UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of

May, 2016

Commission File Number 001-34175

|

ECOPETROL S.A.

|

|

(Exact name of registrant as specified in

its charter)

|

|

N.A.

|

|

(Translation of registrant’s name

into English)

|

|

COLOMBIA

|

|

(Jurisdiction of incorporation or organization)

|

|

Carrera 13 No. 36 – 24

|

|

BOGOTA D.C. – COLOMBIA

|

|

(Address of principal executive offices)

|

Indicate by check mark

whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form

40-F

¨

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes

¨

No

x

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes

¨

No

x

Indicate by check mark

whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

¨

No

x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

N/A

Ecopetrol

Group Announces Its Results for the First Quarter of 2016

1

|

|

·

|

Amid

the lowest Brent price of the last 12 years, in the first quarter of 2016 the Group achieved

a net income attributable to shareholders of Ecopetrol of COP$363 billion.

|

|

|

·

|

Net

income attributable to shareholders of Ecopetrol, increased 127% as compared to the first

quarter of 2015.

|

|

|

·

|

Solid

cash flow generation with an Ebitda margin of 39.5%, resulting in an Ebitda of COP$4.1

trillion for the first quarter of 2016.

|

|

|

·

|

Group’s

savings amounted COP$421 billion during the first quarter of 2016. The Company continues

to demonstrate its capacity to adapt under an adverse price scenario.

|

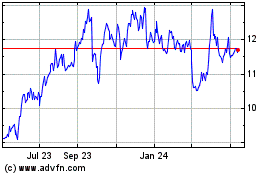

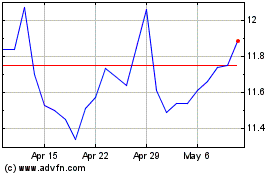

Bogota, May 3, 2016. Ecopetrol

S.A. (BVC: ECOPETROL; NYSE: EC) (“Ecopetrol” or the “Company”) announced today Ecopetrol Group’s

financial results for the first quarter of 2016, prepared and filed in Colombian pesos (COP$) and under International Financial

Reporting Standards (IFRS) applicable in Colombia.

Table 1: Summary

of the Group’s Consolidated Financial Results

|

A

|

|

B

|

|

|

C

|

|

|

D

|

|

|

E

|

|

|

(COP$ Billion)

|

|

1Q 2016*

|

|

|

1Q 2015*

|

|

|

∆ ($)

|

|

|

∆ (%)

|

|

|

Total sales

|

|

|

10,485

|

|

|

|

12,301

|

|

|

|

(1,816

|

)

|

|

|

(14.8

|

)%

|

|

Operating profit

|

|

|

1,599

|

|

|

|

2,357

|

|

|

|

(758

|

)

|

|

|

(32.2

|

)%

|

|

Net Income Consolidated

|

|

|

611

|

|

|

|

356

|

|

|

|

255

|

|

|

|

71.6

|

%

|

|

Non-controlling interest

|

|

|

(248

|

)

|

|

|

(196

|

)

|

|

|

(52

|

)

|

|

|

26.5

|

%

|

|

Net (loss) income attributable to Owners of Ecopetrol **

|

|

|

363

|

|

|

|

160

|

|

|

|

203

|

|

|

|

126.9

|

%

|

|

Other comprehensive income attributable to Owners of Ecopetrol **

|

|

|

(416

|

)

|

|

|

1,097

|

|

|

|

(1,513

|

)

|

|

|

(137.9

|

)%

|

|

EBITDA

|

|

|

4,137

|

|

|

|

4,782

|

|

|

|

(645

|

)

|

|

|

(13.5

|

)%

|

|

EBITDA Margin

|

|

|

39.5

|

%

|

|

|

38.9

|

%

|

|

|

|

|

|

|

|

|

* These figures are included for illustration

purposes only. Unaudited.

** According to IAS-1, “Presentation

of financial statements”, paragraph 83, the company must include in the statement of comprehensive results, the results

attributable to non-controlling interest (minority interest) and the results attributable to shareholders of the controlling company.

1

Some figures in this release are presented in U.S. dollars (US$) as indicated. The exhibits in the main body of this report

have been rounded to one decimal. Figures expressed in billions of COP$ are equal to COP$1 thousand million. All financial information

in this report is unaudited.

In the view of the President of Ecopetrol

S.A., Juan Carlos Echeverry G.:

"The price environment in the

first quarter of 2016 continued to defy the oil industry, which saw the value of crude reach US$28/barrel, a 12 year record low.

Ecopetrol, however, managed to generate profits amid this challenging environment, focusing its efforts on reducing costs, increasing

efficiency, producing profitable barrels and prioritizing cash generation.

During the first quarter of 2016 the

price of Ecopetrol´s crude basket fell 43% and its refining margin fell 24% in comparison to those of the same period of

2015. The actions undertaken to operate more efficiently and with lower costs, coupled with the positive impact of the devaluation

of the exchange rate over our revenues and the recording of a lower financial net loss allowed to register a growth of 127% in

net profit attributable to shareholders and to improve the EBITDA margin compared to those of the first quarter of 2015. Additionally,

the Company maintained its operating margins and EBITDA at approximately COP$4,000 billion compared to the same quarter.

Savings in costs and expenses contributed

to the obtained results, these amounted to COP$421 billion in the first quarter of the year, against a target of COP$1,600 billion

for all 2016. The efficiencies are mainly due to the optimization of purchasing and contracting plans, better procurement strategies

and renegotiation of contracts.

The reduction of the lifting cost,

cash cost of refining and transportation costs, reported in the first quarter of 2016, compared to the same period last year,

are a result of the progress made by the company pursuant to the Transformation Plan, the devaluation of the COP/USD exchange

rate and austerity and activity reduction measures implemented in all business segments. Ecopetrol is working so that the obtained

efficiencies become structural even in an environment of increasing prices in order to ensure profitable operations and financial

sustainability.

The adjustments in CAPEX and OPEX implemented

since 2015, in line with lower oil prices and the strategic prioritization of value over volume led to programmed lower activity

and lower production in the first quarter of 2016, which came to 737 thousand barrels equivalent per day, compared to 773 thousand

in the first quarter of 2015. This fall also reflects the natural decline and the temporary closure of some fields caused by low

profitability or judicial decisions. Once market conditions and cash availability improve, the Company expects to increase levels

of investment in exploration and production and give way to investments that have been postponed in this low crude oil price environment.

In exploration, the deep water appraisal

well Leon 2 in the Gulf of Mexico of the United States was completed. This one is operated by Repsol, which holds a 60% stake.

The remaining 40% belongs to Ecopetrol America Inc. The Company is awaiting the results of the evaluation of the information provided

by the well, located in one of the regions with the greatest potential for hydrocarbons in deep waters in the world.

Between the first quarter of 2015 and

2016 the gross margin of the refining segment decreased by US$4.5 per barrel mainly as a result of market conditions marked by

lower spreads between prices of middle distillates and the price of oil.

