UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2015

Commission File Number 001-34175

| ECOPETROL S.A. |

|

(Exact name of registrant as specified in

its charter)

|

| N.A. |

|

(Translation of registrant’s name

into English)

|

| COLOMBIA |

|

(Jurisdiction of incorporation or organization)

|

| Carrera 13 No. 36 – 24 |

| BOGOTA D.C. – COLOMBIA |

| (Address of principal executive offices) |

Indicate by check mark

whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ¨

No x

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes ¨

No x

Ecopetrol

Group Announces Its Results for

the Third

Quarter of 20151

| · | Ecopetrol

Corporate Group’s results for the third quarter of 2015 registered an EBITDA of

COP$4.7 trillion pesos and earnings of COP$654 billion pesos. |

| · | Ecopetrol

S.A. achieves COP$1.6 trillion pesos in savings against the 2015 guidance of COP$1.4

trillion. |

| · | The

Corporate Group’s production during the first nine months of the year reached 761

mboed, an increase of 9 mboed versus the same period of 2014. |

Bogota, November 17, 2015. Ecopetrol S.A.

(BVC: ECOPETROL; NYSE: EC; TSX: ECP) announced today Ecopetrol Group’s financial results for the third quarter of 2015 and

the nine first months of the year, prepared and filed in Colombian pesos (COP$) and under International Financial Reporting Standards

(IFRS) applicable in Colombia.

Table 1: Summary of the Group’s

Consolidated Financial Results

| A | |

B | | |

C | | |

D | | |

E | | |

F | | |

G | | |

H | | |

I | | |

J | |

| (COP$ Billion) | |

3Q

2015* | | |

3Q

2014* | | |

∆

($) | | |

∆

(%) | | |

2Q

2015* | | |

Jan-Sep

15* | | |

Jan-Sep

14* | | |

∆

($) | | |

∆

(%) | |

| Total Sales | |

| 13,003.4 | | |

| 16,813.7 | | |

| (3,810.3 | ) | |

| (22.7 | )% | |

| 14,009.6 | | |

| 39,313.8 | | |

| 51,717.2 | | |

| (12,403.4 | ) | |

| (24.0 | )% |

| Operating Profit | |

| 2,850.1 | | |

| 4,443.5 | | |

| (1,593.4 | ) | |

| (35.9 | )% | |

| 3,549.2 | | |

| 8,757.2 | | |

| 15,620.5 | | |

| (6,863.3 | ) | |

| (43.9 | )% |

| Consolidated Net Income | |

| 886.5 | | |

| 1,885.0 | | |

| (998.5 | ) | |

| (53.0 | )% | |

| 1,695.5 | | |

| 2,938.0 | | |

| 8,708.8 | | |

| (5,770.8 | ) | |

| (66.3 | )% |

| Non-Controlling Interest | |

| (232.4 | ) | |

| (154.0 | ) | |

| (78.4 | ) | |

| 50.9 | % | |

| (188.9 | ) | |

| (617.3 | ) | |

| (492.6 | ) | |

| (124.7 | ) | |

| 25.3 | % |

| Ecopetrol Equity Holders** | |

| 654.1 | | |

| 1,731.0 | | |

| (1,076.9 | ) | |

| (62.2 | )% | |

| 1,506.6 | | |

| 2,320.7 | | |

| 8,216.2 | | |

| (5,895.5 | ) | |

| (71.8 | )% |

| Other Comprehensive Income | |

| 2,203.0 | | |

| 1,209.7 | | |

| 993.3 | | |

| 82.1 | % | |

| 459.1 | | |

| 3,374.5 | | |

| 920.8 | | |

| 2,453.7 | | |

| 266.5 | % |

| EBITDA | |

| 4,698.4 | | |

| 6,344.3 | | |

| (1,645.9 | ) | |

| (25.9 | )% | |

| 5,521.9 | | |

| 15,003.0 | | |

| 21,241.7 | | |

| (6,238.7 | ) | |

| (29.4 | )% |

| EBITDA Margin | |

| 36.1 | % | |

| 37.7 | % | |

| | | |

| | | |

| 39.4 | % | |

| 38.2 | % | |

| 41.1 | % | |

| | | |

| | |

* These figures are included for illustration purposes only.

Unaudited.

** According to IAS-1, “Presentation

of financial statements”, paragraph 83, the company must include in the statement of comprehensive results the results attributable

to non-controlling interest (minority interest) and the results attributable to shareholders of the controlling company.

Note: To see the impact of the Hedge Account

over the net income of 1Q 2015, 2Q 2015, 3Q 2015 and January-September 2015, please refer to the table 12 of the chapter "Cash

Flow Hedge for Future Company Exports".

1

According to Article 3 of Decree 2784 of December 28, 2012, the application date of the new technical framework is December

31, 2015. Therefore, the financial information presented prior to this date is preliminary and subject to adjustments. The information

presented in this report is not audited.

As indicated in paragraphs 9 and 18 of

International Accounting Standard 27 “Consolidated and Separated Financial Statements,” Ecopetrol and its corporate

group must present their financial information on a consolidated basis, combining the financial statements of the parent company

and its subsidiaries line by line, adding assets, liabilities, shareholder equity, revenues and expenses of a similar nature, removing

the reciprocal items between the corporate group and recognizing the non-controlling interest.

The financial results in this report are

not comparable line by line with the previously issued financial results in the report for the third quarter of 2014, which were

prepared in accordance with the Public Accounting Regime (Régimen de Contabilidad Pública) as adopted by the Colombian

National Accounting Office. For the sake of comparison, the previously issued financial results for the third quarter of 2014 are

presented in this report under IFRS.

The Company modified its EBITDA calculation

methodology, for more information please refer to the page number 10.

Some figures in this release are presented

in U.S. dollars (US$) as indicated. The exhibits in the main body of this report have been rounded to one decimal. Figures expressed

in billions of COP$ are equal to COP$1 thousand million. All financial information in this report is unaudited.

In the opinion of Ecopetrol’s CEO

Juan Carlos Echeverry G.:

“The industry continued to operate

in a complex environment given low crude prices and the consequent adjustments in investments, costs and expenses observed in

oil and gas companies. Ecopetrol, additionally, has responded to the challenges posed by attacks on oil infrastructure, El Niño

Phenomenon, closing of the border with Venezuela and devaluation of the exchange rate. In order to face this new reality, the

company has been reinventing itself by means of the transformation program contained in the 2015-2020 strategy. The implementation

of the transformation program increases efficiency from a structural standpoint and strengthens an organizational culture based

on the principles of: integrity, collaboration and creativity.

The transformation plan also includes

a comprehensive program for improving oil recovery that seeks to maximize the potential of existing fields and aims to strengthen

our position in the Americas as a reference for this type of activity.

Up to September, Ecopetrol achieved budgetary

savings of COP$1.6 trillion pesos, exceeding the initial goal of COP$1.4 trillion pesos set for 2015. This figure reflects both

structural savings, as well as the streamlining of certain activities. This effort can be observed in the reduction of the company’s

production/barrel costs: lifting cost per barrel in 3Q 2015 was US$6.89/barrel, compared to US$7.47/barrel in 2Q 2015 and US$10.70/barrel

in 3Q 2014. During January and September 2015, lifting cost per barrel was US$7.29/barrel, compared to US$10.91/barrel in the

same period of 2014, reflecting a US$1.03/barrel reduction attributable to efficiency and cost reduction strategies and -US$2.61

attributable to the exchange rate.

The company has set a new challenge to

achieve budgetary savings of COP$2.2 trillion pesos in 2015, in an effort to mitigate some of the effect of a lower international

price of crude through efficiencies and lower cost of services, purchases, and oil and maintenance services, among others.

In the third quarter, Ecopetrol also generated

value for its shareholders through the rotation of its asset portfolio, completing the first stage of divestment of its share

interest in Empresa de Energía de Bogotá, from which it obtained COP$614 billion pesos. The company also opened

the first round in the process of selling off Interconexión Eléctrica S.A.

Other business opportunities have arisen

in the Middle Magdalena region with Occidental Andina LLC (OXY) for the development of a pilot project. If successful, it could

increase the company’s reserves by up to 100 million barrels of crude at the field La Cira-Infantas. Another pilot will

be developed with the Canadian company Parex Resources, at the field Aguas Blancas, designed to recover 55 million barrels of

light crude.

In the production segment, enhanced recovery

was strengthened with 28 recovery pilot projects underway, of which 16 show positive results in increasing pressure and 14 in

increasing the production of crude. Over the past 5 years, Ecopetrol has added 187 million barrels of proven reserves by means

of enhanced recovery, in which it is a pioneer, and has yielded proven results such as the one in La Cira-Infantas field. Through

steam injection, production increased from 5 thousand barrels/day in 2005 to 40 thousand barrels/day in 2015. Processes are becoming

increasingly more efficient: between 2014 and 2015 the number of drilling days per well decreased from 34 to 26 at Castilla field

and from 36 to 20 at Chichimene.

