UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June, 2015

Commission File Number 001-34175

| ECOPETROL S.A. |

|

(Exact name of registrant as specified in

its charter)

|

| N.A. |

|

(Translation of registrant’s name

into English)

|

| COLOMBIA |

|

(Jurisdiction of incorporation or organization)

|

| Carrera 13 No. 36 – 24 |

| BOGOTA D.C. – COLOMBIA |

| (Address of principal executive offices) |

Indicate by check mark

whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ☐ No

☒

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes ☐ No

☒

Indicate by check mark

whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No

☒

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

Ecopetrol S.A. hereby designates this report on Form 6-K

as being incorporated by reference into its registration statement on Form F-3, as filed with the SEC on July 26, 2013 (File No.

333-190198).

Exhibits

Exhibit 5.1 – Opinion of Sullivan & Cromwell LLP,

New York counsel to the Company, regarding the validity of the securities.

Exhibit 5.2 – Opinion of Brigard & Urrutia Abogados,

Colombian counsel to the Company, regarding validity of the securities.

Exhibit 23.1 – Consent of Sullivan & Cromwell LLP

(included in Exhibit 5.1 above).

Exhibit 23.2 – Consent of Brigard & Urrutia Abogados

(included in Exhibit 5.2 above).

Exhibit 99.1 – Form of 5.375% Notes Due 2026

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

Ecopetrol S.A. |

| |

|

|

| |

By: |

/s/ Magda Manosalva |

| |

Name: |

Magda Manosalva |

| |

Title: |

Chief Financial Officer |

Date: June 26, 2015

Exhibit 5.1

[Letterhead of Sullivan & Cromwell LLP]

June 26, 2015

Ecopetrol S.A.,

Carrera 13, #36-24, Piso 7,

Bogotá, Colombia.

Ladies and Gentlemen:

We are acting as New York counsel to Ecopetrol

S.A., a Colombian mixed economy company (the “Company”), in connection with the registration under the Securities Act

of 1933 (the “Act”) and sale of $1,500,000,000 principal amount the Company’s 5.375% Notes due 2026 (the “Securities”).

The securities are being sold under the Company’s Registration Statement on Form F-3ASR (No. 333-190198), filed with the

U.S. Securities and Exchange Commission on July 26, 2013, pursuant to the Prospectus dated June 23, 2015, as supplemented by the

Prospectus Supplement dated June 23, 2015. As such United States counsel, we have examined such corporate records, certificates

and other documents, and such questions of law, as we have considered necessary or appropriate for the purposes of this opinion.

Upon the basis of such examination, it is

our opinion that the Securities constitute valid and legally binding obligations of the Company, subject to bankruptcy, insolvency,

fraudulent transfer, reorganization, moratorium and similar laws of general applicability relating to or affecting creditors' rights

and to general equity principles.

In rendering the foregoing opinion we are

not passing upon, and assume no responsibility for, any disclosure in the Registration Statement, the Prospectus or the Prospectus

Supplement regarding the Company, the Securities or the offering and sale of the Securities. In addition, in rendering the foregoing

opinion, we are expressing no opinion as to United States Federal or state laws relating to fraudulent transfers.

The foregoing opinion is limited to the Federal

laws of the United States and the laws of the State of New York, and we are expressing no opinion as to the effect of the laws

of any other jurisdiction.

We have relied as to certain matters on information

obtained from public officials, officers of the Company and other sources believed by us to be responsible, and we have assumed,

without independent verification, that the Indenture has been duly authorized, executed and delivered by the Trustee and by the

Company insofar as Colombian law is concerned, that the Securities constitute valid and legally binding obligations of the Company

under the laws of Colombia, that the Trustee’s certificates of authentication of the Securities have been manually signed

by one of the Trustee’s authorized officers, that the Notes have been delivered against payment as contemplated in the Registration

Statement and that the signatures on all documents examined by us are genuine. With respect to all matters of Colombian law, we

understand that you are relying upon the opinion, dated the date hereof, of Brigard & Urrutia S.A.S.

We hereby consent to the filing of this

opinion as an exhibit to the Registration Statement and to the references to us under the heading “Legal

Matters” in the Prospectus and the Prospectus Supplement. In giving such consent, we do not thereby admit that we

are in the category of persons whose consent is required under Section 7 of the Act.

| |

Very truly yours, |

| |

|

| |

/s/ Sullivan & Cromwell LLP |

Exhibit 5.2

|

CALLE

70 A # 4 – 41

BOGOTÁ

D.C., COLOMBIA

TEL.:

(571) 744 22 44

FAX: (571)

310 06 09 / 310 05 86

www.bu.com.co |

June 26, 2015

Ecopetrol S.A.

Carrera 13 No. 36-24

Bogotá D.C., Colombia

Ladies and Gentlemen,

We have acted as special

Colombian counsel to Ecopetrol S.A., a mixed economy company (sociedad de economía mixta) organized as a stock corporation

(sociedad anónima) under the laws of the Republic of Colombia (“Colombia”) (the “Issuer”),

in connection with the Issuer’s offering of U.S. $1,500,000,000 in aggregate principal amount of the Issuer’s 5.375%

Notes due 2026 (the “Securities"), pursuant to the Underwriting Agreement dated as of June 23, 2015 (the "Underwriting

Agreement "), between the Underwriter and you. The Securities will be issued pursuant to the Indenture (as defined herein).