The Cartagena refinery continued its

boot and stabilization process, obtaining a regular operation of the delayed coking, catalytic cracking and diesel hydro-treaters

units. As of March 31, 28 units of a total of 34 were operational. It is expected that all units in the complex will be in full

operation by the second half of 2016. Additionally, loads of crude up to 140 thousand barrels of oil a day have been achieved.

Test of high viscosity crude transportation

were started in February 2016. Satisfactory results were obtained moving oil with a viscosity of 405 centistokes (cSt). This project,

along with the expansion of capacity in Ocensa (P-135) will reduce the cost of dilution which is key to the production of heavy

crudes, which today represent about 58% of the total production of the Group.

In December 2015 the Company imposed

a significant cut on its 2016 investments compared to the levels of previous years with the approval of a budget of US$4,800 million.

The need to preserve the financial sustainability of the Company with the low oil prices environment prompted a further cut in

the investment plan for 2016, which now will range between US$3,000 and US$3,400 million. The expected production was adjusted

to this new reality from 755 thousand barrels per day to approximately 715 thousand barrels of oil equivalent per day.

2016 is a transition year for the Ecopetrol

Group during which the cycle of investments in Midstream and Downstream will conclude with some transport projects and the startup

of the Cartagena refinery. From 2017 on the Company will devote a greater proportion of its investments to Upstream.

Financing needs for this year are in

the US$1,500 - US$1,900 million range, without taking into account the resources that may be obtained from the Company´s

divestment plan. To date, US$475 million has already been obtained through credit facilities with local and international banks.

Cash flow was also leveraged by the

results of the auction of Ecopetrol´s stake in ISA held in April 2016, which allowed allotting shares in the amount of COP$377

billion.

Shareholders also contributed to the

financial strengthening of the Company with the decision not to distribute dividends in 2016, which was made during the last general

meeting of shareholders.

Operational excellence, focus on capital

discipline, rationalization of investments and rotation of the portfolio of assets to generate cash flow have enabled Ecopetrol

to successfully navigate the current price environment.

Ecopetrol continues to position itself

for the future by strengthening its portfolio of exploration and production in order to seize opportunities that may be generated

in the next cycle of higher crude oil prices. In this way we can ensure growth in the long term, financial sustainability and

value creation for Ecopetrol."

Ecopetrol

Group Announces Its Results for

the

First Quarter of 2016

Table of Contents

|

|

I.

|

Consolidated Financial Results

|

The following table summarizes sales volume

for the periods indicated:

Table 2: Sales

Volume

|

A

|

|

B

|

|

|

C

|

|

|

D

|

|

|

Local sales volume (mboed)

|

|

IQ 2016

|

|

|

IQ2015

|

|

|

∆ (%)

|

|

|

Crude Oil

|

|

|

15.8

|

|

|

|

20.1

|

|

|

|

(21.6

|

)%

|

|

Natural Gas

|

|

|

86.8

|

|

|

|

81.4

|

|

|

|

6.6

|

%

|

|

Gasoline

|

|

|

106.5

|

|

|

|

92.4

|

|

|

|

15.2

|

%

|

|

Medium Distillates

|

|

|

139.7

|

|

|

|

142.0

|

|

|

|

(1.6

|

)%

|

|

LPG and Propane

|

|

|

16.8

|

|

|

|

15.5

|

|

|

|

8.8

|

%

|

|

Fuel Oil

|

|

|

6.9

|

|

|

|

5.2

|

|

|

|

31.5

|

%

|

|

Industrial and Petrochemical

|

|

|

19.7

|

|

|

|

21.4

|

|

|

|

(8.0

|

)%

|

|

Total Local Sales

|

|

|

392.2

|

|

|

|

378.0

|

|

|

|

3.7

|

%

|

|

Export sales volume (mboed)

|

|

IQ 2016

|

|

|

IQ2015

|

|

|

∆ (%)

|

|

|

Crude Oil

|

|

|

463.5

|

|

|

|

570.4

|

|

|

|

(18.7

|

)%

|

|

Products

|

|

|

131.4

|

|

|

|

72.7

|

|

|

|

80.6

|

%

|

|

Natural Gas

|

|

|

1.6

|

|

|

|

16.2

|

|

|

|

(89.9

|

)%

|

|

Total Export Sales

|

|

|

596.5

|

|

|

|

659.3

|

|

|

|

(9.5

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Sales Volume

|

|

|

988.7

|

|

|

|

1,037.3

|

|

|

|

(4.7

|

)%

|

a.1) Market in Colombia (39.7% of total

sales in the first quarter of 2016):

Local sales in the first quarter of 2016

increased compared to the same period of last year, due to:

|

|

·

|

Greater

demand for gasoline driven by: 1) growth of the automotive fleet, 2) suspension of the

blending of ethanol in the country’s northern zone, and 3) the effect of the Venezuelan

border closing of.

|

|

|

·

|

An

increase in sales of natural gas for thermal power generation due primarily to the intensification

of the El Niño phenomenon and the availability of natural gas resulting from the

decline in exports.

|

|

|

·

|

Lower

sales of crude to Equion because of the evacuation of its crude by alternate transport

systems.

|

|

|

·

|

Lower

sales of diesel due to lower demand in Colombia.

|

a.2) International market (60.3% of

total sales in the first quarter of 2016):

Volume exported decreased 9.5% in the

first quarter of 2016 with respect to the same period of last year, mainly explained by the net effect of:

|

|

·

|

Lower

exports of crude due to: 1) delivery of crude to the Cartagena refinery, 2) lower production

by the Ecopetrol Group and 3) lower operating availability of transport systems.

|

|

|

·

|

Lower

gas exports as a result of the expiration of the gas supply contract with Venezuela on

June 30, 2015.

|

|

|

·

|

Greater

exports of products due to start-up of operations of the Cartagena refinery (diesel,

naphtha, jet fuel and fuel oil).

|

Export Markets:

Table 3: Export Markets

|

A

|

|

B

|

|

|

C

|

|

|

D

|

|

E

|

|

|

F

|

|

|

Export Destinations - Crudes (mbod)

|

|

Export Destinations - Products (mboed)

|

|

Destination

|

|

1Q 2016

|

|

|

1Q 2015

|

|

|

Destination

|

|

1Q 2016

|

|

|

1Q 2015

|

|

|

Asia

|

|

|

77.9

|

|

|

|

153.7

|

|

|

Asia

|

|

|

8.4

|

|

|

|

14.8

|

|

|

U.S. Gulf Coast

|

|

|

202.1

|

|

|

|

151.2

|

|

|

U.S. Gulf Coast

|

|

|

27.0

|

|

|

|

18.1

|

|

|

U.S. West Coast

|

|

|

55.2

|

|

|

|

51.5

|

|

|

U.S. West Coast

|

|

|

19.8

|

|

|

|

12.1

|

|

|

U.S. East Coast

|

|

|

16.4

|

|

|

|

5.5

|

|

|

U.S. East Coast

|

|

|

21.3

|

|

|

|

0.1

|

|

|

Europe

|

|

|

59.9

|

|

|

|

87.2

|

|

|

Europe

|

|

|

0.4

|

|

|

|

4.9

|

|

|

Central America / Caribbean

|

|

|

29.1

|

|

|

|

107.2

|

|

|

Central America / Caribbean

|

|

|

34.9

|

|

|

|

16.6

|

|

|

South America

|

|

|

11.9

|

|

|

|

8.5

|

|

|

South America

|

|

|

5.8

|

|

|

|

6.1

|

|

|

Other

|

|

|

11.0

|

|

|

|

5.6

|

|

|

Other

|

|

|

13.8

|

|

|

|

0.0

|

|

|

Total

|

|

|

463.5

|

|

|

|

570.4

|

|

|

Total

|

|

|

131.4

|

|

|

|

72.7

|

|

|

|

·

|

Crude:

Seeking to obtain higher sales margins for Ecopetrol crudes, an increase of sales

in the United States market was achieved due to the signing of contracts with East Coast

refineries, taking advantage of greater competitiveness of imported as opposed to domestic

crudes (closing of WTI – Brent differential) as a result of the announcement of

the release of exports and lower production in the United States.

|

|

|

|

Sales to the Asian market fell because

of the increase in supply from Iraq and Iran, which have focused their strategy on recovering

their market share in Asia, by selling their crude at lower prices than those of Latin

American crudes.

|

|

|

|

Finally, during the first quarter, lower

volumes were allocated to Central America and the Caribbean, in view of reduced incentives

for storage in these regions, which in turn resulted from lower expectations for recovering

prices in the near-term.

|

|

|

·

|

Products:

The volume of fuel oil delivered to Asia dropped as a consequence of the decline

in the demand of small refineries (which can use crude oil instead of fuel oil) and large

inventories in Singapore. Similarly, a decline was observed in sales of fuel oil to Europe

due to oversupply resulting from higher runs of simple conversion refineries in this

region. These volumes were exported to the East Coast of the U.S. where the product is

used for the preparation of bunker fuels.

|

Noteworthy among other products

exported are diesel, naphtha and high sulfur diesel, which were placed on the markets of the United States´ Gulf Coast and

Atlantic Coast and Africa, respectively.

|

|

b.

|

Crude, Refined Products, and Gas Prices

|

The following table shows the average prices of Brent, Maya

and West Texas Intermediate (WTI) crude.

Table 4: Price of Crude References

|

A

|

|

B

|

|

|

C

|

|

|

D

|

|

|

E

|

|

Prices of Crude References

(Average, US$/Bl)

|

|

1Q 2016

|

|

|

1Q 2015

|

|

|

∆ (%)

|

|

|

∆ ($)

|

|

|

Brent

|

|

|

35.2

|

|

|

|

55.1

|

|

|

|

(36.1

|

)%

|

|

|

(19.9

|

)

|

|

MAYA

|

|

|

23.1

|

|

|

|

43.9

|

|

|

|

(47.4

|

)%

|

|

|

(20.8

|

)

|

|

WTI

|

|

|

33.6

|

|

|

|

48.6

|

|

|

|

(30.9

|

)%

|

|

|

(15.0

|

)

|

The following table shows the average sales price of the crude

oil basket, refined products basket and natural gas basket.

Table 5: Average Sales Price

|

A

|

|

B

|

|

|

C

|

|

|

D

|

|

|

E

|

|

|

F

|

|

Sales Price

(US$/Bl)

|

|

1Q 2016

|

|

|

1Q 2015*

|

|

|

∆ (%)

|

|

|

∆ $

|

|

|

Sales Volume

(mboed)

1Q 2016

|

|

|

Crude oil basket

|

|

|

25.1

|

|

|

|

44.3

|

|

|

|

(43.3

|

)%

|

|

|

(19.2

|

)

|

|

|

479.3

|

|

|

Products basket

|

|

|

41.6

|

|

|

|

68.1

|

|

|

|

(38.9

|

)%

|

|

|

(26.5

|

)

|

|

|

421.0

|

|

|

Natural gas basket

|

|

|

25.0

|

|

|

|

23.7

|

|

|

|

5.5

|

%

|

|

|

1.3

|

|

|

|

88.4

|

|

* Some amounts exhibit changes or reclassifications

for purposes of comparison

Crude:

The crude sale basket declined by US$19.2/Bl

between the first quarter of 2016 and the same period of 2015, reflecting the drop in benchmark indicators (Brent decreased by

US$19.9/Bl) mainly as a result of the continuing imbalance between supply and demand for crude at the global market and diminished

growth projections for the leading global economies.

The differential of the crude basket versus

Brent improved by US$0.7/Bl (1Q-2016: -US$10.1/Bl vs 1Q-2015: -US$10.8/Bl) due to the re-composition of export destinations allowing

a better valuation of our crudes due to the capture of higher demand and the growing interest of refiners in the U.S. for imported

crude oil.

Factors such as the accumulation of crude

inventories, the strengthening of the dollar and the persistent oversupply in the first quarter of 2016, are maintaining differentials

at levels of the first quarter of 2015, despite the drop of Brent.

The Ecopetrol Group’s crude export

basket was referenced to the following indicators: Brent (78.4%), Maya (21.1%) and Other (0.5%); which shows a reduction to the

Maya index and an increase in the Brent index, as compared to the first quarter of 2015 ( Brent: 69.4%, Maya: 29.2% and others

1.4%).

Refined Products:

During the first quarter of 2016, the

refined products sales basket price decreased by US$26.5 per barrel, as compared to the first quarter of 2015, due to the drop

in international benchmark prices for gasoline, diesel and jet fuel.

Natural Gas:

During the first quarter of 2016, natural

gas prices increased by US$1.3 per barrel equivalent in comparison to the same quarter of 2015, attributable to higher prices

in force since December 2015 as a result of the commercialization process made in 2015.

The first quarter of 2016 had the lowest

oil prices in the last 12 years. The Company has confronted this situation with optimization plans that are reflected in lower

costs for maintenance, contracted services and agreements, among other factors. At the close of this period profit for shareholders

have been registered for COP$363 billion, with a positive EBITDA margin of 39.5%, both figures being higher than those presented

for the same period last year.

