Hearing Examiner in El Paso Electric’s New Mexico Rate Case Issues Recommended Decision

February 17 2016 - 4:41PM

Business Wire

El Paso Electric Company (EPE) (NYSE: EE) announced that the

Hearing Examiner assigned by the New Mexico Public Regulation

Commission (NMPRC) to EPE’s rate case (Case No. 15-00127-UT) issued

a Recommended Decision in the case on February 16, 2016. In the

Recommended Decision, the Hearing Examiner recommends an annual

increase in non-fuel base rates of approximately $0.64 million.

EPE had initially requested an annual increase in non-fuel base

rates of approximately $8.6 million, or 7.1%. EPE later reduced its

requested increase in non-fuel base rates to approximately $6.4

million. A hearing on the matter was held before the Hearing

Examiner in November 2015. Today the NMPRC issued an order

extending the suspension period in the rate case from March 10,

2016 until April 8, 2016, by which time the NMPRC is expected to

issue a Final Order. All parties will be allowed to file Exceptions

before the NMPRC ultimately rules on the issues by Final Order.

“While we do not agree with some of the Hearing Examiner’s

recommendations, we also recognize that this is just one more step

in the process of establishing fair rates in New Mexico," said Mary

Kipp, El Paso Electric CEO. “The rate case involves some complex

legal and accounting issues, and we look forward to presenting our

position to the full New Mexico Commission."

EPE will provide an update on the New Mexico rate case during

the earnings conference call scheduled for February 24, 2016, at

10:30 a.m., Eastern Time.

El Paso Electric is a regional electric utility providing

generation, transmission and distribution service to approximately

400,000 retail and wholesale customers in a 10,000 square mile area

of the Rio Grande valley in west Texas and southern New Mexico. El

Paso Electric has a net dependable generating capability of 2,055

MW.

Safe Harbor

This news release includes statements, including statements

regarding the NMPRC’s expected procedural schedule, that may

constitute forward-looking statements made pursuant to the safe

harbor provisions within the meaning of Section 27A of the

Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”). This information often involves risks and

uncertainties that could cause actual results to differ materially

from such forward-looking statements. Factors that could cause or

contribute to such differences include, but are not limited to: (i)

increased prices for fuel and purchased power and the possibility

that regulators may not permit EPE to pass through all such

increased costs to customers or to recover previously incurred fuel

costs in rates; (ii) full and timely recovery of capital

investments and operating costs through rates in New Mexico; and

(iii) other factors detailed by EPE in its public filings with the

Securities and Exchange Commission. EPE's filings are available

from the Securities and Exchange Commission or may be obtained

through EPE's website, http://www.epelectric.com. Although El Paso

Electric believes that the expectations reflected in such

forward-looking statements are reasonable, no assurances can be

given that these expectations will prove to be correct. Any such

forward-looking statement is qualified by reference to these risks

and factors. EPE cautions that these risks and factors are not

exclusive. EPE does not undertake to update any forward-looking

statement that may be made from time to time by or on behalf of EPE

except as required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160217006621/en/

El Paso Electric CompanyPublic RelationsEddie Gutierrez,

915-543-5763eduardo.gutierrez@epelectric.comorInvestor

RelationsLisa Budtke,

915-543-5947lisa.budtke@epelectric.comorRichard Gonzalez,

915-543-2236richard.gonzalez@epelectric.com

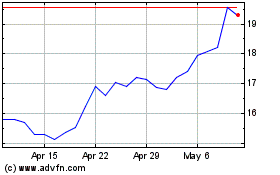

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Mar 2024 to Apr 2024

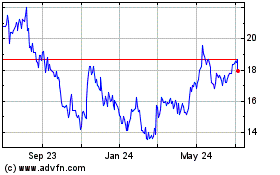

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Apr 2023 to Apr 2024