All capitalized terms not defined herein have such definitions as are specified in the Underwriting Agreement and the Indenture

(together, the “Agreements”).

We have considered the

laws of Colombia, including its Constitution and the relevant decrees, treaties, rules, regulations and codes, as of the date hereof,

and have examined such documents and instruments as we have deemed necessary to give this opinion, including the following:

| (a) | The Underwriting Agreement; |

| (b) | The indenture dated as of July 23, 2009, between the Issuer and the Bank of New York Mellon (the

"Trustee"), and a copy of Amendment No. 1 of the Indenture, dated June 26, 2015 (collectively, the “Indenture”); |

| (c) | The form of the Securities to be executed on behalf of the Issuer; |

| (d) | The officer’s certificate dated June 26, 2015 delivered by the Issuer to the Trustee pursuant

to Section 301 of the Indenture; |

| (e) | A copy of the certificate of incorporation and legal representation of the Issuer as of June 26,

2015, issued by the Chamber of Commerce of Bogota; |

| (f) | A copy of the Issuer’s Bylaws in effect as the provided to us by the Company;

and |

|

CALLE

70 A # 4 – 41

BOGOTÁ

D.C., COLOMBIA

TEL.:

(571) 744 22 44

FAX: (571)

310 06 09 / 310 05 86

www.bu.com.co |

| (g) | Copies of all relevant provisions of Colombian laws, decrees, directives and other governmental

acts pertaining to the authorization of the issuance and sale of the Securities, including: |

| (1) | Issuer’s board of directors’ minute No. 222, dated on May 22 of 2015, authorizing the

issuance and offering the Securities; |

| (2) | The preliminary authorization from the Colombian Ministry of Finance and Public Treasury (“MHCP”)

pursuant to which the Issuer was authorized to take all actions aimed at incurring certain foreign indebtedness, by means of Resolution

0928 dated April 10, 2015; |

| (3) | The definitive authorization granted by the MHCP pursuant to Resolution 2204 dated June 22, 2015,

relating to the issuance and sale of the Securities and the execution and performance of the documents required to consummate the

transaction; |

| (4) | The favorable opinion from the National Planning Department (Departamento Nacional de Planeación),

including opinions No. 20134380924731 dated as of December 24, 2013 and No. 20144380119281 as of February 7, 2014 for the Issuer

to incur indebtedness under the Securities; |

| (5) | The filing of information before the Colombian Central Bank (Banco de la República)

of public external indebtedness report on Form No. 6 (Formulario 6), resulting from the issuance of the Securities under

the Indenture and the Securities; |

| (6) | Order of publication of the Procurement Diary (Diario Oficial), related to the publication

of the definitive authorization for the offering of the Securities issued by the MHCP; |

| (7) | Evidence of the publication of the Underwriting Agreement in the Sistema Electrónico

para la Contratación Pública – SECOP; and |

| (8) | Filing of the documents related to the transaction with the Contraloría General de la

República as a record of the indebtedness. |

In providing this opinion,

we have made the following assumptions: (a) the authenticity and genuineness of all signatures; (b) that all documents submitted

to us as copy or specimen documents conform to their originals; (c) the authenticity and completeness of the original documents

from which such copies were made (d) that all documents submitted to us have not been amended or affected by any subsequent action

not disclosed or known to us; (e) that each of the parties to the Underwriting Agreement, the Indenture and the Notes (collectively,

the "Transaction Documents"), other than the Issuer, has the corporate power and authority to enter into and perform

each of the Transaction Documents, and that the Transaction Documents have been duly authorized, executed, and delivered by each

of such parties other than the Issuer.

|

CALLE

70 A # 4 – 41

BOGOTÁ

D.C., COLOMBIA

TEL.:

(571) 744 22 44

FAX: (571)

310 06 09 / 310 05 86

www.bu.com.co |

We have relied, as to

factual matters, on representations, statements and warranties contained in the Underwriting Agreement and in the documents we

have examined. Also, we have examined such corporate records, certificates and other documents, and such questions of law, as we

considered necessary or appropriate for the purposes of this opinion. The opinions herein are limited in all respects to the laws

of Colombia as they stand at the date hereof and as they are currently interpreted. We do not express any opinion on the laws of

any jurisdiction other than Colombia.

Based on the foregoing

and upon such investigation, as we have deemed necessary, we are of the opinion that:

1. The Issuer is a

mixed economy company (sociedad de economía mixta) duly organized and validly existing under the laws of the Republic

of Colombia and has the necessary corporate power and capacity to own its property and assets and to carry on its business under

the laws of Colombia.

2. The execution,

delivery and performance by the Issuer of its obligations under the Agreements and the Securities have been duly authorized by

all necessary action on its part and by all necessary constitutional, legislative, executive, administrative and other governmental

action.

3. The Securities have

been duly authorized, executed, issued and delivered by the Issuer in accordance with the Indenture and, assuming due authentication

and delivery by the Trustee (and assuming that the Notes constitute valid and legally binding obligations under the laws of the

State of New York, and are issued and delivered against payment of the purchase price therefor), the Securities will constitute

valid and legally binding obligations of the Issuer, enforceable in accordance with their respective terms, except as the enforcement

thereof may be limited by exequatur requirements for the recognition of foreign judgements in Colombia, specific regulations

applicable to state owned companies, Colombian public policy laws, bankruptcy, insolvency, moratorium (including, without limitation,

all laws relating to fraudulent transfers) or other similar laws relating to or affecting enforcement of creditor's rights generally,

or by general principles of equity, and will be entitled to the benefits of the Indenture.