The table below shows a detailed analysis

of the Income Statement results:

Table 6: Consolidated Income Statement

|

A

|

|

B

|

|

|

C

|

|

|

D

|

|

|

E

|

|

Consolidated Income Statement

COP$ Billion

|

|

1Q 2016*

|

|

|

1Q 2015*

|

|

|

∆ ($)

|

|

|

∆ (%)

|

|

|

Local Sales

|

|

|

6,032

|

|

|

|

5,827

|

|

|

|

205

|

|

|

|

3.5

|

%

|

|

Export Sales

|

|

|

4,453

|

|

|

|

6,474

|

|

|

|

(2,021

|

)

|

|

|

(31.2

|

)%

|

|

Total Sales

|

|

|

10,485

|

|

|

|

12,301

|

|

|

|

(1,816

|

)

|

|

|

(14.8

|

)%

|

|

Variable Costs

|

|

|

5,495

|

|

|

|

6,437

|

|

|

|

(942

|

)

|

|

|

(14.6

|

)%

|

|

Fixed Costs

|

|

|

1,951

|

|

|

|

2,118

|

|

|

|

(167

|

)

|

|

|

(7.9

|

)%

|

|

Cost of Sales

|

|

|

7,446

|

|

|

|

8,555

|

|

|

|

(1,109

|

)

|

|

|

(13.0

|

)%

|

|

Gross Profits

|

|

|

3,039

|

|

|

|

3,746

|

|

|

|

(707

|

)

|

|

|

(18.9

|

)%

|

|

Operating Expenses

|

|

|

1,440

|

|

|

|

1,389

|

|

|

|

51

|

|

|

|

3.7

|

%

|

|

Operating Income/Loss

|

|

|

1,599

|

|

|

|

2,357

|

|

|

|

(758

|

)

|

|

|

(32.2

|

)%

|

|

Financial Income/Loss

|

|

|

(136

|

)

|

|

|

(1,530

|

)

|

|

|

1,394

|

|

|

|

(91.1

|

)%

|

|

Results from Subsidiaries

|

|

|

(27

|

)

|

|

|

1

|

|

|

|

(28

|

)

|

|

|

(2,800.0

|

)%

|

|

Provision for Income Tax

|

|

|

(825

|

)

|

|

|

(472

|

)

|

|

|

(353

|

)

|

|

|

74.8

|

%

|

|

Net Income Consolidated

|

|

|

611

|

|

|

|

356

|

|

|

|

255

|

|

|

|

71.6

|

%

|

|

Non-Controlling Interests

|

|

|

(248

|

)

|

|

|

(196

|

)

|

|

|

(52

|

)

|

|

|

26.5

|

%

|

|

Net income attributable to Owners of Ecopetrol **

|

|

|

363

|

|

|

|

160

|

|

|

|

203

|

|

|

|

126.9

|

%

|

|

Other Comprehensive Income Attributable to Owners of Ecopetrol

|

|

|

(416

|

)

|

|

|

1,097

|

|

|

|

(1,513

|

)

|

|

|

(137.9

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

|

4,137

|

|

|

|

4,782

|

|

|

|

(645

|

)

|

|

|

(13.5

|

)%

|

|

EBITDA Margin

|

|

|

39.5

|

%

|

|

|

38.9

|

%

|

|

|

|

|

|

|

|

|

* These figures are unaudited and are

included for illustration purposes only. Some lines might have been reclassified by the sake of comparison.

** According to IAS-1, “Presentation

of financial statements”, paragraph 83, the company must include in the statement of comprehensive results, the results

attributable to non-controlling interest (minority interest) and the results attributable to shareholders of the controlling company.

Sales Revenues

for the first quarter

of 2016, with respect to the same period last year, decreased 15% (-COP$1.816 billion), as a combined result of:

|

|

·

|

Lower

average price for the Ecopetrol Group’s basket of crude and products (-US$18.6/Barrel):

-COP$3,961 billion.

|

|

|

·

|

Effect

of sales volume +COP$106 billion, resulting primarily from:

|

|

|

o

|

Higher volumes sold of refined

products and petrochemicals (+72 mboed) by +COP$1,086 billion, principally because of

the startup of operations at the Cartagena Refinery, growth in demand due to the increase

of vehicles in Colombia, and provision of supply in the border zone with Venezuela; primarily

offset by:

|

|

|

o

|

Lower volumes in crude sales (-111

mboed) by –COP$922, due to lower production, fewer purchases by third parties in

the southern part of the country because of closing of the wells of certain producers,

and because of the provision of crude to load the Cartagena Refinery.

|

|

|

o

|

Lower volumes in gas sales (-9

mboed) by –COP$58 billion, principally due to lower exports, given the termination

of the gas supply contract with Venezuela.

|

|

|

·

|

Devaluation

of the COP/USD Exchange rate, which on average went from COP$2,469/US$ in the first quarter

of 2015 to COP$3,249/US$ in the first quarter of 2016, improving total revenues by COP$1,966

billion.

|

|

|

·

|

Other

minor revenues by +COP$73 billion.

|

The

cost of sales

for the first

quarter of 2016 fell 13% (-COP$1,109 billion) as a result of:

|

|

·

|

Variable

costs:

declined by 15% (-COP$942 billion), mainly as a result of:

|

|

|

a)

|

Lower costs in purchases of crude, gas and products (-COP$844

billion) due to the net effect of:

|

|

|

o

|

Lower average purchase price given

international reference prices by -COP$1,676 billion.

|

|

|

o

|

Increase in volumes purchased

(+4 mboed) by +COP$75 billion, primarily due to: 1) crude imports for the startup of

operations at the Cartagena Refinery, offset by, 2) lower purchases of crude due to the

closing of wells of certain third parties in the southern part of the country, and 3)

lower imports of fuels given the startup of operations at the Cartagena Refinery.

|

|

|

o

|

Devaluation of the average COP/USD

exchange rate: +COP$757 billion.

|

|

|

b)

|

Lower transport costs –COP$86

billion, mainly because of optimizations in transport by tank trucks and fewer capacity

purchases given greater transport system availability.

|

|

|

c)

|

Other minor variable categories:

-COP$12 billion.

|

|

|

·

|

Fixed

costs:

decline by 8% (-COP$167 billion) mainly as a result of:

|

|

|

a)

|

A decline in maintenance and

services contracted (-COP$168 billion), mainly due to: 1) optimizations achieved in the

execution of our Transformation plan, 2) lower operating costs for partnership contracts

in the Rubiales and Quifa fields, mainly because of the downsizing of personnel entailing

lower costs for canteen and facilities, catering, hotels, air and ground transportation

of staff, 3) cutting costs at the Casanare field by closing six wells and optimizing

contracts; and 4) restructuring of services and quantities, and renegotiation of rates

for framework maintenance contracts at the fields.

|

|

|

b)

|

Drop in labor costs of –COP$94

billion, principally because of the reduction in variable compensation.

|

|

|

c)

|

An increase in depreciation of

+COP$91 billion, principally at Reficar because of the startup of operations at the Refinery

as well as capitalization of higher maintenance at the Barrancabermeja Refinery.

|

|

|

d)

|

Other minor categories +COP$4

billion.

|

In 2016, results were impacted in an amount

of COP$21 billion because of attacks on infrastructure. This includes repair of transport systems, removal of illegal hookups,

renewal of pipeline operation and decontamination of areas.

Gross margin for the first quarter of

2016 stood at 29%, as compared to 30% for the same quarter last year.