In the first 9 months of 2015, the Corporate

Group’s year-to-date production was 761 mboed, 9 thousand barrels more than in the previous year. This result was achieved

despite the nearly 2% drop in production in 3Q 2015 versus 3Q 2014 because of the attacks on the oil pipeline Caño Limón-Coveñas,

the decline of certain fields, and the lower price level affecting some fields with high price contract clauses. The increase

in activity at the fields Castilla and Chichimene has mitigated the impact of these events. Currently, and with an improvement

in the public order situation, production has recovered to reach the goal of 760 thousand barrels equivalent/day for 2015.

In exploration, in the past year, Orca

and Kronos were discovered offshore in the Colombian Caribbean. The exploratory campaign also included drilling of the well Calasú

in the Caribbean and two wells onshore: Muérgana Sur, located in the Llanos Orientales, and Champeta, located in the lower

Magdalena valley. Furthermore, blocks were added in basins of interest such as those awarded to Ecopetrol (50%) and Anadarko (operator,

50%) and another one 100% Ecopetrol in Lease Sale 426 by the U.S. BOEM (Bureau of Ocean Energy Management) in the Gulf of Mexico.

In refining, on October 21st,

the new Cartagena Refinery reached a key milestone in the start-up process and commissioning with the introduction of hydrocarbons

in the Crude Unit. The first shipment of refined products will take place in November. This is the first step in the commissioning

of 31 sequential plants making up the new Cartagena Refinery, capable of producing clean fuels that meet international markets´

highest environmental standards. All of the plants will be operating by the second quarter of 2016.

The new refinery, considered the most

modern in Latin America, will increase its capacity in 2016 from 80 thousand to 165 thousand barrels/day, and its conversion factor

from 74% to 97%, with greater flexibility in processing heavier crudes. Ecopetrol concludes investments over a 9-year period in

this refinery, which required significant infusion of cash, which now can be used to focus on the exploration and production segments.

At the Barrancabermeja Refinery, gross

margin was US$16.7/ barrel in 3Q 2015 versus US$15.5/barrel in 3Q 2014, due to the implementation of initiatives to transform

streams such as LPG and vacuum bottoms into diluent for heavy crude, and the performance of international prices of refined products

compared to crude.

In transportation, infrastructure was

strengthened to ensure Coveñas’ crude storage reliability, with the addition of two tanks with 420 thousand barrels

of capacity each that will be available in 4Q 2015. In order to verify the performance of transport systems with crude of heavier

viscosity, a test was conducted in September of oil pipelines that transport heavy crude for export (ODL and Ocensa). The results

were successful; this will help reduce diluent consumption in 2016. This is an important step in efficiency, it is the realization

of a strategy to reduce the cost of dilution, especially important for the production and profitability of heavy crudes.

Despite the drop in production (-4%) and

price of the crude basket (-26%) between 2Q and 3Q of 2015, the Corporate Group had an EBITDA margin of 36% and generated EBITDA

of COP$4.7 trillion in the third quarter of 2015, compared to COP$5.5 trillion in the second quarter of 2015. This was made possible

as a result of the continuous effort of all segments to obtain greater savings in their operations and to the strength derived

from being an integrated company.

The financial result of COP$654 billion

pesos in third quarter 2015 reflects the adoption of the Hedge Accounting policy as established by the international accounting

standard IAS 39. The adoption of this standard makes it possible for the effect of the “Exchange Difference” on part

of the dollar-denominated debt portfolio to be reclassified in shareholder equity, taking into account the natural hedge that

Ecopetrol’s crude export revenues generate for it. Ecopetrol has thus made use of an instrument that allows it to show in

its financial statements management of exchange rate risk based on the nature of its business.

The company has responded to the important

challenges posed by the low price environment, attacks on infrastructure, El Niño phenomenon and closing of the border

with Venezuela. It has managed its performance based on financial discipline, operating efficiencies and investment management.

It remains focused on generating value for stakeholders and ensuring profitable growth based on the guidelines of its new strategy

and its sustainability and financial soundness in the long run.”

Ecopetrol

Group Announces Its Results for

the Third

Quarter of 2015

Table of Contents

| I. | Consolidated Financial Results |

The following table summarizes sales volume

for the periods indicated:

Table 2: Sales Volume

| A | |

B | | |

C | | |

D | | |

E | | |

F | | |

G | |

| Ecopetrol S.A. (consolidated) | |

| | |

| | |

| | |

| | |

| | |

| |

| Local Sales Volume (mboed) | |

3Q 2015 | | |

3Q 2014 | | |

∆ (%) | | |

Jan-Sep 15 | | |

Jan-Sep 14 | | |

∆ (%) | |

| Crude Oil | |

| 4.2 | | |

| 24.8 | | |

| (83.1 | )% | |

| 12.3 | | |

| 26.4 | | |

| (53.4 | )% |

| Natural Gas | |

| 79.6 | | |

| 83.7 | | |

| (4.9 | )% | |

| 82.9 | | |

| 81.8 | | |

| 1.3 | % |

| Gasoline | |

| 97.0 | | |

| 82.7 | | |

| 17.3 | % | |

| 94.0 | | |

| 84.3 | | |

| 11.5 | % |

| Medium Distillates | |

| 147.3 | | |

| 143.3 | | |

| 2.8 | % | |

| 143.8 | | |

| 141.6 | | |

| 1.6 | % |

| LPG and Propane | |

| 17.5 | | |

| 15.1 | | |

| 15.9 | % | |

| 16.2 | | |

| 14.8 | | |

| 9.5 | % |

| Fuel Oil | |

| 4.5 | | |

| 1.8 | | |

| 150.0 | % | |

| 5.2 | | |

| 2.7 | | |

| 92.6 | % |

| Industrial and Petrochemical | |

| 21.5 | | |

| 19.2 | | |

| 12.0 | % | |

| 21.0 | | |

| 20.2 | | |

| 4.0 | % |

| Total Local Sales | |

| 371.6 | | |

| 370.6 | | |

| 0.3 | % | |

| 375.4 | | |

| 371.8 | | |

| 1.0 | % |

| Export Sales Volume (mboed) | |

3Q 2015 | | |

3Q 2014 | | |

∆(%) | | |

Jan-Sep 15 | | |

Jan-Sep 14 | | |

∆(%) | |

| Crude Oil | |

| 497.5 | | |

| 560.1 | | |

| (11.2 | )% | |

| 548.0 | | |

| 528.2 | | |

| 3.7 | % |

| Products | |

| 63.9 | | |

| 82.3 | | |

| (22.4 | )% | |

| 65.9 | | |

| 86.8 | | |

| (24.1 | )% |

| Natural Gas | |

| 6.0 | | |

| 14.9 | | |

| (59.7 | )% | |

| 10.4 | | |

| 18.8 | | |

| (44.7 | )% |

| Total Export Sales | |

| 567.4 | | |

| 657.3 | | |

| (13.7 | )% | |

| 624.3 | | |

| 633.8 | | |

| (1.5 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Sales Volume | |

| 939.0 | | |

| 1,027.9 | | |

| (8.6 | )% | |

| 999.7 | | |

| 1,005.6 | | |

| (0.6 | )% |

a.1) Colombian Market

(39% of total sales in the third quarter of 2015):

Local sales remained relatively stable

in third quarter of 2015 compared to the same period of last year, owing primarily to:

| · | Increased

gasoline sales, caused by: 1) an increase in sales of gasoline-powered vehicles, because

of the lower price difference between gasoline and diesel and absence of a vehicle replacement

program; 2) increased demand in areas along the Venezuelan border, due to Venezuela’s

decision to temporarily close its border with Colombia |

| · | Lower

sales of local crude oil, resulting from the evolution of the marine fuels business and

the substitution of fuel oil for this segment. |

a.2) International Market

(61% of total sales in the third quarter of 2015):

Export volumes decreased 14% in the third

quarter of 2015 as compared to the third quarter of 2014, mainly as a result of:

| · | Lower

crude exports, attributable to decreased export capacity in transportation systems, especially

in the southern part of the country and in the Caño Limón-Coveñas

oil pipeline. |

| · | Lower

exports of refined products, especially fuel oil, as a result of the difficulties encountered

in transporting these products to port by means of the Magdalena River, due to the reduced

river flow. |

| · | Decreased

natural gas exports, owing to the termination of the Venezuela sale contract since June

30, 2015. |

Export Markets:

Table 3: Export Markets

| A | |

B | | |

C | | |

D | | |

E | | |

F | |

G | | |

H | | |

I | | |

J | |

| Export Destinations - Crudes (mbod) | | |

Export Destinations - Products (mboed) | |

| Destination | |

3Q

2015 | | |

3Q

2014 | | |

Jan-Sep

15 | | |

Jan-Sep

14 | | |

Destination | |

3Q

2015 | | |

3Q

2014 | | |

Jan-Sep

15 | | |

Jan-Sep

14 | |

| Asia | |

| 167.5 | | |

| 186.4 | | |

| 161.4 | | |

| 199.3 | | |

Asia | |

| 11.5 | | |

| 16.7 | | |

| 17.2 | | |

| 16.3 | |

| U.S. Gulf Coast | |

| 115.1 | | |

| 179.7 | | |

| 131.7 | | |

| 143.6 | | |

U.S. Gulf Coast | |

| 5.5 | | |

| 22.0 | | |

| 9.4 | | |

| 13.8 | |

| U.S. West Coast | |

| 56.6 | | |

| 17.8 | | |

| 50.1 | | |

| 32.9 | | |

U.S. West Coast | |

| 0.0 | | |

| 0.2 | | |

| 1.5 | | |

| 1.2 | |

| U.S. East Coast | |

| 30.6 | | |

| 5.2 | | |

| 26.1 | | |

| 3.4 | | |

U.S. East Coast | |

| 21.5 | | |

| 4.5 | | |

| 0.6 | | |

| 12.4 | |

| Europe | |

| 60.3 | | |

| 108.3 | | |

| 74.6 | | |

| 92.3 | | |

Europe | |

| 0.6 | | |

| 0.4 | | |

| 16.9 | | |

| 0.1 | |

| Central America / Caribbean | |

| 66.0 | | |

| 48.5 | | |

| 90.1 | | |

| 45.9 | | |

Central America / Caribbean | |

| 19.5 | | |

| 31.4 | | |

| 2.8 | | |

| 37.0 | |

| South America | |

| 0.0 | | |

| 3.9 | | |

| 7.0 | | |

| 7.5 | | |

South America | |

| 5.3 | | |

| 6.8 | | |

| 17.5 | | |

| 5.9 | |

| Other | |

| 1.4 | | |

| 10.3 | | |

| 7.0 | | |

| 3.3 | | |

Other | |

| 0.0 | | |

| 0.3 | | |

| 0.0 | | |

| 0.1 | |

| Total | |

| 497.5 | | |

| 560.1 | | |

| 548.0 | | |

| 528.2 | | |

Total | |

| 63.9 | | |

| 82.3 | | |

| 65.9 | | |

| 86.8 | |

| · | Crude

oil: In line with the strategy to diversify Ecopetrol´s crude export markets, Asia

continues to be the main destination of exports, given their investments in refining,

the quality of our crude and the development of the market. |

In the U.S., the company profited

from opportunities in the East and West coasts, due to favorable refining margins and increased interest of refiners for imported

crude resulting from the loss of competitiveness of American and Canadian crudes.

During the third quarter of

2015, the crude export basket was indexed as follows: Brent (63.7%), Maya (33.7%) and others (2.6%).

| · | Refined

Products: The increased participation of the U.S. East Coast can be explained by increased

demand for fuel oil in that region, cause by an increase in vessel traffic associated

with increased gasoline imports in the third quarter of 2015. This increase explains

the lower exports to the U.S. Gulf Coast. In particular, exports to Central America and

the Caribbean from where they are then distributed to other markets. |

| b. | Crude, Refined Products, and Gas Prices |

The following table shows the average prices of Brent, Maya

and West Texas Intermediate (WTI) crude.

Table 4: Price of Crude References

| A | |

B | | |

C | | |

D | | |

E | | |

F | | |

G | |

Prices of Crude References

(Average, US$/Bl) | |

3Q 2015 | | |

3Q 2014 | | |

∆ (%) | | |

Jan-Sep 15 | | |

Jan-Sep 14 | | |

∆ (%) | |

| Brent | |

| 51.2 | | |

| 103.5 | | |

| (50.5 | )% | |

| 56.5 | | |

| 107.0 | | |

| (47.2 | )% |

| MAYA | |

| 39.8 | | |

| 92.0 | | |

| (56.7 | )% | |

| 44.0 | | |

| 93.5 | | |

| (52.9 | )% |

| WTI | |

| 46.4 | | |

| 97.3 | | |

| (52.3 | )% | |

| 50.9 | | |

| 99.6 | | |

| (48.9 | )% |

The following table shows the average sales price of the crude

oil basket, refined products basket and natural gas basket.

Table 5: Average Sales Price

| A | |

B | | |

C | | |

D | | |

E | | |

F | | |

G | | |

H | | |

I | |

Average

Sales Price

(US$/Bl) | |

3Q

2015 | | |

3Q

2014 | | |

∆

(%) | | |

Sales

Volume

(mboed)

3Q

2015 | | |

Jan-Sep

15 | | |

Jan-Sep

14 | | |

∆

(%) | | |

Sales

Volume

(mboed)

Jan-Sep

15 | |

| Crude Oil Basket | |

| 39.1 | | |

| 84.7 | | |

| (53.8 | )% | |

| 501.7 | | |

| 45.1 | | |

| 90.7 | | |

| (50.3 | )% | |

| 560.3 | |

| Products Basket | |

| 62.9 | | |

| 108.8 | | |

| (42.2 | )% | |

| 351.7 | | |

| 65.9 | | |

| 115.5 | | |

| (42.9 | )% | |

| 346.1 | |

| Natural Gas Basket | |

| 21.4 | | |

| 23.7 | | |

| (9.7 | )% | |

| 85.6 | | |

| 22.1 | | |

| 24.2 | | |

| (8.7 | )% | |

| 93.3 | |

Crude:

The crude sales basket decreased by US$45.6

per barrel between the third quarter of 2015 and the same period of 2014, reflecting the drop in the benchmark indicators over

the same period (Brent: -US$52.3 per barrel, Maya: -US$52.2 per barrel and WTI: -US$50.9 per barrel) as a result primarily, of

the continuous imbalance between demand and supply of crudes, high levels of crude inventories worldwide, and a lower growth outlook

in the leading economies.

The differential between the crude oil

basket and Brent crude oil prices narrowed by US$6.7 per barrel (3Q 2015: US$12.1 per barrel vs 3Q 2014: US$18.8 per barrel).

Due to the presence of low absolute prices, the differential of light/ heavy crudes (Brent/ Castilla) narrows. Additionally, these

results reflected market factors such as: 1) high refining margins in the summer months of 2015 that increased crude oil demand

mainly in the United States, 2) increased purchases by India and China for strategic storage purposes, and 3) forward contracts

that mitigated sale price decreases despite a heavier crude basket.

Refined Products:

The refined products sales basket price

decreased by US$45.9 per barrel during the third quarter of 2015 as compared to the third quarter of 2014, caused by the drop

in international benchmark prices: gasoline (-US$45.9/Bl), diesel (-US$54.9/Bl) and jet fuel (-US$57.7/Bl), consistent with changes

in Brent prices during the same period.

Natural Gas:

During the third quarter of 2015, natural

gas prices decreased, owing to: 1) a decrease in the price of the Guajira gas (3Q 2015: US$4.56/MBTU versus 3Q 2014: US$4.68/MBTU),

mainly from the expiration of the contract with Venezuela, and the results of the commercialization process of the available Guajira

gas, carried in October 2014. With regards to the price of the Cusiana-Cupiagua gas, the drop in price (3Q 2015: US$2.93/MBTU

versus 3Q 2014: US$3.32/MBTU) is explained mainly by the application of the regulation to index prices and the result of the renovation

of contracts that expired in 2015.