Our opinion is subject

to the assumptions, qualifications, exceptions and limitations indicated elsewhere herein. It is also limited to the matters expressly

set forth herein, and no opinion is implied or may be inferred beyond the matters expressly so stated.

This opinion letter

speaks only as of the date hereof and is limited to the matters stated herein and do not extend to, and are no to be read as extending

by implication to, any other matter in connection with the transaction to which they are relate. We expressly disclaim any responsibility

to advise you of any development or circumstance of any kind, including any change of law or fact, which may occur after the date

of this opinion letter than might affect the opinions expressed herein.We are qualified to practice law in Colombia, and we express

no opinion herein as to any laws of any jurisdiction other than the laws of Colombia. We are furnishing this letter to you solely

for your benefit in connection with the offering of the Securities. This opinion is solely for your benefit and may not be relied

upon in any manner or any purpose by any other person.

|

CALLE

70 A # 4 – 41

BOGOTÁ

D.C., COLOMBIA

TEL.:

(571) 744 22 44

FAX: (571)

310 06 09 / 310 05 86

www.bu.com.co |

We hereby consent

to the filing of this opinion as an exhibit to the Current Report on Form 6-K dated the date hereof filed by the Company and

incorporated by reference into the Registration Statement on Form F-3 dated July 26, 2013 (File No. 333-190198) filed by the

Company to effect the registration of the Securities under the Securities Act of 1933, as amended (the “Securities

Act”) and to the use of our name under the heading “Legal Matters” in the prospectus constituting a part of

such Registration Statement and in the prospectus supplement dated June 23, 2015. In giving this consent, we do not hereby admit

that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and

regulations of the Securities and Exchange Commission promulgated thereunder.

| |

Very

truly yours, |

|

| |

|

|

| |

|

|

| |

/s/

Manuel Fernando Quinche |

|

| |

Manuel

Fernando Quinche |

|

| |

Partner |

|

| |

Brigard

& Urrutia Abogados S.A.S. |

|

Exhibit 99.1

FACE OF NOTE

UNLESS THIS REGISTERED NOTE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE

OF THE DEPOSITORY TRUST COMPANY (“DTC”) TO THE COMPANY OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT,

AND ANY NOTE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED

REPRESENTATIVE OF DTC OR SUCH OTHER REPRESENTATIVE OF DTC OR SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF

DTC (AND ANY PAYMENT HEREON IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF

DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL SINCE THE REGISTERED OWNER

HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

TRANSFERS OF THIS GLOBAL NOTE SHALL BE LIMITED TO TRANSFERS

IN WHOLE, BUT NOT IN PART, TO NOMINEES OF CEDE & CO. OR TO A SUCCESSOR THEREOF OR SUCH SUCCESSOR’S NOMINEE.

[FACE OF NOTE]

Ecopetrol S.A.

5.375% Notes due 2026

CUSIP [●]

ISIN [●]

No. [●] US$[●]

Ecopetrol S.A., a mixed economy company (sociedad

de economía mixta) organized under the laws of the Republic of Colombia (the “Company,” which term

includes any successor under the Indenture hereinafter referred to), for value received, promises to pay to Cede & Co., or

its registered assigns, the principal sum of US$[●] on June 26, 2026.

Interest Payment Dates: June 26 and December

26 of each year, commencing December 26, 2015.

Regular Record Dates: June 11 and December

11 of each year.

Reference is hereby made to the further provisions

of this Note set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth

at this place.

IN WITNESS WHEREOF, the Company has caused

this Note to be signed manually or by facsimile by its duly authorized officers.

| Date: June [●], 2015 |

|

|

|

| |

Ecopetrol S.A. |

|

| |

|

|

| |

By: |

|

|

| |

|

Name: Camilo Marulanda López |

|

| |

|

Title: Acting Chief Executive Officer |

|

Trustee’s Certificate of Authentication

This is one of the 5.375% Notes due 2026 described in the within-mentioned

Indenture.

| |

|

|

|

| |

The

Bank of New York Mellon, as Trustee

|

|

| |

|

|

| |

By: |

|

|

| |

|

Name: |

|

| |

|

Title: |

|

[REVERSE SIDE OF NOTE]

Ecopetrol S.A.

5.375% Notes due 2026

(the “Notes”)

| 1. | Principal and Interest. |

The Company will pay the principal of this

Note on June 26, 2026.

The Company promises to pay interest on the

principal amount of this Note on each Interest Payment Date, as set forth below, at the rate per annum shown above.

Interest will be payable semiannually on each

Interest Payment Date, commencing December 26, 2015.

Interest on the Notes will accrue from the

most recent date to which interest has been paid or, if no interest has been paid, from June 26, 2015; provided that, if

there is no existing default in the payment of interest and this Note is authenticated between a Regular Record Date referred to

on the face hereof and the next succeeding Interest Payment Date, interest shall accrue from such Interest Payment Date. Interest

will be computed on the basis of a 360-day year of twelve 30-day months.

In the case of amounts not paid by the Company

under this Note, interest will continue to accrue on such amounts, to the extent permitted by applicable law, at a default rate

equal to 1.0% in excess of the interest rate on this Note, from and including the date when such amounts were due and owing and

through and including the date of payment of such amounts by the Company.