Operating expenses,

including exploration

expenses, grew by 4% (COP$51 billion), mainly due to project expenses associated with updating environmental allowances.

The

net financial (non-operational)

result exhibited lower expenditures of +COP$1,394 billion, as a net result of:

|

|

a)

|

Variation of the result of exchange

rate difference of +COP$1,799 billion, resulting in profits of COP$625 billion in the

first quarter of 2016, as compared to a loss of -COP$1,174 billion in the same period

last year, taking into account the fact that, in 2016, for exchange rates at the close

of the period there was a 4% revaluation of the Colombian peso against the dollar, as

opposed to a devaluation of 7.7% in the first quarter of 2015.

|

As a result of the application,

by Ecopetrol S.A., of Hedge Accounting for future exports, which makes it possible to recognize the effect of exchange rate variations

in long- term foreign currency debt as equity, in the first quarter of 2016 a revenue of COP$679 billion was recorded as Other

Comprehensive Income (OCI – Equity).

|

|

b)

|

Higher financial expense, mainly

due to the (net) increase in interest deriving from debt contracted during the previous

year, from increases in interest rates on floating rate credits, and the effect of an

exchange rate devaluation of -COP$405 billion.

|

Participation in companies

incurred

a loss of -COP$27 billion, as compared to profits in the same period of 2015 of COP$1 billion, primarily due to losses generated

at companies in the exploration and production segment that are not consolidated, due to the low crude oil price conditions.

As a consequence of the factors mentioned

above,

the net result

for

the quarter, attributable to Company shareholders, came to COP$363 billion, 127% higher

than net profits for the first quarter of 2015.

EBITDA

fell 13%, despite a drop

of more than 30% in the price of crude, going from COP$4,782 billion in the first quarter of 2015, to COP$4,137 billion in the

same period of 2016.

EBITDA

margin

went from 38.9% in the first quarter of 2015 to 39.5% in the same period of 2016.

Table 7: Balance Sheet

|

A

|

|

B

|

|

|

C

|

|

|

D

|

|

|

E

|

|

|

Consolidated Balance Sheet

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(COP$ Billion)

|

|

March 31, 2016

|

|

|

December 31, 2015

|

|

|

∆ ($)

|

|

|

∆ (%)

|

|

|

Current Assets

|

|

|

20,456

|

|

|

|

20,113

|

|

|

|

343

|

|

|

|

1.7

|

%

|

|

Non Current Assets

|

|

|

101,292

|

|

|

|

102,883

|

|

|

|

(1,591

|

)

|

|

|

(1.5

|

)%

|

|

Total Assets

|

|

|

121,748

|

|

|

|

122,996

|

|

|

|

(1,248

|

)

|

|

|

(1.0

|

)%

|

|

Current Liabilities

|

|

|

16,273

|

|

|

|

17,443

|

|

|

|

(1,170

|

)

|

|

|

(6.7

|

)%

|

|

Long Term Liabilities

|

|

|

60,468

|

|

|

|

60,321

|

|

|

|

147

|

|

|

|

0.2

|

%

|

|

Total Liabilities

|

|

|

76,741

|

|

|

|

77,764

|

|

|

|

(1,023

|

)

|

|

|

(1.3

|

)%

|

|

Equity

|

|

|

45,007

|

|

|

|

45,232

|

|

|

|

(225

|

)

|

|

|

(0.5

|

)%

|

|

Non Controlling Interest

|

|

|

1,725

|

|

|

|

1,875

|

|

|

|

(150

|

)

|

|

|

(8.0

|

)%

|

|

Total Liabilities and Shareholders' Equity

|

|

|

121,748

|

|

|

|

122,996

|

|

|

|

(1,248

|

)

|

|

|

(1.0

|

)%

|

The main variations in the balance sheet

during the first quarter of 2016 compared to the close of 2015 can be explained by the following factors:

|

|

·

|

Current

assets

increased by COP$343 billion, mainly at Ecopetrol S.A. under the line item

cash and cash equivalents, reflecting funds resulting from the new incurrence of debt

in the first quarter of 2016, partially offset by a decline in commercial accounts receivable,

which in turn was a consequence of lower sales due to low oil prices registered during

the period, and inventory consumption.

|

|

|

·

|

Non-current

assets

fell by -COP$1,591 billion, mainly as a result of:

|

|

|

o

|

Property, Plant and equipment

-COP$1,741 billion, largely as a result of depreciation registered during the period

and the effect on conversion to the asset closing rate by companies with the dollar as

their functional currency.

|

|

|

o

|

Deferred income tax

rate

of

+COP$320 billion, generated primarily at Ecopetrol S.A., taking into account

the effect of temporary differences between fiscal and accounting factors in clearance

of the income allowance at the close of the quarter.

|

|

|

o

|

Other minor variations in non-current

assets in the amount of -COP$170 billion.

|

|

|

·

|

Current

liabilities

decreased COP$1,170 billion in relation to December of 2015, mainly because

of payment of the last share of dividends for 2014 to the majority shareholder, fulfillment

of obligations to third parties and fewer purchases during the period.

|

|

|

·

|

Long-term

liabilities

rose COP$147 billion, mainly due to the combined effect of 1) incurrence

of new debt, with the following banks: Bancolombia in pesos (COP$990 billion) and Bank

of Tokyo Mitsubishi UFJ, Ltd (USD$175 million), offset by, 2) the effect of 4% revaluation

for the period on debts in foreign currency.

|

|

|

·

|

Total

Shareholder´s Equity,

at the close of the first quarter of 2016, came to COP$45,007

billion, of which COP$43,282 billion is attributable to Ecopetrol shareholders, down

-COP$75 billion with respect to the close of December of 2015. This decrease is primarily

due to the combined effect of profits for the quarter and other comprehensive income,

associated with the conversion adjustment for affiliates with a functional currency other

than the Colombian peso.

|

The ratings in effect as of March 31,

2016 were as follows:

|

|

·

|

Moody’s

Investors Service: Baa3 with outlook under revision.

|

|

|

·

|

Standard

and Poor’s: BBB with negative outlook.

|

|

|

·

|

Fitch

Ratings: international rating BBB, local BBB+, both ratings with a stable outlook.

|

Ecopetrol obtained the following loans

in the first quarter of 2016:

|

|

·

|

An

international credit agreement for US$175 million with The Bank of Tokyo-Mitsubushi UFJ,

Ltd (approximately COP$578 billion). The credit agreement has a term of 5 years, repayable

with a 2.5 year grace period on principal and interest, payable semi-annually at a rate

of Libor + 145 basis points. These terms are similar to those obtained by Ecopetrol in

the international syndicated loan closed in February 2015.

|

|

|

·

|

A

bilateral commercial loan agreement with Bancolombia S.A. for COP$990 billion (approximately

USD$300 million). This loan agreement has a term of 8 years and a 2-year grace period

on principal, with interest payable semiannually at a rate of DTF TA + 560 basis points.

|

The terms achieved demonstrate the confidence

of investors and the appetite for Ecopetrol´s credit. The Company continues to have access to sources of funding both locally

and internationally.