Table 6: Consolidated Income Statement

| A | |

B | | |

C | | |

D | | |

E | | |

F | | |

G | | |

H | | |

I | |

| COP$ Billion | |

3Q

2015* | | |

3Q

2014* | | |

∆

($) | | |

∆

(%) | | |

Jan-Sep

15* | | |

Jan-Sep

14* | | |

∆

($) | | |

∆

(%) | |

| Local Sales | |

| 5,643.8 | | |

| 5,859.1 | | |

| (215.3 | ) | |

| (3.7 | )% | |

| 15,765.3 | | |

| 18,551.7 | | |

| (2,786.4 | ) | |

| (15.0 | )% |

| Export Sales | |

| 6,161.3 | | |

| 9,890.8 | | |

| (3,729.5 | ) | |

| (37.7 | )% | |

| 20,371.0 | | |

| 30,389.9 | | |

| (10,018.9 | ) | |

| (33.0 | )% |

| Sale of Services | |

| 1,198.3 | | |

| 1,063.8 | | |

| 134.5 | | |

| 12.6 | % | |

| 3,177.5 | | |

| 2,775.6 | | |

| 401.9 | | |

| 14.5 | % |

| Total Sales | |

| 13,003.4 | | |

| 16,813.7 | | |

| (3,810.3 | ) | |

| (22.7 | )% | |

| 39,313.8 | | |

| 51,717.2 | | |

| (12,403.4 | ) | |

| (24.0 | )% |

| Variable Costs | |

| 6,698.3 | | |

| 8,225.9 | | |

| (1,527.6 | ) | |

| (18.6 | )% | |

| 20,212.2 | | |

| 24,896.7 | | |

| (4,684.5 | ) | |

| (18.8 | )% |

| Fixed Costs | |

| 2,364.2 | | |

| 2,695.6 | | |

| (331.4 | ) | |

| (12.3 | )% | |

| 6,826.2 | | |

| 7,392.1 | | |

| (565.9 | ) | |

| (7.7 | )% |

| Cost of Sales | |

| 9,062.5 | | |

| 10,921.5 | | |

| (1,859.0 | ) | |

| (17.0 | )% | |

| 27,038.4 | | |

| 32,288.8 | | |

| (5,250.4 | ) | |

| (16.3 | )% |

| Gross Profits | |

| 3,940.9 | | |

| 5,892.2 | | |

| (1,951.3 | ) | |

| (33.1 | )% | |

| 12,275.4 | | |

| 19,428.4 | | |

| (7,153.0 | ) | |

| (36.8 | )% |

| Operating Expenses | |

| 1,090.8 | | |

| 1,448.7 | | |

| (357.9 | ) | |

| (24.7 | )% | |

| 3,518.2 | | |

| 3,807.9 | | |

| (289.7 | ) | |

| (7.6 | )% |

| Operating Income/Loss | |

| 2,850.1 | | |

| 4,443.5 | | |

| (1,593.4 | ) | |

| (35.9 | )% | |

| 8,757.2 | | |

| 15,620.5 | | |

| (6,863.3 | ) | |

| (43.9 | )% |

| Financial Income/Loss | |

| (693.0 | ) | |

| (834.4 | ) | |

| 141.4 | | |

| (16.9 | )% | |

| (3,002.3 | ) | |

| (1,042.3 | ) | |

| (1,960.0 | ) | |

| 188.0 | % |

| Results from Subsidiaries | |

| (36.7 | ) | |

| 57.6 | | |

| (94.3 | ) | |

| (163.7 | )% | |

| 10.7 | | |

| 200.4 | | |

| (189.7 | ) | |

| (94.7 | )% |

| Provision for Income Tax | |

| (1,233.9 | ) | |

| (1,781.7 | ) | |

| 547.8 | | |

| (30.7 | )% | |

| (2,827.6 | ) | |

| (6,069.8 | ) | |

| 3,242.2 | | |

| (53.4 | )% |

| Consolidated Net Income | |

| 886.5 | | |

| 1,885.0 | | |

| (998.5 | ) | |

| (53.0 | )% | |

| 2,938.0 | | |

| 8,708.8 | | |

| (5,770.8 | ) | |

| (66.3 | )% |

| Non-Controlling Interests | |

| (232.4 | ) | |

| (154.0 | ) | |

| (78.4 | ) | |

| 50.9 | % | |

| (617.3 | ) | |

| (492.6 | ) | |

| (124.7 | ) | |

| 25.3 | % |

| Ecopetrol Equity holders** | |

| 654.1 | | |

| 1,731.0 | | |

| (1,076.9 | ) | |

| (62.2 | )% | |

| 2,320.7 | | |

| 8,216.2 | | |

| (5,895.5 | ) | |

| (71.8 | )% |

| Other Comprehensive Income | |

| 2,203.0 | | |

| 1,209.7 | | |

| 993.3 | | |

| 82.1 | % | |

| 3,374.5 | | |

| 920.8 | | |

| 2,453.7 | | |

| 266.5 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| EBITDA | |

| 4,698.4 | | |

| 6,344.3 | | |

| (1,645.9 | ) | |

| (25.9 | )% | |

| 15,003.0 | | |

| 21,241.7 | | |

| (6,238.7 | ) | |

| (29.4 | )% |

| EBITDA Margin | |

| 36.1 | % | |

| 37.7 | % | |

| | | |

| | | |

| 38.2 | % | |

| 41.1 | % | |

| | | |

| | |

* These figures are included for illustration

purposes only. Unaudited.

** According to IAS-1, “Presentation

of financial statements”, paragraph 83, the company must include in the statement of comprehensive results the results attributable

to non-controlling interest (minority interest) and the results attributable to shareholders of the controlling company.

Note: To see the impact of the Hedge Account

over the net income of 1Q 2015, 2Q 2015, 3Q 2015 and January-September 2015, please refer to the table 12 of the chapter "Cash

Flow Hedge for Future Company Exports".

Total Sales decreased by COP$3,810 billion, or 22.7%,

during the third quarter of 2015 as compared to the same period of 2014, as a combined result of:

| · | A

US$41.4 per barrel reduction in the price of our crude and refined products basket, resulting

in a decrease of COP$7,222 billion. |

| · | A

89.0 mboed decrease in sales volumes, principally corresponding to reduced export sales

volumes, due to the impact of public order problems on the availability of transport

systems during the third quarter of 2015, resulting in a decrease of COP$991 billion. |

| · | A

COP$167 billion decrease, caused by the recognition of exchange rate effect as Other

Comprehensive Income by the application of hedge accounting, which did not apply in 2014.

|

| · | The

effects of the devaluation of the Colombian peso against the U.S. dollar from an average

of COP$1,909.1/US in the third quarter of 2014 to COP$2,935.6/US in the third quarter

of 2015, resulting in a COP$4,368 billion increase in income. |

| · | A

COP$202 billion increase from transport services, due to the positive effect of the devaluation

on service fees to third parties. |

Cost of Sales decreased by 17%

(-COP$1,859 billion) in the third quarter of 2015 as a result of:

| · | Variable

Costs: 18.6% (-COP$1,528 billion) decrease resulting from: |

a) A COP$1,264 billion reduction

in the purchase prices of crude, gas and refined products due to the net effect of:

| o | Reduced average purchase price

given international benchmark prices: -COP$2,322 billion. |

| o | A COP$694 billion reduction in

purchased volumes (-75 mboed), primarily due to the net effect of: 1) reduced purchases

of crude oil from third parties (COP$1,026 billion), as a result of lower availability

of transport system owing to attacks on infrastructure during the third quarter of 2015,

2) lower purchases of diluents (–COP$517 billion), attributable to: a) optimization

strategies implemented at Ecopetrol S.A, b) non- availability of import facilities at

Puerto Bahía and c) lower transportation of Naphtha by pipeline given the higher

demand of gasoline and diesel, 3) increased gasoline imports (+COP$804 billion) due to

higher local demand and 4) other minor variations (+COP$45 billion). |

| o | Devaluation of the Colombian peso

against the U.S. dollar: +COP$1,752 billion. |

| b) | Inventories decreased by COP$351

billion, caused by the accumulation of inventories as follows: |

| o | Reficar, given the preparation for

the start-up of the refinery’s operations: –COP$178 billion. |

| o | Lower sales of Ecopetrol in the

quarter: –COP$143 billion. |

| o | Propilco,

owing to the shutting down of the Splitter plant: –COP$30 billion. |

| c) | A COP$92 billion increase in transport

costs, especially due to the greater number of tanker trucks in service, the impact of

public order problems on transport systems and the higher costs of logistical, transfer,

loading and unloading services. |

| d) | Other minor variable items: -COP$5

billion. |

| · | Fixed

Costs: a 12.3% (-COP$331 billion) decrease as a result of: |

| a) | A COP$293 billion decline in contracted

services, mainly due to cost optimizations in Ecopetrol S.A. and Hocol S.A. achieved

in carrying out the business transformation plan, operating cost optimizations in partnership

contracts in the Rubiales, Nare and Quifa fields, and lower costs in the Cravo Norte

field, whose portion was lower in 2014, owing to the application of the high price clause. |

| b) | A COP$149 billion reduction in

maintenance costs, led mainly by Ecopetrol S.A. as a result of cost optimization of its

maintenance plan carried out in 2015, notably: restructuring of maintenance services,

quantities, and renegotiation of fees in field maintenance framework contracts. |

| c) | A COP$85 billion increase in depreciation,

primarily from higher asset capitalizations of the transport segment and increased maintenance

at the Barrancabermeja refinery. |

| d) | Other minor items: +COP$26 billion. |

Attacks to our infrastructure negatively

impacted our results during 2015 in the amount of COP$54 billion, including costs associated with repairs of the South and Caño

Limon systems, dismantling of illicit connections, resumption of pipeline operations, and area decontamination.

Gross margin in third quarter of 2015

was 30.3% compared to 35.0% for the same period last year.

Operating Expenses: a 24.7% (-COP$358

billion) decrease as a combined result of:

| a) | A COP$404 billion decrease in exploratory

expenditures due to decreased seismic activity and fewer dry wells reported in the period. |

| b) | COP$35 billion in recovery of operating

provisions in Cenit in the third quarter of 2014. |

| c) | Increase in other minor expenditures:

+COP$11 billion. |

Financial Income/Loss: a COP$141

billion decrease in net financial losses in the third quarter of 2015 as compared to the same period of 2014, as a net result

of:

| a) | A COP$524 billion loss on exchange

rate difference, caused by the adoption of a new accounting policy (hedge accounting)

allowing for hedge of future exports, with effect as of January 1st 2015 (See

Consolidated Financial Results—Cash Flow Hedge for Future Company Exports below). |

| b) | A COP$72 billion increase in revenues

resulting from the sale of shares in Empresa de Energía de Bogotá. |

| c) | A COP$383 billion increase in financial

expenditures from increased indebtedness. |

| d) | A COP$72 billion decrease in financial

expenditures due to valuation of assets and financial liabilities. |

Affiliated company income decreased by

COP$94 billion in the third quarter of 2015, primarily due to a decrease in net income by Equión and Savia, as a consequence

of decreased international crude oil prices.

Income Tax expense decreased by

31% (-COP$548 billion), largely because of lower profits in the period.