The Company will pay principal as provided

above and interest (except defaulted interest) on the principal amount of the Notes as provided above on each June 26 and December

26 to the persons who are Holders (as reflected in the Note Register at the close of business on June 11 and December 11 immediately

preceding the Interest Payment Date), in each case, even if the Note is cancelled on registration of transfer or registration of

exchange after such record date; provided that, with respect to the payment of principal, the Company will not make payment

to the Holder unless this Note is surrendered to a Paying Agent.

The Company will pay principal, premium, if

any, and, as provided above, interest (and Additional Amounts, if any) in money of the United States that at the time of payment

is legal tender for payment of public and private debts. However, the Company may pay principal, premium, if any, and interest

by its check payable in such money. It may mail an interest check to a Holder’s registered address (as reflected in the Note

Register). If a payment date is a date other than a Business Day at a place of payment, payment may be made at that place on the

next succeeding day that is a Business Day and no interest shall accrue for the intervening period.

| 3. | Paying Agent and Security Registrar. |

Initially, the Trustee will act as Authenticating

Agent, Paying Agent in New York and Security Registrar. The Company may appoint or change any Authenticating Agent, Paying Agent

or Security Registrar without notice. The Company, any Subsidiary or any Affiliate of any of them may act as Paying Agent, Security

Registrar or co-Security Registrar.

| 4. | Indenture; Limitations. |

The Company issued the Notes under an Indenture

dated as of July 23, 2009, as amended by Amendment No. 1 to the Indenture, dated June 26, 2015 (the “Indenture”),

between the Company and The Bank of New York Mellon, as trustee (the “Trustee”) and an Officer’s Certificate

dated June 26, 2015 (the “Officer’s Certificate”). Capitalized terms herein are used as defined in the Indenture

or the Officer’s Certificate, as applicable, unless otherwise indicated. The terms of the Notes include those stated in the

Indenture and those made part of the Indenture by reference to the Trust Indenture Act. The Notes are subject to all such terms,

and Holders are referred to the Indenture and the Trust Indenture Act for a statement of all such terms. To the extent permitted

by applicable law, in the event of any inconsistency between the terms of this Note and the terms of the Indenture, the terms of

the Notes shall control.

The Notes are general unsecured obligations

of the Company. The Indenture does not limit the aggregate principal amount of Notes that may be issued.

The Company will have the right at its option

to redeem any of the Notes in whole or in part, at any time or from time to time prior to their maturity, on at least 30 days’

but not more than 60 days’ notice, at a redemption price equal to the greater of (1) 100% of the principal amount of

such Notes and (2) the sum of the present values of each remaining scheduled payment of principal and interest thereon (exclusive

of interest accrued to the date of redemption) discounted to the Redemption Date on a semiannual basis (assuming a 360-day year

consisting of twelve 30-day months) at the Treasury Rate plus 45 basis points, plus accrued and unpaid interest on the principal

amount of the Notes to but excluding the date of redemption.

At any time on or after March 26, 2026 (three

months prior to the maturity date of the Notes), the Company may redeem the Notes, in whole or in part, at any time and from time

to time, on not less than 30 nor more than 60 days’ notice, at a redemption price equal to 100% of the principal amount of

the Notes being redeemed, plus any interest accrued but not paid to, but excluding, the date of redemption.

“Treasury Rate”

means, with respect to any Redemption Date, the rate per annum equal to the semiannual equivalent yield to maturity or interpolated

maturity (on a day count basis) of the Comparable Treasury Issue, assuming a price for the Comparable Treasury Issue (expressed

as a percentage of its principal amount) equal to the Comparable Treasury Price for such Redemption Date.

“Comparable Treasury Issue”

means the United States Treasury security or securities selected by an Independent Investment Banker as having an actual or interpolated

maturity comparable to the remaining term of the Notes to be redeemed that would be utilized, at the time of selection and in accordance

with customary financial practice, in pricing new issues of corporate debt securities of a comparable maturity to the remaining

term of such Notes.

“Independent Investment Banker”

means one of the Reference Treasury Dealers appointed by the Company.

“Comparable Treasury Price”

means, with respect to any Redemption Date (1) the average of the Reference Treasury Dealer Quotations for such Redemption Date,

after excluding the highest and lowest such Reference Treasury Dealer Quotation or (2) if the Company obtains fewer than five such

Reference Treasury Dealer Quotations, the average of all such quotations.

“Reference Treasury Dealer”

means Credit Suisse Securities (USA) LLC, HSBC Securities (USA) Inc. or their affiliates which are primary United States government

securities dealers and three other leading primary United States government securities dealers in New York City reasonably designated

by the Company; provided, however, that if any of the foregoing shall cease to be a primary United States government

securities dealer in New York City (a “Primary Treasury Dealer”), the Company will substitute therefore another Primary

Treasury Dealer.

“Reference Treasury Dealer

Quotation” means, with respect to each Reference Treasury Dealer and any Redemption Date, the average, as

determined by the Independent Investment Banker, of the bid and asked prices for the Comparable Treasury Issue (expressed in

each case as a percentage of its principal amount) quoted in writing to the Company by such Reference Treasury Dealer at 3:30

pm New York time on the third business day preceding such Redemption Date.