The resources from the loan will be used

for the 2016 investment plan and other general corporate purposes.

|

|

g.

|

Results by Business Segment

|

The following table presents business segment results for the

periods indicated:

Table 8: Quarterly Results by Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A

|

|

|

B

|

|

|

C

|

|

|

D

|

|

|

E

|

|

|

F

|

|

|

G

|

|

|

H

|

|

|

I

|

|

|

J

|

|

|

K

|

|

|

|

|

|

E&P

|

|

|

Refining

& Petrochem.

|

|

|

Transportation

and Logistics

|

|

|

Eliminations

|

|

|

Ecopetrol

Consolidated

|

|

|

COP$ Billion

|

|

|

1Q

2016

|

|

|

1Q

2015

|

|

|

1Q

2016

|

|

|

1Q

2015

|

|

|

1Q

2016

|

|

|

1Q

2015

|

|

|

1Q

2016

|

|

|

1Q

2015

|

|

|

1Q

2016

|

|

|

1Q

2015

|

|

|

Local Sales

|

|

|

|

1,834

|

|

|

|

1,911

|

|

|

|

4,087

|

|

|

|

4,217

|

|

|

|

3,130

|

|

|

|

2,492

|

|

|

|

(3,019

|

)

|

|

|

(2,793

|

)

|

|

|

6,032

|

|

|

|

5,827

|

|

|

Export Sales

|

|

|

|

3,784

|

|

|

|

5,644

|

|

|

|

1,204

|

|

|

|

890

|

|

|

|

(1

|

)

|

|

|

-

|

|

|

|

(534

|

)

|

|

|

(60

|

)

|

|

|

4,453

|

|

|

|

6,474

|

|

|

Total Sales

|

|

|

|

5,618

|

|

|

|

7,555

|

|

|

|

5,291

|

|

|

|

5,107

|

|

|

|

3,129

|

|

|

|

2,492

|

|

|

|

(3,553

|

)

|

|

|

(2,853

|

)

|

|

|

10,485

|

|

|

|

12,301

|

|

|

Variable Costs

|

|

|

|

3,753

|

|

|

|

4,233

|

|

|

|

4,089

|

|

|

|

4,179

|

|

|

|

182

|

|

|

|

261

|

|

|

|

(2,529

|

)

|

|

|

(2,236

|

)

|

|

|

5,495

|

|

|

|

6,437

|

|

|

Fixed Costs

|

|

|

|

1,701

|

|

|

|

1,623

|

|

|

|

542

|

|

|

|

468

|

|

|

|

645

|

|

|

|

637

|

|

|

|

(937

|

)

|

|

|

(610

|

)

|

|

|

1,951

|

|

|

|

2,118

|

|

|

Cost of Sales

|

|

|

|

5,454

|

|

|

|

5,856

|

|

|

|

4,631

|

|

|

|

4,647

|

|

|

|

827

|

|

|

|

898

|

|

|

|

(3,466

|

)

|

|

|

(2,846

|

)

|

|

|

7,446

|

|

|

|

8,555

|

|

|

Gross Profit

|

|

|

|

164

|

|

|

|

1,699

|

|

|

|

660

|

|

|

|

460

|

|

|

|

2,302

|

|

|

|

1,594

|

|

|

|

(87

|

)

|

|

|

(7

|

)

|

|

|

3,039

|

|

|

|

3,746

|

|

|

Operating Expenses

|

|

|

|

801

|

|

|

|

731

|

|

|

|

565

|

|

|

|

442

|

|

|

|

248

|

|

|

|

281

|

|

|

|

(174

|

)

|

|

|

(65

|

)

|

|

|

1,440

|

|

|

|

1,389

|

|

|

Operating Profit

|

|

|

|

(637

|

)

|

|

|

968

|

|

|

|

95

|

|

|

|

18

|

|

|

|

2,054

|

|

|

|

1,313

|

|

|

|

87

|

|

|

|

58

|

|

|

|

1,599

|

|

|

|

2,357

|

|

|

Financial Income - Loss

|

|

|

|

123

|

|

|

|

(1,203

|

)

|

|

|

(21

|

)

|

|

|

(369

|

)

|

|

|

(135

|

)

|

|

|

147

|

|

|

|

(103

|

)

|

|

|

(105

|

)

|

|

|

(136

|

)

|

|

|

(1,530

|

)

|

|

Results from Subsidiaries

|

|

|

|

(29

|

)

|

|

|

1

|

|

|

|

4

|

|

|

|

0

|

|

|

|

(2

|

)

|

|

|

0

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(27

|

)

|

|

|

1

|

|

|

Income Tax Benefits (expense)

|

|

|

|

149

|

|

|

|

69

|

|

|

|

(211

|

)

|

|

|

51

|

|

|

|

(763

|

)

|

|

|

(592

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

(825

|

)

|

|

|

(472

|

)

|

|

Net Income Consolidated

|

|

|

|

(394

|

)

|

|

|

(165

|

)

|

|

|

(133

|

)

|

|

|

(300

|

)

|

|

|

1,154

|

|

|

|

868

|

|

|

|

(16

|

)

|

|

|

(47

|

)

|

|

|

611

|

|

|

|

356

|

|

|

(Minus) Non-Controlling Interests

|

|

|

|

-

|

|

|

|

-

|

|

|

|

3

|

|

|

|

2

|

|

|

|

(251

|

)

|

|

|

(198

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

(248

|

)

|

|

|

(196

|

)

|

|

Net Income Attributable to Owners of Ecopetrol

|

|

|

|

(394

|

)

|

|

|

(165

|

)

|

|

|

(130

|

)

|

|

|

(298

|

)

|

|

|

903

|

|

|

|

670

|

|

|

|

(16

|

)

|

|

|

(47

|

)

|

|

|

363

|

|

|

|

160

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

|

|

971

|

|

|

|

2,602

|

|

|

|

580

|

|

|

|

395

|

|

|

|

2,499

|

|

|

|

1,727

|

|

|

|

87

|

|

|

|

58

|

|

|

|

4,137

|

|

|

|

4,782

|

|

|

EBITDA Margin

|

|

|

|

17.3

|

%

|

|

|

34.4

|

%

|

|

|

11.0

|

%

|

|

|

7.7

|

%

|

|

|

79.9

|

%

|

|

|

69.3

|

%

|

|

|

(2.4

|

)%

|

|

|

(2.0

|

)%

|

|

|

39.5

|

%

|

|

|

38.9

|

%

|

Exploration and production

Revenues for the first quarter of 2016

decreased by 26% (-COP$1,937 billion) compared to the first quarter of 2015, mainly due to:

|

|

·

|

Reduction

of prices in Ecopetrol’s crude export basket by 43%

|

|

|

·

|

A

reduction in volume exported, primarily caused by the lower production in Colombia partially

offset by the positive impact of the 32% devaluation of the average COP/USD exchange

rate over the revenues.

|

The cost of sales for the segment decreased

compared to the first quarter of the previous year, exhibiting a variation of 7% (-COP$402 billion), as a result of: 1) efforts

to optimize costs, managing to renegotiate rates for contracts, 2) implementation of strategies for optimization of dilution,

and 3) cost reduction for purchasing of crude oil owing to the drop in international prices. However, these have been offset by

the effect of the devaluation of the average exchange rate over the pipeline fees that are denominated in U.S. dollars.