As a result, the quarter’s Net

Income attributable to Ecopetrol´s shareholders was a profit of COP$654 billion, 62% lower than the corresponding net

result of the third quarter of 2014.

EBITDA decreased by 26% to COP$4,698

billion in the third quarter of 2015 compared to COP$6,344 billion in the same period of 2014, and the EBITDA Margin

was 36% in the third quarter of 2015 as compared to 38% in the third quarter of 2014.

Starting in the third quarter of 2015,

the Company modified its EBITDA calculation methodology to depurate the total effect of the financial results and the impairment

of long term fixed assets, as well as to align it with best practices for calculating this indicator. Up until the second quarter

of 2015, EBITDA was calculated using the following formula:

EBITDA = Net income +/- Net Interest,

+ Taxes + Depreciations + Amortizations +/- Minority Interest.

As of the third quarter of 2015, the following

formula is used:

EBITDA = Net Income +/- Total Financial

Income + Taxes + Depreciations + Amortizations +/- Impairment of Long-Term Fixed Assets

Figures for the 2014 and 2015 periods

have been recalculated for comparison purposes.

EBITDA is not an indicator defined by

International Financial Reporting Standards (IFRS) and our EBITDA figures may not be comparable to those of other companies.

Table 7: Balance Sheet

| A | |

B | | |

C | | |

D | | |

E | |

| (COP$ Billion) | |

September 30, 2015 | | |

June 30, 2015 | | |

∆ ($) | | |

∆ (%) | |

| Current Assets | |

| 28,027.4 | | |

| 27,410.6 | | |

| 616.8 | | |

| 2.3 | % |

| Non Current Assets | |

| 109,387.0 | | |

| 98,760.0 | | |

| 10,627.0 | | |

| 10.8 | % |

| Total Assets | |

| 137,414.4 | | |

| 126,170.6 | | |

| 11,243.8 | | |

| 8.9 | % |

| Current Liabilities | |

| 21,547.9 | | |

| 21,381.5 | | |

| 166.4 | | |

| 0.8 | % |

| Long Term Liabilities | |

| 64,762.3 | | |

| 55,651.5 | | |

| 9,110.8 | | |

| 16.4 | % |

| Total Liabilities | |

| 86,310.2 | | |

| 77,033.0 | | |

| 9,277.2 | | |

| 12.0 | % |

| Shareholders´Equity | |

| 51,104.2 | | |

| 49,137.6 | | |

| 1,966.6 | | |

| 4.0 | % |

| Non Controlling Interest | |

| 1,624.7 | | |

| 1,710.0 | | |

| (85.3 | ) | |

| (5.0 | )% |

| Total Liabilities and Shareholders' Equity | |

| 137,414.4 | | |

| 126,170.6 | | |

| 11,243.8 | | |

| 8.9 | % |

The main variations in the balance sheet

during the third quarter of 2015 compared to the end of June 2015 can be explained by:

| · | A

COP$617 billion increase in Current Assets, primarily in Ecopetrol S.A., due to

the net effect of: |

| o | A COP$1,056 billion increase in

Current Tax Assets, owing to income tax and CREE allowances and balances in favor

of VAT declarations. |

| o | A COP$531 billion decrease in Assets

Maintained for Sale mainly due to the sale of shares in Empresa de Energía

de Bogotá S.A. E.S.P. during the first divestment stage in July 2015. |

| o | Other minor variations for +COP$92

billion |

| · | Non-Current

Assets increased by COP$10,627 billion, mainly due to increases in: |

| o | Property, Plant and Equipment

increased by COP$6,501 billion, due principally to exchange rate effect on affiliated

companies with a functional currency that is different from the Colombian peso (+COP$5,522

billion), asset capitalizations, primarily in Reficar for assets associated with the

refinery project (+COP$1,960 billion), the effects of which were partially offset by

depreciations in the third quarter of 2015 and other minor items (-COP$981 billion). |

| o | Deferred Income Tax increased

by COP$2,793 billion, generated mainly by Ecopetrol S.A., taking into account the differences

in the determination of the tax provision among fiscal and accounting items. |

| o | Natural Resources increased

by COP$1,025 billion, principally due to the effects of the devaluation of the Colombian

peso on assets of affiliated companies with a functional currency that is different from

the Colombian peso, especially Ecopetrol América Inc. (+COP$544 billion) and Hocol

(+COP$245 billion); and a COP$230 billion increase in the costs of carrying out the Gunflint

and Dalmatian South projects in Ecopetrol America Inc. and in other affiliates for +COP$6

billion. |

| o | Other minor variations of +COP$308

billion. |

| · | Current

Liabilities increased by COP$166 billion since June 2015, mainly due to the net effect

of: a COP$606 billion increase in income tax provisions in our transport subsidiaries,

given the increased profits of their operations. |

In addition, a COP$125 billion increase

in other current liabilities, mainly in Ocensa, resulting from an increased valuation of liabilities under hedging instruments,

a COP$718 billion decrease in provider and creditor accounts payable due to the fulfillment of obligations with third parties

and lower purchases in the period, a COP$124 billion increase in financial obligations stemming from the effect of the devaluation

of the Colombian peso, and COP$29 billion in other minor variations.

| · | Long-term

Liabilities increased by COP$9,111 billion, primarily due to the effect of the devaluation

of the Colombian peso on U.S. dollar-denominated debt and an increase in the deferred

tax liability. |

| · | Shareholders’

Equity was COP$51,104 billion, a COP$1,967 billion

increase since June 30 2015, mainly due to a COP$4,607 billion increase in valuations

at affiliates with functional currencies other than the Colombian peso, attributable

to the effects of the devaluation of the Colombian peso. This effect was partially offset

by a COP$2,238 billion increase in Ecopetrol’s dollar-denominated debt due to the

devaluation of the Colombian peso, designated as hedge instrument for future crude exports,

and COP$402 billion in other minor changes. |

The opening balance and financial statements

as of December 31, 2014, under IFRS, may undergo changes due to the modification of the standards and interpretations issued by

the International Accounting Standards Board (“IASB”) and subsequently adopted by Colombia. Therefore, until Ecopetrol

and its affiliates prepare their first complete sets of financial statements under IFRS as of December 31, 2015, there is a possibility

that the comparative consolidated statements for these periods could be adjusted. The company expects that there will be no material

changes in the information presented in its opening and transition balances.

| e. | Results by Business Segment |

The following table presents our business

segment results for the periods indicated:

Table 8: Quarterly Results by Segment

| A | |

B | | |

C | | |

D | | |

E | | |

F | | |

G | | |

H | | |

I | | |

J | | |

K | |

| | |

E&P | | |

Refining &

Petrochem. | | |

Transportation &

Logistics | | |

Eliminations | | |

Ecopetrol Consolidated | |

| COP$

Billion | |

3Q

2015 | | |

3Q

2014 | | |

3Q

2015 | | |

3Q

2014 | | |

3Q

2015 | | |

3Q

2014 | | |

3Q

2015 | | |

3Q

2014 | | |

3Q

2015 | | |

3Q

2014 | |

| Local Sales | |

| 1,833 | | |

| 2,999 | | |

| 5,250 | | |

| 5,407 | | |

| 72 | | |

| 43 | | |

| (1,511 | ) | |

| (2,590 | ) | |

| 5,644 | | |

| 5,859 | |

| Export Sales | |

| 5,338 | | |

| 8,515 | | |

| 850 | | |

| 1,353 | | |

| - | | |

| - | | |

| (27 | ) | |

| 23 | | |

| 6,161 | | |

| 9,891 | |

| Sales of Services | |

| 42 | | |

| 147 | | |

| 56 | | |

| 50 | | |

| 2,791 | | |

| 1,966 | | |

| (1,691 | ) | |

| (1,099 | ) | |

| 1,198 | | |

| 1,064 | |

| Total Sales | |

| 7,213 | | |

| 11,661 | | |

| 6,156 | | |

| 6,810 | | |

| 2,863 | | |

| 2,009 | | |

| (3,229 | ) | |

| (3,666 | ) | |

| 13,003 | | |

| 16,814 | |

| Variable Costs | |

| 4,412 | | |

| 5,458 | | |

| 4,624 | | |

| 5,872 | | |

| 54 | | |

| 31 | | |

| (2,391 | ) | |

| (3,135 | ) | |

| 6,698 | | |

| 8,226 | |

| Fixed Costs | |

| 1,809 | | |

| 1,769 | | |

| 454 | | |

| 472 | | |

| 809 | | |

| 917 | | |

| (708 | ) | |

| (462 | ) | |

| 2,364 | | |

| 2,696 | |

| Cost of Sales | |

| 6,221 | | |

| 7,227 | | |

| 5,078 | | |

| 6,344 | | |

| 863 | | |

| 948 | | |

| (3,099 | ) | |

| (3,597 | ) | |

| 9,062 | | |

| 10,922 | |

| Gross profit | |

| 992 | | |

| 4,434 | | |

| 1,078 | | |

| 466 | | |

| 2,000 | | |

| 1,061 | | |

| (130 | ) | |

| (69 | ) | |

| 3,941 | | |

| 5,892 | |

| Operating Expenses | |

| 603 | | |

| 1,114 | | |

| 414 | | |

| 258 | | |

| 142 | | |

| 130 | | |

| (68 | ) | |

| (54 | ) | |

| 1,091 | | |

| 1,448 | |

| Operating Profit | |

| 389 | | |

| 3,320 | | |

| 664 | | |

| 208 | | |

| 1,858 | | |

| 931 | | |

| (62 | ) | |

| (15 | ) | |

| 2,850 | | |

| 4,444 | |

| Financial Income/Loss | |

| (331 | ) | |

| (652 | ) | |

| (282 | ) | |

| (226 | ) | |

| (54 | ) | |

| 44 | | |

| (26 | ) | |

| (1 | ) | |

| (693 | ) | |

| (835 | ) |

| Results from Subsidiaries | |

| (52 | ) | |

| 58 | | |

| 4 | | |

| (1 | ) | |

| 11 | | |

| 1 | | |

| - | | |

| - | | |

| (37 | ) | |

| 58 | |

| Income tax benefits (expense) | |

| (247 | ) | |

| (1,389 | ) | |

| (239 | ) | |

| (86 | ) | |

| (748 | ) | |

| (307 | ) | |

| - | | |

| - | | |

| (1,234 | ) | |

| (1,782 | ) |

| Net Income Consolidated | |

| (241 | ) | |

| 1,337 | | |

| 147 | | |

| (105 | ) | |

| 1,067 | | |

| 669 | | |

| (88 | ) | |

| (16 | ) | |

| 886 | | |

| 1,885 | |

| (Minus) Non-controlling interests | |

| - | | |

| - | | |

| - | | |

| (1 | ) | |

| 232 | | |

| 155 | | |

| - | | |

| - | | |

| 232 | | |

| 154 | |

| Equity Holders of Ecopetrol | |

| (241 | ) | |

| 1,337 | | |

| 147 | | |

| (104 | ) | |

| 835 | | |

| 514 | | |

| (88 | ) | |

| (16 | ) | |

| 654 | | |

| 1,731 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| EBITDA | |

| 1,745 | | |

| 4,707 | | |

| 888 | | |

| 526 | | |

| 2,125 | | |

| 1,127 | | |

| (60 | ) | |

| (16 | ) | |

| 4,698 | | |

| 6,344 | |

| EBITDA Margin | |

| 24.2 | % | |

| 40.4 | % | |

| 14.4 | % | |

| 7.7 | % | |

| 74.2 | % | |

| 56.1 | % | |

| 1.9 | % | |

| 0.4 | % | |

| 36.1 | % | |

| 37.7 | % |

Note: To see the impact of the Hedge Account

over the net income of 1Q 2015, 2Q 2015, 3Q 2015 and January-September 2015, please refer to the table 12 of the chapter "Cash

Flow Hedge for Future Company Exports".

Table 9: Accumulated Results by Segment

| A | |

B | | |

C | | |

D | | |

E | | |

F | | |

G | | |

H | | |

I | | |

J | | |

K | |

| | |

E&P | | |

Refining &

Petrochem. | | |

Transportation &

Logistics | | |

Eliminations | | |

Ecopetrol Consolidated | |

| COP$ Billion | |

Jan

-

Sep 15 | | |

Jan

-

Sep 14 | | |

Jan

-

Sep 15 | | |

Jan

-

Sep 14 | | |

Jan

-

Sep 15 | | |

Jan

-

Sep 14 | | |

Jan

-

Sep 15 | | |

Jan

-

Sep 14 | | |

Jan

-

Sep 15 | | |

Jan

-

Sep 14 | |

| Local Sales | |

| 6,065 | | |

| 9,335 | | |

| 14,409 | | |

| 16,593 | | |

| 225 | | |

| 108 | | |

| (4,934 | ) | |

| (7,484 | ) | |

| 15,765 | | |

| 18,552 | |

| Export Sales | |

| 17,872 | | |

| 26,575 | | |

| 2,527 | | |

| 4,462 | | |

| - | | |

| - | | |

| (28 | ) | |

| (647 | ) | |

| 20,371 | | |

| 30,390 | |

| Sales of Services | |

| 76 | | |

| 198 | | |

| 128 | | |

| 154 | | |

| 7,597 | | |

| 5,776 | | |

| (4,623 | ) | |

| (3,353 | ) | |

| 3,178 | | |

| 2,775 | |

| Total Sales | |

| 24,013 | | |

| 36,108 | | |

| 17,064 | | |

| 21,209 | | |

| 7,822 | | |

| 5,884 | | |

| (9,585 | ) | |

| (11,484 | ) | |

| 39,314 | | |

| 51,717 | |

| Variable Costs | |

| 13,744 | | |

| 16,098 | | |

| 13,471 | | |

| 18,439 | | |

| 300 | | |

| 230 | | |

| (7,303 | ) | |

| (9,870 | ) | |

| 20,212 | | |

| 24,897 | |

| Fixed Costs | |

| 5,145 | | |

| 5,019 | | |

| 1,350 | | |

| 1,381 | | |

| 2,270 | | |

| 2,374 | | |

| (1,939 | ) | |

| (1,382 | ) | |

| 6,826 | | |

| 7,392 | |

| Cost of Sales | |

| 18,889 | | |

| 21,117 | | |

| 14,821 | | |

| 19,820 | | |

| 2,570 | | |

| 2,604 | | |

| (9,242 | ) | |

| (11,252 | ) | |

| 27,038 | | |

| 32,289 | |

| Gross profit | |

| 5,124 | | |

| 14,991 | | |

| 2,243 | | |

| 1,389 | | |

| 5,252 | | |

| 3,280 | | |

| (343 | ) | |

| (232 | ) | |

| 12,276 | | |

| 19,428 | |

| Operating Expenses | |

| 2,062 | | |

| 2,671 | | |

| 1,141 | | |

| 898 | | |

| 512 | | |

| 398 | | |

| (196 | ) | |

| (159 | ) | |

| 3,519 | | |

| 3,808 | |

| Operating Profit | |

| 3,062 | | |

| 12,320 | | |

| 1,102 | | |

| 491 | | |

| 4,740 | | |

| 2,882 | | |

| (147 | ) | |

| (73 | ) | |

| 8,757 | | |

| 15,620 | |

| Financial Income/Loss | |

| (2,143 | ) | |

| (657 | ) | |

| (623 | ) | |

| (299 | ) | |

| (194 | ) | |

| (73 | ) | |

| (42 | ) | |

| (12 | ) | |

| (3,002 | ) | |

| (1,041 | ) |

| Results from Subsidiaries | |

| (13 | ) | |

| 190 | | |

| 13 | | |

| 9 | | |

| 11 | | |

| 1 | | |

| - | | |

| - | | |

| 11 | | |

| 200 | |

| Income tax benefits (expense) | |

| (673 | ) | |

| (4,905 | ) | |

| (351 | ) | |

| (210 | ) | |

| (1,804 | ) | |

| (955 | ) | |

| - | | |

| - | | |

| (2,828 | ) | |

| (6,070 | ) |

| Net Income Consolidated | |

| 233 | | |

| 6,948 | | |

| 141 | | |

| (9 | ) | |

| 2,753 | | |

| 1,855 | | |

| (189 | ) | |

| (85 | ) | |

| 2,938 | | |

| 8,709 | |

| (Minus) Non-controlling interests | |

| - | | |

| - | | |

| (2 | ) | |

| (4 | ) | |

| 619 | | |

| 497 | | |

| - | | |

| - | | |

| 617 | | |

| 493 | |

| Equity Holders of Ecopetrol | |

| 233 | | |

| 6,948 | | |

| 143 | | |

| (5 | ) | |

| 2,134 | | |

| 1,358 | | |

| (189 | ) | |

| (85 | ) | |

| 2,321 | | |

| 8,216 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| EBITDA | |

| 7,589 | | |

| 16,559 | | |

| 1,898 | | |

| 1,311 | | |

| 5,662 | | |

| 3,446 | | |

| (146 | ) | |

| (74 | ) | |

| 15,003 | | |

| 21,242 | |

| EBITDA Margin | |

| 31.6 | % | |

| 45.9 | % | |

| 11.1 | % | |

| 6.2 | % | |

| 72.4 | % | |

| 58.6 | % | |

| 1.5 | % | |

| 0.6 | % | |

| 38.2 | % | |

| 41.1 | % |

Note: To see the impact of the Hedge Account

over the net income of 1Q 2015, 2Q 2015, 3Q 2015 and January-September 2015, please refer to the table 12 of the chapter "Cash

Flow Hedge for Future Company Exports".