On and after the Redemption Date, interest

will cease to accrue on the Notes or any portion of the Notes called for redemption (unless the Company defaults in the payment

of the redemption price and accrued interest). On or before the Redemption Date, the Company will deposit with the Trustee money

sufficient to pay the redemption price of and (unless the Redemption Date shall be an interest payment date) accrued interest to

the Redemption Date on the Notes to be redeemed on such date.

| 6. | Withholding Tax Redemption. |

The Notes may be redeemed at the Company’s

election, in whole but not in part on any date, by the giving of notice as provided under Section 106 of the Indenture, at

a price equal to 100% of the outstanding principal amount thereof, together with any Additional Amounts and accrued and unpaid

interest to the Redemption Date, if, as a result of any change in, or amendment to, laws or treaties (or any regulation or rulings

promulgated thereunder) of Colombia or any political subdivision or taxing authority thereof or therein or any change in the official

application, administration or interpretation of such laws, treaties, regulations or rulings in such jurisdictions, the Company

is or will become obligated to pay any Additional Amounts on the Notes, if such change or amendment is announced and becomes effective

on or after the issuance of the Notes and such obligation cannot be avoided by taking commercially reasonable measures available

to the Company; provided, however, that no such notice of redemption shall be given earlier than 90 days prior to the earliest

date on which the Company would be obligated to pay such Additional Amounts.

Notice of any redemption will be mailed at

least 30 days but not more than 60 days before the Redemption Date to each Holder of the Notes to be redeemed. Prior to the giving

of notice of redemption of such Notes pursuant to Section 106 of the Indenture, the Company will deliver to the Trustee an

Officer’s Certificate and a written opinion of recognized Colombian counsel independent of the Company and its Affiliates

to the effect that all governmental approvals necessary for it to effect such redemption have been or at the time of redemption

will be obtained and in full force and effect, and that the Company has or will become obligated to pay such Additional Amounts

as a result of such change, amendment, application, administration or interpretation. On the Redemption Date, interest will cease

to accrue on the Notes that have been redeemed.

If less than all of the Notes are to be redeemed,

the particular Notes to be redeemed shall be selected not more than 60 days prior to the Redemption Date by the Trustee from the

Outstanding Notes not previously called for redemption, by such method as the Trustee shall deem fair and appropriate and which

may provide for the selection for redemption of portions of the principal amount of the Notes; provided that no Note of

U.S.$1,000 in principal amount or less shall be redeemed in part.

The Trustee shall promptly notify the Company

and the Security Registrar (if other than itself) in writing of the Notes selected for redemption and, in the case of any Notes

selected for partial redemption, the principal amount thereof to be redeemed.

For all purposes of the Indenture, unless

the context otherwise requires, all provisions relating to the redemption of Notes shall relate, in the case of any Notes redeemed

or to be redeemed only in part, to the portion of the principal of such Notes which has been or is to be redeemed.

Notice of any redemption pursuant to Section 5

hereof will be given in the manner provided in Section 106 of the Indenture, not less than 30 nor more than 60 days prior

to the Redemption Date to the Holders of Notes to be redeemed. Failure to give notice by mailing in the manner herein provided

to the Holder of any Note designated for redemption as a whole or in part, or any defect in the notice to any such Holder, shall

not affect the validity of the proceedings for the redemption of any other Notes or portion thereof.

Any notice that is mailed to the Holder of

any Notes in the manner herein provided shall be conclusively presumed to have been duly given, whether or not such Holder receives

the notice.

All notices of redemption shall state:

1.

the Redemption Date,

2.

the Redemption Price,

3.

if less than all Outstanding Notes are to be redeemed, the identification (and, in the case of partial redemption,

the principal amount) of the particular Note or Notes to be redeemed,

4.

in case any Note is to be redeemed in part only, the notice which relates to such Note shall state that on and after

the Redemption Date, upon surrender of such Note, the Holder of such Note will receive, without charge, a new Note or Notes of

authorized denominations for the principal amount thereof remaining unredeemed,

5.

that, on the Redemption Date, the Redemption Price shall become due and payable upon each such Note or portion thereof

to be redeemed, and, if applicable, that interest thereon shall cease to accrue on and after said date,

6.

the place or places where such Notes are to be surrendered for payment of the Redemption Price and any accrued interest

and Additional Amounts pertaining thereto, and

7.

the CUSIP number or the Euroclear or the Clearstream Luxembourg reference numbers of such Notes, if any (or any other

numbers used by a Depository to identify such Notes).

A notice of redemption published as contemplated

by Section 106 of the Indenture need not identify particular Notes to be redeemed.

Notice of redemption of Notes to be redeemed

at the election of the Company shall be given by the Company or, at the Company’s request, by the Trustee in the name and

at the expense of the Company.

| 9. | Repurchase of Securities upon a Change of Control Repurchase Event. |

The Company must commence, within 30 days

of the occurrence of a Change of Control Repurchase Event, and consummate an Offer to Purchase for all Notes then Outstanding,

at a purchase price equal to 101% of the principal amount of the Notes on the date of repurchase, plus accrued interest (if any)

to the date of purchase. The Company is not required to make an Offer to Purchase following a Change of Control Repurchase Event

if a third party makes an Offer to Purchase that would be in compliance with the provisions described in this section if it were

made by the Company and such third party purchases (for the consideration referred to in the immediately preceding sentence) the

Notes validly tendered and not withdrawn prior to the mailing of the notice to Holders commencing such Offer to Purchase, but in

any event within 30 days following any Change of Control Repurchase Event, the Company, covenants to (i) repay in full all

Indebtedness of the Company that would prohibit the repurchase of the Notes pursuant to such Offer to Purchase or (ii) obtain

any requisite consents under instruments governing any such Indebtedness of the Company to permit the repurchase of the Notes.

