (132 ) Miscellaneous non-operating income

801 687 114 Miscellaneous non-operating deductions (1,356 ) (1,762

) 406 10,434 12,120 (1,686 )

Interest charges

(credits): Interest on long-term debt and revolving credit

facility 34,897 32,978 1,919 Other interest 834 517 317 Capitalized

interest (2,495 ) (2,550 ) 55 Allowance for borrowed funds used

during construction (3,033 ) (4,012 ) 979 30,203

26,933 3,270

Income before income

taxes 24,765 35,019 (10,254 )

Income tax expense 8,289

10,489 (2,200 )

Net income $

16,476 $ 24,530 $

(8,054 ) Basic earnings per share

$ 0.41 $ 0.61 $

(0.20 ) Diluted earnings per share

$ 0.41 $ 0.61 $

(0.20 ) Dividends declared per share of

common stock $ 0.605 $ 0.575 $ 0.030

Weighted average number of shares outstanding 40,335

40,257 78

Weighted average number of shares and

dilutive potential shares outstanding

40,381 40,285 96

El Paso

Electric Company Cash Flow Summary Six Months Ended

June 30, 2016 and 2015 (In thousands and Unaudited)

2016

2015 Cash flows from operating activities: Net income

$ 16,476 $ 24,530 Adjustments to reconcile net income to net cash

provided by operations: Depreciation and amortization of electric

plant in service 47,145 44,700 Amortization of nuclear fuel 21,957

21,379 Deferred income taxes, net 6,695 8,789 Net gains on sale of

decommissioning trust funds (3,498 ) (3,563 ) Other 4,422 2,588

Change in: Accounts receivable (39,117 ) (20,782 ) Net

over-collection (under-collection) of fuel revenues (1,990 ) 10,833

Accounts payable (9,345 ) (15,528 ) Other (2,052 ) (12,571 )

Net

cash provided by operating activities 40,693

60,375 Cash flows from investing

activities: Cash additions to utility property, plant and

equipment (102,785 ) (147,040 ) Cash additions to nuclear fuel

(20,478 ) (22,424 ) Decommissioning trust funds (4,225 ) (3,871 )

Other (2,161 ) (6,480 )

Net cash used for investing

activities (129,649 ) (179,815 )

Cash flows from financing activities: Dividends paid

(24,474 ) (23,220 ) Borrowings under the revolving credit facility,

net (40,124 ) 113,540 Proceeds from issuance of senior notes

157,052 — Other (2,040 ) (1,020 )

Net cash provided by financing

activities 90,414 89,300

Net increase (decrease) in cash and cash equivalents

1,458 (30,140 ) Cash and cash

equivalents at beginning of period 8,149

40,504 Cash and cash equivalents at end of

period $ 9,607 $ 10,364

El Paso Electric Company Quarter

Ended June 30, 2016 and 2015 Sales and Revenues

Statistics

Increase (Decrease) 2016 2015 Amount

Percentage

kWh sales (in

thousands):

Retail: Residential 679,035 640,940 38,095 5.9 % Commercial and

industrial, small 633,714 626,968 6,746 1.1 % Commercial and

industrial, large 270,908 278,822 (7,914 ) (2.8 )% Public

authorities 405,277 419,882 (14,605 ) (3.5 )% Total

retail sales 1,988,934 1,966,612 22,322 1.1 %

Wholesale: Sales for resale 20,668 20,504 164 0.8 % Off-system

sales 450,801 517,752 (66,951 ) (12.9 )% Total

wholesale sales 471,469 538,256 (66,787 ) (12.4 )%

Total kWh sales 2,460,403 2,504,868 (44,465 ) (1.8 )%

Operating

revenues (in thousands):

Non-fuel base revenues: Retail: Residential $ 62,679 $ 59,422 $

3,257 5.5 % Commercial and industrial, small 54,707 53,864 843 1.6

% Commercial and industrial, large 9,489 9,879 (390 ) (3.9 )%

Public authorities 24,672 25,317 (645 ) (2.5 )% Total

retail non-fuel base revenues 151,547 148,482 3,065 2.1 %

Wholesale: Sales for resale 826 689 137 19.9 %

Total non-fuel base revenues 152,373 149,171 3,202

2.1 % Fuel revenues: Recovered from customers during

the period 26,219 28,949 (2,730 ) (9.4 )% Under collection of fuel

6,096 4,855 1,241 25.6 % New Mexico fuel in base rates 16,602

16,437 165 1.0 % Total fuel revenues (a)

48,917 50,241 (1,324 ) (2.6 )% Off-system

sales: Fuel cost 8,398 10,419 (2,021 ) (19.4 )% Shared margins 852

2,316 (1,464 ) (63.2 )% Retained margins 213 164 49

29.9 % Total off-system sales 9,463 12,899 (3,436 ) (26.6 )%

Other (b) 7,112 7,197 (85 ) (1.2 )% Total operating

revenues $ 217,865 $ 219,508 $ (1,643 ) (0.7 )%

(a) Includes deregulated Palo Verde Unit 3 revenues for the

New Mexico jurisdiction of $1.9 million in each period. (b)

Represents revenues with no related kWh sales.

