Current Report Filing (8-k)

June 10 2016 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

June 8, 2016

El Paso Electric Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Texas

|

001-14206

|

74-0607870

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

Stanton Tower, 100 North Stanton, El Paso, Texas

|

|

79901

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(915) 543-5711

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

New Mexico Rate Case Decision

On June 8, 2016, the New Mexico Public Regulation Commission (the “NMPRC”) issued a final order (the “Final Order”) approving an annual increase for El Paso Electric Company (the “Company”) in non-fuel base rates of approximately $1.1 million in Case No. 15-00127-UT.

On May 11, 2015, the Company filed with the NMPRC for an annual increase in non-fuel base rates of approximately $8.6 million or 7.1%. Subsequently, the Company reduced its requested increase in non-fuel base rates to approximately $6.4 million. On February 16, 2016, the Hearing Examiner assigned to the rate case issued to the NMPRC a Recommended Decision proposing an annual increase in non-fuel base rates of approximately $640,000 and a return on equity of 9.60%. The Final Order deviated from the Hearing Examiner’s Recommended Decision by lowering the return on equity to 9.48% and changing the treatment of the pension and other post-employment benefit liability and other deferred taxes. The NMPRC has required that the Company provide additional information on the pension and other post-employment benefit liability. The primary driver of the rate increase authorized by the Final Order was the inclusion in rate base of 100 percent of the Company’s new plant in service since 2009, including the costs of Montana Power Station Units 1 and 2 and associated transmission lines and common facilities and the Eastside Operations Center. The Company currently anticipates that new non-fuel base rates in New Mexico will become effective early in the third quarter of 2016. The Company expects to file its next rate case in New Mexico in early 2017 based upon a September 30, 2016 test-year.

Approximately 24% of the Company’s customers are in New Mexico.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

99.1

|

Press Release issued by the Company on June 8, 2016 regarding the Company’s New Mexico rate case

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Dated: June 9, 2016

|

|

|

|

|

|

|

|

|

EL PASO ELECTRIC COMPANY

|

|

(Registrant)

|

|

|

|

|

By:

|

/s/ NATHAN T. HIRSCHI

|

|

Name:

|

Nathan T. Hirschi

|

|

Title:

|

Senior Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

99.1

|

Press Release issued by the Company on June 8, 2016 regarding the Company’s New Mexico rate case

|

|

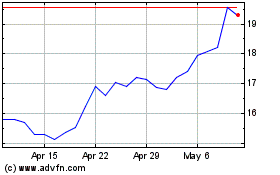

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Mar 2024 to Apr 2024

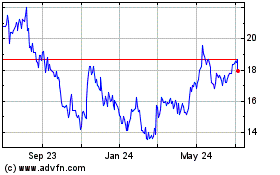

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Apr 2023 to Apr 2024