Exploration and Production

Third quarter 2015 revenues fell 38% (-COP$4,448

billion) compared to the third quarter 2014, mainly as a result of:

| o | An 11% drop (-62.5 mboed) in volume

exported, caused by the attacks on oil infrastructure. |

| o | A 54% decrease in Ecopetrol’s

crude export basket, offset by: |

| o | A 54% devaluation of the Colombian

peso against the U.S. dollar. |

The segment’s cost of sales decreased

14% (-COP$1,006 billion) during the third quarter of 2015 compared to the same period of 2014, mainly due to a COP$437 billion

decrease in naphtha imports (13 thousand barrels) because of dilution optimization strategies and the use of diluent inventory;

a COP$197 billion decrease in contracted services as a result of cost optimization efforts resulting in the renegotiation of contract

fees; and a COP$1,016 billion reduction in crude purchasing costs to the ANH and third parties due to the drop in international

prices. The positive impact on the cost of sales was partially offset by a COP$536 billion increase in the costs of hydrocarbon

transport services, given the net effect of the devaluation in the exchange rate for dollar-denominated transport rates, greater

use of tanker trucks in the third quarter of 2015 because of the attacks on the Caño Limón-Coveñas oil pipelines,

and other minor costs of +COP$36 billion.

Operating expenditures were down by 46%

(-COP$511 billion) during the third quarter of 2015 as compared to the same period of 2014, mainly due to a COP$404 billion decline

in exploration expenditures given lower seismic activity and reduced drilling activity.

As of October 2015, and applied retroactively

from January 1, 2015, the Company designated a portion of its debt as a hedge instrument against its future crude export revenues

by virtue of the adoption of a new accounting policy (hedge accounting). The aforementioned accounting election resulted in a

COP$321 billion decrease in segment net income as compared to the third quarter 2014. For more information, see Consolidated Financial

Results—Cash Flow Hedge for Future Company Exports below.

Net income for the segment showed a COP$241

billion loss in the third quarter of 2015 compared to a gain of COP$1,337 billion in the same period of 2014.

Refining and Petrochemicals

Third quarter of 2015 revenues declined

10% (-COP$654 billion) compared to the same period last year, mainly due to decreased international prices of refined products.

This effect was partially offset by a 4% increase in sales volume, caused by higher national demand for fuel and the devaluation

of the Colombian peso against the U.S. dollar.

The segment’s cost of sales declined

20% (-COP$1,266 billion) as a consequence of decreased costs of raw materials, in line with lower international prices of crude

oil and lower operating costs resulting from optimization strategies implemented by the Company.

As a result of the above, gross sales

margin improved compared to the same period of last year, increasing from 7% to 18%, also reflecting a smaller drop in the sale

prices of products as compared to the cost of raw materials.

Operating expenditures increased 60% (+COP$156

billion) compared to the same period last year, mainly due to higher expenditures at the Cartagena Refinery: 1) a payment provision

to the nation due the expanded reach of the contract granted Reficar in 2010 as guarantee of legal stability2 (primarily

in regards to taxes) for a period of 15 years extendable to 20 years, 2) increase in project expenditures relating to the start-up

and stabilization of the new refinery and 3) depletion of inventory for the Coveñas blend following higher additions of

imported crude in stock during the third quarter of 2015 and lower prices in the market versus inventory costs.

As a result of the improved sales margin,

the consolidated segment’s operating revenues increased by COP$456 billion compared to the same period of last year.

The segment recorded net income of COP$147

billion as compared to a COP$104 billion loss in the same period of last year. With these results, the total accumulated net income

for 2015 is COP$ 143 billion versus a loss of COP$ 5 billion cumulative in 2014, notwithstanding the significant negative effect

of the exchange rate difference on financial expenses.

Transport and Logistics

Net income for the third quarter of 2015

increased 43% (+COP$854 billion), primarily due to the effects of the devaluation of the exchange rate on dollar-denominated transport

rates.

The segment’s cost of sales declined

by 9% (-COP$85 billion), primarily due to lower maintenance costs resulting from cost savings under the Company’s austerity

and cost optimization strategy.

Operating expenses increased by 9% (+COP$12

billion) compared to the same period last year, primarily due to expenses related to the security agreements for the protection

of infrastructure and lower provision reversal versus the same quarter of 2014.

2 By legal stability is understood the guarantee

that the nation extends to Reficar that it will continue applying the standard identified for investments for the duration of

the contract.

The net financial result (non-operating)

decreased by COP$ 98 billion, compared to the third quarter of last year, mainly as a result of the conversion of the dollar_denominated

debt and interest expense, associated with a higher debt of Ecopetrol assigned to the segment.

As a result of the above the segment recorded

net income of COP$835 billion as compared to COP$514 billion in the same period of 2014.

| f. | Results of Cost and Expense Reduction

Initiatives |

In line with steps taken by the oil and

gas industry worldwide to address the drop in crude prices that began in the second half of 2014, Ecopetrol has undertaken austerity

and cost optimization measures that have allowed it to partially mitigate the impact of lower crude prices.

For this purpose, the company set an initial

budget optimization goal for 2015 of COP$1.4 trillion. By September 30, 2015, the Company surpassed the goal, reaching COP$1.6

trillion in budgetary optimizations, which are expected to have a COP$955 billion impact on our profit and loss statements, COP$160

billion on investments and COP$519 billion on cash. The company revised its goal to COP$ 2.2 trillion to look for additional budgetary

optimizations mainly related to: advisory services, construction and assembly, oil services, maintenance, other services, purchases,

among others.

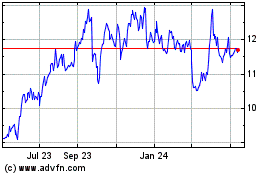

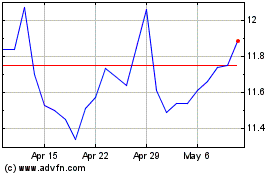

Graph 1: Savings in Cost and Expenditures

of Ecopetrol S.A.

At the close of the third quarter of 2015,

we see the realization of COP$516 billion in controllable savings as compared to the same period of 2014, COP$272 billion of which

corresponds to the fixed costs line item and COP$244 billion correspond to the variable costs line item. The optimization of these

costs is as follows:

Table 10: Savings in Cost and Expenditures

of Ecopetrol S.A.

| A | |

B | | |

C | |

D | |

Manageable

Fixed

Costs

Perfomance | |

Jan

- Sep 15 vs Jan - Sep 14

($COP

Billion) | | |

Manageable

Variable

Costs Performance

| |

Jan

- Sep 15 vs Jan - Sep 14

($COP

Billion) | |

| Associated Services Employed | |

| -182 | | |

Trucks | |

| -198 | |

| Maintenance | |

| -124 | | |

Association Contract Services | |

| -27 | |

| Cost of Projects | |

| -63 | | |

Energy | |

| -24 | |

| Others | |

| ´+97 | | |

Others | |

| ´+5 | |

The reduction of naphtha consumption by

7.1 thousand barrels per day as a result to the strategy of increased viscosity of crudes to be transported by pipelines, between

the third quarter of 2015 and the same period of 2014. This is just the beginning of the dilution efficiencies, one of the key

levers in efficiency given our heavy crude oil production.

With these measures, the goal is to make

the company’s business operation not only more profitable, but also to generate more cash flow to finance the company’s

organic investments, seeking financing that will have a minimal impact on the Company’s financial and credit rating metrics.

In line with the new corporate strategy

focused on ensuring the company’s long-term sustainability, prioritizing value generation by means of the production of

efficient barrels, and a focus on shareholder return, the following initiatives have been undertaken by Ecopetrol during the third

quarter of 2015:

Ecopetrol’s divestment of

its ownership interest in Empresa de Energía de Bogotá S.A. E.S.P.

Since the beginning of 2015, the first

two stages of Ecopetrol’s divestment of its share interest in Empresa de Energía de Bogotá (EEB) have taken

place.

On August 6, the first stage of the equity

divestment program, aimed a certain special conditions beneficiaries3, was completed, generating a total of COP$613,998,000,360

in revenues for Ecopetrol, as shown below:

Table 11 – Adjudication Results

| A | |

B | |

| Offering Price per Share (COP$) | |

| 1,740 | |

| Number of Shares Offered | |

| 631,098,000 | |

| Number of Shares Subscribed | |

| 352,872,414 | |

| Total Amount Subscribed (COP$) | |

| 613,998,000,360 | |

| Number of Shares Sold | |

| 352,872,414 | |

| Gross Proceeds (COP$) | |

| 613,998,000,360 | |

| Trade Date | |

| July

27 de 2015 | |

| Settlement Date | |

| July

31 de 2015 | |

On October 9, 2015, an auction for the

second stage of the equity divestment program was held for the remaining 278,225,586 shares owned by Ecopetrol. The shares were

offered at a price of COP$1,815 per share. The auction was declared void.

3 The beneficiaries of the Special Conditions for

the purposes of the Program and in exclusivity are the following persons:

| (i) | Active workers, retirees, and

former workers who have not been separated by the employer with just cause, as long as

they are nationals or Colombian residents of the EEB and of the companies in which the

latter holds a majority stake, which are related to the regulation. |

| (ii) | Employee or former employee associations

of the EEB |

| (iii) | Worker unions duly created in

accordance with the law. |

| (iv) | Worker union federations and

worker union confederations duly created in accordance with the law |

| (v) | Employee funds duly created in

accordance with the law |

| (vi) | Mutual investment funds duly

created in accordance with the law |

| (vii) | Severance and pension funds

duly created in accordance with the law |

| (viii) | Cooperative entities defined

by cooperative legislation duly created in accordance with the law |

| (ix) | Family compensation funds duly

created in accordance with the law |

In order to continue with the sale process,

Ecopetrol is entitled to hold up to three additional auctions, at a time and in a fashion indicated in the notice of initiation

of the second stage.