El

Paso Electric Company Quarter Ended June 30, 2016 and

2015 Other Statistical Data

Increase (Decrease)

2016 2015 Amount Percentage

Average number of

retail customers: (a)

Residential 361,812 356,495 5,317 1.5 % Commercial and industrial,

small 40,832 40,213 619 1.5 % Commercial and industrial, large 49

50 (1 ) (2.0 )% Public authorities 5,274 5,273 1

— Total 407,967 402,031 5,936 1.5 %

Number of retail

customers (end of period): (a)

Residential 362,417 356,932 5,485 1.5 % Commercial and industrial,

small 40,901 40,356 545 1.4 % Commercial and industrial, large 49

49 — — Public authorities 5,251 5,298 (47 ) (0.9 )%

Total 408,618 402,635 5,983 1.5 %

Weather

statistics: (b)

10-Yr Average Cooling degree days 965 929 1,031 Heating

degree days 75 53 72

Generation and

purchased power (kWh, in thousands):

Increase (Decrease) 2016 2015 Amount

Percentage Palo Verde 1,165,459 1,203,902 (38,443 )

(3.2 )% Four Corners 82,143 173,427 (91,284 ) (52.6 )% Gas plants

1,032,440 1,025,980 6,460 0.6 % Total

generation 2,280,042 2,403,309 (123,267 ) (5.1 )% Purchased power:

Photovoltaic 88,765 87,655 1,110 1.3 % Other 239,329 164,194

75,135 45.8 % Total purchased power 328,094

251,849 76,245 30.3 % Total available energy

2,608,136 2,655,158 (47,022 ) (1.8 )% Line losses and Company use

147,733 150,290 (2,557 ) (1.7 )% Total kWh sold

2,460,403 2,504,868 (44,465 ) (1.8 )%

Palo Verde capacity factor

85.8

%

88.6

%

(2.8

)%

(a)

The number of retail customers is based on

the number of service locations.

(b)

A degree day is recorded for each degree

that the average outdoor temperature varies from a standard of 65

degrees Fahrenheit.

El Paso Electric Company Six Months Ended

June 30, 2016 and 2015 Sales and Revenues Statistics

Increase (Decrease) 2016

2015 Amount Percentage

kWh sales (in

thousands):

Retail: Residential 1,248,120 1,202,593 45,527 3.8 % Commercial and

industrial, small 1,133,940 1,117,034 16,906 1.5 % Commercial and

industrial, large 515,834 531,942 (16,108 ) (3.0 )% Public

authorities 751,512 762,975 (11,463 ) (1.5 )% Total

retail sales 3,649,406 3,614,544 34,862 1.0 %

Wholesale: Sales for resale 32,509 32,449 60 0.2 % Off-system sales

1,029,474 1,201,281 (171,807 ) (14.3 )% Total

wholesale sales 1,061,983 1,233,730 (171,747 ) (13.9

)% Total kWh sales 4,711,389 4,848,274 (136,885 )

(2.8 )%

Operating

revenues (in thousands):

Non-fuel base revenues: Retail: Residential $ 110,422 $ 106,362 $

4,060 3.8 % Commercial and industrial, small 86,847 85,834 1,013

1.2 % Commercial and industrial, large 17,582 18,128 (546 ) (3.0 )%

Public authorities 42,072 42,575 (503 ) (1.2 )% Total

retail non-fuel base revenues 256,923 252,899 4,024 1.6 %

Wholesale: Sales for resale 1,195 1,129 66 5.8

% Total non-fuel base revenues 258,118 254,028 4,090

1.6 % Fuel revenues: Recovered from customers during

the period 48,753 63,371 (14,618 ) (23.1 )% Under (over) collection

of fuel (a) 1,993 (10,832 ) 12,825 — New Mexico fuel in base rates

32,828 32,550 278 0.9 % Total fuel revenues

(b) 83,574 85,089 (1,515 ) (1.8 )% Off-system

sales: Fuel cost 16,890 23,284 (6,394 ) (27.5 )% Shared margins

3,407 6,252 (2,845 ) (45.5 )% Retained margins 573 520

53 10.2 % Total off-system sales 20,870 30,056 (9,186

) (30.6 )% Other (c) 13,112 14,081 (969 ) (6.9 )%

Total operating revenues $ 375,674 $ 383,254 $ (7,580

) (2.0 )% (a) Includes Department of Energy refunds related

to spent fuel storage of $1.6 million and $5.8 million,

respectively. (b) Includes deregulated Palo Verde Unit 3 revenues

for the New Mexico jurisdiction of $4.0 million and $5.0 million,

respectively. (c) Represents revenues with no related kWh sales.