Operating expenses increased 10% (+COP$70

billion) chiefly in project expenses due to the recognition of higher environmental provisions and the increase in the cost of

freights in U.S. dollars as a result of the devaluation of the exchange rate.

The net financial result reflects an income

of COP$123 billion in the first quarter of 2016 as compared with an expense of COP$1,203 billion in the same period of the year

before. This result primarily reflects the revaluation of the closing COP/USD exchange rate in the first quarter of 2016.

As a net result, the segment showed a

loss attributable to Ecopetrol´s shareholders of COP$394 billion in the first quarter of 2016 compared to a loss of COP$165

billion for the same period in 2015.

Refining and petrochemicals

In spite of the drop in the benchmark

product prices, the revenues of this segment for the first quarter of 2016 increased by 4% (COP$184 billion) compared to the same

period of the previous year, owing mainly to the entry into service of the Cartagena refinery which made it possible to increase

exports of products such as fuel oil, naphtha, diesel and coke.

Cost of sales for this segment remained

relatively steady with a reduction of COP$16 billion, the net effect of: 1) reduced imports of fuels; 2) lower operating costs

for contracted services, materials and supplies, as a result of optimization strategies carried forward by the Barrancabermeja

refinery and 3) higher processing cost due to the entry into service of the Cartagena refinery.

Gross sales margin was 12% versus 9% in

the first quarter of 2015.

Operating expenses rose by 28% (+COP$123

billion) compared with the same quarter of the year before, mainly due to larger expenses related with the start-up of the Cartagena

refinery.

Net financial expenses fell by 94% (-COP$348

billion) caused by revaluation of the closing exchange rates presented in the first quarter of 2016.

The consolidated segment showed a loss

attributable to Ecopetrol´ s shareholders of COP$130 billion in the first quarter of 2016 compared to a loss of COP$298

billion for the same period in 2015.

Transport and Logistics

Revenues for the first quarter of 2016

increased 26% (+COP$637 billion), mainly due to the effect of the devaluation of the average exchange rate for charges denominated

in dollars and higher volumes of refined products transported.

Cost of sales for this segment fell 8%

(-COP$71 billion), primarily as a result of lower costs of maintenance generated within the Group’s transformation program

and reduced variable cost owing to the decrease in transported volumes through pipelines.

Operating expenses went down by 12% (-COP$33

billion) compared to the same period of the year before, which is explained principally by the decline in the value of wealth

tax as well as lower expenses associated with reparations for theft and attacks.

The net financial (non-operating) result

reflects an increase in expenses of COP$282 billion mostly caused by interest expenses and the effect of the

revaluation

of the closing exchange rate in the first quarter of 2016 over the net active position of the segment.

As a final result, the segment reported

net profits

attributable to Ecopetrol´ s shareholders of

COP$903 billion, compared

to COP$670 billion for the same period of 2015.

|

|

h.

|

Results of Cost and Expense Reduction

Initiatives

|

Since the second half of 2014, Ecopetrol

has intensified its austerity measures and optimization of costs and expenses initiatives. These efforts have enabled Ecopetrol

to mitigate the impact of lower crude oil prices on the Company´s revenues.

In February of 2016, Ecopetrol set an

additional budget optimization goal for 2016 of COP$1.6 trillion. The savings made during the first quarter of 2016 are as follows:

Table 9: Optimizations

|

A

|

|

B

|

|

|

C

|

|

|

D

|

|

|

P&L (COP$ Billion)

|

|

1Q 2016

|

|

|

1Q 2015

|

|

|

∆ ($)

|

|

|

Fixed Costs

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Association Services

|

|

|

312

|

|

|

|

355

|

|

|

|

(42

|

)

|

|

Maintenance

|

|

|

128

|

|

|

|

222

|

|

|

|

(94

|

)

|

|

Contracted Services

|

|

|

186

|

|

|

|

281

|

|

|

|

(95

|

)

|

|

Labor Cost

|

|

|

262

|

|

|

|

355

|

|

|

|

(93

|

)

|

|

Non-Capitalized Cost of Projects

|

|

|

-

|

|

|

|

7

|

|

|

|

(7

|

)

|

|

Variable Costs

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Association Services

|

|

|

133

|

|

|

|

149

|

|

|

|

(16

|

)

|

|

Process' Materials

|

|

|

52

|

|

|

|

54

|

|

|

|

(1

|

)

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commissions, Fees and Serv.

|

|

|

47

|

|

|

|

55

|

|

|

|

(7

|

)

|

|

Support to Military Forces and Agreements

|

|

|

23

|

|

|

|

40

|

|

|

|

(17

|

)

|

|

Other General Expenses

|

|

|

80

|

|

|

|

81

|

|

|

|

(1

|

)

|

|

Labor

|

|

|

97

|

|

|

|

143

|

|

|

|

(46

|

)

|

|

Total Costs and Expenses

|

|

|

|

|

|

|

|

|

|

|

(421

|

)

|

These efficiencies are attributable mainly

to the optimization of procurement and contracting plans, renegotiation of contracts and better procurement strategies.

Table 10: Investments* by Ecopetrol’s

Corporate Group

|

A

|

|

B

|

|

|

C

|

|

|

D

|

|

|

E

|

|

|

1Q 2016 (US$ million) **

|

|

|

Segment

|

|

Ecopetrol S.A.

|

|

|

Affiliates and

Subsidiaries***

|

|

|

Total

|

|

|

Allocation by

segment

|

|

|

Production

|

|

|

365.4

|

|

|

|

68.5

|

|

|

|

433.9

|

|

|

|

48.9

|

%

|

|

Refining, Petrochemicals and Biofuels

|

|

|

21.7

|

|

|

|

244.2

|

|

|

|

265.9

|

|

|

|

29.9

|

%

|

|

Exploration

|

|

|

10.0

|

|

|

|

60.9

|

|

|

|

70.9

|

|

|

|

8.0

|

%

|

|

Midstream

|

|

|

1.8

|

|

|

|

104.4

|

|

|

|

106.2

|

|

|

|

12.0

|

%

|

|

Corporate

|

|

|

9.6

|

|

|

|

0.0

|

|

|

|

9.6

|

|

|

|

1.1

|

%

|

|

New Businesses

|

|

|

1.1

|

|

|

|

0.0

|

|

|

|

1.1

|

|

|

|

0.1

|

%

|

|

Supply and Marketing

|

|

|

0.3

|

|

|

|

0.0

|

|

|

|

0.3

|

|

|

|

0.0

|

%

|

|

Total

|

|

|

409.9

|

|

|

|

478.0

|

|

|

|

887.9

|

|

|

|

100.0

|

%

|

*Figures on this table differ from the

capital expenditure figures presented in the Consolidated Statement of Cash Flows on page 32 because the figures on this table

include both operating expenditures and capital expenditure outflows of investment projects, while the investment line of the

Consolidated Statement of Cash Flows only includes capital expenditures.

