Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 08 2016 - 5:25PM

Edgar (US Regulatory)

Free Writing

Prospectus

Filed Pursuant to Rule

433

Registration Statement

No. 333-190198

FINAL TERMS AND CONDITIONS AS OF

JUNE 8, 2016 OF

ECOPETROL S.A. U.S.$500,000,000 REOPENING OF 5.875% NOTES DUE 2023

|

ISSUER:

|

Ecopetrol S.A.

|

|

|

|

|

SECURITY:

|

5.875% Notes Due 2023 (the “

Notes

”)

|

|

|

|

|

RANKING:

|

Senior, unsecured and unsubordinated obligations of the Issuer, ranking

pari passu

, without any preferences among themselves, with all of its other present and future unsecured and unsubordinated obligations that constitute its External Indebtedness (as defined in the prospectus).

|

|

|

|

|

PRINCIPAL AMOUNT:

|

U.S.$500,000,000

|

|

|

|

|

REOPENING:

|

The Notes constitute a further issuance of, and will form a single series with, the U.S.$1,300,000,000 amount of the Issuer’s outstanding 5.875% Notes Due 2023 issued on September 18, 2013.

|

|

|

|

|

MATURITY:

|

September 18, 2023

|

|

|

|

|

ISSUE PRICE:

|

101.612% plus accrued interest from March 18, 2016 to the expected settlement date, plus accrued interest, if any, subsequent to June 15, 2016, if settlement occurs after that date. Accrued interest from March 18, 2016 to the expected settlement date of June 15, 2016 will total US$7,098,958.33

|

|

|

|

|

INTEREST PAYMENT DATES:

|

September 18 and March 18, commencing on September 18, 2016.

|

|

|

|

|

COUPON RATE:

|

5.875%

|

|

|

|

|

BENCHMARK TREASURY:

|

UST 1.625% due May 31, 2023

|

|

|

|

|

BENCHMARK TREASURY SPOT AND YIELD:

|

100-25+ and 1.504%

|

|

|

|

|

SPREAD TO BENCHMARK TREASURY:

|

409.6 bps

|

|

|

|

|

REOPENING YIELD:

|

5.600%

|

|

|

|

|

PRICING DATE:

|

June 8, 2016

|

|

MAKE-WHOLE CALL:

|

45 basis points

|

|

|

|

|

EXPECTED SETTLEMENT DATE:

|

June 15, 2016 (T+5)

|

|

|

|

|

NET PROCEEDS BEFORE EXPENSES:

|

U.S.$507,060,000 excluding accrued interest

|

|

|

|

|

CUSIP/ISIN:

|

CUSIP: 279158 AC3

ISIN: US279158AC30

|

|

|

|

|

CLEARING:

|

DTC / Euroclear / Clearstream

|

|

|

|

|

JOINT BOOK-RUNNING MANAGERS:

|

HSBC Securities (USA) Inc.

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

|

|

|

|

|

MINIMUM DENOMINATION:

|

U.S.$1,000 and integral multiples of U.S.$1,000 in excess thereof

|

|

|

|

|

GOVERNING LAW:

|

New York

|

|

|

|

|

FORMAT:

|

SEC Registered

|

|

|

|

|

DAY COUNT:

|

30/360

|

|

|

|

|

OPTIONAL REDEMPTION PROVISIONS:

|

At any time or from time to time, in whole or in part, at the Issuer’s option at a make-whole premium based on Treasury Rate plus 45 basis points.

|

|

|

|

|

WITHHOLDING TAX REDEMPTION PROVISIONS:

|

At any time at the Issuer’s option if the Issuer becomes obligated to pay additional amounts under the Notes, in whole but not in part, at par.

|

|

|

|

|

EXPECTED RATINGS

1

:

|

Baa3 / BBB / BBB (Moody’s / S&P / Fitch)

|

1

A rating of securities is not a recommendation

to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

The Issuer has filed a registration statement (including

a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus

in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer

and this offering, including the Issuer’s current reports on Form 6-K, filed with the SEC on June 7, 2016 and June 8, 2016,

including any exhibits thereto, each accessible via the following links:

https://www.sec.gov/Archives/edgar/data/1444406/000114420416107316/v441928_6k.htm

https://www.sec.gov/Archives/edgar/data/1444406/000114420416107395/v441778_6k.htm

, and

https://www.sec.gov/Archives/edgar/data/1444406/000114420416107395/v441778_ex99-1.htm

.

You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Underwriters can

arrange to send you the prospectus if you request it by calling or writing HSBC Securities (USA) Inc. at 1-866-811-8049 or Merrill

Lynch, Pierce, Fenner & Smith Incorporated at 1-800-294-1322.

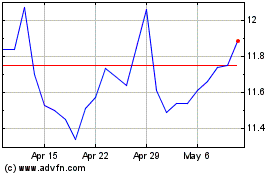

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Mar 2024 to Apr 2024

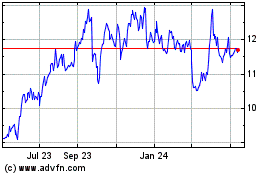

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Apr 2023 to Apr 2024