Regulatory News:

Total Gabon (Paris:EC):

Main Financial Indicators

Q3

16 Q2 16

Q3 16vs.Q2 16

9M 16 9M 15

9M 16vs.9M 15

Average Brent price $/b

45.9 45.6

+1%

41.9

55.3 -24% Average Total Gabon crude

price $/b

41.2

40.8 +1%

36.4 50.5

-28% Crude oil production from fieldsoperated by

Total Gabon kb/d1

55.8 55.0

+1%

55.2

56.2 -2% Crude oil production from

Total Gabon interests2 kb/d

47.9 46.0

+4%

47.0

46.3 +2% Sales volumes

Mb3

4.11

4.33 -5%

13.35 11.99

+11% Revenues $M

191 194 -2%

546 661

-17% Funds generated from operations

$M

53

37

+43%

104 142

-27%

Capital expenditures $M

35 37 -5%

108 204

-47% Net income (loss) $M

11 4

x3

(1)

(35) N/A

1 Thousand barrels per day.2 Including tax oil reverting to the

Republic as per production sharing contracts.3 Million barrels.

Third-Quarter 2016 Results

Selling Prices

In third-quarter 2016, Brent averaged $45.9 per barrel, up 1%

from $45.6 in the second quarter. The selling price of the Mandji

and Rabi Light crude oil grades marketed by Total Gabon averaged

$41.2 per barrel during the period, an increase of 1% from $40.8 in

the previous quarter.

Production

Total Gabon’s equity share of operated and non-operated oil

production1 rose by 4% to 47,900 barrels per day in third-quarter

2016, versus 46,000 barrels per day in the second quarter. The

increase was mainly due to:

- Successful coiled tubing interventions

on Anguille Nord Est (ANE) and choke opening on well ANE008.

- Lower-than-expected production losses

following the second-quarter shut-in of Torpille for scheduled

work.

- Improved facility availability.

- Well workovers on the Rabi Kounga

license.

These factors more than offset the natural decline in

fields.

Revenues

Revenues fell 2% to $191 million in third-quarter 2016,

down $3 million from $194 million in the second quarter.

This decrease resulted from the decline in volumes sold over the

period due to the lifting schedule (down $9 million). It was

partly offset by higher selling prices and services provided to

partners (up $2 million and $3 million respectively).

Funds Generated from Operations

Funds generated from operations amounted to $53 million in

third-quarter 2016, versus $37 million in the second quarter.

The increase was mainly due to:

- Higher selling prices and production

(including inventory).

- One-off financial expenses incurred in

the second quarter to renew the credit facility.

Capital Expenditures

Third-quarter 2016 capital expenditures were $35 million,

down from $37 million in the second quarter. Outlays mainly

concerned the following projects:

- Completion of coiled tubing

interventions on Anguille and Torpille.

- Work to improve the integrity and

longevity of offshore facilities on Anguille, Torpille and

Grondin.

Net Income

The company reported a net income in third-quarter 2016 of

$11 million, compared to a second-quarter net income of

$4 million. This $7 million increase was mainly due to:

- Higher selling prices and production,

including for inventory.

- One-off financial expenses incurred in

the second quarter to renew the credit facility.

1 Including tax oil reverting to the Republic as per production

sharing contracts.

Nine-Month 2016 Results

Selling Prices

Brent averaged $41.9 per barrel in the first nine months of the

year, down 24% from $55.3 per barrel in the first nine months of

2015. The selling price of the Mandji and Rabi Light crude oil

grades marketed by Total Gabon averaged $36.4 per barrel over the

period, a decrease of 28% from $50.5 per barrel in the prior-year

period. This decline, greater than that of Brent, was due to lower

prices for these grades of crude oil.

Production

Total Gabon's equity share of operated and non-operated oil

production1 averaged 47,000 barrels per day during the first nine

months of 2016, compared to 46,300 barrels per day in the

prior-year period. The 2% increase was mainly due to:

- Improved availability of the Anguille

and Torpille wells (problems with tubing deposits on AGMN in 2015

and the loss of the PG2-CE electrical cable in 2015) and of the

Anguille export pumps.