The Company shall first comply with the covenant in the preceding sentence before it shall be required to repurchase Notes pursuant

to this Section 9.

The Company shall comply, to the extent applicable,

with the requirements of Rule 14e-1 of the Exchange Act and other applicable securities laws or regulations in connection

with making an Offer to Purchase upon the occurrence of a Change of Control Repurchase Event. To the extent that the provisions

of any applicable securities laws or regulations conflict with provisions of this Section 9, the Company shall comply with

the applicable securities laws and regulations and will not be deemed to have breached the Company’s obligations under this

Section 9 by virtue of the Company’s compliance with such securities laws or regulations.

| 10. | Denominations; Transfer; Exchange. |

The Notes are in registered form without coupons

in minimum denominations of US$1,000 of principal amount and multiples of US$1,000 in excess thereof. A Holder may register the

transfer or exchange of Notes in accordance with the Indenture. The Security Registrar may require a Holder, among other things,

to furnish appropriate endorsements and transfer documents and to pay any taxes and fees required by law or permitted by the Indenture.

The Security Registrar need not register the transfer or exchange of any Notes selected for redemption. Also, it need not register

the transfer or exchange of any Notes for a period of 15 days before a selection of Notes to be redeemed is made.

| 11. | Persons Deemed Owners. |

A Holder shall be treated as the owner of

a Note for all purposes.

If money for the payment of principal, premium,

if any, or interest remains unclaimed for two years, the Trustee and the Paying Agent will pay the money back to the Company at

its request. After that, Holders entitled to the money must look to the Company for payment, unless an abandoned property law designates

another Person, and all liability of the Trustee and such Paying Agent with respect to such money shall cease.

| 13. | Discharge Prior to Redemption or Maturity. |

The Company’s obligations pursuant to

the Indenture will be discharged, except for obligations pursuant to certain sections thereof, subject to the terms of the Indenture,

upon the payment of all the Notes or upon the irrevocable deposit with the Trustee of U.S. Dollars or Government Securities sufficient

to pay when due principal of and interest on the Notes to maturity or redemption, as the case may be.

| 14. | Amendment; Supplement; Waiver. |

Subject to certain exceptions, the Indenture

or the Notes may be amended or supplemented with the consent of the Holders of at least a majority in principal amount of the Notes

then Outstanding, and any existing default or compliance with any provision may be waived with the consent of the Holders of at

least a majority in principal amount of the Notes then Outstanding. Without notice to or the consent of any Holder, the parties

thereto may amend or supplement the Indenture or the Notes to, among other things, cure any ambiguity, defect or inconsistency

and make any change that does not materially and adversely affect the rights of any Holder.

| 15. | Restrictive Covenants. |

The Indenture imposes certain limitations

on the ability of the Company and its Material Subsidiaries, among other things, to create, incur or assume Liens (except for Permitted

Liens), or, with respect to the Company, to consolidate with or merge into, or sell, assign, transfer, lease, convey or otherwise

dispose of all or substantially all of its assets and the properties and assets of its Subsidiaries (taken as a whole) as an entirety

to, any entity or entities except under certain circumstances. Within 120 days after the end of each fiscal year, the Company must

report to the Trustee on compliance with such limitations.

When a successor person or other entity assumes

all the obligations of its predecessor under the Notes and the Indenture, the predecessor person will be released from those obligations.

| 17. | Defaults and Remedies. |

“Event of Default” means

any one of the following events (whatever the reason for such Event of Default and whether it shall be voluntary or involuntary

or be effected by operation of law or pursuant to any judgment, decree or order of any court or any order, rule or regulation of

any administrative or governmental body):

(1)

default in the payment of any interest on any Note, or any Additional Amounts payable with respect thereto, when

the interest becomes or the Additional Amounts become due and payable, and continuance of the default for a period of 30 days;

(2)

default in the payment of the principal of or any premium on any Note, or any Additional Amounts payable with respect

thereto, when the principal or premium becomes or the Additional Amounts become due and payable at their maturity, upon redemption

or otherwise, and continuance of the default for a period of 7 days;

(3)

default in the performance, or breach, of any covenant or warranty of the Company in the Indenture (other than a

covenant or warranty a default in whose performance or whose breach is elsewhere in this Section specifically dealt with or which

has expressly been included in the Indenture solely for the benefit of a series of notes other than this series of Notes) or the

Notes and continuance of the default or breach for a period of 60 days (inclusive of any cure period contained in any such covenant

or other term for compliance thereunder) after there has been given, by registered or certified mail, to the Company by the Trustee

or to the Company and the Trustee by the Holders of at least 25% in principal amount of the Outstanding Notes, a written notice

specifying the default or breach and requiring it to be remedied and stating that the notice is a notice of default under Section 603

of the Indenture;

(4)

any event of default as defined in any mortgage, indenture or instrument under which there may be issued, or by which

there may be secured or evidenced, any External Indebtedness of the Company, other than the Notes, or any Material Subsidiary of

the Company, whether the External Indebtedness now exists or shall hereafter be created, shall occur and shall result in such External

Indebtedness in aggregate principal amount (or, if applicable, with an issue price and accreted original issue discount) in excess

of US$100.0 million (or its equivalent in another currency) becoming or being declared due and payable prior to the date on which

it would otherwise become due and payable;