Divestment of Ecopetrol’s

ownership interest in Empresa Interconexión Eléctrica S.A E.S.P.

On September 29, 2015, began the first

stage of the equity divestment program of Interconexión Eléctrica S.A. E.S.P. (ISA) shares owned by Ecopetrol. This

offering, aimed at certain special conditions beneficiaries, will run until November 30, 2015.

Ecopetrol and JX Nippon establish

an alliance for the exploration of a Brazilian offshore block

Through its affiliate in Brazil (Ecopetrol

Óleo e Gás), Ecopetrol established an alliance with the Japanese company JX Nippon Oil & Gas Exploration for

exploration of the FZA-M-320 block, located in shallow waters off the Foz do Brasil basin, in the Equatorial rim of the Amazon.

Ecopetrol held exclusive rights to the

basin, as adjudicated in Round 11 by Brazil’s National Oil, Gas and Biofuel Agency (ANP) in May of 2013.

The joint venture agreement, currently

in the process of being approved by the ANP, established that JX Nippon would join exploration in the area with a 30% stake, not

only in exploratory investments but also any resources that might be discovered. Ecopetrol will maintain the remaining 70% stake

and continue as operator.

Ecopetrol and Parex sign agreement

for development of the field Aguas Blancas

Ecopetrol signed an agreement with the

Canadian company Parex Resources to increase the reserves and production of the Aguas Blancas field, located in Magdalena Medio.

The agreement, if successful, could potentially recover additional 55 million barrels of light crude and increase the field’s

production to up to 10 thousand barrels per day by 2020.

Estimated investments in the first stage

(three years) of US$61 million will be undertaken by Parex and will be allocated for the drilling of wells and development of

a secondary recovery pilot. If successful, total investments could reach US$700 million and would be assumed 60% by Parex and

40% by Ecopetrol. The share of production will be distributed in equal parts between the two companies, after royalties.

Ecopetrol and Oxy seal deal to increase

the reserves and production of La Cira-Infantas

Ecopetrol and Occidental Andina, LLC (Oxy)

reached an agreement to carry out a project that could incorporate more than 100 million additional barrels of crude in reserves

for Ecopetrol, if successful, in the field La Cira-Infantas, located in the Santander Magdalena Medio region.

The initiative seeks to increase the field’s

recovery factor from the current 17% to an estimated 30% and continue increasing production, with the goal of reaching more than

50 thousand barrels a day. If the initial stage of the project is successful, the amount of required estimated investments could

reach US$2,000 million, which would be executed gradually over a period of 10 years.

| b. | Cash Flow Hedge for Future Company

Exports |

Ecopetrol S.A. is exposed to foreign exchange

risk given that a high percentage of its crude export revenues are denominated in U.S. dollars.

Also, in recent years, the company has

acquired long-term debt for investment activities in U.S. dollars. This situation creates a natural hedge relationship due to

the fact that the risks generated by the foreign exchange difference of export revenues are naturally hedged with the foreign

exchange valuation risks of the long-term debt in U.S. dollars.

Aligned with the company’s risk

management strategy and with the objective of presenting in the Financial Statements the effect of the mentioned natural hedge

between exports and debt, on September 30, 2015, the Board of Directors designated US$5,440 million of Ecopetrol S.A’s debt

(49% of the debt in dollars) as hedge instrument of its future export sales for the period 2015-2023, in accordance with IAS 39

– Financial instruments: recognition and measurement.

With adoption of this standard, the volatility

of foreign exchange rate’s effect on the hedged portion of the debt is recognized directly in the Equity, as part of the

Other Comprehensive Income, removing the volatility from the income statement. The foreign exchange effect will be reflected periodically

in the P&L settlement as foreign sales are realized, understanding that the foreign exchange risk materializes as exports

are realized.

The effects of the adoption of hedge accounting

policy are entirely recognized in 3Q 2015, causing an impact on net income in an amount of COP$2.2 trillion, resulting from a

positive effect of COP$3.9 trillion on the financial results minus COP$1.7 trillion of deferred income tax and the effect on export

revenues realized during the period.

In accordance with Resolution 509 of 2015

of the Colombian National Accounting Office, the accounting policy adopted will be applied to the entire 2015 accounting period,

starting on January 1st.

For comparison purposes, the following

table shows re-stated net income for the first, second and third quarters of 2015, for local purposes, reflecting the impact of

application of the previously described hedge policy:

Table 12 – Sensitization of Net

Income 2015

| COP$ Millions | |

1Q 2015 | | |

2Q 2015 | | |

3Q 2015 | | |

Jan-Sep 2015 | |

| Net Income Reported | |

| 160,030 | | |

| 1,506,556 | | |

| 654,117 | | |

| 2,320,703 | |

| | |

| | | |

| | | |

| | | |

| | |

| Impact on: | |

| | | |

| | | |

| | | |

| | |

| (-) Financial Results (a) | |

| 984,627 | | |

| 38,701 | | |

| 2,868,821 | | |

| 3,892,149 | |

| (-) Revenue (b) | |

| (12,001 | ) | |

| (29,860 | ) | |

| (125,242 | ) | |

| (167,103 | ) |

| (-) Deferred Income Tax ( c) | |

| (395,163 | ) | |

| (9,358 | ) | |

| (1,081,778 | ) | |

| (1,486,299 | ) |

| Total Impacts | |

| (407,164 | ) | |

| (39,218 | ) | |

| (1,207,020 | ) | |

| (1,653,402 | ) |

| Net Income Under Local IFRS Restated | |

| 737,493 | | |

| 1,506,039 | | |

| 77,171 | | |

| 2,320,703 | |

Notes:

| (a) | The effect of the hedge accounting

over the portion of debt used as hedging instrument (US$5,440 million) reclassified to

the account Other Comprehensive Income of Shareholder Equity in 2Q and 3Q 2015. |

| (b) | Recognition in the period’s

result of the exchange differences of debt and revenues once crude export earnings are

realized. |

| (c) | The impact on deferred income

tax is the result of the recognition of temporary differences in the exchange difference

treatment in terms of accounting and taxation. |

Table 13: Investments* by Ecopetrol´

s Corporate Group

| A | |

B | | |

C | | |

D | | |

E | |

| January - September 2015 (US$ million)** |

| Segment | |

Ecopetrol S.A. | | |

Affiliates and

Subsidiaries*** | | |

Total | | |

Allocation by

segment | |

| Production | |

| 2,026.0 | | |

| 378.5 | | |

| 2,404.5 | | |

| 50.9 | % |

| Refining, Petrochemicals and Biofuels | |

| 107.4 | | |

| 1,254.2 | | |

| 1,361.6 | | |

| 28.8 | % |

| Exploration | |

| 192.7 | | |

| 153.7 | | |

| 346.3 | | |

| 7.3 | % |

| Transportation | |

| 27.8 | | |

| 528.9 | | |

| 556.7 | | |

| 11.8 | % |

| Corporate | |

| 49.6 | | |

| 0.0 | | |

| 49.6 | | |

| 1.0 | % |

| New Business**** | |

| 3.8 | | |

| 0.0 | | |

| 3.8 | | |

| 0.1 | % |

| Supply and Marketing | |

| 1.0 | | |

| 0.0 | | |

| 1.0 | | |

| 0.0 | % |

| Total | |

| 2,408.4 | | |

| 2,315.3 | | |

| 4,723.6 | | |

| 100.0 | % |

*Figures in this table differ from the

capital expenditure figures presented in the Consolidated Statement of Cash Flows on page 33 because the figures in this table

include both operating expenditures and capital expenditure outflows of investment projects, while the investment line of the

Consolidated Statement of Cash Flows includes capital expenditures only.

** Investments were converted using the

average representative Market Exchange Rate for the period of analysis.

**Prorated according to Ecopetrol’

s stake.

*** Corresponds to the new organizational

structure and refers to investments approved for the New Business segment. These assets were part of the Corporate segment until

2014.

Investments in the period January - September

of 2015 were US$4,723.6 million (Ecopetrol S.A. itself accounting for 51% of that amount while affiliates and subsidiaries accounted

for 49%). These investments were distributed as follows:

| · | Production

(50.9%): The drilling campaign, especially in the Castilla, Chichimene and Rubiales fields. |

| · | Refining,

Petrochemicals and Biofuels (28.8%): the Industrial Services Master Plan of the Barrancabermeja

refinery and the Cartagena refinery modernization project. |

| · | Transport

(11.8%): the Reficar logistics project, which was aimed at ensuring the supply of crude

and liquid products for the Cartagena Refinery, and the San Fernando – Monterrey,

Ocensa P135 and Costa Norte – Galán projects. |

| · | Exploration

(7.3%): higher costs in drilling the Kronos and Calasú wells. |

Exploration in Colombia:

The following table summarizes the results

of the exploration activities in Colombia for the periods indicated:

Table 14: Wildcats in Colombia

| A | |

B | | |

C | | |

D | | |

E | | |

F | | |

G | | |

H | | |

I | |