- Successful coiled tubing interventions

on Anguille Nord Est (ANE) and choke opening of well ANE008 in the

second quarter of 2016.

- Well workovers on the Rabi Kounga

license.

These factors were partly offset by:

- The natural decline in fields.

- The sale of Mboga.

- The planned shut-in of Coucal/Avocette

in February 2016.

Revenues

Revenues for the first nine months of 2016 amounted to

$546 million, down 17%, or $115 million, from

$661 million in the same period of 2015. The contraction

resulted primarily from lower selling prices of the crude oil

grades marketed by Total Gabon (down $179 million), but was

partly offset by higher volumes sold over the period due to the

lifting schedule and by services provided to third parties (up

$59 million and $5 million respectively).

Funds Generated from Operations

Funds generated from operations slid 27% to $104 million

for the period, versus $142 million in the first nine months

of 2015. The decline was primarily due to lower revenues, and was

partly offset by lower operating costs as a result of the

cost-cutting program implemented by the Company.

Capital Expenditures

In the first nine months of the year, capital expenditures

totaled $108 million, down 47% from $204 million in the

prior-year period. Outlays mainly concerned:

- The drilling program on the Gonelle

field.

- Coiled tubing interventions on Anguille

and Torpille.

- Work to improve the integrity and

longevity of offshore facilities on Anguille, Torpille and Grondin

and the onshore Cap Lopez terminal.

- Completion of the revamping of Pageau

(Torpille Area).

- Well workovers on the Rabi

license.

- Geophysical and development surveys and

studies.

Net Income

The company reported a net loss of $1 million in the first

nine months of the year, down $34 million versus a net loss of

$35 million in the prior-year period. The main reasons for the

improvement were:

- Higher production.

- Lower production costs as a result of

the cost-cutting program implemented by the Company.

- The capital gain realized from the sale

of Mboga.

These factors were partly offset by:

- Lower selling prices.

- An increase in depreciation and

amortization expense following the commissioning of

work-in-progress.

- One-off financial expenses incurred to

renew the credit facility.

Highlights Since the Beginning of Third-Quarter 2016

Board of Directors Meeting on August 30, 2016

The Board of Directors met on August 30, 2016 and reviewed the

financial accounts for first-half 2016. The Company's Interim 2016

Financial Report for the period ending June 30 was published on its

website on the same date.

Health, Safety and Environment

On November 10, 2016, Total Gabon reached 627 consecutive days

worked without a lost-time injury.

Operations

Coiled Tubing Interventions

The coiled tubing interventions were successfully completed on

August 2. Twelve wells were involved: seven on ANE, three on AGM

and two on TRM. The related costs were 25% lower than budgeted.

Well Abandonment

Twelve wells were abandoned: five on the Pageau field, four on

the Gonelle field and three on the Mandaros field. The Setty

drilling rig was released on August 31, 2016.

1 Including tax oil reverting to the Republic as per production

sharing contracts.

Société anonyme incorporated in Gabon

with a Board of Directors and share capital of

$76,500,000Headquarters: Boulevard Hourcq, Port-Gentil, BP

525, Gabonese Republicwww.total-gabon.comRegistered

in Port-Gentil: 2000 B 00011

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161111005446/en/

Media Contact in Gabon:Mathurin Mengue-BibangTel.: + 241 01 55

63 29

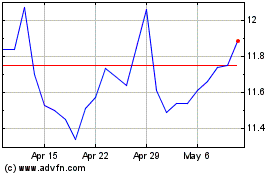

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Mar 2024 to Apr 2024

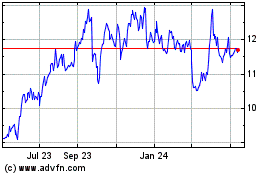

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Apr 2023 to Apr 2024