(5)

the entry by a court having competent jurisdiction of one or more final and non-appealable judgments or final decrees

against the Company or a Material Subsidiary involving in the aggregate a liability (not paid or fully covered by insurance) of

1% of Consolidated Net Tangible Assets (or its equivalent in another currency) or more, and all such judgments or decrees have

not been vacated, discharged or stayed within 180 days after the date set for payment;

(6)

the Company admits that it is generally unable to pay its debts as they become due or passes a resolution to dissolve;

(7)

the entry by a court having competent jurisdiction of:

(a)

a decree or order for relief in respect of the Company in an involuntary proceeding under Bankruptcy Law, which decree

or order shall remain unstayed and in effect for a period of 180 consecutive days;

(b)

a decree or order in an involuntary proceeding under Bankruptcy Law adjudging the Company to be insolvent, or approving

a petition seeking a similar relief under Bankruptcy Law in respect of the Company, which decree or order shall remain unstayed

and in effect for a period of 180 consecutive days; or

(c)

a final and non-appealable order appointing a custodian, receiver, liquidator, assignee, trustee or other similar

official of the Company or of any substantial part of the property of the Company or ordering the winding up or liquidation of

the affairs of the Company; and

(8)

the commencement by the Company of a voluntary proceeding under any applicable bankruptcy, insolvency or other similar

law or of a voluntary proceeding seeking to be adjudicated insolvent or the consent by the Company to the entry of a decree or

order for relief in an involuntary proceeding under any applicable bankruptcy, insolvency or other similar law or to the commencement

of any insolvency proceedings against it, or the filing by the Company of a petition or answer or consent seeking relief under

any applicable bankruptcy, insolvency or other similar law, or the consent by the Company to the filing of the petition or to the

appointment of or taking possession by a custodian, receiver, liquidator, assignee, trustee or similar official of the Company

or any substantial part of the property of the Company or the making by the Company of an assignment for the benefit of creditors,

or the taking of corporate action by the Company in furtherance of any such action.

If an Event of Default with respect to the

Notes at the time Outstanding (other than an Event of Default specified in clause (7) or (8) of this Section 17) occurs

and is continuing, then the Trustee or the Holders of not less than 25% in principal amount of the Outstanding Notes may declare

the principal of all the Notes to be due and payable immediately, by a notice in writing to the Company (and to the Trustee if

given by the Holders), and upon any declaration the principal or such lesser amount shall become immediately due and payable. If

an Event of Default specified in clause (7) or (8) of this Section 17 occurs, all unpaid principal of and accrued interest

on the Outstanding Notes shall become and be immediately due and payable without any declaration or other act on the part of the

Trustee or any Holder of any Note.

At any time after a declaration of acceleration

or automatic acceleration with respect to the Notes has been made and before a judgment or decree for payment of the money due

has been obtained by the Trustee, the Holders of not less than a majority in principal amount of the outstanding Notes, by written

notice to the Company and the Trustee, may rescind and annul the declaration and its consequences if:

1.

the Company has paid or deposited with the Trustee a sum of money sufficient to pay (1) all overdue installments of any

interest on and Additional Amounts with respect to all the notes and (2) all fees and expenses incurred by the Trustee in accordance

with the Indenture in connection with the Event of Default that gave rise to the acceleration by the Holders and the principal

of and any premium on the notes which have become due otherwise than by the declaration of acceleration and interest on the notes;

and

2. all Events of Default with respect to

the Notes, other than the nonpayment of the principal of, any premium and interest on, and any Additional Amounts with respect

to the Notes which shall have become due solely by the acceleration, shall have been cured or waived.

Any payments by the Company under or with

respect to the Notes may require the payment of Additional Amounts as may become payable under Section 1005 of the Indenture.

| 19. | Governing Law; Submission to Jurisdiction; Appointment of CSC; Sovereign Immunity Waiver. |

The Indenture and this Note shall be governed

by and construed in accordance with the laws of the State of New York except that the laws of Colombia will govern all matters

relating to authorization and execution of the Indenture and this Note by the Company.

Each of the Trustee and the Company irrevocably

consents and agrees, to the fullest extent permitted by applicable law, that any legal action, suit or proceeding against it with

respect to its obligations, liabilities or any other matter arising out of or based on the Indenture and this Note may be brought

in any United States federal or state court in the State of New York, County of New York.

The Company designates, appoints, and empowers

Corporation Service Company with offices currently at 1133 Avenue of the Americas, Suite 3100, New York, New York 10036, as its

designee, appointee and agent to receive and accept for and on its behalf, and its properties, assets and revenues, service of

any and all legal process, summons, notices and documents that may be served in any action, suit or proceeding brought against

any of the Company in any such United States federal or state court with respect to its obligations, liabilities or any other matter

arising out of or in connection with the Indenture and this Note and that may be made on such designee, appointee and agent in

accordance with legal procedures prescribed for such courts. If for any reason such designee, appointee and agent hereunder shall

cease to be available to act as such, the Company agrees to designate a new designee, appointee and agent in The City of New York

on the terms and for the purposes under Section 113 of the Indenture reasonably satisfactory to the Trustee. The Company further

hereby irrevocably consents and agrees to the service of any and all legal process, summons, notices and documents in any such

action, suit or proceeding against the Company by serving a copy thereof upon the relevant agent for service of process referred

to in this Section 19 (whether or not the appointment of such agent shall for any reason prove to be ineffective or such agent

shall accept or acknowledge such service). The Company agrees that the failure of any such designee, appointee and agent to give

any notice of such service to them shall not impair or affect in any way the validity of such service or any judgment rendered

in any action or proceeding based thereon. Each of the parties irrevocably and unconditionally waives, to the fullest extent permitted

by law, any objection that they may now or hereafter have to the laying of venue of any of the aforesaid actions, suits or proceedings

arising out of or in connection with the Indenture and this Note brought in the federal courts located in The City of New York

or the courts of the State of New York located in The County of New York and hereby further irrevocably and unconditionally waives

and agrees, to the fullest extent permitted by law, not to plead or claim in any such court that any such action, suit or proceeding

brought in any such court has been brought in an inconvenient forum.

