Report of Foreign Issuer (6-k)

April 15 2015 - 6:02AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2015

Commission File Number 001-34175

| ECOPETROL S.A. |

| (Exact name of registrant as specified in its charter) |

| |

| N.A. |

| (Translation of registrant’s name into English) |

| COLOMBIA |

| (Jurisdiction of incorporation or organization) |

| Carrera 13 No. 36 – 24 |

| BOGOTA – COLOMBIA |

(Address of principal

executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form

40-F ¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ¨ No x

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes ¨ No x

Indicate by check mark whether the registrant

by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate

below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

Ecopetrol Reports on the Authorization

Received from the Ministry of Finance and Public Credit

Ecopetrol S.A. (BVC: ECOPETROL; NYSE: EC;

TSX: ECP) hereby reports that, as part of the procedures required for keeping available debt alternatives to finance its investment

plan, it has obtained authorization from the Ministry of Finance and Public Credit, pursuant to Resolution 0928 of April 10, 2015,

to arrange for debt issuances in international capital markets in an aggregate amount of up to three-billion one-hundred-and-seventy-five

million dollars (US$3,175,000,000).

This authorization in itself does not constitute

an issuance of securities or a financing operation. Therefore, Ecopetrol must complete in due course all of the necessary approval

procedures with the Ministry of Finance and Public Credit, as well as Ecopetrol’s own Board of Directors, before any debt

issuance may be covered by this authorization.

This announcement is not an offer for sale

of or a solicitation of any offer to buy any securities of Ecopetrol in any transaction. If and when issued, the securities will

not be registered under the US Securities Act of 1933, as amended (the “Securities Act”). The securities may not be

offered or sold in the United States absent registration with the US Securities and Exchange Commission or pursuant to an applicable

exemption from the registration requirements of the Securities Act and applicable securities laws.

Bogotá D.C., April 14, 2015

Ecopetrol is the largest company in

Colombia and is an integrated oil and gas company; it is among the top 40 oil companies in the world and among the top four oil

companies in Latin America. Besides Colombia – where it generates over 60% of the national production – it has exploration

and production activities in Brazil, Peru, the US (Gulf of Mexico) and Angola. Ecopetrol owns the largest refinery in Colombia,

most of the pipeline and multi-product pipeline network in the country, and is significantly increasing its participation in bio-fuels.

This release contains statements that

may be considered forward looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933 and Section 21E

of the U.S. Securities Exchange Act of 1934. All forward-looking statements, whether made in this release or in future filings

or press releases or orally, address matters that involve risks and uncertainties, including in respect of the Company’s

prospects for growth and its ongoing access to capital to fund the Company’s business plan, among others. Consequently, changes

in the following factors, among others, could cause actual results to differ materially from those included in the forward-looking

statements: market prices of oil and gas, our exploration and production activities, market conditions, applicable regulations,

the exchange rate, Ecopetrol’s competitiveness and the performance of Colombia’s economy and industry, to mention a

few. We do not intend, and do not assume any obligation to update these forward-looking statements.

For further information, please contact:

Investor Relations Director (A)

Claudia Trujillo

Phone: +571-234-5190

e-mail: investors@ecopetrol.com.co

Media Relations (Colombia)

Jorge Mauricio Tellez

Phone: + 571-234-4329

Fax: +571-234-4480

e-mail: mauricio.tellez@ecopetrol.com.co

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

Ecopetrol S.A. |

| |

|

| |

By: |

/s/ Magda Manosalva |

| |

Name: |

Magda Manosalva |

| |

Title: |

Chief Financial Officer |

Date: April 14, 2015

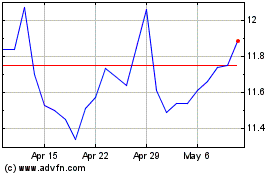

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Mar 2024 to Apr 2024

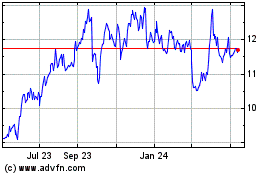

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Apr 2023 to Apr 2024