El Paso Electric Company Six Months Ended

June 30, 2016 and 2015 Other Statistical Data

Increase

(Decrease) 2016 2015 Amount

Percentage

Average number of

retail customers: (a)

Residential 360,929 355,625 5,304 1.5 % Commercial and industrial,

small 40,684 40,127 557 1.4 % Commercial and industrial, large 49

50 (1 ) (2.0 )% Public authorities 5,324 5,245 79

1.5 % Total 406,986 401,047 5,939 1.5 %

Number of retail

customers (end of period): (a)

Residential 362,417 356,932 5,485 1.5 % Commercial and industrial,

small 40,901 40,356 545 1.4 % Commercial and industrial, large 49

49 — — Public authorities 5,251 5,298 (47 ) (0.9 )%

Total 408,618 402,635 5,983 1.5 %

Weather

statistics: (b)

10-Year Average Cooling degree days 988 963 1,061 Heating

degree days 1,129 1,206 1,255

Generation and

purchased power (kWh, in thousands):

Increase (Decrease) 2016 2015 Amount

Percentage Palo Verde 2,545,956 2,566,096 (20,140 )

(0.8 )% Four Corners 163,149 310,645 (147,496 ) (47.5 )% Gas plants

1,669,870 1,694,555 (24,685 ) (1.5 )% Total

generation 4,378,975 4,571,296 (192,321 ) (4.2 )% Purchased power:

Photovoltaic 156,529 146,714 9,815 6.7 % Other 444,486

405,907 38,579 9.5 % Total purchased power 601,015

552,621 48,394 8.8 % Total available energy

4,979,990 5,123,917 (143,927 ) (2.8 )% Line losses and Company use

268,601 275,643 (7,042 ) (2.6 )% Total kWh sold

4,711,389 4,848,274 (136,885 ) (2.8 )%

Palo Verde capacity factor

93.7

%

95.0

%

(1.3

)%

(a)

The number of retail customers presented

is based on the number of service locations.

(b)

A degree day is recorded for each degree

that the average outdoor temperature varies from a standard of 65

degrees Fahrenheit.

El Paso Electric Company Financial

Statistics At June 30, 2016 and 2015 (In thousands,

except number of shares, book value per common share, and

ratios) Balance Sheet

2016 2015 Cash and cash equivalents $ 9,607

$ 10,364 Common stock equity $ 1,010,940 $

984,678 Long-term debt (a) 1,278,301 1,122,264 Total

capitalization $ 2,289,241 $ 2,106,942 Current

maturities of long-term debt $ — $ 15,000

Short-term borrowings under the revolving credit facility $ 101,614

$ 128,072 Number of shares - end of period

40,520,871 40,425,884 Book value per common

share $ 24.95 $ 24.36 Common equity ratio (b)

42.3 % 43.8 % Debt ratio 57.7 % 56.2 % (a)

In accordance with ASU 2015-03 (Subtopic

835-30), Interest - Imputation of Interest, debt issuance costs

related to a recognized debt liability are presented in the balance

sheet as a direct deduction from the carrying amount of that debt

liability. The Company implemented ASU 2015-03 in the first quarter

of 2016, and retrospectively to all periods presented.

(b) The capitalization component includes common stock

equity, long-term debt and the current maturities of long-term

debt, and short-term borrowings under the RCF.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160803005541/en/

El Paso Electric CompanyMedia ContactsEddie Gutierrez,

915-543-5763eduardo.gutierrez@epelectric.comorInvestor

RelationsLisa Budtke, 915-543-5947lisa.budtke@epelectric.com

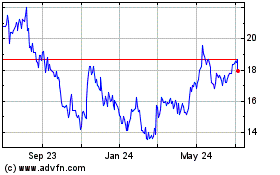

Excelerate Energy (NYSE:EE)

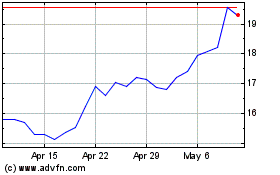

Historical Stock Chart

From Mar 2024 to Apr 2024

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Apr 2023 to Apr 2024