The Company irrevocably waives, to the fullest

extent permitted by applicable law, any immunity (including sovereign immunity) from suit, action, proceeding or jurisdiction to

which it might otherwise be entitled in any such suit, action or proceeding in any U.S. federal or New York State court in the

Borough of Manhattan, The City of New York, or in any competent court in Colombia; except as provided under (i) Articles 192, 193

and 195 of Law 1437 of 2011 (Código de Procedimiento Administrativo y de lo Contencioso Administrativo) applicable

to administrative or judicial proceedings initiated on or after July 2, 2012 and (ii) Articles 513 and 684 of the Colombian Civil

Procedure Code (Código de Procedimiento Civil), (which will be gradually superseded by Articles 593, 594 and 595

et al subject to the entry into force of Law 1564 of 2012 (Código General del Proceso) pursuant to the terms

of article 627, paragraph 6 thereof and as determined by the Council of the Judiciary (Consejo Superior de la Judicatura),

pursuant to which the revenues, assets and property of the Company located in Colombia are not subject to execution, set-off or

attachment provided, however, that under the laws of Colombia, any suit, action, proceeding or jurisdiction for the collection

of amounts ordered by or arising from collectable documents pursuant to Law 1437 of 2011 (Código de Procedimiento Administrativo

y de lo Contencioso Administrativo) will be subject to the rules set forth under Articles 298 and 299 of Law 1437 of 2011 (Código

de Procedimiento Administrativo y de lo Contencioso Administrativo) applicable to administrative or judicial proceedings initiated

on or after July 2, 2012. Under the laws of Colombia, the regulations that govern statutes of limitations and other time limits

for any suit, action, proceeding or jurisdiction may not be waived by the Issuer. In addition, to the extent that the Company or

any of its revenues, assets or properties will be entitled, in any jurisdiction, to any immunity from setoff, banker’s lien,

attachment or any similar right or remedy, and to the extent that there will be attributed, in any jurisdiction, such an immunity,

the Company hereby irrevocably agrees not to claim and irrevocably waives such immunity to the fullest extent permitted by the

laws of such jurisdiction with respect to any claim, suit, action, proceeding, right or remedy arising out of or in connection

with the Indenture and this Note. The Company reserves the right to plead sovereign immunity under the United States Foreign Sovereign

Immunities Act of 1976, as amended, with respect to any action brought against it under the United States federal securities laws

or any state securities laws.

| 20. | Trustee Dealings with Company. |

The Trustee under the Indenture, in its individual

or any other capacity, may make loans to, accept deposits from and perform services for the Company or its Affiliates and may otherwise

deal with the Company or its Affiliates as if it were not the Trustee.

| 21. | No Recourse Against Others. |

No recourse for the payment of the principal

of, premium, if any, or interest on any of the Notes or for any claim based thereon or otherwise in respect thereof, and no recourse

under or upon any obligation, covenant or agreement of the Company in the Indenture or in the Notes or because of the creation

of any Indebtedness represented thereby, shall be had against any shareholder, officer, director, employee or controlling person

of the Company or of any successor thereof.

This Note shall not be valid until the Trustee

or Authenticating Agent signs the certificate of authentication on the other side of this Note.

Customary abbreviations may be used in the

name of a Holder or an assignee, such as: TEN COM (= tenants in common), TEN ENT (= tenants by the entireties), JT TEN (= joint

tenants with right of survivorship and not as tenants in common), CUST (= Custodian) and U/G/M/A (= Uniform Gifts to Minors Act).

The Company will furnish to any Holder upon

written request and without charge a copy of the Indenture. Requests may be made to Ecopetrol S.A., Carrera 13 No. 36-24 Bogota,

Colombia, Attention: Investor Relations Officer.

FORM OF TRANSFER NOTICE

FOR VALUE RECEIVED the undersigned registered

holder hereby sell(s), assign(s) and transfer(s) unto

Insert Taxpayer Identification No.

_________________________________________________________________________

Please print or typewrite name and address including zip code

of assignee

_________________________________________________________________________

the within Note and all rights thereunder, hereby irrevocably constituting and appointing

___________________________________________ attorney to transfer

said Note on the books of the Company with full power of substitution in the premises.

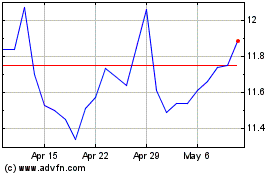

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Mar 2024 to Apr 2024

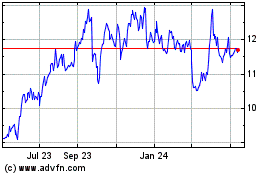

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Apr 2023 to Apr 2024