** Investments were converted using the

average representative Market Exchange Rate from January to March of 2016: COP$3,249/US$

***Prorated according to Ecopetrol’s

stake.

Investments during the first quarter of

2016 were US$888 million (Ecopetrol S.A. itself accounting for 46% of that amount while affiliates and subsidiaries accounted

for 54%). These investments were distributed as follows:

|

|

·

|

Production

(48.9%): Development plans, mostly the drilling campaign in the Castilla and Chichimene

fields and well workovers.

|

|

|

·

|

Refining,

Petrochemicals and Biofuels (29.9%): Cartagena refinery, Bioenergy and the concession

of port at the Cartagena refinery.

|

|

|

·

|

Transport

(12.0%): the Ocensa P135 and San Fernando-Monterrey projects, the initiative to transport

higher viscosity crudes and investments for the operational continuity of the segment.

|

|

|

·

|

Exploration

(8%): Drilling of the appraisal well Leon 2 located in the U.S. Gulf Coast and the development

of activities aimed to assure the social and environmental viability of wells scheduled

to be drilled in the second half of the year.

|

|

|

·

|

Other

(Corporate, New Businesses and Supply and Marketing, 1.2%): technological renovation

and information systems.

|

In light of the current low crude oil

price environment, on April 26, 2016, Ecopetrol announced a reduction of its investment plan for 2016, seeking to ensure capital

discipline and focus on cash generation and financial sustainability of the Ecopetrol Group.

The 2016 Investment Plan went from US$4.8

billion, as approved on December 2015, to a range between US$3.0 and US$3.4 billion. With this level of investment, the Ecopetrol

Group expects to produce approximately 715 thousand barrels of petroleum equivalent per day during 2016.

2016 is a year of transition, during which

investments will be made to finish transportation and refining projects, primarily the start up the new Cartagena refinery. Starting

in 2017, the Company will dedicate a larger portion of its investments to the exploration and production segments.

In exploration and production, resources

will be allocated to the assessment of exploratory findings and the development of principal fields. 93% of funds will be invested

in Colombia and the rest overseas.

Table 11 - 2016 Investments by Segment

|

A

|

|

B

|

|

2016 Investment Plan of Ecopetrol S.A.,

Affiliates and Subsidiaries

(US$ millions)

|

|

|

Business areas

|

|

|

2,966

|

|

|

Exploration

|

|

|

282

|

|

|

Production

|

|

|

1,116

|

|

|

Transportation

|

|

|

433

|

|

|

Refining and Petrochemicals

|

|

|

1,135

|

|

|

Other

|

|

|

34

|

|

|

Total

|

|

|

3,000

|

|

The resources required for the investment

plan will be obtained from internal cash generation, divestment of non-strategic assets and financing. Financing needs for 2016

remain within the range of US$1.5 billion to US$1.9 billion for the Ecopetrol Group.

Exploration in Colombia:

At the end of the first quarter of 2016,

the exploratory well Payero-1 in the Niscota block, which is located in the Piedemonte Llanero basin, was being drilled by Equion

(operator). Hocol holds 20%, Total 50% and Repsol 30% of the working interest.

International Exploration:

During the first quarter of 2016, the

drilling of the appraisal well Leon 2, located in deep waters of the U.S. Gulf of Mexico (operated by Repsol, which holds a participation

of 60% while Ecopetrol America, Inc. holds the remaining 40%) was completed. The results of the well are currently under evaluation.

Furthermore, we acquired 832 square kilometers

of seismic in the POT-M-567 block where Ecopetrol Brasil holds 100% working interest.

As a result of the low crude oil price

environment and the strategy of emphasizing value generation over volumetric growth, Ecopetrol has been moving towards a rationalization

of its investments. The lower production in the first quarter on 2016 is a consequence of the decreased activity. Nevertheless,

as soon as market conditions improve, a robust and profitable production portfolio will allow Ecopetrol to increase its investment

levels, and ultimately activities at its fields.

In the first quarter of 2016, Ecopetrol

Group’s production was 736.6 mboed, a decrease of 36.8 mboed, 4.8% lower than in the first quarter of 2015. This result

is explained by: 1) rationalization of activity, 2) the natural decline of production in the fields and, 3) temporary closing

of some fields due to low profitability and judicial decisions. Production levels seen in the first quarter of 2016 are in line

with the goals set by the Company at the new CAPEX level between US$3.0 and US$3.4 billion.

The following table summarizes the results

of our oil and gas production activities for the periods indicated:

Table 12: Ecopetrol Group’s Gross*

Oil and Gas Production**

|

A

|

|

B

|

|

|

C

|

|

|

D

|

|

|

E

|

|

|

Ecopetrol S.A. (mboed)

|

|

1Q 2016

|

|

|

1Q 2015

|

|

|

∆ (%)

|

|

|

∆ (bls)

|

|

|

Crude Oil

|

|

|

565.3

|

|

|

|

598.0

|

|

|

|

(5.5

|

)%

|

|

|

(32.7

|

)

|

|

Natural Gas***

|

|

|

124.3

|

|

|

|

124.0

|

|

|

|

0.2

|

%

|

|

|

0.3

|

|

|

Total

|

|

|

689.6

|

|

|

|

722.0

|

|

|

|

(4.5

|

)%

|

|

|

(32.4

|

)

|

|

Hocol (mboed)

|

|

1Q 2016

|

|

|

1Q 2015

|

|

|

∆ (%)

|

|

|

∆ (bls)

|

|

|

Crude Oil

|

|

|

16.1

|

|

|

|

20.0

|

|

|

|

(19.5

|

)%

|

|

|

(3.9

|

)

|

|

Natural Gas

|

|

|

0.6

|

|

|

|

0.1

|

|

|

|

500.0

|

%

|

|

|

0.5

|

|

|

Total

|

|

|

16.7

|

|

|

|

20.1

|

|

|

|

(16.9

|

)%

|

|

|

(3.4

|

)

|

|

Savia (mboed)

|

|

1Q 2016

|

|

|

1Q 2015

|

|

|

∆ (%)

|

|

|

∆ (bls)

|

|

|

Crude Oil

|

|

|

4.3

|

|

|

|

5.1

|

|

|

|

(15.7

|

)%

|

|

|

(0.8

|

)

|

|